Flyleaf Books

Executive Summary

Introduction

Flyleaf Books is a start-up used bookstore in the Cleveland, Ohio area. It is the goal of the company management to acquire local market share in the used bookstore industry through low price, a dominant selection of products, a competitive variety of services including a buyback/trade program and hard to find book search, plus a relaxing, friendly environment that encourages browsing and reading.

Company

Flyleaf will be a limited liability corporation registered in the state of Ohio. The company will be jointly owned by Mr. James Vinck, a former head librarian of the Philadelphia City Library, and his wife Aracela.

Mr. Vinck is establishing this firm as a growth-oriented endeavor in order to supplement his retirement, continue meeting people with similar interests, and to leave a viable business to his children. Flyleaf Books will be establishing its store in one of the busiest section of Brecksville, an outlying suburb of Cleveland. This area is well know for its upscale residents and high-quality establishments. Our facility is a former 8,000 square ft. furniture store which allows the company to stock a large amount of inventory.

Products/Services

Flyleaf Books will offer a wide range of book, magazine, and music selections. This includes just about every conceivable category including fiction, non-fiction, business, science, children’s, hobbies, collecting, and other types of books. Our music selection will concentrate on CD’s as these are the most popular and take up the least amount of floor space. In addition, we will be offering a competitive buy and trade service to assist in lowering our inventory acquisition costs and making our store more attractive to our customers. In addition, we offer a search and order service for customer seeking to find hard to get items. Flyleaf Books will have a relaxed “reading room” type atmosphere that we will encourage through the placement of chairs, couches, etc.

Market

Our market is facing a decline in growth over the past two years. This is attributed to the overall weak economy. Book store industry sales rose only 3.6% for last year whereas overall U.S. retail sales grew by 4.3%. However, management believes that this may be an advantage to the used bookstore industry. As customers cut back on purchasing, used bookstores will look more attractive to customers who still wish to purchase books. Therefore, management believes this may be a good time to get into the industry and gain market share.

The bookstore industry as a whole is going through a large consolidation. Previously, the market was dominated by local, small stores and regional chains. With the advent of the “superstore” as created by Barnes & Noble, the largest players in the market have been able to gather significant market share and drive many independent booksellers out of the market.

Where independent booksellers can still create a viable position for themselves within the market is in the used books segment. This segment generally does not attract big companies since the “superstore” concept is much more difficult to replicate in a market with such low profit margins. This tends to favor the local independent bookseller in the used book market segment as long as they can acquire a sufficiently large enough facility to house an attractive inventory and compete with the national chains.

Financial Considerations

Our start-up expenses come to $178,000, which are single time fees associated with opening the store. These costs are financed by both private investors and SBA loans. Please note that we expect to be operating at a loss for the first couple of months before advertising begins to take effect and draw in customers. Flyleaf Books will be receiving periodic influxes of cash to cover operating expenses during the first two years as it strives toward sustainable profitability. Funding has been arranged through lending institutions and private investors already. We do not anticipate any cash flow problems during the next three years.

1.1 Objectives

These are the goals for the next three years for Flyleaf Books:

- Achieve profitability by July Year 2.

- Earn approximately $200,000 in sales by Year 3.

- Pay owners a reasonable salary while running at a profit.

1.2 Keys to Success

In order to survive and expand, Flyleaf Books must keep the following issues in mind:

- We must attain a high level of visibility through the media, billboards, and other advertising.

- We must establish rigid procedures for cost control and incentives for maintaining tight control in order to become THE low-cost leader in used books.

- In order to continually attract customers, we must be able to keep the maximum amount of inventory available and achieve a high level of customer service.

1.3 Mission

Flyleaf Book’s mission is to provide used quality literature of all types at the lowest possible prices in the Cleveland, OH area. The company additionally seeks to provide a comfortable atmosphere for its clients that promotes browsing, relaxation, and an enjoyable environment to spend extend time in. Flyleaf’s attraction to its customers will be our large selection of books, magazines, used CD’s and our purchasing/buyback option, which lower our book acquisition costs and allows our customers to discard unwanted books/CD’s in exchange for cash.

Company Summary

Flyleaf will be a limited liability corporation registered in the state of Ohio. The company will be jointly owned by Mr. James Vinck, a former head librarian of the Philadelphia City Library, and his wife Aracela.

Flyleaf Books will be establishing its store in one of the busiest section of Brecksville, an outlying suburb of Cleveland. This area is well know for its upscale residents and high-quality establishments. Our facility is a former 8,000 square ft. furniture store which allows the company to stock a large amount of inventory.

2.1 Company Ownership

Flyleaf will be a limited liability corporation registered in the state of Ohio. The company will be jointly owned by Mr. James Vinck, a former head librarian of the Philadelphia City Library, and his wife Aracela. Due to high start-up costs, the income and dividends to the principals will be limited for at least the first three years of operation.

The company plans to be leveraged through private investment and a limited number of loans. Mr. Vinck is establishing this firm as a growth-oriented endeavor in order to supplement his retirement, continue meeting people with similar interests, and to leave a viable business to his children. Flyleaf Books will be establishing its store at 14539 Greenhouse Ave NW, one of the busiest section of Brecksville, an outlying suburb of Cleveland. This area is well know for its upscale residents and high-quality establishments. Our facility is a former 8,000 square ft. furniture store which allows the company to stock a large amount of inventory. This facility is located in the front of the Loeman’s Square strip mall. This is an excellent location since it is across the street from the Twin Towers shopping mall. Other establishments within this strip mall include Fry’s Food and Drug, Subway Sandwiches, Boaters World, Michael’s Arts and Crafts, Office Depot, and Jared Jewelry. The company expects to begin offering its services in July.

2.2 Start-up Summary

Our start-up expenses come to $178,000, which are largely single time fees associated with opening the store. These costs are financed by both private investment and short- and long-term SBA guaranteed loans.

| Start-up | |

| Requirements | |

| Start-up Expenses | |

| Legal | $2,400 |

| Pre-sale advertising/marketing | $4,000 |

| Land location and finders fee | $20,000 |

| Insurance | $1,780 |

| Rent | $6,000 |

| Expensed Equipment | $25,000 |

| Initial store facilities | $50,000 |

| Other | $3,000 |

| Total Start-up Expenses | $112,180 |

| Start-up Assets | |

| Cash Required | $33,820 |

| Start-up Inventory | $16,000 |

| Other Current Assets | $8,000 |

| Long-term Assets | $8,000 |

| Total Assets | $65,820 |

| Total Requirements | $178,000 |

| Start-up Funding | |

| Start-up Expenses to Fund | $112,180 |

| Start-up Assets to Fund | $65,820 |

| Total Funding Required | $178,000 |

| Assets | |

| Non-cash Assets from Start-up | $32,000 |

| Cash Requirements from Start-up | $33,820 |

| Additional Cash Raised | $0 |

| Cash Balance on Starting Date | $33,820 |

| Total Assets | $65,820 |

| Liabilities and Capital | |

| Liabilities | |

| Current Borrowing | $15,000 |

| Long-term Liabilities | $75,000 |

| Accounts Payable (Outstanding Bills) | $8,000 |

| Other Current Liabilities (interest-free) | $10,000 |

| Total Liabilities | $108,000 |

| Capital | |

| Planned Investment | |

| Mr. James Vinck | $50,000 |

| Mrs. Aracela Vinck | $20,000 |

| Additional Investment Requirement | $0 |

| Total Planned Investment | $70,000 |

| Loss at Start-up (Start-up Expenses) | ($112,180) |

| Total Capital | ($42,180) |

| Total Capital and Liabilities | $65,820 |

| Total Funding | $178,000 |

Products

Flyleaf Books will offer a wide range of book, magazine, and music selections. This includes just about every conceivable category including fiction, non-fiction, business, science, children’s, hobbies, collecting, and other types of books.

Our music selection will concentrate on CDs as these are the most popular and take up the least amount of floor space. In addition, we will be offering a competitive buy and trade service to assist in lowering our inventory acquisition costs and making our store more attractive to our customers. We also offer a search and order service for customer seeking hard to find items. Another less obvious service to our customers will be the relaxed “reading room” type atmosphere that we will encourage through the placement of chairs, couches, and etc. We strongly encourage our customers to spend as long as they like reading through our book selection and enjoying a quiet, relaxing environment. Our store hours will be 8:30 a.m. to 8:00 p.m. Monday-Friday and 10:00 a.m. to 6:00 p.m. Saturday. Once profitability becomes stable, we will extend these hours.

Market Analysis Summary

Our market is facing a decline in growth over the past two years. This is attributed to the overall weak economy. Book store industry sales rose only 3.6% for 2002 whereas overall U.S. retail sales grew by 4.3%. Management believes that the economic slump may be an advantage to the used bookstore industry. As customers cut back on purchasing, used bookstores will look more attractive to customers who still wish to purchase books. Therefore, management believes this may be a good time to get into the industry and gain market share.

Used bookstores serve the entire purchasing population of its geographical area but focuses on the customer who desire to purchase books/music at a discount price and, with regards to books, often do not see a long-term attachment to the product.

Our main competitors are: Barnes & Noble (which holds approximately 22% nationwide market share), Borders (which holds approximately 15%), and other local new and used bookstores.

4.1 Market Segmentation

The company anticipates serving the needs of all the potential customers within a ten to fifteen mile radius in which the approximate population is 150,000 (based on census information). The majority of the residents in this area are Caucasian (78.8%) Black (13.6%) and Hispanic (9%) with occupations classified as professional, homemaker, or retired. The majority of household incomes range from $50,000 – $100,000 (50.3%). The median income in this area is $68,096, compared to the whole Cleveland area which is $34,248. The typical “head of household” age is 25 – 34 (22.4%) or age 34 – 44 (23.1%) with a median age of 44.4 years old and an average age of 32 years old.

Target market segments

Used bookstores serve the entire purchasing population of its geographical area but focuses on customers who desire to purchase books/music at discount prices because they are seen either as near commodity items or, in the case of books, are not considered to be a long-term investment (i.e. they will trade them back). Because of this relatively low value placed upon our merchandise by potential customers, Flyleaf Books can still flourish in an upscale environment like Brecksville. This is especially true with people seeking to cut costs with the bad economy. Even though we service the entire book reading population in Brecksville and the surrounding area, we can divide our customers based on purchasing habits.

- Casual Shoppers: These are customers who go to the bookstore with no set idea of what they want to purchase. They seek to spend a fair amount of time browsing the store and often are considered impulse buyers. Often they leave the store with small purchases or without buying anything. These customers are attracted to bookstores with low prices and large inventory.

- “Hard to Find” Shoppers: These are customers with very specific needs. They are looking for a difficult to obtain item, usually a book that is out of print. If we can satisfy this customer, then we are able to build significant customer loyalty. These clients are generally price insensitive and are also drawn to stores that have large inventory.

- Specific Category Shoppers: These customers are those types that generally buy books or music of one category, such as fiction or romance. These customers generally have a good idea of what they want to purchase and have the greatest buyback/trade potential. These customers represent the highest volume purchaser, often leaving the store having spent $30-$50.

The following table and pie graph show how our market segments are broken up into size and relative percentages. We use the city of Brecksville census information to determine growth figures.

| Market Analysis | |||||||

| Year 1 | Year 2 | Year 3 | Year 4 | Year 5 | |||

| Potential Customers | Growth | CAGR | |||||

| Casual shoppers | 2% | 78,000 | 79,560 | 81,151 | 82,774 | 84,429 | 2.00% |

| “Hard to find” shoppers | 2% | 22,000 | 22,440 | 22,889 | 23,347 | 23,814 | 2.00% |

| Specific category shoppers | 2% | 50,000 | 51,000 | 52,020 | 53,060 | 54,121 | 2.00% |

| Total | 2.00% | 150,000 | 153,000 | 156,060 | 159,181 | 162,364 | 2.00% |

4.2 Industry Analysis

Our market is facing a decline in growth over the past two years. This is attributed to the overall weak economy. Book store industry sales rose only 3.6% for 2002 whereas overall U.S. retail sales grew by 4.3%. However, management believes that this may be an advantage to the used bookstore industry. According to interviews made by Mr. Vinck with bookstore owners and managers, the used book industry has typically done better than other retailers during economic downturns. As customers cut back on purchasing, used bookstores will look more attractive to purchase books. Therefore, management believes this may be a good time to get into the industry and gain market share. As the weak economy continues, we expect growth to be initially quite high but overall volume sales to be low, and then seeing this taper off to industry norms.

The bookstore industry as a whole is going through a large consolidation. Previously, the market was dominated by local, small stores and regional chains. With the advent of the “superstore” as created by Barnes & Noble, the largest players in the market have been able to gather significant market share and drive a lot of independent booksellers out of the market.

Where independent booksellers can still create a viable position for themselves is within the used books segment. This segment generally does not attract big companies since the “superstore” concept is much more difficult to replicate in a market with such low profit margins. Dominant selection, both in used and new books is the key to bringing in new customers and the only way to do that is to operate at a low-price leader. These two factors tend to favor the local independent bookseller in the used book market segment as long as they can acquire a sufficiently large enough facility to house an attractive inventory and LOCALLY compete with the national chains.

4.2.1 Competition and Buying Patterns

Our main competitors are: Barnes & Noble (which holds approximately 22% nationwide market share), Borders (which holds approximately 15%), and other local new and used bookstores. The used bookstore that most closely rivals our own is Greenbaum Books which is located approximately 13 miles away in Ashbury. It is estimated that they hold 9% of the local market share.

Management feels it must be clearly stated that we do not intend to directly compete with the Barnes & Noble/Borders superstores. Superstores are large and carry approximately 150,000 titles per location. Over the years, these large companies has successfully leveraged their resources to engineer customer experience to a degree that consistently differentiates otherwise commodity-like products and services. This differentiation provides these companies strategic competitive advantage. Resources such as distribution technology, strategic alliances, process research and development, and brand name combine into value-added services that provide the customer with proximity, dominant selection, discounts, and store ambiance. This is simply beyond our capacity and we will be fulfilling a sufficiently different need for our customers. However, we believe that we can successfully duplicate the differentiated experience for our customer without the overall costs.

Strategy and Implementation Summary

Flyleaf’s competitive edge will be the lower prices we will charge our customers and the dominant selection above what our used bookstore rivals can offer. This is based on management’s industry knowledge, greater capitalization and excellent location. One of the most critical element of Flyleaf’s success will be its marketing and advertising. In order to capture attention and sales our company will use prominent signs at the store locations, billboards, media bites on local news, and radio advertisements to capture customers. We expect an average 4.5% increase in sales during the first three years as we establish ourselves in the community. After that we assume a much higher average growth of between 10%-15% growth over the next five years with growth then tapering off to the industry average of 2.5% from year to year. These figures may seem very high, but considering the level of initial sales and the growth possibilities, management actually considers this to be conservative.

5.1 Competitive Edge

The company’s competitive edge will be the lower prices we will charge our customers and the larger selection we can offer: through our large store, buyback/trade program, and leveraging management excellent supplier contacts. As stated before, in the bookstore industry, low cost and dominate selection are the two success criteria. We plan to create these advantages in a new, comforting environment that will retain customers.

5.2 Marketing Strategy

One of the most critical elements of Flyleaf Book’s success will be its marketing and advertising. In order to capture attention and sales our company will use prominent signs at the store locations, billboards, media bites on local news, and radio advertisements to capture customers.

5.3 Sales Strategy

Since our store will be a stand alone facility, there is little in the way to directly influence how we close the sale other than to have an attractive storefront with our low prices and excellent selection. We believe this in itself is its own seller. One critical procedure we will be establishing is to insure top customer service and reliability and that our store always has enough inventory of all our products. We will be using industry data on inventory for bookstore chains to assist us.

5.3.1 Sales Forecast

Based on a 10% mark-up, our forecasted sales will increase by an average of 4.5% from year to year.

These sales figures are based on a conglomerate of commuter and walk-by traffic established by the Loeman/Twin Towers Mall management and with an average $3.00 purchase amount conforming to industry averages. The target profit margin was defined as an average net profit of all merchandise. As retained earnings increase, a debt retirement fund will be established to encourage early repayment, thus relieving interest expense. Also, a cash basis for purchases will be used to avoid incurring liabilities.

| Sales Forecast | |||

| Year 1 | Year 2 | Year 3 | |

| Sales | |||

| Fiction Books | $164,292 | $172,507 | $182,512 |

| Sci-Fi Books | $184,829 | $194,070 | $205,327 |

| Magazines/newspapers | $143,756 | $150,944 | $159,698 |

| Children’s Books | $184,829 | $194,070 | $205,327 |

| Biography Books | $123,219 | $129,380 | $136,884 |

| Business Books | $112,951 | $118,599 | $125,477 |

| CD’s and Music | $184,829 | $188,526 | $199,460 |

| Other | $205,366 | $209,473 | $214,081 |

| Total Sales | $1,304,071 | $1,357,569 | $1,428,767 |

| Direct Cost of Sales | Year 1 | Year 2 | Year 3 |

| Fiction Books | $126,505 | $131,105 | $136,884 |

| Sci-Fi Books | $142,318 | $147,494 | $153,995 |

| Magazines/newspapers | $110,692 | $114,717 | $119,774 |

| Children’s Books | $142,318 | $147,494 | $153,995 |

| Biography Books | $94,879 | $98,329 | $102,663 |

| Business Books | $86,972 | $90,135 | $94,108 |

| CD’s and Music | $142,318 | $143,279 | $149,595 |

| Other | $158,131 | $159,199 | $160,561 |

| Subtotal Direct Cost of Sales | $1,004,135 | $1,031,752 | $1,071,575 |

Management Summary

As stated earlier, Flyleaf Books will be an LLC company owned by Mr. James Vinck and his wife, Aracela. Mrs. Vinck is expected to assist Mr. Vinck in various ways and to act as the company’s bookkeeper. The ower’s son, Todd, is currently a business major at OSU and is expected to graduate in 2005. He has expressed an interest in eventually taking over the management of the company and will be working as a part-time manager with this goal in mind. The company also plans to hire various part-time salespeople as needed. Additional personnel will be added if necessary.

Mr. James Vinck is a graduate of the Dartmouth University, with a degree in library science. He has worked for more than twenty years for the Philadelphia city library system and in 1995 became the head librarian. Over that time Mr. Vinck has established excellent contacts in the book acquisition industry and plans to leverage these contacts in his new business.

6.1 Personnel Plan

Initially the company will have a small staff including upper management and sales personnel. We expect to expand our personnel and extend our hours once we begin to make a profit.

| Personnel Plan | |||

| Year 1 | Year 2 | Year 3 | |

| Mr. James Vinck | $42,000 | $48,000 | $48,000 |

| Mr. Todd Vinck | $18,000 | $25,000 | $30,000 |

| Salesperson | $10,200 | $11,000 | $11,000 |

| Salesperson | $10,200 | $11,000 | $11,000 |

| Salesperson | $10,200 | $10,200 | $10,200 |

| Salesperson | $10,200 | $10,200 | $10,200 |

| Salesperson | $10,200 | $10,200 | $10,200 |

| Total People | 5 | 5 | 5 |

| Total Payroll | $111,000 | $125,600 | $130,600 |

Financial Plan

The following is our financial projects over the next three years. Please note that we expect to be operating at a loss for the first couple of months before advertising begins to take effect and draw in customers.

7.1 Important Assumptions

The company is basing it assumptions on a stable growth market using average interest rates over the past ten years.

| General Assumptions | |||

| Year 1 | Year 2 | Year 3 | |

| Plan Month | 1 | 2 | 3 |

| Current Interest Rate | 10.00% | 10.00% | 10.00% |

| Long-term Interest Rate | 10.00% | 10.00% | 10.00% |

| Tax Rate | 30.00% | 30.00% | 30.00% |

| Other | 0 | 0 | 0 |

7.2 Break-even Analysis

The following table and chart show our Break-even Analysis. We are deliberately setting these average costs a little low in order to be conservative and give us an idea of the maximum amount of inventory we need to move per month.

| Break-even Analysis | |

| Monthly Revenue Break-even | $90,541 |

| Assumptions: | |

| Average Percent Variable Cost | 77% |

| Estimated Monthly Fixed Cost | $20,824 |

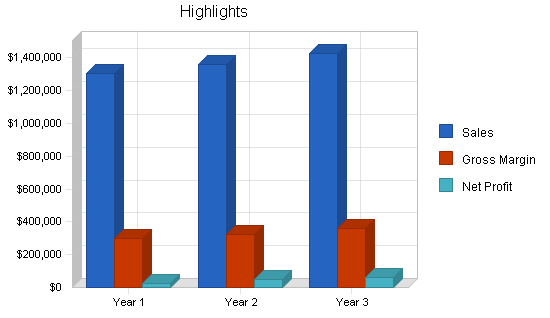

7.3 Projected Profit and Loss

The following table explains our itemized costs and determines gross and net margin. Please note that these predictions are weighted toward having higher costs in comparison to revenues in case unexpected hidden costs arise.

| Pro Forma Profit and Loss | |||

| Year 1 | Year 2 | Year 3 | |

| Sales | $1,304,071 | $1,357,569 | $1,428,767 |

| Direct Cost of Sales | $1,004,135 | $1,031,752 | $1,071,575 |

| Other Costs of Goods | $0 | $0 | $0 |

| Total Cost of Sales | $1,004,135 | $1,031,752 | $1,071,575 |

| Gross Margin | $299,936 | $325,817 | $357,192 |

| Gross Margin % | 23.00% | 24.00% | 25.00% |

| Expenses | |||

| Payroll | $111,000 | $125,600 | $130,600 |

| Sales and Marketing and Other Expenses | $36,000 | $15,000 | $15,000 |

| Depreciation | $0 | $0 | $0 |

| Leased equipment | $0 | $0 | $0 |

| Rent | $60,000 | $65,000 | $68,000 |

| Utilities | $3,600 | $4,000 | $4,000 |

| Insurance | $7,200 | $7,200 | $7,500 |

| Payroll Taxes | $17,093 | $18,840 | $19,590 |

| Other | $15,000 | $10,000 | $10,000 |

| Total Operating Expenses | $249,893 | $245,640 | $254,690 |

| Profit Before Interest and Taxes | $50,044 | $80,177 | $102,502 |

| EBITDA | $50,044 | $80,177 | $102,502 |

| Interest Expense | $13,750 | $13,900 | $12,050 |

| Taxes Incurred | $10,888 | $19,883 | $27,136 |

| Net Profit | $25,406 | $46,394 | $63,316 |

| Net Profit/Sales | 1.95% | 3.42% | 4.43% |

7.4 Projected Cash Flow

Our company will be receiving periodic influxes of cash in order to cover operating expenses during the first two years as it strives toward sustainable profitability. Almost all of this funding has been arranged through lend institutions and private investors already. We do not anticipate any cash flow problems during the next three years.

| Pro Forma Cash Flow | |||

| Year 1 | Year 2 | Year 3 | |

| Cash Received | |||

| Cash from Operations | |||

| Cash Sales | $1,304,071 | $1,357,569 | $1,428,767 |

| Subtotal Cash from Operations | $1,304,071 | $1,357,569 | $1,428,767 |

| Additional Cash Received | |||

| Sales Tax, VAT, HST/GST Received | $0 | $0 | $0 |

| New Current Borrowing | $5,000 | $0 | $0 |

| New Other Liabilities (interest-free) | $0 | $0 | $0 |

| New Long-term Liabilities | $50,000 | $0 | $0 |

| Sales of Other Current Assets | $0 | $0 | $0 |

| Sales of Long-term Assets | $0 | $0 | $0 |

| New Investment Received | $54,000 | $0 | $0 |

| Subtotal Cash Received | $1,413,071 | $1,357,569 | $1,428,767 |

| Expenditures | Year 1 | Year 2 | Year 3 |

| Expenditures from Operations | |||

| Cash Spending | $111,000 | $125,600 | $130,600 |

| Bill Payments | $1,156,323 | $1,217,129 | $1,235,539 |

| Subtotal Spent on Operations | $1,267,323 | $1,342,729 | $1,366,139 |

| Additional Cash Spent | |||

| Sales Tax, VAT, HST/GST Paid Out | $0 | $0 | $0 |

| Principal Repayment of Current Borrowing | $0 | $7,000 | $15,000 |

| Other Liabilities Principal Repayment | $0 | $0 | $0 |

| Long-term Liabilities Principal Repayment | $0 | $5,000 | $10,000 |

| Purchase Other Current Assets | $0 | $0 | $0 |

| Purchase Long-term Assets | $0 | $0 | $0 |

| Dividends | $0 | $0 | $0 |

| Subtotal Cash Spent | $1,267,323 | $1,354,729 | $1,391,139 |

| Net Cash Flow | $145,748 | $2,840 | $37,628 |

| Cash Balance | $179,568 | $182,408 | $220,036 |

7.5 Projected Balance Sheet

The following table is the Projected Balance Sheet for Flyleaf Books.

| Pro Forma Balance Sheet | |||

| Year 1 | Year 2 | Year 3 | |

| Assets | |||

| Current Assets | |||

| Cash | $179,568 | $182,408 | $220,036 |

| Inventory | $122,562 | $125,933 | $130,793 |

| Other Current Assets | $8,000 | $8,000 | $8,000 |

| Total Current Assets | $310,130 | $316,341 | $358,830 |

| Long-term Assets | |||

| Long-term Assets | $8,000 | $8,000 | $8,000 |

| Accumulated Depreciation | $0 | $0 | $0 |

| Total Long-term Assets | $8,000 | $8,000 | $8,000 |

| Total Assets | $318,130 | $324,341 | $366,830 |

| Liabilities and Capital | Year 1 | Year 2 | Year 3 |

| Current Liabilities | |||

| Accounts Payable | $125,904 | $97,722 | $101,894 |

| Current Borrowing | $20,000 | $13,000 | ($2,000) |

| Other Current Liabilities | $10,000 | $10,000 | $10,000 |

| Subtotal Current Liabilities | $155,904 | $120,722 | $109,894 |

| Long-term Liabilities | $125,000 | $120,000 | $110,000 |

| Total Liabilities | $280,904 | $240,722 | $219,894 |

| Paid-in Capital | $124,000 | $124,000 | $124,000 |

| Retained Earnings | ($112,180) | ($86,774) | ($40,381) |

| Earnings | $25,406 | $46,394 | $63,316 |

| Total Capital | $37,226 | $83,619 | $146,935 |

| Total Liabilities and Capital | $318,130 | $324,341 | $366,830 |

| Net Worth | $37,226 | $83,619 | $146,935 |

7.6 Business Ratios

We are using the industry standard Business Ratios for independent used bookstore chains as a comparison to our own.

| Ratio Analysis | ||||

| Year 1 | Year 2 | Year 3 | Industry Profile | |

| Sales Growth | 0.00% | 4.10% | 5.24% | 2.27% |

| Percent of Total Assets | ||||

| Inventory | 38.53% | 38.83% | 35.66% | 22.18% |

| Other Current Assets | 2.51% | 2.47% | 2.18% | 26.81% |

| Total Current Assets | 97.49% | 97.53% | 97.82% | 56.12% |

| Long-term Assets | 2.51% | 2.47% | 2.18% | 43.88% |

| Total Assets | 100.00% | 100.00% | 100.00% | 100.00% |

| Current Liabilities | 49.01% | 37.22% | 29.96% | 26.39% |

| Long-term Liabilities | 39.29% | 37.00% | 29.99% | 24.87% |

| Total Liabilities | 88.30% | 74.22% | 59.94% | 51.26% |

| Net Worth | 11.70% | 25.78% | 40.06% | 48.74% |

| Percent of Sales | ||||

| Sales | 100.00% | 100.00% | 100.00% | 100.00% |

| Gross Margin | 23.00% | 24.00% | 25.00% | 23.55% |

| Selling, General & Administrative Expenses | 21.05% | 20.58% | 20.57% | 16.21% |

| Advertising Expenses | 0.00% | 0.00% | 0.00% | 0.85% |

| Profit Before Interest and Taxes | 3.84% | 5.91% | 7.17% | 1.02% |

| Main Ratios | ||||

| Current | 1.99 | 2.62 | 3.27 | 1.68 |

| Quick | 1.20 | 1.58 | 2.08 | 0.71 |

| Total Debt to Total Assets | 88.30% | 74.22% | 59.94% | 4.63% |

| Pre-tax Return on Net Worth | 97.50% | 79.26% | 61.56% | 57.28% |

| Pre-tax Return on Assets | 11.41% | 20.43% | 24.66% | 10.83% |

| Additional Ratios | Year 1 | Year 2 | Year 3 | |

| Net Profit Margin | 1.95% | 3.42% | 4.43% | n.a |

| Return on Equity | 68.25% | 55.48% | 43.09% | n.a |

| Activity Ratios | ||||

| Inventory Turnover | 10.91 | 8.30 | 8.35 | n.a |

| Accounts Payable Turnover | 10.12 | 12.17 | 12.17 | n.a |

| Payment Days | 27 | 34 | 29 | n.a |

| Total Asset Turnover | 4.10 | 4.19 | 3.89 | n.a |

| Debt Ratios | ||||

| Debt to Net Worth | 7.55 | 2.88 | 1.50 | n.a |

| Current Liab. to Liab. | 0.56 | 0.50 | 0.50 | n.a |

| Liquidity Ratios | ||||

| Net Working Capital | $154,226 | $195,619 | $248,935 | n.a |

| Interest Coverage | 3.64 | 5.77 | 8.51 | n.a |

| Additional Ratios | ||||

| Assets to Sales | 0.24 | 0.24 | 0.26 | n.a |

| Current Debt/Total Assets | 49% | 37% | 30% | n.a |

| Acid Test | 1.20 | 1.58 | 2.08 | n.a |

| Sales/Net Worth | 35.03 | 16.24 | 9.72 | n.a |

| Dividend Payout | 0.00 | 0.00 | 0.00 | n.a |

Appendix

| Sales Forecast | |||||||||||||

| Month 1 | Month 2 | Month 3 | Month 4 | Month 5 | Month 6 | Month 7 | Month 8 | Month 9 | Month 10 | Month 11 | Month 12 | ||

| Sales | |||||||||||||

| Fiction Books | 0% | $8,000 | $9,200 | $10,580 | $12,167 | $12,836 | $13,542 | $14,287 | $15,073 | $15,902 | $16,776 | $17,699 | $18,230 |

| Sci-Fi Books | 0% | $9,000 | $10,350 | $11,903 | $13,688 | $14,441 | $15,235 | $16,073 | $16,957 | $17,890 | $18,873 | $19,911 | $20,509 |

| Magazines/newspapers | 0% | $7,000 | $8,050 | $9,258 | $10,646 | $11,232 | $11,849 | $12,501 | $13,189 | $13,914 | $14,679 | $15,487 | $15,951 |

| Children’s Books | 0% | $9,000 | $10,350 | $11,903 | $13,688 | $14,441 | $15,235 | $16,073 | $16,957 | $17,890 | $18,873 | $19,911 | $20,509 |

| Biography Books | 0% | $6,000 | $6,900 | $7,935 | $9,125 | $9,627 | $10,157 | $10,715 | $11,305 | $11,926 | $12,582 | $13,274 | $13,673 |

| Business Books | 0% | $5,500 | $6,325 | $7,274 | $8,365 | $8,825 | $9,310 | $9,822 | $10,363 | $10,932 | $11,534 | $12,168 | $12,533 |

| CD’s and Music | 0% | $9,000 | $10,350 | $11,903 | $13,688 | $14,441 | $15,235 | $16,073 | $16,957 | $17,890 | $18,873 | $19,911 | $20,509 |

| Other | 0% | $10,000 | $11,500 | $13,225 | $15,209 | $16,045 | $16,928 | $17,859 | $18,841 | $19,877 | $20,970 | $22,124 | $22,788 |

| Total Sales | $63,500 | $73,025 | $83,979 | $96,576 | $101,887 | $107,491 | $113,403 | $119,640 | $126,220 | $133,163 | $140,486 | $144,701 | |

| Direct Cost of Sales | Month 1 | Month 2 | Month 3 | Month 4 | Month 5 | Month 6 | Month 7 | Month 8 | Month 9 | Month 10 | Month 11 | Month 12 | |

| Fiction Books | $6,160 | $7,084 | $8,147 | $9,369 | $9,884 | $10,427 | $11,001 | $11,606 | $12,244 | $12,918 | $13,628 | $14,037 | |

| Sci-Fi Books | $6,930 | $7,970 | $9,165 | $10,540 | $11,119 | $11,731 | $12,376 | $13,057 | $13,775 | $14,533 | $15,332 | $15,792 | |

| Magazines/newspapers | $5,390 | $6,199 | $7,128 | $8,198 | $8,648 | $9,124 | $9,626 | $10,155 | $10,714 | $11,303 | $11,925 | $12,282 | |

| Children’s Books | $6,930 | $7,970 | $9,165 | $10,540 | $11,119 | $11,731 | $12,376 | $13,057 | $13,775 | $14,533 | $15,332 | $15,792 | |

| Biography Books | $4,620 | $5,313 | $6,110 | $7,026 | $7,413 | $7,821 | $8,251 | $8,705 | $9,183 | $9,688 | $10,221 | $10,528 | |

| Business Books | $4,235 | $4,870 | $5,601 | $6,441 | $6,795 | $7,169 | $7,563 | $7,979 | $8,418 | $8,881 | $9,369 | $9,651 | |

| CD’s and Music | $6,930 | $7,970 | $9,165 | $10,540 | $11,119 | $11,731 | $12,376 | $13,057 | $13,775 | $14,533 | $15,332 | $15,792 | |

| Other | $7,700 | $8,855 | $10,183 | $11,711 | $12,355 | $13,034 | $13,751 | $14,508 | $15,305 | $16,147 | $17,035 | $17,546 | |

| Subtotal Direct Cost of Sales | $48,895 | $56,229 | $64,664 | $74,363 | $78,453 | $82,768 | $87,320 | $92,123 | $97,190 | $102,535 | $108,175 | $111,420 | |

| Personnel Plan | |||||||||||||

| Month 1 | Month 2 | Month 3 | Month 4 | Month 5 | Month 6 | Month 7 | Month 8 | Month 9 | Month 10 | Month 11 | Month 12 | ||

| Mr. James Vinck | 0% | $3,500 | $3,500 | $3,500 | $3,500 | $3,500 | $3,500 | $3,500 | $3,500 | $3,500 | $3,500 | $3,500 | $3,500 |

| Mr. Todd Vinck | 0% | $1,500 | $1,500 | $1,500 | $1,500 | $1,500 | $1,500 | $1,500 | $1,500 | $1,500 | $1,500 | $1,500 | $1,500 |

| Salesperson | 0% | $850 | $850 | $850 | $850 | $850 | $850 | $850 | $850 | $850 | $850 | $850 | $850 |

| Salesperson | 0% | $850 | $850 | $850 | $850 | $850 | $850 | $850 | $850 | $850 | $850 | $850 | $850 |

| Salesperson | 0% | $850 | $850 | $850 | $850 | $850 | $850 | $850 | $850 | $850 | $850 | $850 | $850 |

| Salesperson | 0% | $850 | $850 | $850 | $850 | $850 | $850 | $850 | $850 | $850 | $850 | $850 | $850 |

| Salesperson | 0% | $850 | $850 | $850 | $850 | $850 | $850 | $850 | $850 | $850 | $850 | $850 | $850 |

| Total People | 7 | 5 | 5 | 5 | 5 | 5 | 5 | 5 | 5 | 5 | 5 | 5 | |

| Total Payroll | $9,250 | $9,250 | $9,250 | $9,250 | $9,250 | $9,250 | $9,250 | $9,250 | $9,250 | $9,250 | $9,250 | $9,250 | |

| General Assumptions | |||||||||||||

| Month 1 | Month 2 | Month 3 | Month 4 | Month 5 | Month 6 | Month 7 | Month 8 | Month 9 | Month 10 | Month 11 | Month 12 | ||

| Plan Month | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 | 11 | 12 | |

| Current Interest Rate | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | |

| Long-term Interest Rate | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | |

| Tax Rate | 30.00% | 30.00% | 30.00% | 30.00% | 30.00% | 30.00% | 30.00% | 30.00% | 30.00% | 30.00% | 30.00% | 30.00% | |

| Other | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | |

| Pro Forma Profit and Loss | |||||||||||||

| Month 1 | Month 2 | Month 3 | Month 4 | Month 5 | Month 6 | Month 7 | Month 8 | Month 9 | Month 10 | Month 11 | Month 12 | ||

| Sales | $63,500 | $73,025 | $83,979 | $96,576 | $101,887 | $107,491 | $113,403 | $119,640 | $126,220 | $133,163 | $140,486 | $144,701 | |

| Direct Cost of Sales | $48,895 | $56,229 | $64,664 | $74,363 | $78,453 | $82,768 | $87,320 | $92,123 | $97,190 | $102,535 | $108,175 | $111,420 | |

| Other Costs of Goods | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Total Cost of Sales | $48,895 | $56,229 | $64,664 | $74,363 | $78,453 | $82,768 | $87,320 | $92,123 | $97,190 | $102,535 | $108,175 | $111,420 | |

| Gross Margin | $14,605 | $16,796 | $19,315 | $22,212 | $23,434 | $24,723 | $26,083 | $27,517 | $29,031 | $30,627 | $32,312 | $33,281 | |

| Gross Margin % | 23.00% | 23.00% | 23.00% | 23.00% | 23.00% | 23.00% | 23.00% | 23.00% | 23.00% | 23.00% | 23.00% | 23.00% | |

| Expenses | |||||||||||||

| Payroll | $9,250 | $9,250 | $9,250 | $9,250 | $9,250 | $9,250 | $9,250 | $9,250 | $9,250 | $9,250 | $9,250 | $9,250 | |

| Sales and Marketing and Other Expenses | $3,000 | $3,000 | $3,000 | $3,000 | $3,000 | $3,000 | $3,000 | $3,000 | $3,000 | $3,000 | $3,000 | $3,000 | |

| Depreciation | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Leased equipment | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Rent | $5,000 | $5,000 | $5,000 | $5,000 | $5,000 | $5,000 | $5,000 | $5,000 | $5,000 | $5,000 | $5,000 | $5,000 | |

| Utilities | $300 | $300 | $300 | $300 | $300 | $300 | $300 | $300 | $300 | $300 | $300 | $300 | |

| Insurance | $600 | $600 | $600 | $600 | $600 | $600 | $600 | $600 | $600 | $600 | $600 | $600 | |

| Payroll Taxes | 15% | $1,830 | $1,388 | $1,388 | $1,388 | $1,388 | $1,388 | $1,388 | $1,388 | $1,388 | $1,388 | $1,388 | $1,388 |

| Other | $2,000 | $2,000 | $2,000 | $0 | $2,000 | $0 | $2,000 | $0 | $3,000 | $0 | $2,000 | $0 | |

| Total Operating Expenses | $21,980 | $21,538 | $21,538 | $19,538 | $21,538 | $19,538 | $21,538 | $19,538 | $22,538 | $19,538 | $21,538 | $19,538 | |

| Profit Before Interest and Taxes | ($7,375) | ($4,742) | ($2,222) | $2,675 | $1,897 | $5,185 | $4,545 | $7,980 | $6,493 | $11,090 | $10,774 | $13,744 | |

| EBITDA | ($7,375) | ($4,742) | ($2,222) | $2,675 | $1,897 | $5,185 | $4,545 | $7,980 | $6,493 | $11,090 | $10,774 | $13,744 | |

| Interest Expense | $750 | $1,167 | $1,167 | $1,167 | $1,167 | $1,167 | $1,167 | $1,167 | $1,208 | $1,208 | $1,208 | $1,208 | |

| Taxes Incurred | ($2,438) | ($1,773) | ($1,017) | $452 | $219 | $1,206 | $1,014 | $2,044 | $1,585 | $2,964 | $2,870 | $3,761 | |

| Net Profit | ($5,688) | ($4,136) | ($2,372) | $1,056 | $511 | $2,813 | $2,365 | $4,769 | $3,699 | $6,917 | $6,696 | $8,775 | |

| Net Profit/Sales | -8.96% | -5.66% | -2.82% | 1.09% | 0.50% | 2.62% | 2.09% | 3.99% | 2.93% | 5.19% | 4.77% | 6.06% | |

| Pro Forma Cash Flow | |||||||||||||

| Month 1 | Month 2 | Month 3 | Month 4 | Month 5 | Month 6 | Month 7 | Month 8 | Month 9 | Month 10 | Month 11 | Month 12 | ||

| Cash Received | |||||||||||||

| Cash from Operations | |||||||||||||

| Cash Sales | $63,500 | $73,025 | $83,979 | $96,576 | $101,887 | $107,491 | $113,403 | $119,640 | $126,220 | $133,163 | $140,486 | $144,701 | |

| Subtotal Cash from Operations | $63,500 | $73,025 | $83,979 | $96,576 | $101,887 | $107,491 | $113,403 | $119,640 | $126,220 | $133,163 | $140,486 | $144,701 | |

| Additional Cash Received | |||||||||||||

| Sales Tax, VAT, HST/GST Received | 0.00% | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| New Current Borrowing | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $5,000 | $0 | $0 | $0 | |

| New Other Liabilities (interest-free) | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| New Long-term Liabilities | $0 | $50,000 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Sales of Other Current Assets | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Sales of Long-term Assets | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| New Investment Received | $0 | $0 | $0 | $0 | $50,000 | $0 | $0 | $0 | $0 | $0 | $0 | $4,000 | |

| Subtotal Cash Received | $63,500 | $123,025 | $83,979 | $96,576 | $151,887 | $107,491 | $113,403 | $119,640 | $131,220 | $133,163 | $140,486 | $148,701 | |

| Expenditures | Month 1 | Month 2 | Month 3 | Month 4 | Month 5 | Month 6 | Month 7 | Month 8 | Month 9 | Month 10 | Month 11 | Month 12 | |

| Expenditures from Operations | |||||||||||||

| Cash Spending | $9,250 | $9,250 | $9,250 | $9,250 | $9,250 | $9,250 | $9,250 | $9,250 | $9,250 | $9,250 | $9,250 | $9,250 | |

| Bill Payments | $11,257 | $96,997 | $76,325 | $86,731 | $96,929 | $96,744 | $100,395 | $106,932 | $111,169 | $118,979 | $123,138 | $130,727 | |

| Subtotal Spent on Operations | $20,507 | $106,247 | $85,575 | $95,981 | $106,179 | $105,994 | $109,645 | $116,182 | $120,419 | $128,229 | $132,388 | $139,977 | |

| Additional Cash Spent | |||||||||||||

| Sales Tax, VAT, HST/GST Paid Out | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Principal Repayment of Current Borrowing | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Other Liabilities Principal Repayment | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Long-term Liabilities Principal Repayment | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Purchase Other Current Assets | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Purchase Long-term Assets | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Dividends | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Subtotal Cash Spent | $20,507 | $106,247 | $85,575 | $95,981 | $106,179 | $105,994 | $109,645 | $116,182 | $120,419 | $128,229 | $132,388 | $139,977 | |

| Net Cash Flow | $42,993 | $16,778 | ($1,596) | $595 | $45,708 | $1,497 | $3,758 | $3,458 | $10,802 | $4,934 | $8,099 | $8,724 | |

| Cash Balance | $76,813 | $93,590 | $91,994 | $92,589 | $138,297 | $139,794 | $143,552 | $147,010 | $157,812 | $162,746 | $170,844 | $179,568 | |

| Pro Forma Balance Sheet | |||||||||||||

| Month 1 | Month 2 | Month 3 | Month 4 | Month 5 | Month 6 | Month 7 | Month 8 | Month 9 | Month 10 | Month 11 | Month 12 | ||

| Assets | Starting Balances | ||||||||||||

| Current Assets | |||||||||||||

| Cash | $33,820 | $76,813 | $93,590 | $91,994 | $92,589 | $138,297 | $139,794 | $143,552 | $147,010 | $157,812 | $162,746 | $170,844 | $179,568 |

| Inventory | $16,000 | $53,785 | $61,852 | $71,130 | $81,800 | $86,298 | $91,045 | $96,052 | $101,335 | $106,909 | $112,789 | $118,992 | $122,562 |

| Other Current Assets | $8,000 | $8,000 | $8,000 | $8,000 | $8,000 | $8,000 | $8,000 | $8,000 | $8,000 | $8,000 | $8,000 | $8,000 | $8,000 |

| Total Current Assets | $57,820 | $138,597 | $163,443 | $171,124 | $182,388 | $232,595 | $238,839 | $247,605 | $256,345 | $272,721 | $283,534 | $297,836 | $310,130 |

| Long-term Assets | |||||||||||||

| Long-term Assets | $8,000 | $8,000 | $8,000 | $8,000 | $8,000 | $8,000 | $8,000 | $8,000 | $8,000 | $8,000 | $8,000 | $8,000 | $8,000 |

| Accumulated Depreciation | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| Total Long-term Assets | $8,000 | $8,000 | $8,000 | $8,000 | $8,000 | $8,000 | $8,000 | $8,000 | $8,000 | $8,000 | $8,000 | $8,000 | $8,000 |

| Total Assets | $65,820 | $146,597 | $171,443 | $179,124 | $190,388 | $240,595 | $246,839 | $255,605 | $264,345 | $280,721 | $291,534 | $305,836 | $318,130 |

| Liabilities and Capital | Month 1 | Month 2 | Month 3 | Month 4 | Month 5 | Month 6 | Month 7 | Month 8 | Month 9 | Month 10 | Month 11 | Month 12 | |

| Current Liabilities | |||||||||||||

| Accounts Payable | $8,000 | $94,465 | $73,446 | $83,500 | $93,708 | $93,404 | $96,835 | $103,236 | $107,207 | $114,883 | $118,780 | $126,385 | $125,904 |

| Current Borrowing | $15,000 | $15,000 | $15,000 | $15,000 | $15,000 | $15,000 | $15,000 | $15,000 | $15,000 | $20,000 | $20,000 | $20,000 | $20,000 |

| Other Current Liabilities | $10,000 | $10,000 | $10,000 | $10,000 | $10,000 | $10,000 | $10,000 | $10,000 | $10,000 | $10,000 | $10,000 | $10,000 | $10,000 |

| Subtotal Current Liabilities | $33,000 | $119,465 | $98,446 | $108,500 | $118,708 | $118,404 | $121,835 | $128,236 | $132,207 | $144,883 | $148,780 | $156,385 | $155,904 |

| Long-term Liabilities | $75,000 | $75,000 | $125,000 | $125,000 | $125,000 | $125,000 | $125,000 | $125,000 | $125,000 | $125,000 | $125,000 | $125,000 | $125,000 |

| Total Liabilities | $108,000 | $194,465 | $223,446 | $233,500 | $243,708 | $243,404 | $246,835 | $253,236 | $257,207 | $269,883 | $273,780 | $281,385 | $280,904 |

| Paid-in Capital | $70,000 | $70,000 | $70,000 | $70,000 | $70,000 | $120,000 | $120,000 | $120,000 | $120,000 | $120,000 | $120,000 | $120,000 | $124,000 |

| Retained Earnings | ($112,180) | ($112,180) | ($112,180) | ($112,180) | ($112,180) | ($112,180) | ($112,180) | ($112,180) | ($112,180) | ($112,180) | ($112,180) | ($112,180) | ($112,180) |

| Earnings | $0 | ($5,688) | ($9,823) | ($12,196) | ($11,140) | ($10,629) | ($7,816) | ($5,451) | ($682) | $3,018 | $9,935 | $16,631 | $25,406 |

| Total Capital | ($42,180) | ($47,868) | ($52,003) | ($54,376) | ($53,320) | ($2,809) | $4 | $2,369 | $7,138 | $10,838 | $17,755 | $24,451 | $37,226 |

| Total Liabilities and Capital | $65,820 | $146,597 | $171,443 | $179,124 | $190,388 | $240,595 | $246,839 | $255,605 | $264,345 | $280,721 | $291,534 | $305,836 | $318,130 |

| Net Worth | ($42,180) | ($47,868) | ($52,003) | ($54,376) | ($53,320) | ($2,809) | $4 | $2,369 | $7,138 | $10,838 | $17,755 | $24,451 | $37,226 |