Acme Consulting--UK

Executive Summary

Acme Consulting will be formed as a consulting company specialising in marketing of high-technology products in international markets. Its founders are former marketers of consulting services, personal computers, and market research, all in international markets. They are founding Acme to formalise the consulting services they offer.

1.1 Objectives

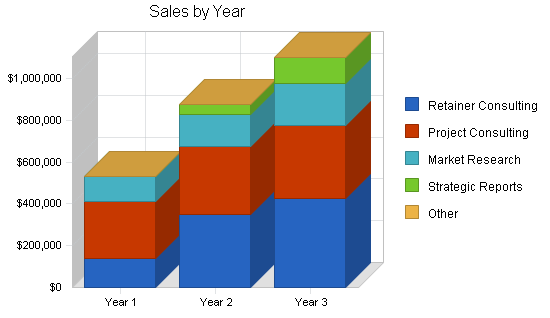

- Sales of £550,000 in Year 1 and £1 million by Year 3.

- Gross margin higher than 70%.

- Net income remains more than 5% of sales through Year 3.

1.2 Mission

Acme Consulting offers high-tech manufacturers a reliable, high-quality alternative to in-house resources for business development, market development, and channel development on an international scale. A true alternative to in-house resources offers a very high level of practical experience, know-how, contacts, and confidentiality. Clients must know that working with Acme is a more professional, less risky way to develop new areas even than working completely in-house with their own people. Acme must also be able to maintain financial balance, charging a high value for its services, and delivering an even higher value to its clients. Initial focus will be development in the European and Latin American markets, or for European clients in the United Kingdom market.

1.3 Keys to Success

- Excellence in fulfilling the promise–completely confidential, reliable, trustworthy expertise and information.

- Developing visibility to generate new business leads.

- Leveraging from a single pool of expertise into multiple revenue generation opportunities: retainer consulting, project consulting, market research, and market research published reports.

Company Summary

Acme Consulting is a new company providing high-level expertise in international high-tech business development, channel development, distribution strategies, and marketing of high-tech products. It will focus initially on providing two kinds of international triangles:

- Providing United Kingdom clients with development for European and Latin American markets.

- Providing European and United Kingdom clients with development for the United States and Latin American markets.

As it grows it will take on people and consulting work in related markets, such as the rest of Latin America, the Far East, and similar markets. It will also look for additional leverage by taking brokerage positions and representation positions to create percentage holdings in product results.

2.1 Company Ownership

Acme Consulting will be created as a Limited Company based in London, England, owned by its principal investors and principal operators. As of this writing, it has not been registered with Companies House and owners are still considering alternatives of legal formation.

2.2 Start-up Summary

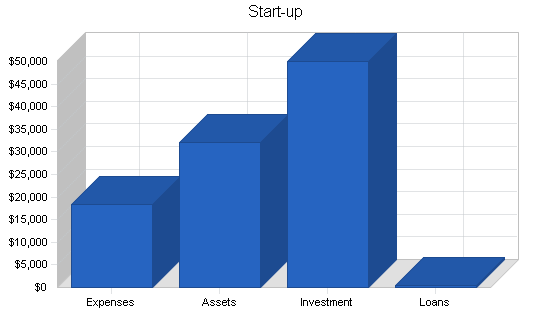

Total start-up expense (including legal costs, logo design, stationery and related expenses) comes to £18,350. Start-up assets required include £32,000 in current assets (office furniture, etc.) and £25,000 in initial cash to handle the first few months of consulting operations as sales and accounts receivable play through the cash flow. The details are included below.

| Start-up Funding | |

| Start-up Expenses to Fund | £18,350 |

| Start-up Assets to Fund | £32,000 |

| Total Funding Required | £50,350 |

| Assets | |

| Non-cash Assets from Start-up | £7,000 |

| Cash Requirements from Start-up | £25,000 |

| Additional Cash Raised | £0 |

| Cash Balance on Starting Date | £25,000 |

| Total Assets | £32,000 |

| Liabilities and Capital | |

| Liabilities | |

| Current Borrowing | £0 |

| Long-term Liabilities | £0 |

| Accounts Payable (Outstanding Bills) | £350 |

| Other Current Liabilities (interest-free) | £0 |

| Total Liabilities | £350 |

| Capital | |

| Planned Investment | |

| Investor 1 | £20,000 |

| Investor 2 | £20,000 |

| Other | £10,000 |

| Additional Investment Requirement | £0 |

| Total Planned Investment | £50,000 |

| Loss at Start-up (Start-up Expenses) | (£18,350) |

| Total Capital | £31,650 |

| Total Capital and Liabilities | £32,000 |

| Total Funding | £50,350 |

| Start-up | |

| Requirements | |

| Start-up Expenses | |

| Legal | £1,000 |

| Stationery etc. | £3,000 |

| Brochures | £5,000 |

| Consultants | £5,000 |

| Insurance | £350 |

| Expensed equipment | £3,000 |

| Other | £1,000 |

| Total Start-up Expenses | £18,350 |

| Start-up Assets | |

| Cash Required | £25,000 |

| Other Current Assets | £7,000 |

| Long-term Assets | £0 |

| Total Assets | £32,000 |

| Total Requirements | £50,350 |

2.3 Company Locations and Facilities

The initial office will be established in top quality office space in London’s Canary Wharf, as there are high quality office spaces with security and lobby areas. It is important for a high tech consulting company to spend money on high quality centrally located office space.

Services

Acme offers the expertise a high-technology company needs to develop new product distribution and new market segments in new markets. This can be taken as high-level retainer consulting, market research reports, or project-based consulting.

3.1 Service Description

- Retainer consulting: We represent a client company as an extension of its business development and market development functions. This begins with complete understanding of the client company’s situation, objectives, and constraints. We then represent the client company quietly and confidentially, sifting through new market developments and new opportunities as is appropriate to the client, representing the client in initial talks with possible allies, vendors, and channels.

- Project consulting: Proposed and billed on a per-project and per-milestone basis, project consulting offers a client company a way to harness our specific qualities and use our expertise to solve specific problems, develop and/or implement plans, and develop specific information.

- Market research: Group studies available to selected clients at £5,000 per unit. A group study is a packaged and published complete study of a specific market, channel, or topic. Examples might be studies of developing consumer channels in France or Mexico, or implications of changing margins in software.

3.2 Competitive Comparison

The competition comes in several forms:

- The most significant competition is no consulting at all, companies choosing to do business development, channel development and market research in-house. Their own managers do this on their own, as part of their regular business functions. Our key advantage in competition with in-house development is that managers are already overloaded with responsibilities, they don’t have time for additional responsibilities in new market development or new channel development. Also, Acme can approach alliances, vendors, and channels on a confidential basis, gathering information and making initial contacts in ways that the corporate managers can’t.

- The high-level prestige management consulting: McKinsey, Bain, Accenture, etc. These are essentially generalists who take their name-brand management consulting into specialty areas. Most of these are US firms that have expanded to the UK and have offices in London and all over continental Europe. Their other very important weakness is the management structure that has the partners selling new jobs, and inexperienced associates delivering the work. We compete against them as experts in our specific fields, and with the guarantee that our clients will have the top-level people doing the actual work.

- The third general kind of competitor is the international market research company: International Data Corporation (IDC), Dataquest, etc. These companies are formidable competitors for published market research and market forums, but cannot provide the kind of high-level consulting that Acme will provide.

- The fourth kind of competition is the market-specific smaller house. For example: Gloucestershire Research in the United Kingdom, Select S.A. de C.V. in Mexico (now affiliated with IDC).

- Sales representation, brokering, and deal catalysts are an ad-hoc business form that will be defined in detail by the specific nature of each individual case.

3.3 Sales Literature

The business will begin with a general corporate brochure establishing the positioning. This brochure will be developed as part of the start-up expenses.

Literature and mailings for the initial market forums will be very important.

3.4 Fulfillment

- The key fulfilment and delivery will be provided by the principals of the business. The real core value is professional expertise, provided by a combination of experience, hard work, and education (in that order).

- We will turn to qualified professionals for freelance back-up in market research and presentation and report development, which are areas that we can afford to sub-contract without risking the core values provided to the clients.

3.5 Technology

Acme Consulting will maintain the latest Windows and Macintosh capabilities including:

- Complete e-mail facilities on the Internet, CompuServe, Applelink, and others for working with clients directly through e-mail delivery of drafts and information.

- Complete presentation facilities for preparation and delivery of multimedia presentations on Macintosh or Windows machines, in formats including on-disk presentation, live presentation, or video presentation.

- Complete desktop publishing facilities for delivery of regular retainer reports, project output reports, marketing materials, and market research reports.

3.6 Future Services

In the future, Acme will broaden the coverage by expanding into coverage of additional markets (e.g., all of Latin America, Far East) and additional product areas (e.g., telecommunications and technology integration).

We are also studying the possibility of newsletter or electronic newsletter services, or perhaps special on-topic reports.

Market Analysis Summary

Acme will be focusing on high-technology manufacturers of computer hardware and software, services, and networking, who want to sell into markets in the United Kingdom, Europe, and Latin America. These are mostly larger companies, and occasionally medium-sized companies.

Our most important group of potential customers are executives in larger corporations. These are marketing managers, general managers, sales managers, sometimes charged with international focus and sometimes charged with market or even specific channel focus. They do not want to waste their time or risk their money looking for bargain information or questionable expertise. As they go into markets looking at new opportunities, they are very sensitive to risking their company’s name and reputation.

4.1 Market Segmentation

Large manufacturer corporations: Our most important market segment is the large manufacturer of high-technology products, such as Apple, Hewlett-Packard, IBM, Microsoft, Siemens, or Olivetti. These companies will be calling on Acme for development functions that are better spun off than managed in-house, for market research, and for market forums.

Medium-sized growth companies: Particularly in software, multimedia, and some related high-growth fields, Acme will offer an attractive development alternative to the company that is management constrained and unable to address opportunities in new markets and new market segments.

| Market Analysis | |||||||

| Year 1 | Year 2 | Year 3 | Year 4 | Year 5 | |||

| Potential Customers | Growth | CAGR | |||||

| U.K. High Tech | 10% | 5,000 | 5,500 | 6,050 | 6,655 | 7,321 | 10.00% |

| European High Tech | 15% | 1,000 | 1,150 | 1,323 | 1,521 | 1,749 | 15.00% |

| Latin America | 35% | 250 | 338 | 456 | 616 | 832 | 35.07% |

| Other | 2% | 10,000 | 10,200 | 10,404 | 10,612 | 10,824 | 2.00% |

| Total | 6.27% | 16,250 | 17,188 | 18,233 | 19,404 | 20,726 | 6.27% |

4.2 Target Market Segment Strategy

As indicated by the previous table and Illustration, we must focus on a few thousand well-chosen potential customers in Europe and Latin America, while also offering services to UK and US firms that want to expand into European markets. These few thousand high-tech manufacturing companies are the key customers for Acme.

4.3 Service Business Analysis

The consulting “industry” is pulverised and disorganised, with thousands of smaller consulting organisations and individual consultants for every one of the few dozen well-known companies.

Consulting participants range from major international name-brand consultants to tens of thousands of individuals. One of Acme’s challenges will be establishing itself as a real consulting company, positioned as a relatively risk-free corporate purchase.

4.3.1 Distributing a Service

Consulting is sold and purchased mainly on a word-of-mouth basis, with relationships and previous experience being, by far, the most important factor.

The major name-brand houses have locations in major cities and major markets, and executive-level managers or partners develop new business through industry associations, business associations, chambers of commerce and industry, etc., and in some cases social associations such as country clubs.

The medium-level houses are generally area specific or function specific, and are not easily able to leverage their business through distribution.

4.3.2 Competition and Buying Patterns

The key element in purchase decisions made at the Acme client level is trust in the professional reputation and reliability of the consulting firm.

4.3.3 Main Competitors

1. The high-level prestige management consulting firms:

Strengths: International locations managed by owner-partners with a high level of presentation and understanding of general business. Enviable reputations which make purchase of consulting an easy decision for a manager, despite the very high prices.

Weaknesses: General business knowledge doesn’t substitute for the specific market, channel, and distribution expertise of Acme, focusing on high-technology markets and products only. Also, fees are extremely expensive, and work is generally done by very junior-level consultants, even though sold by high-level partners.

2. The international market research company:

Strengths: International offices, specific market knowledge, permanent staff developing market research information on permanent basis, good relationships with potential client companies.

Weaknesses: Market numbers are not marketing, not channel development nor market development. Although these companies compete for some of the business Acme is after, they cannot really offer the same level of business understanding at a high level.

3. Market specific or function specific experts:

Strengths: Expertise in market or functional areas. Acme should not try to compete with Gloucestershire Research or Accenture, or Select in their markets with market research, or with ChannelCorp in channel management.

Weaknesses: The inability to spread beyond a specific focus, or to rise above a specific focus, to provide actual management expertise, experience, and wisdom beyond the specifics.

4. Companies do in-house research and development:

Strengths: No incremental cost except travel; also, the general work is done by the people who are entirely responsible, the planning is done by those who will implement it.

Weaknesses: Most managers are terribly overburdened already, unable to find incremental resources in time and people to apply to incremental opportunities. Also, there is a lot of additional risk in market and channel development done in-house from the ground up. Finally, retainer-based antenna consultants can greatly enhance a company’s reach and extend its position into conversations that might otherwise never have taken place.

4.3.4 Business Participants

At the highest level are the few well-established major names in management consulting. Most of these are organised as partnerships established in major markets around the world, linked together by interconnecting directors and sharing the name and corporate wisdom. Some evolved from accounting companies (e.g. Arthur Andersen, Touche Ross) and some from management consulting (McKinsey, Bain). These companies charge very high rates for consulting, and maintain relatively high overhead structures and fulfilment structures based on partners selling and junior associates fulfilling.

At the intermediate level are some function-specific or market-specific consultants, such as the market research firms (IDC, Dataquest) or channel development firms (ChannelCorp, Channel Strategies, ChannelMark).

Some kinds of consulting are little more than contract expertise provided by somebody who, while temporarily out of work, offers consulting services.

Strategy and Implementation Summary

Acme will focus on three geographical markets, Europe, Latin America, and the United Kingdom, and in limited product segments: personal computers, software, networks, telecommunication, personal organisers, and technology integration products.

The target customer is usually a manager in a larger corporation, and occasionally an owner or president of a medium-sized corporation in a high-growth period.

5.1 Value Proposition

Acme Consulting will be priced at the upper edge of what the market will bear, competing with the name-brand consultants. The pricing fits with the general positioning of Acme as providing high-level expertise.

Consulting should be based on £3,000 per day for project consulting, £1,500 per day for market research, and £7,000 per month and up for retainer consulting. Market research reports should be priced at £3,000 per report, which will, of course, require that reports be very well planned, focused on very important topics, and very well presented.

5.2 Sales Strategy

The sales forecast monthly summary is included in the appendix. The annual sales projections are included below.

| Sales Forecast | |||

| Year 1 | Year 2 | Year 3 | |

| Sales | |||

| Retainer Consulting | £140,000 | £350,000 | £425,000 |

| Project Consulting | £270,000 | £325,000 | £350,000 |

| Market Research | £122,000 | £150,000 | £200,000 |

| Strategic Reports | £0 | £50,000 | £125,000 |

| Other | £0 | £0 | £0 |

| Total Sales | £532,000 | £875,000 | £1,100,000 |

| Direct Cost of Sales | Year 1 | Year 2 | Year 3 |

| Retainer Consulting | £21,200 | £38,000 | £48,000 |

| Project Consulting | £29,550 | £56,000 | £70,000 |

| Market Research | £57,250 | £105,000 | £131,000 |

| Strategic Reports | £0 | £20,000 | £40,000 |

| Other | £0 | £0 | £0 |

| Subtotal Direct Cost of Sales | £108,000 | £219,000 | £289,000 |

5.3 Strategic Alliances

At this writing, strategic alliances with Smith and Jones are possibilities, given the content of existing discussions. Given the background of prospective partners, we might also be talking to European companies including Siemens, Olivetti, and others, and to United States companies related to Apple Computer. In Latin America we would be looking at the key local high-technology vendors, beginning with Printaform.

5.4 Milestones

Our detailed milestones are shown in the following table and chart. The related budgets are included with the expenses shown in the projected Profit and Loss statement, which is in the financial analysis that comes in Chapter 7 of this plan.

| Milestones | |||||

| Milestone | Start Date | End Date | Budget | Manager | Department |

| Business plan | 10/1/2005 | 11/19/2005 | £3,500 | HM | Devpt |

| Logo design | 1/1/2006 | 2/1/2006 | £1,500 | TAJ | Marketing |

| Retainer contracts | 2/1/2006 | 12/31/2006 | £7,000 | HM | Sales |

| Stationery | 3/1/2006 | 4/15/2006 | £300 | JD | G&A |

| Brochures | 3/1/2006 | 4/15/2006 | £1,700 | TAJ | Marketing |

| Financial backing presentations | 4/1/2006 | 9/15/2006 | £7,000 | HM | Devpt |

| Initial mailing | 6/1/2006 | 7/1/2006 | £3,000 | HM | Sales |

| Office location | 1/15/2006 | 2/9/2006 | £3,000 | JD | G&A |

| Office equipment | 1/15/2006 | 2/19/2006 | £8,000 | JD | G&A |

| Other | 1/1/2006 | 12/31/2006 | £7,000 | ABC | Department |

| Totals | £42,000 | ||||

Management Summary

The initial management team depends on the founders themselves, with little back-up. As we grow, we will take on additional consulting help, plus graphic/editorial, sales, and marketing.

6.1 Organizational Structure

Acme should be managed by working partners, in a structure taken mainly from Smith Partners. In the beginning we assume 3-5 partners:

- Ralph Sampson.

- At least one, probably two, partners from Smith and Jones.

- One strong United States partner, based in San Francisco.

- The organisation has to be very flat in the beginning, with each of the founders responsible for his or her own work and management.

- One other strong partner.

6.2 Management Team

The Acme business requires a very high level of international experience and expertise, which means that it will not be easily leveragable in the common consulting company mode in which partners run the business and make sales, while associates fulfil. Partners will necessarily be involved in the fulfilment of the core business proposition, providing the expertise to the clients. The initial personnel plan is still tentative. It should involve 3-5 partners, 1-3 consultants, one strong editorial/graphic person with good staff support, one strong marketing person, an office manager, and a secretary. Later, we add more partners, consultants, and sales staff. Founders’ resumes are included as an attachment to this plan.

6.3 Personnel Plan

The detailed monthly personnel plan for the first year is included in the appendix. The annual personnel estimates are included here.

| Personnel Plan | |||

| Year 1 | Year 2 | Year 3 | |

| Partners | £96,000 | £175,000 | £200,000 |

| Consultants | £0 | £50,000 | £63,000 |

| Editorial/graphic | £12,000 | £14,000 | £17,000 |

| VP Marketing | £14,000 | £50,000 | £55,000 |

| Sales people | £0 | £30,000 | £33,000 |

| Office Manager | £5,250 | £30,000 | £33,000 |

| Secretarial | £5,250 | £20,000 | £22,000 |

| Other | £0 | £0 | £0 |

| Other | £0 | £0 | £0 |

| Total People | 7 | 14 | 20 |

| Total Payroll | £132,500 | £369,000 | £423,000 |

Financial Plan

Our financial plan is based on conservative estimates and assumptions. We will need to plan on initial investment to make the financials work.

7.1 Important Assumptions

The General Assumptions table summarises key financial assumptions, including sales entirely on invoice basis, payroll burden, and present-day interest and taxation rates.

We also assume 45-day average collection days, expenses mainly on net 30 basis and 35 days on average for payment of invoices.

| General Assumptions | |||

| Year 1 | Year 2 | Year 3 | |

| Plan Month | 1 | 2 | 3 |

| Current Interest Rate | 8.00% | 8.00% | 8.00% |

| Long-term Interest Rate | 10.00% | 10.00% | 10.00% |

| Tax Rate | 25.42% | 25.00% | 25.42% |

| Other | 0 | 0 | 0 |

7.2 Key Financial Indicators

The following benchmark chart indicates our key financial indicators for the first three years. We foresee major growth in sales and operating expenses, and a bump in our collection days as we spread the business during expansion.

7.3 Break-even Analysis

The following table and chart summarise the break-even analysis, including monthly units and sales break-even points.

| Break-even Analysis | |

| Monthly Revenue Break-even | £30,098 |

| Assumptions: | |

| Average Percent Variable Cost | 20% |

| Estimated Monthly Fixed Cost | £23,988 |

7.4 Projected Profit and Loss

The detailed monthly pro-forma income statement for the first year is included in the appendix. The annual estimates are included here.

| Pro Forma Profit and Loss | |||

| Year 1 | Year 2 | Year 3 | |

| Sales | £532,000 | £875,000 | £1,100,000 |

| Direct Cost of Sales | £108,000 | £219,000 | £289,000 |

| Other | £0 | £0 | £0 |

| Total Cost of Sales | £108,000 | £219,000 | £289,000 |

| Gross Margin | £424,000 | £656,000 | £811,000 |

| Gross Margin % | 79.70% | 74.97% | 73.73% |

| Expenses | |||

| Payroll | £132,500 | £369,000 | £423,000 |

| Sales and Marketing and Other Expenses | £108,600 | £137,000 | £195,000 |

| Depreciation | £0 | £0 | £0 |

| Leased Equipment | £3,600 | £7,000 | £7,000 |

| Utilities | £9,000 | £12,000 | £12,000 |

| Insurance | £3,600 | £2,000 | £2,000 |

| Rent | £12,000 | £0 | £0 |

| Other | £0 | £0 | £0 |

| Payroll Taxes (National Insurance, etc) | £18,550 | £51,660 | £59,220 |

| Other | £0 | £0 | £0 |

| Total Operating Expenses | £287,850 | £578,660 | £698,220 |

| Profit Before Interest and Taxes | £136,150 | £77,340 | £112,780 |

| EBITDA | £136,150 | £77,340 | £112,780 |

| Interest Expense | £6,800 | £11,400 | £15,400 |

| Taxes Incurred | £31,516 | £16,485 | £24,751 |

| Net Profit | £97,834 | £49,455 | £72,629 |

| Net Profit/Sales | 18.39% | 5.65% | 6.60% |

7.5 Projected Cash Flow

Cash flow projections are critical to our success. The monthly cash flow is shown in the illustration, with one bar representing the cash flow per month and the other representing the monthly balance. The annual cash flow figures are included below. Detailed monthly numbers are included in the appendix.

| Pro Forma Cash Flow | |||

| Year 1 | Year 2 | Year 3 | |

| Cash Received | |||

| Cash from Operations | |||

| Cash Sales | £399,000 | £656,250 | £825,000 |

| Cash from Receivables | £100,450 | £197,764 | £261,234 |

| Subtotal Cash from Operations | £499,450 | £854,014 | £1,086,234 |

| Additional Cash Received | |||

| Sales Tax, VAT, HST/GST Received | £0 | £0 | £0 |

| New Current Borrowing | £30,000 | £100,000 | £0 |

| New Other Liabilities (interest-free) | £0 | £0 | £0 |

| New Long-term Liabilities | £50,000 | £0 | £0 |

| Sales of Other Current Assets | £0 | £0 | £0 |

| Sales of Long-term Assets | £0 | £0 | £0 |

| New Investment Received | £0 | £0 | £0 |

| Subtotal Cash Received | £579,450 | £954,014 | £1,086,234 |

| Expenditures | Year 1 | Year 2 | Year 3 |

| Expenditures from Operations | |||

| Cash Spending | £132,500 | £369,000 | £423,000 |

| Bill Payments | £274,773 | £446,264 | £592,221 |

| Subtotal Spent on Operations | £407,273 | £815,264 | £1,015,221 |

| Additional Cash Spent | |||

| Sales Tax, VAT, HST/GST Paid Out | £0 | £0 | £0 |

| Principal Repayment of Current Borrowing | £0 | £0 | £0 |

| Other Liabilities Principal Repayment | £0 | £0 | £0 |

| Long-term Liabilities Principal Repayment | £0 | £0 | £0 |

| Purchase Other Current Assets | £0 | £0 | £0 |

| Purchase Long-term Assets | £0 | £0 | £0 |

| Dividends | £0 | £0 | £0 |

| Subtotal Cash Spent | £407,273 | £815,264 | £1,015,221 |

| Net Cash Flow | £172,177 | £138,750 | £71,013 |

| Cash Balance | £197,177 | £335,927 | £406,940 |

7.6 Projected Balance Sheet

The balance sheet shows healthy growth of net worth, and strong financial position. The monthly estimates are included in the appendix.

| Pro Forma Balance Sheet | |||

| Year 1 | Year 2 | Year 3 | |

| Assets | |||

| Current Assets | |||

| Cash | £197,177 | £335,927 | £406,940 |

| Accounts Receivable | £32,550 | £53,536 | £67,303 |

| Other Current Assets | £7,000 | £7,000 | £7,000 |

| Total Current Assets | £236,727 | £396,464 | £481,243 |

| Long-term Assets | |||

| Long-term Assets | £0 | £0 | £0 |

| Accumulated Depreciation | £0 | £0 | £0 |

| Total Long-term Assets | £0 | £0 | £0 |

| Total Assets | £236,727 | £396,464 | £481,243 |

| Liabilities and Capital | Year 1 | Year 2 | Year 3 |

| Current Liabilities | |||

| Accounts Payable | £27,243 | £37,524 | £49,674 |

| Current Borrowing | £30,000 | £130,000 | £130,000 |

| Other Current Liabilities | £0 | £0 | £0 |

| Subtotal Current Liabilities | £57,243 | £167,524 | £179,674 |

| Long-term Liabilities | £50,000 | £50,000 | £50,000 |

| Total Liabilities | £107,243 | £217,524 | £229,674 |

| Paid-in Capital | £50,000 | £50,000 | £50,000 |

| Retained Earnings | (£18,350) | £79,484 | £128,939 |

| Earnings | £97,834 | £49,455 | £72,629 |

| Total Capital | £129,484 | £178,939 | £251,569 |

| Total Liabilities and Capital | £236,727 | £396,464 | £481,243 |

| Net Worth | £129,484 | £178,939 | £251,569 |

7.7 Business Ratios

The following table shows the projected business ratios. We expect to maintain healthy ratios for profitability, risk, and return. The industry profile comparisons are for the Management Consulting Services.

| Ratio Analysis | ||||

| Year 1 | Year 2 | Year 3 | Industry Profile | |

| Sales Growth | 0.00% | 64.47% | 25.71% | 8.52% |

| Percent of Total Assets | ||||

| Accounts Receivable | 13.75% | 13.50% | 13.99% | 21.99% |

| Other Current Assets | 2.96% | 1.77% | 1.45% | 50.95% |

| Total Current Assets | 100.00% | 100.00% | 100.00% | 75.87% |

| Long-term Assets | 0.00% | 0.00% | 0.00% | 24.13% |

| Total Assets | 100.00% | 100.00% | 100.00% | 100.00% |

| Current Liabilities | 24.18% | 42.25% | 37.34% | 34.32% |

| Long-term Liabilities | 21.12% | 12.61% | 10.39% | 17.09% |

| Total Liabilities | 45.30% | 54.87% | 47.73% | 51.41% |

| Net Worth | 54.70% | 45.13% | 52.27% | 48.59% |

| Percent of Sales | ||||

| Sales | 100.00% | 100.00% | 100.00% | 100.00% |

| Gross Margin | 79.70% | 74.97% | 73.73% | 100.00% |

| Selling, General & Administrative Expenses | 61.46% | 69.32% | 67.09% | 80.54% |

| Advertising Expenses | 4.51% | 4.57% | 4.00% | 1.54% |

| Profit Before Interest and Taxes | 25.59% | 8.84% | 10.25% | 2.69% |

| Main Ratios | ||||

| Current | 4.14 | 2.37 | 2.68 | 1.63 |

| Quick | 4.14 | 2.37 | 2.68 | 1.31 |

| Total Debt to Total Assets | 45.30% | 54.87% | 47.73% | 60.47% |

| Pre-tax Return on Net Worth | 99.90% | 36.85% | 38.71% | 4.80% |

| Pre-tax Return on Assets | 54.64% | 16.63% | 20.24% | 12.14% |

| Additional Ratios | Year 1 | Year 2 | Year 3 | |

| Net Profit Margin | 18.39% | 5.65% | 6.60% | n.a |

| Return on Equity | 75.56% | 27.64% | 28.87% | n.a |

| Activity Ratios | ||||

| Accounts Receivable Turnover | 4.09 | 4.09 | 4.09 | n.a |

| Collection Days | 57 | 72 | 80 | n.a |

| Accounts Payable Turnover | 11.07 | 12.17 | 12.17 | n.a |

| Payment Days | 27 | 26 | 26 | n.a |

| Total Asset Turnover | 2.25 | 2.21 | 2.29 | n.a |

| Debt Ratios | ||||

| Debt to Net Worth | 0.83 | 1.22 | 0.91 | n.a |

| Current Liab. to Liab. | 0.53 | 0.77 | 0.78 | n.a |

| Liquidity Ratios | ||||

| Net Working Capital | £179,484 | £228,939 | £301,569 | n.a |

| Interest Coverage | 20.02 | 6.78 | 7.32 | n.a |

| Additional Ratios | ||||

| Assets to Sales | 0.44 | 0.45 | 0.44 | n.a |

| Current Debt/Total Assets | 24% | 42% | 37% | n.a |

| Acid Test | 3.57 | 2.05 | 2.30 | n.a |

| Sales/Net Worth | 4.11 | 4.89 | 4.37 | n.a |

| Dividend Payout | 0.00 | 0.00 | 0.00 | n.a |

Appendix

| Sales Forecast | |||||||||||||

| Month 1 | Month 2 | Month 3 | Month 4 | Month 5 | Month 6 | Month 7 | Month 8 | Month 9 | Month 10 | Month 11 | Month 12 | ||

| Sales | |||||||||||||

| Retainer Consulting | £7,000 | £7,000 | £7,000 | £7,000 | £14,000 | £14,000 | £14,000 | £14,000 | £14,000 | £14,000 | £14,000 | £14,000 | |

| Project Consulting | £0 | £0 | £10,000 | £20,000 | £30,000 | £40,000 | £20,000 | £10,000 | £30,000 | £45,000 | £50,000 | £15,000 | |

| Market Research | £0 | £0 | £0 | £4,000 | £8,000 | £15,000 | £10,000 | £5,000 | £20,000 | £20,000 | £20,000 | £20,000 | |

| Strategic Reports | £0 | £0 | £0 | £0 | £0 | £0 | £0 | £0 | £0 | £0 | £0 | £0 | |

| Other | £0 | £0 | £0 | £0 | £0 | £0 | £0 | £0 | £0 | £0 | £0 | £0 | |

| Total Sales | £7,000 | £7,000 | £17,000 | £31,000 | £52,000 | £69,000 | £44,000 | £29,000 | £64,000 | £79,000 | £84,000 | £49,000 | |

| Direct Cost of Sales | Month 1 | Month 2 | Month 3 | Month 4 | Month 5 | Month 6 | Month 7 | Month 8 | Month 9 | Month 10 | Month 11 | Month 12 | |

| Retainer Consulting | £2,500 | £1,700 | £1,700 | £1,700 | £1,700 | £1,700 | £1,700 | £1,700 | £1,700 | £1,700 | £1,700 | £1,700 | |

| Project Consulting | £0 | £0 | £700 | £2,700 | £3,000 | £4,250 | £2,250 | £700 | £3,000 | £5,000 | £6,250 | £1,700 | |

| Market Research | £0 | £0 | £0 | £1,500 | £4,000 | £7,000 | £4,000 | £2,750 | £9,500 | £9,500 | £9,500 | £9,500 | |

| Strategic Reports | £0 | £0 | £0 | £0 | £0 | £0 | £0 | £0 | £0 | £0 | £0 | £0 | |

| Other | £0 | £0 | £0 | £0 | £0 | £0 | £0 | £0 | £0 | £0 | £0 | £0 | |

| Subtotal Direct Cost of Sales | £2,500 | £1,700 | £2,400 | £5,900 | £8,700 | £12,950 | £7,950 | £5,150 | £14,200 | £16,200 | £17,450 | £12,900 | |

| Personnel Plan | |||||||||||||

| Month 1 | Month 2 | Month 3 | Month 4 | Month 5 | Month 6 | Month 7 | Month 8 | Month 9 | Month 10 | Month 11 | Month 12 | ||

| Partners | 140% | £8,000 | £8,000 | £8,000 | £8,000 | £8,000 | £8,000 | £8,000 | £8,000 | £8,000 | £8,000 | £8,000 | £8,000 |

| Consultants | 125% | £0 | £0 | £0 | £0 | £0 | £0 | £0 | £0 | £0 | £0 | £0 | £0 |

| Editorial/graphic | 120% | £0 | £0 | £0 | £0 | £0 | £0 | £0 | £0 | £0 | £4,000 | £4,000 | £4,000 |

| VP Marketing | 110% | £0 | £0 | £0 | £0 | £0 | £0 | £0 | £0 | £3,500 | £3,500 | £3,500 | £3,500 |

| Sales people | 110% | £0 | £0 | £0 | £0 | £0 | £0 | £0 | £0 | £0 | £0 | £0 | £0 |

| Office Manager | 110% | £0 | £0 | £0 | £0 | £0 | £0 | £0 | £0 | £0 | £1,750 | £1,750 | £1,750 |

| Secretarial | 110% | £0 | £0 | £0 | £0 | £0 | £0 | £0 | £0 | £0 | £1,750 | £1,750 | £1,750 |

| Other | 110% | £0 | £0 | £0 | £0 | £0 | £0 | £0 | £0 | £0 | £0 | £0 | £0 |

| Other | 0% | £0 | £0 | £0 | £0 | £0 | £0 | £0 | £0 | £0 | £0 | £0 | £0 |

| Total People | 3 | 3 | 3 | 3 | 3 | 3 | 3 | 3 | 5 | 7 | 7 | 7 | |

| Total Payroll | £8,000 | £8,000 | £8,000 | £8,000 | £8,000 | £8,000 | £8,000 | £8,000 | £11,500 | £19,000 | £19,000 | £19,000 | |

| General Assumptions | |||||||||||||

| Month 1 | Month 2 | Month 3 | Month 4 | Month 5 | Month 6 | Month 7 | Month 8 | Month 9 | Month 10 | Month 11 | Month 12 | ||

| Plan Month | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 | 11 | 12 | |

| Current Interest Rate | 8.00% | 8.00% | 8.00% | 8.00% | 8.00% | 8.00% | 8.00% | 8.00% | 8.00% | 8.00% | 8.00% | 8.00% | |

| Long-term Interest Rate | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | |

| Tax Rate | 30.00% | 25.00% | 25.00% | 25.00% | 25.00% | 25.00% | 25.00% | 25.00% | 25.00% | 25.00% | 25.00% | 25.00% | |

| Other | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | |

| Pro Forma Profit and Loss | |||||||||||||

| Month 1 | Month 2 | Month 3 | Month 4 | Month 5 | Month 6 | Month 7 | Month 8 | Month 9 | Month 10 | Month 11 | Month 12 | ||

| Sales | £7,000 | £7,000 | £17,000 | £31,000 | £52,000 | £69,000 | £44,000 | £29,000 | £64,000 | £79,000 | £84,000 | £49,000 | |

| Direct Cost of Sales | £2,500 | £1,700 | £2,400 | £5,900 | £8,700 | £12,950 | £7,950 | £5,150 | £14,200 | £16,200 | £17,450 | £12,900 | |

| Other | £0 | £0 | £0 | £0 | £0 | £0 | £0 | £0 | £0 | £0 | £0 | £0 | |

| Total Cost of Sales | £2,500 | £1,700 | £2,400 | £5,900 | £8,700 | £12,950 | £7,950 | £5,150 | £14,200 | £16,200 | £17,450 | £12,900 | |

| Gross Margin | £4,500 | £5,300 | £14,600 | £25,100 | £43,300 | £56,050 | £36,050 | £23,850 | £49,800 | £62,800 | £66,550 | £36,100 | |

| Gross Margin % | 64.29% | 75.71% | 85.88% | 80.97% | 83.27% | 81.23% | 81.93% | 82.24% | 77.81% | 79.49% | 79.23% | 73.67% | |

| Expenses | |||||||||||||

| Payroll | £8,000 | £8,000 | £8,000 | £8,000 | £8,000 | £8,000 | £8,000 | £8,000 | £11,500 | £19,000 | £19,000 | £19,000 | |

| Sales and Marketing and Other Expenses | £9,050 | £9,050 | £9,050 | £9,050 | £9,050 | £9,050 | £9,050 | £9,050 | £9,050 | £9,050 | £9,050 | £9,050 | |

| Depreciation | £0 | £0 | £0 | £0 | £0 | £0 | £0 | £0 | £0 | £0 | £0 | £0 | |

| Leased Equipment | £300 | £300 | £300 | £300 | £300 | £300 | £300 | £300 | £300 | £300 | £300 | £300 | |

| Utilities | £750 | £750 | £750 | £750 | £750 | £750 | £750 | £750 | £750 | £750 | £750 | £750 | |

| Insurance | £300 | £300 | £300 | £300 | £300 | £300 | £300 | £300 | £300 | £300 | £300 | £300 | |

| Rent | £1,000 | £1,000 | £1,000 | £1,000 | £1,000 | £1,000 | £1,000 | £1,000 | £1,000 | £1,000 | £1,000 | £1,000 | |

| Other | £0 | £0 | £0 | £0 | £0 | £0 | £0 | £0 | £0 | £0 | £0 | £0 | |

| Payroll Taxes (National Insurance, etc) | 15% | £1,120 | £1,120 | £1,120 | £1,120 | £1,120 | £1,120 | £1,120 | £1,120 | £1,610 | £2,660 | £2,660 | £2,660 |

| Other | £0 | £0 | £0 | £0 | £0 | £0 | £0 | £0 | £0 | £0 | £0 | £0 | |

| Total Operating Expenses | £20,520 | £20,520 | £20,520 | £20,520 | £20,520 | £20,520 | £20,520 | £20,520 | £24,510 | £33,060 | £33,060 | £33,060 | |

| Profit Before Interest and Taxes | (£16,020) | (£15,220) | (£5,920) | £4,580 | £22,780 | £35,530 | £15,530 | £3,330 | £25,290 | £29,740 | £33,490 | £3,040 | |

| EBITDA | (£16,020) | (£15,220) | (£5,920) | £4,580 | £22,780 | £35,530 | £15,530 | £3,330 | £25,290 | £29,740 | £33,490 | £3,040 | |

| Interest Expense | £417 | £417 | £550 | £550 | £550 | £617 | £617 | £617 | £617 | £617 | £617 | £617 | |

| Taxes Incurred | (£4,931) | (£3,909) | (£1,618) | £1,008 | £5,558 | £8,728 | £3,728 | £678 | £6,168 | £7,281 | £8,218 | £606 | |

| Net Profit | (£11,506) | (£11,728) | (£4,853) | £3,023 | £16,673 | £26,185 | £11,185 | £2,035 | £18,505 | £21,843 | £24,655 | £1,818 | |

| Net Profit/Sales | -164.37% | -167.54% | -28.54% | 9.75% | 32.06% | 37.95% | 25.42% | 7.02% | 28.91% | 27.65% | 29.35% | 3.71% | |

| Pro Forma Cash Flow | |||||||||||||

| Month 1 | Month 2 | Month 3 | Month 4 | Month 5 | Month 6 | Month 7 | Month 8 | Month 9 | Month 10 | Month 11 | Month 12 | ||

| Cash Received | |||||||||||||

| Cash from Operations | |||||||||||||

| Cash Sales | £5,250 | £5,250 | £12,750 | £23,250 | £39,000 | £51,750 | £33,000 | £21,750 | £48,000 | £59,250 | £63,000 | £36,750 | |

| Cash from Receivables | £0 | £58 | £1,750 | £1,833 | £4,367 | £7,925 | £13,142 | £17,042 | £10,875 | £7,542 | £16,125 | £19,792 | |

| Subtotal Cash from Operations | £5,250 | £5,308 | £14,500 | £25,083 | £43,367 | £59,675 | £46,142 | £38,792 | £58,875 | £66,792 | £79,125 | £56,542 | |

| Additional Cash Received | |||||||||||||

| Sales Tax, VAT, HST/GST Received | 0.00% | £0 | £0 | £0 | £0 | £0 | £0 | £0 | £0 | £0 | £0 | £0 | £0 |

| New Current Borrowing | £0 | £0 | £20,000 | £0 | £0 | £10,000 | £0 | £0 | £0 | £0 | £0 | £0 | |

| New Other Liabilities (interest-free) | £0 | £0 | £0 | £0 | £0 | £0 | £0 | £0 | £0 | £0 | £0 | £0 | |

| New Long-term Liabilities | £50,000 | £0 | £0 | £0 | £0 | £0 | £0 | £0 | £0 | £0 | £0 | £0 | |

| Sales of Other Current Assets | £0 | £0 | £0 | £0 | £0 | £0 | £0 | £0 | £0 | £0 | £0 | £0 | |

| Sales of Long-term Assets | £0 | £0 | £0 | £0 | £0 | £0 | £0 | £0 | £0 | £0 | £0 | £0 | |

| New Investment Received | £0 | £0 | £0 | £0 | £0 | £0 | £0 | £0 | £0 | £0 | £0 | £0 | |

| Subtotal Cash Received | £55,250 | £5,308 | £34,500 | £25,083 | £43,367 | £69,675 | £46,142 | £38,792 | £58,875 | £66,792 | £79,125 | £56,542 | |

| Expenditures | Month 1 | Month 2 | Month 3 | Month 4 | Month 5 | Month 6 | Month 7 | Month 8 | Month 9 | Month 10 | Month 11 | Month 12 | |

| Expenditures from Operations | |||||||||||||

| Cash Spending | £8,000 | £8,000 | £8,000 | £8,000 | £8,000 | £8,000 | £8,000 | £8,000 | £11,500 | £19,000 | £19,000 | £19,000 | |

| Bill Payments | £700 | £10,513 | £10,832 | £14,057 | £20,223 | £27,577 | £34,482 | £24,620 | £19,466 | £34,134 | £38,230 | £39,940 | |

| Subtotal Spent on Operations | £8,700 | £18,513 | £18,832 | £22,057 | £28,223 | £35,577 | £42,482 | £32,620 | £30,966 | £53,134 | £57,230 | £58,940 | |

| Additional Cash Spent | |||||||||||||

| Sales Tax, VAT, HST/GST Paid Out | £0 | £0 | £0 | £0 | £0 | £0 | £0 | £0 | £0 | £0 | £0 | £0 | |

| Principal Repayment of Current Borrowing | £0 | £0 | £0 | £0 | £0 | £0 | £0 | £0 | £0 | £0 | £0 | £0 | |

| Other Liabilities Principal Repayment | £0 | £0 | £0 | £0 | £0 | £0 | £0 | £0 | £0 | £0 | £0 | £0 | |

| Long-term Liabilities Principal Repayment | £0 | £0 | £0 | £0 | £0 | £0 | £0 | £0 | £0 | £0 | £0 | £0 | |

| Purchase Other Current Assets | £0 | £0 | £0 | £0 | £0 | £0 | £0 | £0 | £0 | £0 | £0 | £0 | |

| Purchase Long-term Assets | £0 | £0 | £0 | £0 | £0 | £0 | £0 | £0 | £0 | £0 | £0 | £0 | |

| Dividends | £0 | £0 | £0 | £0 | £0 | £0 | £0 | £0 | £0 | £0 | £0 | £0 | |

| Subtotal Cash Spent | £8,700 | £18,513 | £18,832 | £22,057 | £28,223 | £35,577 | £42,482 | £32,620 | £30,966 | £53,134 | £57,230 | £58,940 | |

| Net Cash Flow | £46,550 | (£13,205) | £15,668 | £3,027 | £15,144 | £34,098 | £3,660 | £6,172 | £27,909 | £13,658 | £21,895 | (£2,398) | |

| Cash Balance | £71,550 | £58,345 | £74,013 | £77,040 | £92,184 | £126,282 | £129,942 | £136,114 | £164,023 | £177,681 | £199,575 | £197,177 | |

| Pro Forma Balance Sheet | |||||||||||||

| Month 1 | Month 2 | Month 3 | Month 4 | Month 5 | Month 6 | Month 7 | Month 8 | Month 9 | Month 10 | Month 11 | Month 12 | ||

| Assets | Starting Balances | ||||||||||||

| Current Assets | |||||||||||||

| Cash | £25,000 | £71,550 | £58,345 | £74,013 | £77,040 | £92,184 | £126,282 | £129,942 | £136,114 | £164,023 | £177,681 | £199,575 | £197,177 |

| Accounts Receivable | £0 | £1,750 | £3,442 | £5,942 | £11,858 | £20,492 | £29,817 | £27,675 | £17,883 | £23,008 | £35,217 | £40,092 | £32,550 |

| Other Current Assets | £7,000 | £7,000 | £7,000 | £7,000 | £7,000 | £7,000 | £7,000 | £7,000 | £7,000 | £7,000 | £7,000 | £7,000 | £7,000 |

| Total Current Assets | £32,000 | £80,300 | £68,787 | £86,955 | £95,898 | £119,676 | £163,099 | £164,617 | £160,997 | £194,031 | £219,897 | £246,667 | £236,727 |

| Long-term Assets | |||||||||||||

| Long-term Assets | £0 | £0 | £0 | £0 | £0 | £0 | £0 | £0 | £0 | £0 | £0 | £0 | £0 |

| Accumulated Depreciation | £0 | £0 | £0 | £0 | £0 | £0 | £0 | £0 | £0 | £0 | £0 | £0 | £0 |

| Total Long-term Assets | £0 | £0 | £0 | £0 | £0 | £0 | £0 | £0 | £0 | £0 | £0 | £0 | £0 |

| Total Assets | £32,000 | £80,300 | £68,787 | £86,955 | £95,898 | £119,676 | £163,099 | £164,617 | £160,997 | £194,031 | £219,897 | £246,667 | £236,727 |

| Liabilities and Capital | Month 1 | Month 2 | Month 3 | Month 4 | Month 5 | Month 6 | Month 7 | Month 8 | Month 9 | Month 10 | Month 11 | Month 12 | |

| Current Liabilities | |||||||||||||

| Accounts Payable | £350 | £10,155 | £10,370 | £13,391 | £19,312 | £26,417 | £33,655 | £23,988 | £18,333 | £32,862 | £36,886 | £39,000 | £27,243 |

| Current Borrowing | £0 | £0 | £0 | £20,000 | £20,000 | £20,000 | £30,000 | £30,000 | £30,000 | £30,000 | £30,000 | £30,000 | £30,000 |

| Other Current Liabilities | £0 | £0 | £0 | £0 | £0 | £0 | £0 | £0 | £0 | £0 | £0 | £0 | £0 |

| Subtotal Current Liabilities | £350 | £10,155 | £10,370 | £33,391 | £39,312 | £46,417 | £63,655 | £53,988 | £48,333 | £62,862 | £66,886 | £69,000 | £57,243 |

| Long-term Liabilities | £0 | £50,000 | £50,000 | £50,000 | £50,000 | £50,000 | £50,000 | £50,000 | £50,000 | £50,000 | £50,000 | £50,000 | £50,000 |

| Total Liabilities | £350 | £60,155 | £60,370 | £83,391 | £89,312 | £96,417 | £113,655 | £103,988 | £98,333 | £112,862 | £116,886 | £119,000 | £107,243 |

| Paid-in Capital | £50,000 | £50,000 | £50,000 | £50,000 | £50,000 | £50,000 | £50,000 | £50,000 | £50,000 | £50,000 | £50,000 | £50,000 | £50,000 |

| Retained Earnings | (£18,350) | (£18,350) | (£18,350) | (£18,350) | (£18,350) | (£18,350) | (£18,350) | (£18,350) | (£18,350) | (£18,350) | (£18,350) | (£18,350) | (£18,350) |

| Earnings | £0 | (£11,506) | (£23,233) | (£28,086) | (£25,063) | (£8,391) | £17,794 | £28,979 | £31,014 | £49,519 | £71,362 | £96,017 | £97,834 |

| Total Capital | £31,650 | £20,144 | £8,417 | £3,564 | £6,587 | £23,259 | £49,444 | £60,629 | £62,664 | £81,169 | £103,012 | £127,667 | £129,484 |

| Total Liabilities and Capital | £32,000 | £80,300 | £68,787 | £86,955 | £95,898 | £119,676 | £163,099 | £164,617 | £160,997 | £194,031 | £219,897 | £246,667 | £236,727 |

| Net Worth | £31,650 | £20,144 | £8,417 | £3,564 | £6,587 | £23,259 | £49,444 | £60,629 | £62,664 | £81,169 | £103,012 | £127,667 | £129,484 |