Cellular Providers

Executive Summary

Introduction

Cellular Providers is taking advantage of an opportunity to become a highly distinguished and recognized industry leader in the cellular communications industry. It is the goal of our company to become established as the leading distributor of wireless communications services.

In order to achieve this goal, Cellular Providers’ critical success factors will be to identify emerging trends and integrate them into Cellular Providers’ operations, respond quickly to technology changes/be there early, provide high-quality services, continue to invest time and money in marketing and advertising, continue to expand into specialty markets, and stay ahead of the “technology curve.”

The Company

The company was initially formed as a sole proprietorship by Jason Sanderson. Mr. Sanderson capitalized on the growing wireless communications industry to create a niche market for its services and accessories. Through its research and development, Cellular Providers has maintained a technological lead in the marketplace and provided the best quality care for the consumer. Today, revenue sources include a variety of phones, and a full range of accessories and services.

Cellular Providers’ head office is located at 654 Smith Lane, #87, Pullman, WA 23423. Cellular Providers’ leases its 1,000 square feet head office which, has adequate office space to conduct its operations. At some point in the future, management expects to outgrow this office space.

Cellular Providers has a world class management team with direct knowledge of the industry, extensive research experience, and unique administrative skills. Its team includes Jason Sanderson, president; Jerry Tillman, vice president; and Joe Dunn. Together, they have a combined total of over 10 years experience in the cellular and retail industries. In the future, Cellular Providers expects to require a highly qualified CFO, HR manager, additional customer service personnel, additional sales reps, and a public relations manager.

The Services

The company has a developed mix of services targeting both businesses and consumers. At today’s breakneck pace of business, companies need more ways than ever to keep in touch, and the easier the better.

Cellular Providers’ innovative product and service offerings provide the best advantages to customers, including sleek and innovative cellular phone models, text and numeric paging, data capability, no roaming or landline connection charges, and much more.

The Market

The ten-year outlook in the wireless communications service is excellent. The number of new cellular subscribers in the United States increased dramatically from 1992 to 1998, and 1999 saw continuation of that growth. The number of new subscribers exceeded 10 million, with a record 11.5 million net new subscribers in 1997, for a total of 55.3 million at the end of that year. By the end of 1999 analysts had that figure reaching 80 million. While projections differ, the number of cellular and PCS subscribers in the U.S. is expected to have a compound average growth rate (CAGR) of 12%. With the evolution of new technology, this industry is expected to generate increased revenues.

There are a number of trends that are driving this growing industry. The most significant ones are greater marketing and advertising efforts, rapidly expanding networks, and technological advances. New services and applications such as advanced messaging, data and video transmission, location technology, and remote monitoring are in the early stages of what most analysts predict will be a period of explosive growth.

The company plans to focus on three target markets that will provide us with the greatest market penetration. This includes the specialty business users, the general business users, and the personal users. We intend to offer service packages that are priced appropriately for each segment and will offer the services that best suit each segment’s needs.

Cellular Providers’ ongoing marketing strategy involves the company maintaining and expanding a broad base of clients in target territories, establishing alliances with product and services companies so that it can deliver high quality products, and invoking its own organization to bring these together and implement total solutions for customers. The company will move from the traditional product-focused strategy to a total-focus on customer ownership.

Financial Considerations

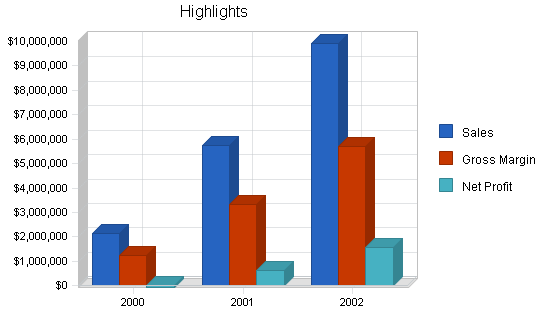

It is estimated that Cellular Providers will have strong profits based on $10 million in sales by Year 3. Cellular Providers is currently seeking funding in the amount of $100,000 as a three-year loan for the purpose of increasing market share, opening up additional retail locations, hiring additional staff, and effectively advertising and promoting its services.

1.1 Objectives

Business Objectives

- Company growth.

- Become established as the leading distributor of wireless communications services.

- Increase number of retail outlets.

Financial Objectives

- Increase revenue

Marketing Objectives

- Increase marketing efforts.

- Expand market area.

- Expand marketing reach.

- Brand recognition.

- Increase telemarketing efforts.

1.2 Mission

Cellular Providers is committed to continued high levels of customer service and selling cellular and two way radio service through progressive retail locations and outside sales representatives.

Cellular Providers is striving to become the nation’s leading distributor of cellular service and accessories. Cellular Providers’ vision capitalizes on technologically superior products and services and is designed to enhance business and personal communication.

1.3 Keys to Success

Timing is critical in business. Cellular Providers is taking advantage of an opportunity to become a highly distinguished and recognized industry leader because of certain key advantages:

- The management team has a unique combination of business knowledge and experience in this market.

- Cellular Providers has combined its expertise to offer services for every type of customer in this credit-sensitive industry.

- Cellular Providers has established partnering relationships with leading companies in the industry and customers.

Cellular Providers’ critical success factors include funding, marketing, quality sales professionals, good management, aggressive branding, increasing reach, affiliating with the right partners, being specific to the needs of businesses and the public, competitive intelligence, appropriate use of technology, and remaining dynamic to keep pace with evolving wireless communications business strategies.

Company Summary

Cellular Providers is one of the state’s leaders in the field of wireless communications services.

Cellular Providers is a distributor of AT&T and Sprint PCS services. The company was formed for the purpose of selling and distributing wireless communications services. Over the course of its existence, the professionals at Cellular Providers have been involved in selling cellular service and accessories. Cellular Providers carries the latest in wireless technology from two of the major wireless companies in the industry.

The company’s management philosophy is based on responsibility and mutual respect. Cellular Providers maintains an environment and structure that encourages productivity and respect for customers and fellow employees. Additionally, the environment encourages employees to have fun by allowing creative independence and providing challenges that are realistic and rewarding.

2.1 Company Ownership

The legal name of the company is Cellular Providers, LLC. The company was initially formed as a sole proprietorship by Jason Sanderson.

Cellular Providers was formed as a company committed to being on the cutting edge of wireless communications services. Cellular Providers was capitalized with financing arranged through first round investors in the amount of $50,000. These funds were used for acquiring inventory, developing equipment and a complete product and service line, and creating supportive marketing materials.

Jason Sanderson capitalized on the growing wireless communications industry to create a niche market for its services and accessories. Through its research and development, Cellular Providers has maintained a technological lead in the marketplace and provided the best quality care for the consumer. Today, revenue sources include the services, a full range of accessories, and a variety of phones.

2.2 Company Locations and Facilities

Cellular Providers’ leases its 1,000 square feet head office which has adequate office space to conduct its operations. At some point in the future, management expects to outgrow this office space. Additional office space will be sought at the appropriate time.

| Past Performance | |||

| 1997 | 1998 | 1999 | |

| Sales | $275,781 | $496,406 | $893,530 |

| Gross Margin | $118,586 | $238,275 | $464,636 |

| Gross Margin % | 43.00% | 48.00% | 52.00% |

| Operating Expenses | $94,869 | $154,879 | $278,781 |

| Collection Period (days) | 0 | 0 | 0 |

| Inventory Turnover | 12.00 | 12.00 | 24.00 |

| Balance Sheet | |||

| 1997 | 1998 | 1999 | |

| Current Assets | |||

| Cash | $150,000 | $200,000 | $175,000 |

| Accounts Receivable | $55,156 | $99,281 | $178,706 |

| Inventory | $20,000 | $24,000 | $34,000 |

| Other Current Assets | $3,000 | $1,500 | $3,000 |

| Total Current Assets | $228,156 | $324,781 | $390,706 |

| Long-term Assets | |||

| Long-term Assets | $20,000 | $35,000 | $50,000 |

| Accumulated Depreciation | $0 | $0 | $0 |

| Total Long-term Assets | $20,000 | $35,000 | $50,000 |

| Total Assets | $248,156 | $359,781 | $440,706 |

| Current Liabilities | |||

| Accounts Payable | $4,700 | $12,067 | $18,097 |

| Current Borrowing | $10,000 | $0 | $0 |

| Other Current Liabilities (interest free) | $0 | $0 | $0 |

| Total Current Liabilities | $14,700 | $12,067 | $18,097 |

| Long-term Liabilities | $1,800,000 | $1,750,000 | $1,650,000 |

| Total Liabilities | $1,814,700 | $1,762,067 | $1,668,097 |

| Paid-in Capital | $200,000 | $75,000 | $0 |

| Retained Earnings | ($1,780,261) | ($1,510,682) | ($1,413,246) |

| Earnings | $13,717 | $33,396 | $185,855 |

| Total Capital | ($1,566,544) | ($1,402,286) | ($1,227,391) |

| Total Capital and Liabilities | $248,156 | $359,781 | $440,706 |

| Other Inputs | |||

| Payment Days | 45 | 45 | 45 |

| Sales on Credit | $0 | $0 | $0 |

| Receivables Turnover | 0.00 | 0.00 | 0.00 |

Services

The company has a developed mix of services targeting both businesses and consumers. At today’s breakneck pace of business, companies need more ways than ever to keep in touch, and the easier the better.

Cellular Providers’ innovative product and service offerings provide the following advantages to customers.

- A full range of sleek, modern handsets to choose from.

- Text and numeric paging.

- Data capability.

- A full range of features.

- A national network.

- No roaming or landline connection charges.

- One-second rounding after the first minute.

3.1 Service Description

Cellular Providers has created a niche market as a one-stop shop for wireless services. Additionally, Cellular Providers has professionals with over 10 years combined experience in the industry, sophistication, and sales and distribution channels that are successful. Our services are formulated with ingredients known to increase the quality of communications, enhance internal business communications, and give users the opportunity to access the latest technology such as the ability to access the Internet on their handset.

Cellular Providers maintains a number of different services and accessories. Each of these services and accessories can be placed at the growth phase on the product life cycle curve.

3.2 Competitive Comparison

Cellular Providers is well positioned as a significant player in the cellular and two-way radio service marketplace. There are varying degrees of competition in each area, ranging from a great deal of perceived competition to the very minimal competition in satellite dishes. New technology research and upgrades will be on the cutting edge to improve our product and service lines and ensure that Cellular Providers remains a leader in this field. In comparison to the other key industry players, Cellular Providers offers a greater complement of products and services that make it a truly one-stop shop for wireless communications services. Significant differences include these offerings: satellite dishes, specialty markets with a direct need, services from four different wireless service providers, and residual revenue from service lines.

3.3 Fulfillment

Cellular Providers is required to comply with various rules and regulations among a number of local, state, and federal agencies. Locally, the company is required to maintain its business license and comply with local regulations and city codes. From a State level, the company is required to comply with all State laws concerning employment law, corporate law, and consumer products regulations. From a Federal level, the company is required to comply with additional consumer product laws, taxation, etc.

Cellular Providers’ accounting policy follows generally accepted accounting principals. Cellular Providers’ financials are turned over to the CPA on a quarterly basis.

Cellular Providers uses Quick Books for its accounting software; Accounting is system based on the accrual method. The fiscal year is based on year-end. Financial reporting methods include monthly, quarterly, and annual statements. An annual audit is to be performed by the firm’s CPA firm in January.

Cellular Providers carries insurance for business liability, automobile, and medical coverage. Additional insurance programs such as worker’s compensation and key-man coverage will most likely be consummated by the close of the second quarter of 2000.

Management has no knowledge of pending lawsuits or threat of legal action directed at either the company or its officers.

3.4 Technology

Cellular Providers’ business tools may be considered to be those assets that keep the business running smoothly. These tools include computers, software, business forms, standard agreements, various internal process standards, and other company-specific documentation.

Estimated technological changes in this section concern those changes that would most likely affect Cellular Providers’ ability to compete. As Cellular Providers’ management identifies changing technology, these changes will be studied, analyzed, and evaluated. Of those technological changes that show significant impact on Cellular Providers’ future, funds and resources will likely be committed to making adjustments to Cellular Providers’ business operations. Actions include expanding sales, customer service, and training in order to meet the demand of the business community.

Market Analysis Summary

Cellular Providers continues to conduct industry analysis to stay current on the nature and dynamics of the industry. This process helps management develop insight and devise sustainable business and marketing strategies to assure future success and avoid making decisions based on blind assumptions. Cellular Providers’ business model was developed under two areas of knowledge: understanding the industry, and by having worked for and observed successful companies (and their business models) in the wireless communications services industry.

According to reports published by CNN Financial News from the Commerce Department, the U.S. economy capped off 1999 at a furious pace, posting its fastest quarter of growth in more than three years, as demand at home and abroad for U.S.-made goods remained robust and companies spent more stocking their shelves.

Gross domestic product grew at a 6.9 percent annual rate in the fourth quarter, the Commerce Department said, above the revised 6.5 percent increase expected by economists and well ahead of the 5.8 percent pace originally reported a month ago. It was the biggest gain since the second quarter of 1996, and dwarfed the third-quarter expansion of 5.7 percent.

The GDP price deflator, a key inflation gauge, rose at a 2 percent annual rate, the same rate initially recorded a month ago and in-line with economists’ forecasts of a 2 percent gain. The price deflator rang in at 1.1 percent in the third quarter. For the entire year, the U.S. economy grew at a 4.1 percent pace, while the GDP price deflator advanced 1.6 percent. Higher productivity has allowed businesses to produce more without increasing expenses, keeping the cost of the final product low.

The U.S. economy’s rate of expansion during the past three years has been faster than what Fed officials have said can be sustained without a renewed inflation threat. Fed officials have stated at different intervals that a “comfortable” rate of growth is typically around 3 percent. Small businesses are taking advantage of the opportunities the Internet affords.

International Data Corporation (IDC) estimates that the number of small businesses engaged in e-commerce will increase 47.1% annually, from 400,000 at the end of 1998 to almost 2.8 million at the end of the year 2003, signaling the broad adoption of the Internet by these small enterprises. The widespread adoption of the Internet as a purchasing vehicle has created a wealth of opportunities for businesses that offer products and services to small businesses and consumers. Simultaneously, it has given both small businesses and consumers a wider variety of products from which to choose at competitive prices.

4.1 Target Market Segment Strategy

Cellular Providers sources of revenue are derived from the sale of wireless communications services to businesses and consumers, the sale of accessories, and co-brands (revenue sharing). In comparison to other start-up companies of recent years, Cellular Providers has done very well.

4.1.1 Market Trends

The most significant trends are greater marketing and advertising efforts, rapidly expanding networks, and technological advances. New services and applications such as advanced messaging, data and video transmission, location technology, and remote monitoring are in the early stages of what most analysts predict will be a period of explosive growth.

4.1.2 Market Growth

Current economic conditions driving Cellular Providers’ industry sector include a rising GNP, interest rates edging up gradually, communications economy that is growing, and an increasing number of consumers with greater amounts of disposable income. The savings rate has begun to rise as well. Warning signs of change include rising interest rates and inflation. If these begin to rise sharply, it signals a faltering economy and can have negative effects on all business including Cellular Providers.

The ten-year outlook in the wireless communications service is excellent. The U.S., Department of Commerce estimates that billions are invested each year for research and development. The number of new cellular subscribers in the United States increased dramatically from 1992 to 1998, and 1999 saw continuation of that growth. The number of new subscribers exceeded 10 million, with a record 11.5 million net new subscribers in 1997, for a total of 55.3 million at the end of that year. By the end of 1999 analysts had that figure reaching 80 million. One analytical firm believes that 82 percent of U.S. adults from households with an income higher than $35,000 per year (approximately 90 million people) will be subscribers by 2002. While projections differ, the number of cellular and PCS subscribers in the U.S. is expected to have a compound average growth rate (CAGR) of 12%. With the evolution of new technology, this industry is expected to generate increased revenues.

The explosive growth of the Internet, as a tool for global communications, has enabled millions of people to interact electronically. IDC estimates that there were 142 million Web users worldwide at the end of 1998, and expect this number will grow to approximately 502 million by the end of the year 2003. Rapid acceptance of the Internet as a communications platform by both businesses and consumers has created the foundation for significant growth in business-to-business and business-to-consumer e-commerce. The cellular and PCS industries continued to attract more non-business users largely as a result of a decline in the cost of handsets and bundled service packages. Additionally, it is seen as fashionable to have a handset while driving or interacting with others.

4.2 Market Segmentation

According to the Cellular Telecommunications Industry Association, industry investment grew to $46 billion in 1997, up over 41% from 1996. Dataquest estimates that the average annual revenue per subscriber for PCS was $576 in 1997, with total revenue for 1997 at $1.03 billion, over 3% of the combined total for cellular and PCS.

By 2001 there are expected to be about 40 million U.S. PCS subscribers, and total revenue for the year of $15.9 billion, according to Dataquest. Other predictions vary: Decision Resources forecasts that PCS will account for only 21.8% (19.5 million) of U.S. mobile voice subscribers, while cellular will account for the remaining 78.2% (70 million) by the end of 2001, but estimates total revenues will reach $31.4 billion. On average, however, it is projected that PCS subscribers will account for 40-45% of subscribers and about half of total service revenues by 2002.

| Market Analysis | |||||||

| 2000 | 2001 | 2002 | 2003 | 2004 | |||

| Potential Customers | Growth | CAGR | |||||

| Specialty Business Users | 0% | 226,000 | 226,000 | 226,000 | 226,000 | 226,000 | 0.00% |

| General Business Users | 0% | 650,000 | 650,000 | 650,000 | 650,000 | 650,000 | 0.00% |

| Personnel Users- Washington State | 0% | 5,987,000 | 5,987,000 | 5,987,000 | 5,987,000 | 5,987,000 | 0.00% |

| Total | 0.00% | 6,863,000 | 6,863,000 | 6,863,000 | 6,863,000 | 6,863,000 | 0.00% |

4.3 Competition and Buying Patterns

Effective competitive strategies are built upon understanding what defines and determines if another company is a competitor. Cellular Providers does not believe that all cellular and two-way radio service firms compete with it because many of these do not provide the array of services that it provides. The number of companies selling cellular services continue to grow and each competes for a share of the market. This translates into escalating advertising costs especially with larger and established companies. This trend is expected to continue and intensify over the coming years.

Cellular Providers’ outline for competitive strategy includes monitoring competitors for innovative changes, devising responsive and timely strategies, contingency and implementation plans, devising marketing strategies, compare pricing by rivals, and remain always watchful of technology developments and innovation by service providers, and respond accordingly.

4.4 Business Participants

Within the U.S., there are numerous companies that provide one or more types of communications services. According to U.S. Trade and Outlook ’99, there were more than 1,500 cellular systems operating in 750 U.S. markets. Far fewer provide the depth, breadth, and level of expertise as that of Cellular Providers. Globally, as in the U.S, there are companies that offer wireless communications services. Few carry the range of services as that of Cellular Providers.

Marketing Strategy

Cellular Providers developed its sales and marketing strategy by analyzing its own internal strengths and then analyzing current market conditions. This process helped Cellular Providers create its marketing and sales strategy to leverage its competitive advantages with a unique marketing strategy, thus establishing it as the nation’s leading wireless communications service provider for businesses and consumers.

The company will create momentum through critical mass and brand recognition. Cellular Providers will monitor the effectiveness of its marketing efforts in order to determine the advertising return on investment and the commerce generated from the various channels.

Cellular Providers’ ongoing marketing strategy involves the company maintaining and expanding a broad base of clients in target territories, establishing alliances with product and services companies so that it can deliver high-quality products, and invoking its own organization to bring these together and implement total solutions for customers. The company will move from the traditional product-focused strategy to a total-focus on customer ownership.

The overall marketing plan for Cellular Providers’ service is based on the following fundamentals:

- The segment of the market(s) planned to reach.

- Distribution channels planned to be used to reach market segments: retail outlets, sales representatives, and telemarketing.

- Share of the market expected to capture over a fixed period of time.

Our year 2000 marketing goals include the following:

- Capture 5% market share of businesses in the Idaho and Washington market areas.

- Capture 1% market share of consumers in the Idaho and Washington market areas.

- Develop market share for satellite dishes and equipment.

- Educate businesses and consumers about services provided.

- Substantially increase sales over 1999 levels.

- Position the company as the number one provider of solutions to wireless communications.

- Make a major branding effort emphasizing Cellular Providers’ name and array of services.

- Initiate new marketing program with a budget of $240,000.

- Create new collateral marketing materials (brochures, radio ads, video).

- Media placements including magazine, TV, radio, Internet, print, and banner advertising.

- Expand product and service offerings.

- Provide sales reps with free demo systems.

5.1 Pricing Strategy

Cellular Providers’ retail prices are competitive and affordable for businesses. The company has also established a pricing and commissions structure for sales representatives and distributors. Bulk purchasing enables the company to reduce its cost of goods sold, increase revenue, and pass on the savings to businesses and consumers.

5.2 Promotion Strategy

Cellular Providers’ overall goal is to generate additional retail traffic, increase the business and consumer base, and create more awareness to the need for this type of service in the marketplace. Currently, marketing efforts have revolved around sales representatives and telemarketing.

During 2000, Cellular Providers’ marketing goals also include positioning the company for co-branding alliances with several industry leaders. It is Cellular Providers’ belief that the best way to introduce its services to businesses as well as consumers is through aggressive telemarketing.

In addition to standard advertisement practices, Cellular Providers will gain considerable recognition through these additional promotional mediums:

- Press releases sent to major industry publications.

- Television advertising.

- Trade shows.

- Construction.

- Oil and gas journals.

5.3 Marketing Programs

Advertising programs include direct response advertising, public relations program, co-marketing promotion, relationship building, direct sales efforts, telemarketing, trade shows, ads in print media and radio and television.

Cellular Providers’ marketing propositions are designed to appeal to various target audiences, regardless of their level of sophistication. Cellular Providers will continually inform businesses and consumers through press releases and media placements about the service benefits as well as endorsements from other customers.

These two factors naturally create a curiosity from those not previously exposed to Cellular Providers services, as well as the public sector seeking improved methods in cellular service deals. Overall, this is intended to encourage further investigation by businesses and consumers and is precisely the result Cellular Providers seeks. It is believed that this strategy will draw an abundance of curiosity from which a substantial market can be developed.

As an extra incentive for customers and potential customers to remember Cellular Providers’ name, the company plans to distribute advertising specialties with the company logo. This will be an ongoing program for the company, when appropriate and where it is identified as beneficial.

The objective of incentives is to portray Cellular Providers’ goals and products as an attractive functionality. It is also to show customers how to use the latest in technology as it relates to wireless communications services.

5.4 Strategic Alliances

Cellular Providers has strategic partnerships with the leading companies industry. Management feels that these partnerships will enhance sales and help build critical mass and business momentum. The partnering companies are given below.

- AT&T;

- Sprint PCS.

When Cellular Providers agrees to accept a new client, it is accepting a new business partner. Plans are underway to further strengthen relationships and establish other relationships as the need arises in the future.

5.5 Competitive Edge

Activities contributing to company success include identifying emerging trends and integrate them into Cellular Providers’ operations, respond quickly to technology changes/be there early, provide high-quality services, continue to invest time and money in marketing and advertising, continue to expand into specialty markets, and stay ahead of the “technology curve.”

Our future is highly dependent upon measuring resources we need in order to execute our plans and be competitive. Our method includes qualitative and/or quantitative measurements of competition and by estimating our own company growth, sales, and cash flows.

Our resources are also measured in terms of people, equipment, financial, and critique to see if the resources fit are adequate for the situation. Resources are available as needed to meet the technology curve. In general our strengths include business management, accounting and finance, knowledge of the wireless communications services industry, and experience in running successful businesses in the past.

Cellular Providers prides itself on its high-quality customer service. Although excellent customer service is expected, not all provide this. Cellular Providers is available at all times for customer orders and inquiries.

Sales Forecast

The following table and chart illustrates the projected sales forecast of Cellular Providers.

| Sales Forecast | |||

| 2000 | 2001 | 2002 | |

| Sales | |||

| Personal User Sales | $1,734,283 | $4,800,000 | $8,000,000 |

| Business User Sales | $419,800 | $960,000 | $1,920,000 |

| Total Sales | $2,154,083 | $5,760,000 | $9,920,000 |

| Direct Cost of Sales | 2000 | 2001 | 2002 |

| Personal User Sales | $728,399 | $2,030,400 | $3,400,000 |

| Business User Sales | $188,910 | $406,080 | $812,160 |

| Subtotal Direct Cost of Sales | $917,309 | $2,436,480 | $4,212,160 |

Management Summary

Cellular Providers has a world class management team with direct knowledge of the industry, extensive research experience, and unique administrative skills. Its team includes Jason Sanderson, president; Jerry Tillman, vice president; and Joe Dunn. Together, they have a combined total of over 10 years experience in the cellular and retail industries.

7.1 Personnel Plan

Future staffing needs require monthly evaluation. Factors determining future staffing include growth, demand on existing resources, future capabilities needed, and budgeting. In the future, Cellular Providers will require a highly qualified CFO, HR manager, additional customer service personnel, additional sales reps, and a public relations manager.

| Personnel Plan | |||

| 2000 | 2001 | 2002 | |

| CEO | $0 | $150,000 | $175,000 |

| CFO | $60,000 | $95,000 | $110,000 |

| HR Manager | $49,992 | $55,000 | $60,000 |

| Regional Manager | $45,000 | $50,000 | $55,000 |

| Office Manager | $30,000 | $35,000 | $40,000 |

| Marketing Staff | $69,000 | $150,000 | $250,000 |

| Retail Staff #1 | $54,000 | $65,000 | $76,000 |

| Retail Staff #2 | $34,500 | $65,000 | $76,000 |

| Retail Staff #3 | $18,000 | $65,000 | $76,000 |

| Retail Staff #4 | $0 | $65,000 | $76,000 |

| Retail Staff #5 | $0 | $42,500 | $76,000 |

| Retail Staff #6 | $0 | $30,000 | $76,000 |

| Retail Staff #7 | $0 | $0 | $32,500 |

| Retail Staff #8 | $0 | $0 | $20,000 |

| Other Personnel | $31,166 | $84,000 | $112,000 |

| Total People | 10 | 16 | 22 |

| Total Payroll | $391,658 | $951,500 | $1,310,500 |

Financial Plan

The following sections outline the financial plan for Cellular Providers.

8.1 Use of Funds

Cellular Providers is currently seeking funding in the amount of $100,000 for the purpose of increasing market share, opening up additional retail locations, hiring additional staff, and effectively advertising and promoting its services.

Use and distribution of proceeds: Integrate new services, develop website, and expand into other markets. Produce media relations package(s); further build the brand name through marketing, advertising, and promotion; and acquire additional products. Funding proceeds will also be used to increase Cellular Providers’ capabilities, enhance brand name, and extend Cellular Providers’ market area. Funds will also be directed into business relations, television advertising, press releases, print advertising, Internet advertising, and website development and maintenance. The initial investment will be used as a “kick off” marketing budget. It is expected that from this point on the company will self finance its expansion and marketing programs.

| Use of Funds | |

| Use | Amount |

| Office Furniture and Fixtures | $50,000 |

| Marketing | $10,000 |

| Inventory | $20,000 |

| Miscellaneous (Inventory Control, Service Centers, etc.) | $20,000 |

| Total | $100,000 |

8.2 Important Assumptions

Basic assumptions are presented in the table below.

Corporate Tax: Figure is estimated at 30% of profits.

Interest: Figure is estimated at 10% annually.

| General Assumptions | |||

| 2000 | 2001 | 2002 | |

| Plan Month | 1 | 2 | 3 |

| Current Interest Rate | 10.00% | 10.00% | 10.00% |

| Long-term Interest Rate | 10.00% | 10.00% | 10.00% |

| Tax Rate | 0.00% | 30.00% | 30.00% |

| Other | 0 | 0 | 0 |

8.3 Break-even Analysis

The break-even analysis shows the monthly sales revenues needed to break even.

| Break-even Analysis | |

| Monthly Revenue Break-even | $165,042 |

| Assumptions: | |

| Average Percent Variable Cost | 43% |

| Estimated Monthly Fixed Cost | $94,759 |

8.4 Projected Profit and Loss

The financial projections present the company’s expected financial position, results of operations and cash flow for the three years ending December 31, 2004. Accordingly, the forecast reflects its judgment as of April 4, 2000, the date of this forecast, of the expected conditions and its expected course of action. There will usually be differences between forecasted and actual results, because events and circumstances frequently do not occur as expected, and those differences may be material.

Financial projections are based on sales volume at the levels described in the revenue section and presents, to the best of management’s knowledge and belief, the company’s expected assets, liabilities, capital, revenues, and expenses. Further, the projections reflect management’s judgement of the expected conditions and its expected course of action given the hypothetical assumptions.

Revenues are derived from sales of wireless communications services, products, and accessories to businesses and consumers.

Annual Growth: We expect growth to increase by 200% per year on the basis that the company will be stepping up marketing and sales efforts, as well as initiating new partnerships and alliances that will foster growth and extensions of our existing markets. These strategies are aimed to build momentum and critical mass within the company and its overall sales results.

Cost of Goods: Cellular Providers expects that its products will bear a reasonably high markup, which translates to a relatively low cost of goods. Our cost of goods includes consideration cost of products, shipping charges (which may be passed along to the consumer), and sales commissions.

Marketing/Promotion: We group advertising, promotions, and retail outlet marketing under this category.

Retail Outlets: We estimate that each retail location will cost $30,000 to set up and we anticipate opening up 10 new stores.

Other: We estimate that we may need additional funds for other promotions and this is set aside in a special fund.

Rent: It is assumed that rent will be an average $1,500 per month per store.

Repairs and Maintenance: This is an estimated figure which is expected to grow with the setup of service centers.

Salary: Figures are estimated based on the national average for similar positions. They assume however, the hiring of a store manager, a regional manager, a CFO, an HR manager, and acquiring the services of a marketing company.

Utilities: Figures are estimated. Management estimates that utilities will be at $800 per month per store.

| Pro Forma Profit and Loss | |||

| 2000 | 2001 | 2002 | |

| Sales | $2,154,083 | $5,760,000 | $9,920,000 |

| Direct Cost of Sales | $917,309 | $2,436,480 | $4,212,160 |

| Other | $0 | $0 | $0 |

| Total Cost of Sales | $917,309 | $2,436,480 | $4,212,160 |

| Gross Margin | $1,236,774 | $3,323,520 | $5,707,840 |

| Gross Margin % | 57.42% | 57.70% | 57.54% |

| Expenses | |||

| Payroll | $391,658 | $951,500 | $1,310,500 |

| Marketing/Promotion | $473,712 | $917,200 | $1,476,200 |

| Depreciation | $4,992 | $5,000 | $5,000 |

| Store Set Up Costs | $90,000 | $60,000 | $90,000 |

| Repairs and Maintenance | $6,000 | $6,000 | $6,000 |

| Utilities | $22,400 | $57,600 | $76,800 |

| Insurance | $21,600 | $50,000 | $66,000 |

| Rent | $42,000 | $78,000 | $134,000 |

| Payroll Taxes | $58,749 | $142,725 | $196,575 |

| Legal/Consultants | $6,000 | $6,000 | $6,000 |

| Inventory Control systems | $20,000 | $0 | $0 |

| Total Operating Expenses | $1,137,111 | $2,274,025 | $3,367,075 |

| Profit Before Interest and Taxes | $99,663 | $1,049,495 | $2,340,765 |

| EBITDA | $104,655 | $1,054,495 | $2,345,765 |

| Interest Expense | $166,180 | $142,460 | $99,140 |

| Taxes Incurred | $0 | $272,111 | $672,488 |

| Net Profit | ($66,517) | $634,925 | $1,569,138 |

| Net Profit/Sales | -3.09% | 11.02% | 15.82% |

8.5 Projected Cash Flow

The following table and chart shows the projected cash flow of Cellular Providers.

| Pro Forma Cash Flow | |||

| 2000 | 2001 | 2002 | |

| Cash Received | |||

| Cash from Operations | |||

| Cash Sales | $1,550,940 | $4,147,200 | $7,142,400 |

| Cash from Receivables | $658,468 | $1,406,261 | $2,539,325 |

| Subtotal Cash from Operations | $2,209,408 | $5,553,461 | $9,681,725 |

| Additional Cash Received | |||

| Sales Tax, VAT, HST/GST Received | $0 | $0 | $0 |

| New Current Borrowing | $100,000 | $0 | $0 |

| New Other Liabilities (interest-free) | $0 | $0 | $0 |

| New Long-term Liabilities | $0 | $0 | $0 |

| Sales of Other Current Assets | $0 | $0 | $0 |

| Sales of Long-term Assets | $0 | $0 | $0 |

| New Investment Received | $0 | $0 | $0 |

| Subtotal Cash Received | $2,309,408 | $5,553,461 | $9,681,725 |

| Expenditures | 2000 | 2001 | 2002 |

| Expenditures from Operations | |||

| Cash Spending | $391,658 | $951,500 | $1,310,500 |

| Bill Payments | $1,702,342 | $4,215,061 | $7,014,849 |

| Subtotal Spent on Operations | $2,094,000 | $5,166,561 | $8,325,349 |

| Additional Cash Spent | |||

| Sales Tax, VAT, HST/GST Paid Out | $0 | $0 | $0 |

| Principal Repayment of Current Borrowing | $33,600 | $33,600 | $32,800 |

| Other Liabilities Principal Repayment | $0 | $0 | $0 |

| Long-term Liabilities Principal Repayment | $125,000 | $300,000 | $500,000 |

| Purchase Other Current Assets | $37,000 | $50,000 | $100,000 |

| Purchase Long-term Assets | $0 | $0 | $0 |

| Dividends | $0 | $0 | $0 |

| Subtotal Cash Spent | $2,289,600 | $5,550,161 | $8,958,149 |

| Net Cash Flow | $19,808 | $3,300 | $723,576 |

| Cash Balance | $194,808 | $198,108 | $921,684 |

8.6 Projected Balance Sheet

The following table is the projected balance sheet.

| Pro Forma Balance Sheet | |||

| 2000 | 2001 | 2002 | |

| Assets | |||

| Current Assets | |||

| Cash | $194,808 | $198,108 | $921,684 |

| Accounts Receivable | $123,381 | $329,920 | $568,195 |

| Inventory | $112,462 | $298,712 | $516,409 |

| Other Current Assets | $40,000 | $90,000 | $190,000 |

| Total Current Assets | $470,651 | $916,739 | $2,196,288 |

| Long-term Assets | |||

| Long-term Assets | $50,000 | $50,000 | $50,000 |

| Accumulated Depreciation | $4,992 | $9,992 | $14,992 |

| Total Long-term Assets | $45,008 | $40,008 | $35,008 |

| Total Assets | $515,659 | $956,747 | $2,231,296 |

| Liabilities and Capital | 2000 | 2001 | 2002 |

| Current Liabilities | |||

| Accounts Payable | $218,167 | $357,931 | $596,142 |

| Current Borrowing | $66,400 | $32,800 | $0 |

| Other Current Liabilities | $0 | $0 | $0 |

| Subtotal Current Liabilities | $284,567 | $390,731 | $596,142 |

| Long-term Liabilities | $1,525,000 | $1,225,000 | $725,000 |

| Total Liabilities | $1,809,567 | $1,615,731 | $1,321,142 |

| Paid-in Capital | $0 | $0 | $0 |

| Retained Earnings | ($1,227,391) | ($1,293,908) | ($658,983) |

| Earnings | ($66,517) | $634,925 | $1,569,138 |

| Total Capital | ($1,293,908) | ($658,983) | $910,154 |

| Total Liabilities and Capital | $515,659 | $956,747 | $2,231,296 |

| Net Worth | ($1,293,908) | ($658,983) | $910,154 |

8.7 Business Ratios

Cellular Providers is a company that is seeking to grow rapidly in order to seize market share in a dynamic industry. As the company is, on average, in the high growth phase of the product life cycle for its telecommunications products, the company is experiencing higher leverage of its assets and a lower ROA than the industry standard.

| Ratio Analysis | ||||

| 2000 | 2001 | 2002 | Industry Profile | |

| Sales Growth | 141.08% | 167.40% | 72.22% | 4.80% |

| Percent of Total Assets | ||||

| Accounts Receivable | 23.93% | 34.48% | 25.46% | 14.30% |

| Inventory | 21.81% | 31.22% | 23.14% | 2.50% |

| Other Current Assets | 7.76% | 9.41% | 8.52% | 46.50% |

| Total Current Assets | 91.27% | 95.82% | 98.43% | 63.30% |

| Long-term Assets | 8.73% | 4.18% | 1.57% | 36.70% |

| Total Assets | 100.00% | 100.00% | 100.00% | 100.00% |

| Current Liabilities | 55.19% | 40.84% | 26.72% | 43.60% |

| Long-term Liabilities | 295.74% | 128.04% | 32.49% | 26.30% |

| Total Liabilities | 350.92% | 168.88% | 59.21% | 69.90% |

| Net Worth | -250.92% | -68.88% | 40.79% | 30.10% |

| Percent of Sales | ||||

| Sales | 100.00% | 100.00% | 100.00% | 100.00% |

| Gross Margin | 57.42% | 57.70% | 57.54% | 57.80% |

| Selling, General & Administrative Expenses | 58.41% | 45.60% | 40.45% | 35.50% |

| Advertising Expenses | 10.00% | 10.00% | 10.00% | 1.00% |

| Profit Before Interest and Taxes | 4.63% | 18.22% | 23.60% | 1.90% |

| Main Ratios | ||||

| Current | 1.65 | 2.35 | 3.68 | 1.17 |

| Quick | 1.26 | 1.58 | 2.82 | 0.95 |

| Total Debt to Total Assets | 350.92% | 168.88% | 59.21% | 69.90% |

| Pre-tax Return on Net Worth | 5.14% | -137.64% | 246.29% | 4.20% |

| Pre-tax Return on Assets | -12.90% | 94.80% | 100.46% | 14.00% |

| Additional Ratios | 2000 | 2001 | 2002 | |

| Net Profit Margin | -3.09% | 11.02% | 15.82% | n.a |

| Return on Equity | 0.00% | 0.00% | 172.40% | n.a |

| Activity Ratios | ||||

| Accounts Receivable Turnover | 4.89 | 4.89 | 4.89 | n.a |

| Collection Days | 61 | 51 | 59 | n.a |

| Inventory Turnover | 10.91 | 11.85 | 10.34 | n.a |

| Accounts Payable Turnover | 8.72 | 12.17 | 12.17 | n.a |

| Payment Days | 27 | 24 | 24 | n.a |

| Total Asset Turnover | 4.18 | 6.02 | 4.45 | n.a |

| Debt Ratios | ||||

| Debt to Net Worth | 0.00 | 0.00 | 1.45 | n.a |

| Current Liab. to Liab. | 0.16 | 0.24 | 0.45 | n.a |

| Liquidity Ratios | ||||

| Net Working Capital | $186,084 | $526,009 | $1,600,146 | n.a |

| Interest Coverage | 0.60 | 7.37 | 23.61 | n.a |

| Additional Ratios | ||||

| Assets to Sales | 0.24 | 0.17 | 0.22 | n.a |

| Current Debt/Total Assets | 55% | 41% | 27% | n.a |

| Acid Test | 0.83 | 0.74 | 1.86 | n.a |

| Sales/Net Worth | 0.00 | 0.00 | 10.90 | n.a |

| Dividend Payout | 0.00 | 0.00 | 0.00 | n.a |

Appendix

| Sales Forecast | |||||||||||||

| Jan | Feb | Mar | Apr | May | Jun | Jul | Aug | Sep | Oct | Nov | Dec | ||

| Sales | |||||||||||||

| Personal User Sales | 0% | $109,615 | $123,643 | $139,600 | $139,600 | $139,600 | $139,600 | $139,600 | $139,600 | $139,600 | $139,600 | $174,712 | $209,513 |

| Business User Sales | 0% | $35,650 | $35,650 | $35,650 | $35,650 | $35,650 | $35,650 | $35,650 | $35,650 | $35,650 | $35,650 | $31,650 | $31,650 |

| Total Sales | $145,265 | $159,293 | $175,250 | $175,250 | $175,250 | $175,250 | $175,250 | $175,250 | $175,250 | $175,250 | $206,362 | $241,163 | |

| Direct Cost of Sales | Jan | Feb | Mar | Apr | May | Jun | Jul | Aug | Sep | Oct | Nov | Dec | |

| Personal User Sales | $46,038 | $51,930 | $58,632 | $58,632 | $58,632 | $58,632 | $58,632 | $58,632 | $58,632 | $58,632 | $73,379 | $87,995 | |

| Business User Sales | $16,043 | $16,043 | $16,043 | $16,043 | $16,043 | $16,043 | $16,043 | $16,043 | $16,043 | $16,043 | $14,243 | $14,243 | |

| Subtotal Direct Cost of Sales | $62,081 | $67,973 | $74,675 | $74,675 | $74,675 | $74,675 | $74,675 | $74,675 | $74,675 | $74,675 | $87,622 | $102,238 | |

| Personnel Plan | |||||||||||||

| Jan | Feb | Mar | Apr | May | Jun | Jul | Aug | Sep | Oct | Nov | Dec | ||

| CEO | 0% | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| CFO | 0% | $5,000 | $5,000 | $5,000 | $5,000 | $5,000 | $5,000 | $5,000 | $5,000 | $5,000 | $5,000 | $5,000 | $5,000 |

| HR Manager | 0% | $4,166 | $4,166 | $4,166 | $4,166 | $4,166 | $4,166 | $4,166 | $4,166 | $4,166 | $4,166 | $4,166 | $4,166 |

| Regional Manager | 0% | $3,750 | $3,750 | $3,750 | $3,750 | $3,750 | $3,750 | $3,750 | $3,750 | $3,750 | $3,750 | $3,750 | $3,750 |

| Office Manager | 0% | $2,500 | $2,500 | $2,500 | $2,500 | $2,500 | $2,500 | $2,500 | $2,500 | $2,500 | $2,500 | $2,500 | $2,500 |

| Marketing Staff | 0% | $4,000 | $4,000 | $4,000 | $4,000 | $4,000 | $7,000 | $7,000 | $7,000 | $7,000 | $7,000 | $7,000 | $7,000 |

| Retail Staff #1 | 0% | $4,500 | $4,500 | $4,500 | $4,500 | $4,500 | $4,500 | $4,500 | $4,500 | $4,500 | $4,500 | $4,500 | $4,500 |

| Retail Staff #2 | 0% | $0 | $0 | $0 | $2,500 | $2,500 | $2,500 | $4,500 | $4,500 | $4,500 | $4,500 | $4,500 | $4,500 |

| Retail Staff #3 | 0% | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $4,500 | $4,500 | $4,500 | $4,500 |

| Retail Staff #4 | 0% | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| Retail Staff #5 | 0% | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| Retail Staff #6 | 0% | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| Retail Staff #7 | 0% | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| Retail Staff #8 | 0% | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| Other Personnel | 0% | $1,167 | $1,167 | $1,167 | $2,333 | $2,333 | $2,333 | $2,333 | $2,333 | $4,000 | $4,000 | $4,000 | $4,000 |

| Total People | 6 | 6 | 6 | 8 | 8 | 8 | 8 | 8 | 10 | 10 | 10 | 10 | |

| Total Payroll | $25,083 | $25,083 | $25,083 | $28,749 | $28,749 | $31,749 | $33,749 | $33,749 | $39,916 | $39,916 | $39,916 | $39,916 | |

| Pro Forma Profit and Loss | |||||||||||||

| Jan | Feb | Mar | Apr | May | Jun | Jul | Aug | Sep | Oct | Nov | Dec | ||

| Sales | $145,265 | $159,293 | $175,250 | $175,250 | $175,250 | $175,250 | $175,250 | $175,250 | $175,250 | $175,250 | $206,362 | $241,163 | |

| Direct Cost of Sales | $62,081 | $67,973 | $74,675 | $74,675 | $74,675 | $74,675 | $74,675 | $74,675 | $74,675 | $74,675 | $87,622 | $102,238 | |

| Other | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Total Cost of Sales | $62,081 | $67,973 | $74,675 | $74,675 | $74,675 | $74,675 | $74,675 | $74,675 | $74,675 | $74,675 | $87,622 | $102,238 | |

| Gross Margin | $83,184 | $91,320 | $100,576 | $100,576 | $100,576 | $100,576 | $100,576 | $100,576 | $100,576 | $100,576 | $118,740 | $138,925 | |

| Gross Margin % | 57.26% | 57.33% | 57.39% | 57.39% | 57.39% | 57.39% | 57.39% | 57.39% | 57.39% | 57.39% | 57.54% | 57.61% | |

| Expenses | |||||||||||||

| Payroll | $25,083 | $25,083 | $25,083 | $28,749 | $28,749 | $31,749 | $33,749 | $33,749 | $39,916 | $39,916 | $39,916 | $39,916 | |

| Marketing/Promotion | $33,340 | $31,444 | $33,838 | $37,838 | $45,838 | $37,838 | $37,838 | $37,838 | $37,838 | $37,838 | $42,504 | $59,724 | |

| Depreciation | $416 | $416 | $416 | $416 | $416 | $416 | $416 | $416 | $416 | $416 | $416 | $416 | |

| Store Set Up Costs | $0 | $0 | $15,000 | $15,000 | $0 | $0 | $0 | $15,000 | $15,000 | $0 | $15,000 | $15,000 | |

| Repairs and Maintenance | $500 | $500 | $500 | $500 | $500 | $500 | $500 | $500 | $500 | $500 | $500 | $500 | |

| Utilities | $800 | $800 | $1,600 | $1,600 | $1,600 | $1,600 | $1,600 | $2,400 | $2,400 | $2,400 | $2,400 | $3,200 | |

| Insurance | $800 | $800 | $800 | $1,600 | $1,600 | $1,600 | $1,600 | $2,400 | $2,400 | $2,400 | $2,400 | $3,200 | |

| Rent | $1,500 | $1,500 | $3,000 | $3,000 | $3,000 | $3,000 | $3,000 | $4,500 | $4,500 | $4,500 | $4,500 | $6,000 | |

| Payroll Taxes | 15% | $3,762 | $3,762 | $3,762 | $4,312 | $4,312 | $4,762 | $5,062 | $5,062 | $5,987 | $5,987 | $5,987 | $5,987 |

| Legal/Consultants | 15% | $500 | $500 | $500 | $500 | $500 | $500 | $500 | $500 | $500 | $500 | $500 | $500 |

| Inventory Control systems | $0 | $0 | $20,000 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Total Operating Expenses | $66,701 | $64,805 | $104,499 | $93,515 | $86,515 | $81,965 | $84,265 | $102,365 | $109,457 | $94,457 | $114,124 | $134,444 | |

| Profit Before Interest and Taxes | $16,483 | $26,515 | ($3,923) | $7,061 | $14,061 | $18,611 | $16,311 | ($1,789) | ($8,881) | $6,119 | $4,617 | $4,481 | |

| EBITDA | $16,899 | $26,931 | ($3,507) | $7,477 | $14,477 | $19,027 | $16,727 | ($1,373) | ($8,465) | $6,535 | $5,033 | $4,897 | |

| Interest Expense | $14,435 | $14,328 | $14,222 | $14,115 | $14,008 | $13,902 | $13,795 | $13,688 | $13,582 | $13,475 | $13,368 | $13,262 | |

| Taxes Incurred | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Net Profit | $2,048 | $12,187 | ($18,145) | ($7,054) | $52 | $4,709 | $2,516 | ($15,478) | ($22,463) | ($7,356) | ($8,752) | ($8,780) | |

| Net Profit/Sales | 1.41% | 7.65% | -10.35% | -4.03% | 0.03% | 2.69% | 1.44% | -8.83% | -12.82% | -4.20% | -4.24% | -3.64% | |

| Pro Forma Cash Flow | |||||||||||||

| Jan | Feb | Mar | Apr | May | Jun | Jul | Aug | Sep | Oct | Nov | Dec | ||

| Cash Received | |||||||||||||

| Cash from Operations | |||||||||||||

| Cash Sales | $104,591 | $114,691 | $126,180 | $126,180 | $126,180 | $126,180 | $126,180 | $126,180 | $126,180 | $126,180 | $148,581 | $173,637 | |

| Cash from Receivables | $89,353 | $90,709 | $40,805 | $44,751 | $49,070 | $49,070 | $49,070 | $49,070 | $49,070 | $49,070 | $49,070 | $49,360 | |

| Subtotal Cash from Operations | $193,944 | $205,400 | $166,985 | $170,931 | $175,250 | $175,250 | $175,250 | $175,250 | $175,250 | $175,250 | $197,651 | $222,998 | |

| Additional Cash Received | |||||||||||||

| Sales Tax, VAT, HST/GST Received | 0.00% | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| New Current Borrowing | $100,000 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| New Other Liabilities (interest-free) | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| New Long-term Liabilities | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Sales of Other Current Assets | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Sales of Long-term Assets | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| New Investment Received | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Subtotal Cash Received | $293,944 | $205,400 | $166,985 | $170,931 | $175,250 | $175,250 | $175,250 | $175,250 | $175,250 | $175,250 | $197,651 | $222,998 | |

| Expenditures | Jan | Feb | Mar | Apr | May | Jun | Jul | Aug | Sep | Oct | Nov | Dec | |

| Expenditures from Operations | |||||||||||||

| Cash Spending | $25,083 | $25,083 | $25,083 | $28,749 | $28,749 | $31,749 | $33,749 | $33,749 | $39,916 | $39,916 | $39,916 | $39,916 | |

| Bill Payments | $23,164 | $151,210 | $129,661 | $174,531 | $152,902 | $145,777 | $138,382 | $139,169 | $156,590 | $156,878 | $143,833 | $190,246 | |

| Subtotal Spent on Operations | $48,247 | $176,293 | $154,744 | $203,280 | $181,651 | $177,526 | $172,131 | $172,918 | $196,506 | $196,794 | $183,749 | $230,162 | |

| Additional Cash Spent | |||||||||||||

| Sales Tax, VAT, HST/GST Paid Out | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Principal Repayment of Current Borrowing | $2,800 | $2,800 | $2,800 | $2,800 | $2,800 | $2,800 | $2,800 | $2,800 | $2,800 | $2,800 | $2,800 | $2,800 | |

| Other Liabilities Principal Repayment | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Long-term Liabilities Principal Repayment | $15,000 | $10,000 | $10,000 | $10,000 | $10,000 | $10,000 | $10,000 | $10,000 | $10,000 | $10,000 | $10,000 | $10,000 | |

| Purchase Other Current Assets | $5,000 | $0 | $12,000 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $20,000 | $0 | |

| Purchase Long-term Assets | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Dividends | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Subtotal Cash Spent | $71,047 | $189,093 | $179,544 | $216,080 | $194,451 | $190,326 | $184,931 | $185,718 | $209,306 | $209,594 | $216,549 | $242,962 | |

| Net Cash Flow | $222,897 | $16,307 | ($12,559) | ($45,149) | ($19,201) | ($15,076) | ($9,681) | ($10,468) | ($34,056) | ($34,344) | ($18,898) | ($19,964) | |

| Cash Balance | $397,897 | $414,204 | $401,645 | $356,497 | $337,295 | $322,219 | $312,537 | $302,069 | $268,013 | $233,670 | $214,772 | $194,808 | |

| Pro Forma Balance Sheet | |||||||||||||

| Jan | Feb | Mar | Apr | May | Jun | Jul | Aug | Sep | Oct | Nov | Dec | ||

| Assets | Starting Balances | ||||||||||||

| Current Assets | |||||||||||||

| Cash | $175,000 | $397,897 | $414,204 | $401,645 | $356,497 | $337,295 | $322,219 | $312,537 | $302,069 | $268,013 | $233,670 | $214,772 | $194,808 |

| Accounts Receivable | $178,706 | $130,027 | $83,920 | $92,185 | $96,504 | $96,504 | $96,504 | $96,504 | $96,504 | $96,504 | $96,504 | $105,216 | $123,381 |

| Inventory | $34,000 | $68,289 | $74,770 | $82,142 | $82,142 | $82,142 | $82,142 | $82,142 | $82,142 | $82,142 | $82,142 | $96,384 | $112,462 |

| Other Current Assets | $3,000 | $8,000 | $8,000 | $20,000 | $20,000 | $20,000 | $20,000 | $20,000 | $20,000 | $20,000 | $20,000 | $40,000 | $40,000 |

| Total Current Assets | $390,706 | $604,213 | $580,894 | $595,973 | $555,143 | $535,942 | $520,865 | $511,184 | $500,716 | $466,660 | $432,316 | $456,371 | $470,651 |

| Long-term Assets | |||||||||||||

| Long-term Assets | $50,000 | $50,000 | $50,000 | $50,000 | $50,000 | $50,000 | $50,000 | $50,000 | $50,000 | $50,000 | $50,000 | $50,000 | $50,000 |

| Accumulated Depreciation | $0 | $416 | $832 | $1,248 | $1,664 | $2,080 | $2,496 | $2,912 | $3,328 | $3,744 | $4,160 | $4,576 | $4,992 |

| Total Long-term Assets | $50,000 | $49,584 | $49,168 | $48,752 | $48,336 | $47,920 | $47,504 | $47,088 | $46,672 | $46,256 | $45,840 | $45,424 | $45,008 |

| Total Assets | $440,706 | $653,797 | $630,062 | $644,725 | $603,479 | $583,862 | $568,369 | $558,272 | $547,388 | $512,916 | $478,156 | $501,795 | $515,659 |

| Liabilities and Capital | Jan | Feb | Mar | Apr | May | Jun | Jul | Aug | Sep | Oct | Nov | Dec | |

| Current Liabilities | |||||||||||||

| Accounts Payable | $18,097 | $146,940 | $123,819 | $169,426 | $148,035 | $141,165 | $133,763 | $133,950 | $151,344 | $152,135 | $137,532 | $182,723 | $218,167 |

| Current Borrowing | $0 | $97,200 | $94,400 | $91,600 | $88,800 | $86,000 | $83,200 | $80,400 | $77,600 | $74,800 | $72,000 | $69,200 | $66,400 |

| Other Current Liabilities | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| Subtotal Current Liabilities | $18,097 | $244,140 | $218,219 | $261,026 | $236,835 | $227,165 | $216,963 | $214,350 | $228,944 | $226,935 | $209,532 | $251,923 | $284,567 |

| Long-term Liabilities | $1,650,000 | $1,635,000 | $1,625,000 | $1,615,000 | $1,605,000 | $1,595,000 | $1,585,000 | $1,575,000 | $1,565,000 | $1,555,000 | $1,545,000 | $1,535,000 | $1,525,000 |

| Total Liabilities | $1,668,097 | $1,879,140 | $1,843,219 | $1,876,026 | $1,841,835 | $1,822,165 | $1,801,963 | $1,789,350 | $1,793,944 | $1,781,935 | $1,754,532 | $1,786,923 | $1,809,567 |

| Paid-in Capital | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| Retained Earnings | ($1,413,246) | ($1,227,391) | ($1,227,391) | ($1,227,391) | ($1,227,391) | ($1,227,391) | ($1,227,391) | ($1,227,391) | ($1,227,391) | ($1,227,391) | ($1,227,391) | ($1,227,391) | ($1,227,391) |

| Earnings | $185,855 | $2,048 | $14,235 | ($3,910) | ($10,965) | ($10,912) | ($6,203) | ($3,688) | ($19,165) | ($41,629) | ($48,985) | ($57,737) | ($66,517) |

| Total Capital | ($1,227,391) | ($1,225,343) | ($1,213,156) | ($1,231,301) | ($1,238,356) | ($1,238,303) | ($1,233,594) | ($1,231,079) | ($1,246,556) | ($1,269,019) | ($1,276,376) | ($1,285,127) | ($1,293,908) |

| Total Liabilities and Capital | $440,706 | $653,797 | $630,062 | $644,725 | $603,479 | $583,862 | $568,369 | $558,272 | $547,388 | $512,916 | $478,156 | $501,795 | $515,659 |

| Net Worth | ($1,227,391) | ($1,225,343) | ($1,213,156) | ($1,231,301) | ($1,238,356) | ($1,238,303) | ($1,233,594) | ($1,231,079) | ($1,246,556) | ($1,269,019) | ($1,276,376) | ($1,285,127) | ($1,293,908) |