Catholic School Development Foundation

Executive Summary

Catholic School Development Foundation (CSDF) will be a not-for-profit operating foundation whose exclusive purpose is to provide development and fund raising counsel to Catholic elementary and secondary schools. By definition, an operating foundation is “An organization that uses its resources to conduct research or provide a direct service.” (Foundation Directory, 1995, p. vi.)

While most operating foundations depend upon large endowments, the concept driving this foundation relies instead upon a “living endowment.” This term, wide-spread in Catholic school circles, refers to the sisters, brothers and priests that educated several generations of immigrant families while themselves living a vow of poverty. Historically, our Catholic schools have had no financial endowment; rather they flourished at very low cost to families because of extremely low overhead–thanks to their living endowment.

To operate CSDF via a living endowment does not mean that the consultants working through CSDF must be vowed religious. Nor does it mean that CSDF employees live a life of poverty. In fact, compensation can be every bit as good as for-profit firms. To understand how this is possible one must first understand the for-profit consulting fee/cost structure.

The industry-standard fees charged by for-profit firms for campaign work average $15,000 per month per client. Of this amount, about one-third goes to the consultant doing the work, another third is overhead (primarily training costs and the cost of making presentations across the country for new work), and one-third is profit to the owner of the firm. This standard income/expense structure creates a problem for the “for-profit” and an opportunity for the “not-for-profit.”

The problem for conventional firms lies in young consultants who see the monthly fees charged, compare it to their paycheck, and conclude “I can do this on my own.” Consequently, the established national firms face constant turnover, recruitment and training costs while suffering a chronic lack of experience in the consultants who actually do the work. At the same time, they have created a barrage of new regional competition. Over the last ten years there has been an explosion of development consulting firms, most with no one in the firm except the owner. The business card may read “John Doe & Associates” but there are rarely any associates.

The opportunity for the not-for-profit lies in the one-third of fees that normally would be profit. What if, instead of buying a house on the beach for a firm owner, those profits were set aside each month in a cash reserve to serve Catholic schools that cannot afford development counsel? While Jesuit High School may easily afford high monthly fees, St. Ann’s Indian School cannot. By setting aside the “profits” from one client, CSDF could afford to send a consultant to St Ann’s. In doing so, CSDF consultants will be the new living endowment serving those schools least able to afford development counsel.

1.1 Objectives

- Two clients in Year 1, four in Year 2, seven in Year 3. From this point forward, growth can proceed much faster.

- Sales growing steadily from Year 1 through Year 3.

- Break even for three consecutive years as CSDF establishes its name and reputation. Generate earnings in year four allowing us to begin gratis consulting projects.

1.2 Mission

Catholic School Development Foundation exists to provide development counsel to America’s Catholic elementary and high schools.

- Focused on this single objective, we are specialists, not generalists.

- Relieved of profit pressures, we take the long-term view of building lasting relationships between the school and its supporters.

- We will always act in the long-term interest of our clients. If you are not ready for a campaign, we will say so. Then we’ll do everything we can to get ready.

- We are development consultants, not fundraising consultants. We take a comprehensive approach to the financial health of the school.

- Our primary job as consultants is very much like that of a teacher. In our case, we teach by ‘doing.’ This implies, of course, a partnership between teacher and student.

- Knowing the unique circumstances of raising money for schools, we only employ consultants with specific experience in this area.

- Though we are a not-for-profit organization, to attract experienced specialists we must compete with the largest firms in the country. While we operate on a sliding scale, we ask clients to remember this as they consider our proposal.

- Campaigns can be stressful. Prayer keeps us positive, calls to mind the mission behind the money, and reconciles misunderstandings. It overcomes fear in those who ask and softens the hearts of those who give. This is why we believe prayer is an integral part of success.

1.3 Keys to Success

The keys to success are:

- Ability to attract and RETAIN qualified personnel.

- Perception in the marketplace as a specialist serving Catholic schools.

- Establishing trust with potential clients as a non-profit devoted to their cause.

The ‘capital’ in a consulting firm walks out the door every evening at five. The only real equity rests in the experience levels of the people in the firm, for they represent the ability of the firm to attract future business.

Keeping experienced people is difficult. Since the late 1980s there has been an explosion of new consulting firms serving non-profits with fundraising and consulting services. Many consultants, now independent, were trained by the large national firms. The organization that discovers how to attract and retain qualified people will ultimately win the day. This, above all else, is the key to success.

Why is it tempting for people to set up their own firms once they have a modicum of experience? The answer lies in the nature of a not-yet-mature industry: fundraising consulting is the ultimate ‘low entry barriers’ business.

- There are no education requirements.

- There are no professional degree requirements.

- There are no licensing requirements. The person giving a ten dollar haircut must be licensed. But a consultant leading a $10 million campaign–putting an organization at great risk–requires none.

- Ultimately, getting work is a function of relationships, not experience and knowledge. Because so few Board members have experience with major gift fundraising, it is difficult for them to separate experienced professionals from good salesmen.

- It only takes one successful campaign to launch a career as a consultant, especially if that school was a high-profile prep school.

- Finally, start-up and office expenses are minimal. Since clients never visit the firm, a home office will easily suffice. A good voice mail system can give the impression of a much larger, more established firm. Many one-man firms have been established for less than $5,000.

In short, it is relatively easy to establish an independent firm. But if an organization is going to grow, it must retain qualified personnel. To do this, it must be more attractive for consultants to stay than to leave. This is the central issue we will discuss later.

Organization Summary

Catholic School Development Foundation is dedicated to helping Catholic elementary and secondary schools develop sustainable sources of gift revenue. In doing so, we take a comprehensive approach to helping the school succeed. For example, evidence of good business practice is essential to healthy donor relations. Therefore, this is one example of the many areas we review to ensure long-term sources of gift revenue.

2.1 Legal Entity

Catholic School Development Foundation will be incorporated as a nonprofit operating foundation. A policy-making board will meet quarterly.

2.2 Start-up Summary

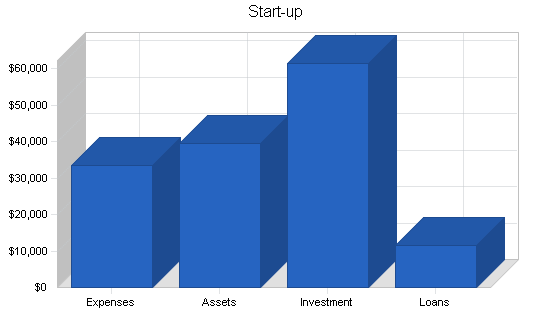

Total start-up expense details are included in the following start-up table. About a third of is earmarked for the travel necessary to secure contracts. A home office is assumed. Required start-up assets include cash reserves and purchase of a laptop computer and software. The office is already equipped with furniture.

| Start-up Funding | |

| Start-up Expenses to Fund | $33,400 |

| Start-up Assets to Fund | $39,400 |

| Total Funding Required | $72,800 |

| Assets | |

| Non-cash Assets from Start-up | $3,000 |

| Cash Requirements from Start-up | $36,400 |

| Additional Cash Raised | $0 |

| Cash Balance on Starting Date | $36,400 |

| Total Assets | $39,400 |

| Liabilities and Capital | |

| Liabilities | |

| Current Borrowing | $0 |

| Long-term Liabilities | $0 |

| Accounts Payable (Outstanding Bills) | $0 |

| Other Current Liabilities (interest-free) | $11,400 |

| Total Liabilities | $11,400 |

| Capital | |

| Planned Investment | |

| Personal Savings | $30,000 |

| Investor 2 | $20,000 |

| Other | $11,400 |

| Additional Investment Requirement | $0 |

| Total Planned Investment | $61,400 |

| Loss at Start-up (Start-up Expenses) | ($33,400) |

| Total Capital | $28,000 |

| Total Capital and Liabilities | $39,400 |

| Total Funding | $72,800 |

| Start-up | |

| Requirements | |

| Start-up Expenses | |

| Legal | $1,000 |

| Stationery etc. | $600 |

| Brochures, Logo & Mailing Lists | $5,000 |

| Phone | $600 |

| Internet Services | $3,000 |

| Postage | $2,000 |

| Video Production & Copies | $6,200 |

| Travel Costs to Secure Contracts | $10,000 |

| Computer | $3,000 |

| Other | $2,000 |

| Total Start-up Expenses | $33,400 |

| Start-up Assets | |

| Cash Required | $36,400 |

| Other Current Assets | $3,000 |

| Long-term Assets | $0 |

| Total Assets | $39,400 |

| Total Requirements | $72,800 |

2.3 Locations and Facilities

The initial office will be established in Fargo, North Dakota. With direct flights to Chicago, Minneapolis, and Denver, the central location provides timely access both East and West. Once the core team is well established (seven or more in Fargo), the organization will be in a position to employ out-of-state consultants. The moratorium on out-of-state consultants offers an opportunity to form a strong core group and culture, with frequent training opportunities and little expense.

Services

Catholic School Development Foundation offers:

- Capital Campaign Readiness Assessment (Core business).

- Capital Campaign Counsel (Core business).

- Planned Giving Programs.

- Annual Fund Development.

- Market Research of Alumni and Parents.

- Alumni Relations Programs.

- Donor Relations Programs.

- Strategic Public Relations.

- Marketing and Recruitment Consulting.

- Development Director Recruitment and Training Services.

3.1 Service Description

Core Business: Capital Campaign Readiness Assessment and Capital Campaign Counsel

Schools are most willing to spend substantial money on campaign counsel. Therefore, campaign counsel must be the core of our business. Monthly retainer fees of $15,000 for a 10-12 month campaign are not uncommon (i.e. a single school campaign contract generates $150,000 to $180,000 plus travel expenses). Depending on the campaign goal, these fees translate into campaign expenses of 4-6% and are considered good stewardship; the industry standard is 10% though some fund-raising ‘firms’ have been known to take as much as 70% of total dollars raised.

Fund raising costs of 6% on a $4M campaign (common these days) yields a substantial sum of money ($240,000) available to the school for consulting fees.

Planned Giving Programs

The largest intergenerational wealth transfer in world history will occur within the next decade. Many schools have talked about endowments, but made the mistake of trying to grow them with cash gifts. Most have successfully completed capital building campaigns in the 90’s, but because they sought cash, built only modest endowments. Planned gifts represent the opportunity of a lifetime for our Catholic schools, and the single most promising new area in development consulting.

Annual Fund Development and Market Research of Alumni and Parents

These two services go hand in hand. By now, every Catholic high school in America has an Annual Fund; phonathons and direct mail are common. To grow revenue, schools will need to make use of market research to better understand why alumni parents choose to give or not to give.

Alumni Relations Programs

The number one factor influencing major gifts is the degree to which an individual has been meaningfully involved in the mission of an organization. Alumni Relations Programs build on this principal to attract people and dollars.

Donor Relations Programs

Too often, once capital campaign pledges are secured schools leave relations with donors to chance. There is rarely, if ever, a planned system of communication and involvement to keep the 200+ best donors (who represent 90% of all gift revenue!) informed and involved–and ready for the next campaign.

Strategic Public Relations

About half the Catholic high schools in America have a public relations officer on staff. But even among these schools, it is extremely rare to see a communication plan built on the strategic interests of the school. Donor Relations are high-touch and focused, the goal of Strategic Public Relations is to improve perceptions in order to grow the number of supporters.

Marketing and Recruitment Consulting

In the late 80’s and early 90’s many Catholic schools suffered severe enrollment problems. By 1997 that was no longer the case. A demographic bulge, plus continuing uncertainties about public schools helped fuel the growth in Catholic school enrollment. But fortunes could change with demographics. Now is the time many schools need to think strategically about their position in the market–before demand weakens.

Development Director Recruitment and Training Services

The turnover rate among development directors is very high due to the overwhelming demand in the NFP sector for experienced development people, and the high burnout rate of people new to the field. An investment in training yields as much as twice the first-year revenue for the school.

3.2 Alternative Providers

The competition comes in two forms. First there are a multitude of regional consulting firms consisting of one person, or an owner who sub-contracts consultants. Second are the national firms such as Ketchum, Community Counseling Service, etc.

Though the large firms have the financial power to advertise with full-page ads in the Chronicle of Philanthropy and sponsor elaborate booths at national conventions, it is the smaller firms who consistently have more qualified staff. Herein lies the irony. The large firms may truthfully say they have “launched 10,000 campaigns.” What they don’t say is that over 30 years they may have gone through 5,000 consultants, each doing two campaigns before burning out.

On the other hand, the smaller firm may have only completed 30 campaigns, but each consultant was responsible for 15 of them. Who looks better on the surface? But who is better qualified?

In presentations, prospective clients always want to know who they will be working with. The firms, leery of the question, work hard to change the conversation from the level of the specific consultant to the success of the company as a whole. But the natural inclination of the buyer is to return to the level of the individual. Rather than fight this inclination in the buyer, the wise firm would seek to grow a company that could capitalize on it. If a single firm could combine the power of marketing the firm name, backed up with experienced people across the board, the rest, as they say, would be history. Thus, we return to the name of the game identified earlier: retaining qualified staff.

The second issue is identification with a specific market. Most firms tend to be all things to all people. Other than Catholic School Management, a very fine firm on the East Coast with a small number of consultants, it is extremely rare for development consulting firms to identify themselves as specialists in one particular area of the market. We believe this represents a tremendous opportunity to grab the #1 slot in top-of-mind awareness categories. “Catholic School Development Foundation: The #1 provider of development services to Catholic schools.”

Finally, as a not-for-profit, the Catholic School Development Foundation has another competitive advantage: an aura of trust. Given the lack of government supervision and the disparities in quality outlined in the Keys to Success section, it is little wonder that distrust surrounds the contracting of development counsel. We believe our incorporation as a NFP allows us to readily differentiate ourselves from the pack. Doing so will lead to more presentations and lower business acquisition costs–dollars that can be used for gratis clients and salary enhancement (thereby retaining the best talent!).

3.3 Printed Collaterals

The business will begin with a general brochure establishing our position, developed as part of the start-up expenses. Because our market is very specific, mailing lists and direct mail are the most natural avenue. The sales process takes three steps:

- General mailings for awareness. Interested parties are invited to call or write for a free publication: “Are you ready for a Campaign?”

- Those that identify themselves as interested receive the publication, followed by a phone call to discern their needs.

- Those interested in services receive a seven minute introductory video of the founder on location at the schools and projects he helped build, talking personally about the drama inherent in each campaign. The objective is for the prospective client to see himself and his own situation reflected in that of other clients we have already successfully worked with prior to forming CSDF.

3.4 Fulfillment

Fulfillment will be provided by principals. Once CSDF has expanded to four full-time employees we can then consider hiring a junior level consultant. It would be too expensive and difficult to expect to attract an entire stable of experienced consultants. We will need to train a certain number of experienced development directors interested in consulting. The key to success is balance in the consulting staff between junior and senior consultants.

3.5 Technology

We will be PC-based. An Internet presence is assumed, not only for marketing, but for company communications.

3.6 Future Services

Planned Giving represents the most promising extension of our services. For a discussion of this, see Service Description section.

Market Analysis Summary

There are only 1,300 Catholic high schools in the U.S., and 8,000+ Catholic grade schools. This defines our market.

4.1 Market Segmentation

Before CSDF can fulfill its mission of serving all Catholic schools, it must establish secure cash flow in the first three years. Therefore, our first priority is identifying clients in need who have the ability to pay.

Because Catholic high schools have more mature development programs and larger budgets than elementary schools, they are the first group of interest to us. Within the high school market, our most immediate group of potential customers are diocesan Catholic high schools, which represent about 1,000 schools located mainly in the Great Lakes states and the Midwest.

Schools owned by religious orders comprise the remaining 300 Catholic high schools. Order schools (operated by the Jesuits, Dominicans, Christian Brothers, etc.) tend to be more advanced–most have staffs of three to seven people in the development office and have completed at least one campaign in the last 10 years. Diocesan schools, less experienced, are now following in their footsteps: Thus they represent a very defined target market and logical starting point.

4.2 Service Providers Analysis

As noted earlier, the development and extension consulting industry is pulverized, with hundreds of smaller regional consulting organizations and individual consultants for every one of the few well-known companies. One of our challenges will be establishing the foundation as a legitimate consulting entity. Printed materials, video, an Internet presence and high quality phone and voice mail system are needed to project this image.

4.2.1 Organization Participants

As noted in the Competitive Comparison section and elsewhere, there are few major national firms relative to regional firms. While some firms have envisioned consolidating the market through mergers and acquisitions, no one has yet succeeded. In short, a dream is not the same as a plan. All current market forces encourage further pulverization rather than centralization.

4.2.2 Distributing a Service

Consulting is sold and purchased mainly on the basis of references, with relationships and previous experience being, by far, the most important factor. This fact, plus the low cost of entry into the industry, are the driving factors behind the inability to consolidate the market.

4.2.3 Alternatives and Usage Patterns

While the barriers to entry are low, the unseen danger to the unexperienced lies in the sales cycle. Schools are notorious for debating at length decisions surrounding the procurement of consulting help. The sales cycle usually takes three to six months, and can take as long as 18 months from first inquiry to start date of the contract.

Aware of this, we currently have paying clients in the market supporting our personal needs, and potential clients “in the pipeline.” For the purposes of this business plan, the issue is moving from that of an independent consultant with extremely low overhead to an operating foundation with plans for growth and employees.

4.2.4 Main Alternatives

The main competitors are not the large national firms, but the smaller regional one-man shops. Considering the importance of personal connections and references, this should not be too surprising.

The only way to trump personal connections is to position our foundation as specialists in serving Catholic schools. That fact alone should win us a spot in the traditional three-firm interview lineup. From that point forward we have an opportunity to establish a relationship and sell our services.

Strategy and Implementation Summary

The market was defined in the Market Segmentation section. We discussed diocesan high schools as our primary target market.

Over the last 10 years we’ve worked in 20+ schools as an independent consultant or employee of various firms. Within the high school market it would seem logical to first approach these 20 schools to evaluate their current needs and seek referrals.

5.1 Pricing Strategy

Initially we will be priced at the upper edge of what the market will bear, competing with name-brand consultants. The pricing fits with our position as a specialist serving Catholic schools.

Consulting bids will be calculated on fees of $1,200 per day. We believe this is the optimum point that balances market tolerance with the Foundation’s need for cash to attract qualified personnel.

5.2 Fundraising Strategy

The annual sales projections are included in the Funding Forecast table.

| Funding Forecast | |||

| Year 1 | Year 2 | Year 3 | |

| Funding | |||

| Consulting Services: Founder | $87,500 | $120,000 | $60,000 |

| Consulting Services: Employee(s) | $52,500 | $300,000 | $600,000 |

| Other | $0 | $0 | $0 |

| Total Funding | $140,000 | $420,000 | $660,000 |

| Direct Cost of Funding | Year 1 | Year 2 | Year 3 |

| Consulting Services: Founder | $6,000 | $8,000 | $8,000 |

| Consulting Services: Employee(s) | $0 | $6,000 | $8,000 |

| Other | $0 | $0 | $0 |

| Subtotal Cost of Funding | $6,000 | $14,000 | $16,000 |

5.3 Milestones

Our detailed milestones for March 2001 through March 2002 are shown in the following table.

| Milestones | |||||

| Milestone | Start Date | End Date | Budget | Manager | Department |

| Business plan | 3/1/2001 | 3/15/2001 | $0 | GSJ | Marketing |

| Logo design | 4/1/2001 | 5/1/2001 | $2,000 | GSJ | Marketing |

| Client Presentations | 8/1/2001 | 3/1/2002 | $10,000 | GSJ | Marketing |

| DM Mailings | 6/1/2001 | 10/30/2001 | $2,000 | Vendor | Web |

| Brochures | 5/2/2001 | 6/1/2001 | $3,000 | Vendor | Web |

| Financial Backing | 3/15/2001 | 8/30/2001 | $600 | GSJ | Department |

| Internet Services Set Up | 4/1/2001 | 5/15/2001 | $3,000 | Vendor | Department |

| Phone/Voicemail Installed | 7/15/2001 | 8/5/2001 | $600 | Vendor | Department |

| Office equipment | 4/1/2001 | 4/30/2001 | $3,000 | GSJ | Department |

| Video Production | 6/1/2001 | 8/15/2001 | $6,200 | Vendor | Department |

| Legal Incorporation | 4/1/2001 | 5/1/2001 | $1,000 | Brother, Esq. | Department |

| Totals | $31,400 | ||||

5.4 Strategic Alliances

While we envision no formal strategic alliances, personal relationships with leaders within the National Catholic Educational Association are important for the sake of references. Many of these relationships already exist.

Management Summary

The central challenge to growing an organization is in the first two years. During this period the organization, small in size, cannot afford to designate a single individual to the exclusive growth of the business. Rather, the leader must also be profitable in the field. Experience shows that a firm must reach five to seven full-time consultants in order to afford the ‘luxury’ of a full time president/sales manager.

6.1 Organizational Structure

Structure within the consulting firms tends to be extremely fluid. The best structure allows experienced people freedom but ensures quality control. The way to achieve both is through the concept of milestone dates. For example, in capital campaigns there are key board meetings that endorse strategy and set financial goals. As company policy, we will always have more than one CSDF individual present at these key dates. This ensures that the on-site consultant maintains objectivity, and that CSDF rather than a renegade volunteer remains in control of the project.

6.2 Personnel Plan

Throughout this proposal we have said that attracting and retaining qualified personnel is central to success. Therefore, it is important to reflect on the factors influencing this area. In priority order for many consultants:

- Money. Starting salaries for consultants average $45,000 to $60,000, depending on experience.

- Size of the paycheck relative to the perceived paycheck of the boss. Interest in leaving a firm and establishing one’s own business begins when the consultant suspects that his paycheck is a fraction of what the boss is making. Because CSDF is a not-for-profit, the founder’s salary would be information shared with the board of directors and employee-consultants.

- Time at home.

- A sense of mission.

- The ability to periodically work on new and creative projects without financial pressures.

Combining these five factors we envision attracting experienced consultants who have reached a mid-point in their career where money is important, but not the sole driving factor in their employment decision. With the top money comes the most stressful situations and pressures. While a certain amount of this is exciting, many consultants would enjoy a chance to work on a project every few months that was pure gratis. This is the person we seek.

At the same time, because we are a not-for-profit, the one-third of consulting fees that traditionally flow to owners are now available as cash reserves to improve salaries and provide for gratis projects. Again, to retain qualified consultants, the compensation plan must make it more attractive to stay than to set up one’s own firm. Once a consultant has two years experience with the organization, the compensation plan should provide for an option to remain strictly salaried, or move to a commission structure.

Every firm owner we’ve worked for spoke of their business as a ‘ministry.’ At the same time the most bitter disputes erupted solely from the issue of money. The Catholic School Development Foundation offers an opportunity for competitive compensation AND a chance to periodically work for the poorest schools (with salaries covered by the Foundation). In doing so, we draw a sharp distinction between those who claim their work is a ministry, and those interested in walking the talk.

In our first engagement as a development consultant in 1991, we had the good fortune of sailing Milwaukee Bay on the private yacht of a multi-millionaire. He hosted a fundraising function for about a dozen classmates, and we were there to meet the guests. As we boarded the yacht, decorated entirely in white, all guests were asked to remove their shoes. In that instant it occurred to the young consultant that when one is done worrying about making money, a new stress is felt–keeping it and caring for one’s possessions.

The radical idea we hope to sell is this: You will be well compensated for your work, with provision made for a comfortable retirement. But if you are looking for financial equity, CSDF cannot help you. We have none to offer. Rather, the equity you gain is a life well lived.

| Personnel Plan | |||

| Year 1 | Year 2 | Year 3 | |

| Founder | $45,000 | $60,000 | $70,000 |

| Additional Consultants | $20,000 | $180,000 | $400,000 |

| Secretarial | $0 | $20,000 | $22,000 |

| Other | $0 | $0 | $0 |

| Total People | 2 | 3 | 6 |

| Total Payroll | $65,000 | $260,000 | $492,000 |

Financial Plan

Our financial plan is based on conservative estimates and assumptions. We will need to plan on initial investment to make the financials work.

7.1 Important Assumptions

The following table summarizes key financial assumptions. Retainer fees in this industry are generally billed in advance of service.

| General Assumptions | |||

| Year 1 | Year 2 | Year 3 | |

| Plan Month | 1 | 2 | 3 |

| Current Interest Rate | 8.00% | 8.00% | 8.00% |

| Long-term Interest Rate | 10.00% | 10.00% | 10.00% |

| Tax Rate | 2.50% | 0.00% | 2.50% |

| Other | 0 | 0 | 0 |

7.2 Key Financial Indicators

The following benchmark chart indicates our key financial indicators for the first three years.

7.3 Break-even Analysis

The following chart and table summarizes the break-even analysis, assuming two full-time consultants in the second year of operations.

| Break-even Analysis | |

| Monthly Revenue Break-even | $8,593 |

| Assumptions: | |

| Average Percent Variable Cost | 4% |

| Estimated Monthly Fixed Cost | $8,225 |

7.4 Projected Surplus or Deficit

An annual pro-forma income statement is included here.

| Surplus and Deficit | |||

| Year 1 | Year 2 | Year 3 | |

| Funding | $140,000 | $420,000 | $660,000 |

| Direct Cost | $6,000 | $14,000 | $16,000 |

| Other | $0 | $0 | $0 |

| Total Direct Cost | $6,000 | $14,000 | $16,000 |

| Gross Surplus | $134,000 | $406,000 | $644,000 |

| Gross Surplus % | 95.71% | 96.67% | 97.58% |

| Expenses | |||

| Payroll | $65,000 | $260,000 | $492,000 |

| Sales and Marketing and Other Expenses | $21,000 | $28,000 | $33,000 |

| Depreciation | $0 | $0 | $0 |

| Insurance | $3,600 | $7,200 | $14,400 |

| Rent | $0 | $0 | $10,000 |

| Other | $0 | $0 | $0 |

| Insurance | $0 | $0 | $0 |

| Payroll Taxes | $9,100 | $36,400 | $68,880 |

| Other | $0 | $0 | $0 |

| Total Operating Expenses | $98,700 | $331,600 | $618,280 |

| Surplus Before Interest and Taxes | $35,300 | $74,400 | $25,720 |

| EBITDA | $35,300 | $74,400 | $25,720 |

| Interest Expense | $0 | $0 | $0 |

| Taxes Incurred | ($2,145) | $0 | $643 |

| Net Surplus | $37,445 | $74,400 | $25,077 |

| Net Surplus/Funding | 26.75% | 17.71% | 3.80% |

7.5 Projected Cash Flow

Cash flow projections are critical to our success. The monthly cash flow is shown in the illustration, with one bar representing the cash flow per month and the other representing the monthly balance. The annual cash flow figures are included in the following table. Consulting is always a feast or famine venture. It is extremely difficult to consistently match demand and supply, especially in firms of five or less consultants. (Beyond this, it evens out.) Therefore, note that a large cash balance in essential to operate through the dry months.

| Pro Forma Cash Flow | |||

| Year 1 | Year 2 | Year 3 | |

| Cash Received | |||

| Cash from Operations | |||

| Cash Funding | $105,000 | $315,000 | $495,000 |

| Cash from Receivables | $25,167 | $85,333 | $148,143 |

| Subtotal Cash from Operations | $130,167 | $400,333 | $643,143 |

| Additional Cash Received | |||

| Sales Tax, VAT, HST/GST Received | $0 | $0 | $0 |

| New Current Borrowing | $0 | $0 | $0 |

| New Other Liabilities (interest-free) | $0 | $0 | $0 |

| New Long-term Liabilities | $0 | $0 | $0 |

| Sales of Other Current Assets | $0 | $0 | $0 |

| Sales of Long-term Assets | $0 | $0 | $0 |

| New Investment Received | $0 | $0 | $0 |

| Subtotal Cash Received | $130,167 | $400,333 | $643,143 |

| Expenditures | Year 1 | Year 2 | Year 3 |

| Expenditures from Operations | |||

| Cash Spending | $65,000 | $260,000 | $492,000 |

| Bill Payments | $34,462 | $81,658 | $138,212 |

| Subtotal Spent on Operations | $99,462 | $341,658 | $630,212 |

| Additional Cash Spent | |||

| Sales Tax, VAT, HST/GST Paid Out | $0 | $0 | $0 |

| Principal Repayment of Current Borrowing | $0 | $0 | $0 |

| Other Liabilities Principal Repayment | $0 | $0 | $0 |

| Long-term Liabilities Principal Repayment | $0 | $0 | $0 |

| Purchase Other Current Assets | $0 | $0 | $0 |

| Purchase Long-term Assets | $0 | $0 | $0 |

| Dividends | $0 | $0 | $0 |

| Subtotal Cash Spent | $99,462 | $341,658 | $630,212 |

| Net Cash Flow | $30,705 | $58,676 | $12,931 |

| Cash Balance | $67,105 | $125,781 | $138,712 |

7.6 Projected Balance Sheet

The following table shows the project balance sheet.

| Pro Forma Balance Sheet | |||

| Year 1 | Year 2 | Year 3 | |

| Assets | |||

| Current Assets | |||

| Cash | $67,105 | $125,781 | $138,712 |

| Accounts Receivable | $9,833 | $29,500 | $46,357 |

| Other Current Assets | $3,000 | $3,000 | $3,000 |

| Total Current Assets | $79,938 | $158,281 | $188,069 |

| Long-term Assets | |||

| Long-term Assets | $0 | $0 | $0 |

| Accumulated Depreciation | $0 | $0 | $0 |

| Total Long-term Assets | $0 | $0 | $0 |

| Total Assets | $79,938 | $158,281 | $188,069 |

| Liabilities and Capital | Year 1 | Year 2 | Year 3 |

| Current Liabilities | |||

| Accounts Payable | $3,093 | $7,036 | $11,747 |

| Current Borrowing | $0 | $0 | $0 |

| Other Current Liabilities | $11,400 | $11,400 | $11,400 |

| Subtotal Current Liabilities | $14,493 | $18,436 | $23,147 |

| Long-term Liabilities | $0 | $0 | $0 |

| Total Liabilities | $14,493 | $18,436 | $23,147 |

| Paid-in Capital | $61,400 | $61,400 | $61,400 |

| Accumulated Surplus/Deficit | ($33,400) | $4,045 | $78,445 |

| Surplus/Deficit | $37,445 | $74,400 | $25,077 |

| Total Capital | $65,445 | $139,845 | $164,922 |

| Total Liabilities and Capital | $79,938 | $158,281 | $188,069 |

| Net Worth | $65,445 | $139,845 | $164,922 |

7.7 Standard Ratios

Business ratios for the years of this plan are shown below. Industry profile ratios based on the Standard Industrial Classification (SIC) code 8299, Schools & Educational Services, NEC, are shown for comparison.

| Ratio Analysis | ||||

| Year 1 | Year 2 | Year 3 | Industry Profile | |

| Funding Growth | 0.00% | 200.00% | 57.14% | 9.50% |

| Percent of Total Assets | ||||

| Accounts Receivable | 12.30% | 18.64% | 24.65% | 15.50% |

| Other Current Assets | 3.75% | 1.90% | 1.60% | 45.60% |

| Total Current Assets | 100.00% | 100.00% | 100.00% | 62.40% |

| Long-term Assets | 0.00% | 0.00% | 0.00% | 37.60% |

| Total Assets | 100.00% | 100.00% | 100.00% | 100.00% |

| Current Liabilities | 18.13% | 11.65% | 12.31% | 43.30% |

| Long-term Liabilities | 0.00% | 0.00% | 0.00% | 17.30% |

| Total Liabilities | 18.13% | 11.65% | 12.31% | 60.60% |

| Net Worth | 81.87% | 88.35% | 87.69% | 39.40% |

| Percent of Funding | ||||

| Funding | 100.00% | 100.00% | 100.00% | 100.00% |

| Gross Surplus | 95.71% | 96.67% | 97.58% | 0.00% |

| Selling, General & Administrative Expenses | 73.50% | 81.81% | 95.95% | 73.80% |

| Advertising Expenses | 3.57% | 2.38% | 1.82% | 5.00% |

| Surplus Before Interest and Taxes | 25.21% | 17.71% | 3.90% | 3.20% |

| Main Ratios | ||||

| Current | 5.52 | 8.59 | 8.12 | 1.33 |

| Quick | 5.52 | 8.59 | 8.12 | 1.11 |

| Total Debt to Total Assets | 18.13% | 11.65% | 12.31% | 60.60% |

| Pre-tax Return on Net Worth | 53.94% | 53.20% | 15.60% | 5.50% |

| Pre-tax Return on Assets | 44.16% | 47.01% | 13.68% | 14.00% |

| Additional Ratios | Year 1 | Year 2 | Year 3 | |

| Net Surplus Margin | 26.75% | 17.71% | 3.80% | n.a |

| Return on Equity | 57.22% | 53.20% | 15.21% | n.a |

| Activity Ratios | ||||

| Accounts Receivable Turnover | 3.56 | 3.56 | 3.56 | n.a |

| Collection Days | 56 | 68 | 84 | n.a |

| Accounts Payable Turnover | 12.14 | 12.17 | 12.17 | n.a |

| Payment Days | 27 | 22 | 24 | n.a |

| Total Asset Turnover | 1.75 | 2.65 | 3.51 | n.a |

| Debt Ratios | ||||

| Debt to Net Worth | 0.22 | 0.13 | 0.14 | n.a |

| Current Liab. to Liab. | 1.00 | 1.00 | 1.00 | n.a |

| Liquidity Ratios | ||||

| Net Working Capital | $65,445 | $139,845 | $164,922 | n.a |

| Interest Coverage | 0.00 | 0.00 | 0.00 | n.a |

| Additional Ratios | ||||

| Assets to Funding | 0.57 | 0.38 | 0.28 | n.a |

| Current Debt/Total Assets | 18% | 12% | 12% | n.a |

| Acid Test | 4.84 | 6.99 | 6.12 | n.a |

| Funding/Net Worth | 2.14 | 3.00 | 4.00 | n.a |

| Dividend Payout | 0.00 | 0.00 | 0.00 | n.a |

Appendix

| Funding Forecast | |||||||||||||

| Month 1 | Month 2 | Month 3 | Month 4 | Month 5 | Month 6 | Month 7 | Month 8 | Month 9 | Month 10 | Month 11 | Month 12 | ||

| Funding | |||||||||||||

| Consulting Services: Founder | 0% | $0 | $0 | $5,000 | $7,500 | $7,500 | $7,500 | $10,000 | $10,000 | $10,000 | $10,000 | $10,000 | $10,000 |

| Consulting Services: Employee(s) | 0% | $0 | $0 | $0 | $0 | $0 | $0 | $7,500 | $7,500 | $7,500 | $10,000 | $10,000 | $10,000 |

| Other | 0% | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| Total Funding | $0 | $0 | $5,000 | $7,500 | $7,500 | $7,500 | $17,500 | $17,500 | $17,500 | $20,000 | $20,000 | $20,000 | |

| Direct Cost of Funding | Month 1 | Month 2 | Month 3 | Month 4 | Month 5 | Month 6 | Month 7 | Month 8 | Month 9 | Month 10 | Month 11 | Month 12 | |

| Consulting Services: Founder | $0 | $500 | $1,000 | $1,000 | $500 | $0 | $0 | $1,000 | $500 | $500 | $500 | $500 | |

| Consulting Services: Employee(s) | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Other | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Subtotal Cost of Funding | $0 | $500 | $1,000 | $1,000 | $500 | $0 | $0 | $1,000 | $500 | $500 | $500 | $500 | |

| Personnel Plan | |||||||||||||

| Month 1 | Month 2 | Month 3 | Month 4 | Month 5 | Month 6 | Month 7 | Month 8 | Month 9 | Month 10 | Month 11 | Month 12 | ||

| Founder | 140% | $2,500 | $2,500 | $2,500 | $2,500 | $2,500 | $2,500 | $5,000 | $5,000 | $5,000 | $5,000 | $5,000 | $5,000 |

| Additional Consultants | 110% | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $5,000 | $5,000 | $5,000 | $5,000 |

| Secretarial | 110% | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| Other | 0% | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| Total People | 1 | 1 | 1 | 1 | 1 | 1 | 2 | 2 | 2 | 2 | 2 | 2 | |

| Total Payroll | $2,500 | $2,500 | $2,500 | $2,500 | $2,500 | $2,500 | $5,000 | $5,000 | $10,000 | $10,000 | $10,000 | $10,000 | |

| General Assumptions | |||||||||||||

| Month 1 | Month 2 | Month 3 | Month 4 | Month 5 | Month 6 | Month 7 | Month 8 | Month 9 | Month 10 | Month 11 | Month 12 | ||

| Plan Month | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 | 11 | 12 | |

| Current Interest Rate | 8.00% | 8.00% | 8.00% | 8.00% | 8.00% | 8.00% | 8.00% | 8.00% | 8.00% | 8.00% | 8.00% | 8.00% | |

| Long-term Interest Rate | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | |

| Tax Rate | 30.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | |

| Other | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | |

| Surplus and Deficit | |||||||||||||

| Month 1 | Month 2 | Month 3 | Month 4 | Month 5 | Month 6 | Month 7 | Month 8 | Month 9 | Month 10 | Month 11 | Month 12 | ||

| Funding | $0 | $0 | $5,000 | $7,500 | $7,500 | $7,500 | $17,500 | $17,500 | $17,500 | $20,000 | $20,000 | $20,000 | |

| Direct Cost | $0 | $500 | $1,000 | $1,000 | $500 | $0 | $0 | $1,000 | $500 | $500 | $500 | $500 | |

| Other | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Total Direct Cost | $0 | $500 | $1,000 | $1,000 | $500 | $0 | $0 | $1,000 | $500 | $500 | $500 | $500 | |

| Gross Surplus | $0 | ($500) | $4,000 | $6,500 | $7,000 | $7,500 | $17,500 | $16,500 | $17,000 | $19,500 | $19,500 | $19,500 | |

| Gross Surplus % | 0.00% | 0.00% | 80.00% | 86.67% | 93.33% | 100.00% | 100.00% | 94.29% | 97.14% | 97.50% | 97.50% | 97.50% | |

| Expenses | |||||||||||||

| Payroll | $2,500 | $2,500 | $2,500 | $2,500 | $2,500 | $2,500 | $5,000 | $5,000 | $10,000 | $10,000 | $10,000 | $10,000 | |

| Sales and Marketing and Other Expenses | $4,000 | $3,000 | $2,000 | $1,500 | $1,500 | $1,500 | $1,500 | $1,500 | $1,500 | $1,000 | $1,000 | $1,000 | |

| Depreciation | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Insurance | $300 | $300 | $300 | $300 | $300 | $300 | $300 | $300 | $300 | $300 | $300 | $300 | |

| Rent | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Other | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Insurance | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Payroll Taxes | 14% | $350 | $350 | $350 | $350 | $350 | $350 | $700 | $700 | $1,400 | $1,400 | $1,400 | $1,400 |

| Other | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Total Operating Expenses | $7,150 | $6,150 | $5,150 | $4,650 | $4,650 | $4,650 | $7,500 | $7,500 | $13,200 | $12,700 | $12,700 | $12,700 | |

| Surplus Before Interest and Taxes | ($7,150) | ($6,650) | ($1,150) | $1,850 | $2,350 | $2,850 | $10,000 | $9,000 | $3,800 | $6,800 | $6,800 | $6,800 | |

| EBITDA | ($7,150) | ($6,650) | ($1,150) | $1,850 | $2,350 | $2,850 | $10,000 | $9,000 | $3,800 | $6,800 | $6,800 | $6,800 | |

| Interest Expense | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Taxes Incurred | ($2,145) | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Net Surplus | ($5,005) | ($6,650) | ($1,150) | $1,850 | $2,350 | $2,850 | $10,000 | $9,000 | $3,800 | $6,800 | $6,800 | $6,800 | |

| Net Surplus/Funding | 0.00% | 0.00% | -23.00% | 24.67% | 31.33% | 38.00% | 57.14% | 51.43% | 21.71% | 34.00% | 34.00% | 34.00% | |

| Pro Forma Cash Flow | |||||||||||||

| Month 1 | Month 2 | Month 3 | Month 4 | Month 5 | Month 6 | Month 7 | Month 8 | Month 9 | Month 10 | Month 11 | Month 12 | ||

| Cash Received | |||||||||||||

| Cash from Operations | |||||||||||||

| Cash Funding | $0 | $0 | $3,750 | $5,625 | $5,625 | $5,625 | $13,125 | $13,125 | $13,125 | $15,000 | $15,000 | $15,000 | |

| Cash from Receivables | $0 | $0 | $0 | $42 | $1,271 | $1,875 | $1,875 | $1,958 | $4,375 | $4,375 | $4,396 | $5,000 | |

| Subtotal Cash from Operations | $0 | $0 | $3,750 | $5,667 | $6,896 | $7,500 | $15,000 | $15,083 | $17,500 | $19,375 | $19,396 | $20,000 | |

| Additional Cash Received | |||||||||||||

| Sales Tax, VAT, HST/GST Received | 0.00% | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| New Current Borrowing | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| New Other Liabilities (interest-free) | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| New Long-term Liabilities | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Sales of Other Current Assets | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Sales of Long-term Assets | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| New Investment Received | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Subtotal Cash Received | $0 | $0 | $3,750 | $5,667 | $6,896 | $7,500 | $15,000 | $15,083 | $17,500 | $19,375 | $19,396 | $20,000 | |

| Expenditures | Month 1 | Month 2 | Month 3 | Month 4 | Month 5 | Month 6 | Month 7 | Month 8 | Month 9 | Month 10 | Month 11 | Month 12 | |

| Expenditures from Operations | |||||||||||||

| Cash Spending | $2,500 | $2,500 | $2,500 | $2,500 | $2,500 | $2,500 | $5,000 | $5,000 | $10,000 | $10,000 | $10,000 | $10,000 | |

| Bill Payments | $84 | $2,560 | $4,133 | $3,633 | $3,133 | $2,633 | $2,162 | $2,533 | $3,507 | $3,683 | $3,200 | $3,200 | |

| Subtotal Spent on Operations | $2,584 | $5,060 | $6,633 | $6,133 | $5,633 | $5,133 | $7,162 | $7,533 | $13,507 | $13,683 | $13,200 | $13,200 | |

| Additional Cash Spent | |||||||||||||

| Sales Tax, VAT, HST/GST Paid Out | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Principal Repayment of Current Borrowing | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Other Liabilities Principal Repayment | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Long-term Liabilities Principal Repayment | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Purchase Other Current Assets | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Purchase Long-term Assets | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Dividends | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Subtotal Cash Spent | $2,584 | $5,060 | $6,633 | $6,133 | $5,633 | $5,133 | $7,162 | $7,533 | $13,507 | $13,683 | $13,200 | $13,200 | |

| Net Cash Flow | ($2,584) | ($5,060) | ($2,883) | ($467) | $1,262 | $2,367 | $7,838 | $7,550 | $3,993 | $5,692 | $6,196 | $6,800 | |

| Cash Balance | $33,817 | $28,757 | $25,873 | $25,407 | $26,669 | $29,036 | $36,874 | $44,424 | $48,418 | $54,109 | $60,305 | $67,105 | |

| Pro Forma Balance Sheet | |||||||||||||

| Month 1 | Month 2 | Month 3 | Month 4 | Month 5 | Month 6 | Month 7 | Month 8 | Month 9 | Month 10 | Month 11 | Month 12 | ||

| Assets | Starting Balances | ||||||||||||

| Current Assets | |||||||||||||

| Cash | $36,400 | $33,817 | $28,757 | $25,873 | $25,407 | $26,669 | $29,036 | $36,874 | $44,424 | $48,418 | $54,109 | $60,305 | $67,105 |

| Accounts Receivable | $0 | $0 | $0 | $1,250 | $3,083 | $3,688 | $3,688 | $6,188 | $8,604 | $8,604 | $9,229 | $9,833 | $9,833 |

| Other Current Assets | $3,000 | $3,000 | $3,000 | $3,000 | $3,000 | $3,000 | $3,000 | $3,000 | $3,000 | $3,000 | $3,000 | $3,000 | $3,000 |

| Total Current Assets | $39,400 | $36,817 | $31,757 | $30,123 | $31,490 | $33,357 | $35,723 | $46,062 | $56,028 | $60,022 | $66,338 | $73,138 | $79,938 |

| Long-term Assets | |||||||||||||

| Long-term Assets | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| Accumulated Depreciation | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| Total Long-term Assets | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| Total Assets | $39,400 | $36,817 | $31,757 | $30,123 | $31,490 | $33,357 | $35,723 | $46,062 | $56,028 | $60,022 | $66,338 | $73,138 | $79,938 |

| Liabilities and Capital | Month 1 | Month 2 | Month 3 | Month 4 | Month 5 | Month 6 | Month 7 | Month 8 | Month 9 | Month 10 | Month 11 | Month 12 | |

| Current Liabilities | |||||||||||||

| Accounts Payable | $0 | $2,422 | $4,012 | $3,528 | $3,045 | $2,562 | $2,078 | $2,417 | $3,383 | $3,577 | $3,093 | $3,093 | $3,093 |

| Current Borrowing | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| Other Current Liabilities | $11,400 | $11,400 | $11,400 | $11,400 | $11,400 | $11,400 | $11,400 | $11,400 | $11,400 | $11,400 | $11,400 | $11,400 | $11,400 |

| Subtotal Current Liabilities | $11,400 | $13,822 | $15,412 | $14,928 | $14,445 | $13,962 | $13,478 | $13,817 | $14,783 | $14,977 | $14,493 | $14,493 | $14,493 |

| Long-term Liabilities | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| Total Liabilities | $11,400 | $13,822 | $15,412 | $14,928 | $14,445 | $13,962 | $13,478 | $13,817 | $14,783 | $14,977 | $14,493 | $14,493 | $14,493 |

| Paid-in Capital | $61,400 | $61,400 | $61,400 | $61,400 | $61,400 | $61,400 | $61,400 | $61,400 | $61,400 | $61,400 | $61,400 | $61,400 | $61,400 |

| Accumulated Surplus/Deficit | ($33,400) | ($33,400) | ($33,400) | ($33,400) | ($33,400) | ($33,400) | ($33,400) | ($33,400) | ($33,400) | ($33,400) | ($33,400) | ($33,400) | ($33,400) |

| Surplus/Deficit | $0 | ($5,005) | ($11,655) | ($12,805) | ($10,955) | ($8,605) | ($5,755) | $4,245 | $13,245 | $17,045 | $23,845 | $30,645 | $37,445 |

| Total Capital | $28,000 | $22,995 | $16,345 | $15,195 | $17,045 | $19,395 | $22,245 | $32,245 | $41,245 | $45,045 | $51,845 | $58,645 | $65,445 |

| Total Liabilities and Capital | $39,400 | $36,817 | $31,757 | $30,123 | $31,490 | $33,357 | $35,723 | $46,062 | $56,028 | $60,022 | $66,338 | $73,138 | $79,938 |

| Net Worth | $28,000 | $22,995 | $16,345 | $15,195 | $17,045 | $19,395 | $22,245 | $32,245 | $41,245 | $45,045 | $51,845 | $58,645 | $65,445 |