Sigmund's Gourmet Pasta

Executive Summary

Sigmund’s Gourmet Pasta will be the leading gourmet pasta restaurant in Eugene, OR with a rapidly developing consumer brand and growing customer base. The signature line of innovative, premium, pasta dishes include pesto with smoked salmon, pancetta and peas linguini in an alfredo sauce, and fresh mussels and clams in a marinara sauce. Sigmund’s Gourmet Pasta also serves distinctive salads, desserts, and beverages.

Sigmund’s Gourmet Pasta will reinvent the pasta experience for individuals, families, and take-away customers with discretionary income by selling high quality, innovative products at a reasonable price, designing tasteful, convenient locations, and providing industry benchmark customer service.

Sigmund’s first restaurant will be financed through a combination of direct owner investment and long-term loans, guaranteed by the owner’s collateral.

1.1 Objectives

Sigmund’s objectives are to build brand awareness and customer service, while growing sales by opening new stores. Sigmund’s intends to utilize the following strategies to achieve these objectives:

- Offer high quality, innovative menu items, utilizing premium vegetables, meats and cheeses.

- Provide an excellent dining value. Sigmund’s provides large portions of fresh, high-quality food for an average guest check of $10 per person.

- Build brand awareness through inexpensive, guerrilla marketing tactics.

- Pursue disciplined restaurant growth.

- Provide superior customer service.

- Leverage the experience, intelligence, and skills of our sophisticated advisory board.

1.2 Mission

Sigmund’s Gourmet Pasta’s mission is to provide the customer the finest pasta meal and dining experience. We exist to attract and maintain customers. When we adhere to this maxim, everything else will fall into place. Our services will exceed the expectations of our customers.

1.3 Keys to Success

Location, Location, Location.

Sigmund’s site selection criteria are critical to success. Arthur Johnson, former VP Real Estate, Starbucks, helped us identify the following site selection criteria:

- Daytime and evening populations.

- Shopping patterns.

- Car counts.

- Household income levels.

Company Summary

Sigmund’s Gourmet Pasta is a gourmet pasta restaurant started in Eugene, OR. Sigmund’s serves individuals, families, and take-away customers with fresh, creative, attractive pasta dishes, salads and desserts. Sigmund’s uses homemade pasta, fresh vegetables, and premium meats and cheeses.

The Eugene store in the Valley River Shopping Center will be the concept store on which all future stores will be based.

2.1 Company Ownership

Sigmund’s is a privately held Oregon Corporation. The majority stock holder is Kevin Lewis.

2.2 Start-up Summary

Sigmund’s will incur the following start-up costs:

- Pasta machines.

- Commercial stove.

- Commercial refrigerators and freezers.

- Commercial dishwasher.

- Cabinets with cutting board surfaces.

- Chairs and tables.

- Beverage dispenser.

- Dishware and flatware.

- Assorted knives, mixing bowls, and other accessories needed in the production of food.

- Point-of-Sale terminal.

- Computer with Internet connection, CD-RW, and printer.

Please note that the following items which are considered assets to be used for more than a year will labeled long-term assets and will be depreciated using G.A.A.P. approved straight-line depreciation method.

| Start-up Funding | |

| Start-up Expenses to Fund | $2,100 |

| Start-up Assets to Fund | $162,900 |

| Total Funding Required | $165,000 |

| Assets | |

| Non-cash Assets from Start-up | $75,000 |

| Cash Requirements from Start-up | $87,900 |

| Additional Cash Raised | $0 |

| Cash Balance on Starting Date | $87,900 |

| Total Assets | $162,900 |

| Liabilities and Capital | |

| Liabilities | |

| Current Borrowing | $0 |

| Long-term Liabilities | $80,000 |

| Accounts Payable (Outstanding Bills) | $0 |

| Other Current Liabilities (interest-free) | $0 |

| Total Liabilities | $80,000 |

| Capital | |

| Planned Investment | |

| Kevin Lewis | $85,000 |

| Other | $0 |

| Additional Investment Requirement | $0 |

| Total Planned Investment | $85,000 |

| Loss at Start-up (Start-up Expenses) | ($2,100) |

| Total Capital | $82,900 |

| Total Capital and Liabilities | $162,900 |

| Total Funding | $165,000 |

| Start-up | |

| Requirements | |

| Start-up Expenses | |

| Legal | $1,000 |

| Stationery etc. | $100 |

| Menus | $1,000 |

| Insurance | $0 |

| Rent | $0 |

| Research and Development | $0 |

| Expensed Equipment | $0 |

| Other | $0 |

| Total Start-up Expenses | $2,100 |

| Start-up Assets | |

| Cash Required | $87,900 |

| Other Current Assets | $0 |

| Long-term Assets | $75,000 |

| Total Assets | $162,900 |

| Total Requirements | $165,000 |

Services

Sigmund’s has created gourmet pastas and salads that are differentiated and superior to competitors. Customers can taste the quality and freshness of the product in every bite. The following are some characteristics of the product:

- Sigmund’s dough is made with Italian semolina flour.

- Cheeses are all imported.

- Vegetables are organic and fresh with three shipments a week.

- Meats are all top-shelf varieties, organic when possible.

At Sigmund’s, food is not the only product. Sigmund’s prides themselves on providing service that is on par with fine dining. This is accomplished through an extensive training program and only hiring experienced employees.

At A Glance–The Protype Sigmund’s Store:

- Location: an upscale mall, suburban neighborhood, or urban retail district.

- Design: bright, hip, and clean.

- Size: 1,200-1,700 square feet.

- Employees: six to seven full time.

- Seating: 35-45.

- Types of transactions: 80% dine in, 20% take away.

Market Analysis Summary

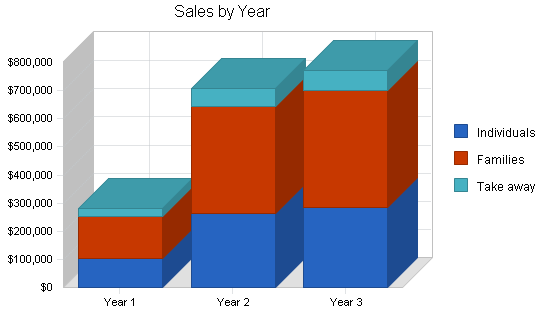

The market can be divided into three target markets, individuals, families and take-away business. Please see the next session for an intricate analysis of the different segments.

Sigmund’s expansion strategy is to further penetrate the existing markets by opening an additional store (or stores) in Eugene in 2004. This clustering approach enables Sigmund’s Gourmet Pasta to increase brand awareness and improve operating and marketing efficiencies. For example:

- Clustering allows Sigmund’s to negotiate a fixed percentage contract with the food wholesalers.

- Marketing expenditures can be spread over multiple revenue centers. This strategy reduces risks involved with opening new restaurants given that Sigmund’s better understands the competitive conditions, consumer tastes, and spending patterns in the market. When the Eugene market is saturated with one or two additional stores, then Sigmund’s intends to look at new markets.

4.1 Market Segmentation

The market can be segmented into three target populations:

- Individuals: people that dine in by themselves.

- Families: a group of people, either friends or a group of non-nuclear relatives dining together.

- Take away: people that prefer to eat Sigmund’s food at another location.

Sigmund’s customers are hungry individuals between the ages of 25 and 50, making up 53% of Eugene (Eugene Chamber of Commerce). Age is not the most defined demographic of this customer base; all age groups enjoy pasta. The most defined characteristic of the target market is income. Gourmet pasta stores have been very successful in high rent, mixed-use urban areas, such as Northwest 23rd in Portland. These areas have a large day and night population consisting of business people and families who have household disposable incomes over $40,000. Combining several key demographic factors, Sigmund’s arrives at a profile of the primary customer as follows:

- Sophisticated families who live nearby.

- Young professionals who work close to the location.

- Shoppers who patronize the high rent stores.

| Market Analysis | |||||||

| Year 1 | Year 2 | Year 3 | Year 4 | Year 5 | |||

| Potential Customers | Growth | CAGR | |||||

| Individuals | 8% | 12,457 | 13,454 | 14,530 | 15,692 | 16,947 | 8.00% |

| Families | 9% | 8,974 | 9,782 | 10,662 | 11,622 | 12,668 | 9.00% |

| Take away | 10% | 24,574 | 27,031 | 29,734 | 32,707 | 35,978 | 10.00% |

| Total | 9.27% | 46,005 | 50,267 | 54,926 | 60,021 | 65,593 | 9.27% |

4.2 Service Business Analysis

In 1999, global pasta sales reached $8 billion. Pasta sales are estimated to grow by at least 10% for the next five years. The big four, Pastabilities, PastaFresh, Pasta Works, and Pasta Perfect contribute $2 billion in combined 2000 revenues. The rest of the market is primarily made up of independent restaurants. Though the barrier to entry into the pasta market is low, due to insufficient capitalization, most entrants fail within their first six months.

4.2.1 Competition and Buying Patterns

National Competition

- Pastabilities. This restaurant offers consumers their choice of noodles, sauces, and ingredients, allowing the customer to assemble their dish as they wish. Food quality is average.

- PastaFresh. This company has a limited selection but the dishes are assembled with high-quality ingredients. The price point is high, but the food is quite good.

- Pasta Works. This company offers pasta that is reasonably fresh, reasonably innovative and at a lower price point. The company was sold a few years ago, and consequently the direction of management has been stagnant lately and has resulted in excessive employee turnover.

- Perfect Pasta. This company had medium-priced pasta dishes that use average ingredients, no creativity, and less than average store atmosphere. Sigmund’s is not sure how this company has been able to grow in size as their whole product is mediocre at best.

Local Competition

- (name omitted)- This is an upscale Italian restaurant that has a limited selection of pasta dishes. Although the selection is limited and pricey, the dishes are quite good.

- (name omitted)- An Italian restaurant with a decent pasta selection, however quality is inconsistent.

- (name omitted)- An upscale restaurant with a large wine selection and good salads. Everything else is mediocre at best and over-priced. Service can often be poor.

Strategy and Implementation Summary

Sigmund’s will leverage their two competitive advantages, superior product and industry benchmarked customer service to build a loyal customer base.

5.1 Competitive Edge

Sigmund’s competitive edge is quite simple – superior product and superior service.

- Product: the product will have the freshest ingredients including homemade pasta, imported cheeses, organic vegetables and top-shelf meats. The product will also be developed to enhance presentation, everything will be aesthetically pleasing.

- Service: customer service will be the priority. All employees will ensure that the customers are having the most pleasant dining experience. All employees will go through an extensive training program and only experienced people will be hired.

5.2 Milestones

Sigmund’s will have several milestones:

- Business plan completion. This will be done as a roadmap for the organization. This will be an indispensable tool for the ongoing performance and improvement of the company. The business plan will be also used for raising capital.

- Set up of the restaurant.

- Opening of the second store.

- Profitability.

| Milestones | |||||

| Milestone | Start Date | End Date | Budget | Manager | Department |

| Business plan completion | 1/1/2001 | 2/1/2001 | $0 | Kevin | Marketing |

| Set up of the restaurant | 1/1/2001 | 3/1/2001 | $162,900 | All | Department |

| Profitability | 11/1/2001 | 11/31/2001 | $0 | Kevin | Department |

| Opening of the second store | 6/1/2004 | 6/30/2004 | $100,000 | Kevin and Erika | Department |

| Totals | $262,900 | ||||

5.3 Marketing Strategy

Sigmund’s Gourmet Pasta’s advertising budget is very limited, so the advertising program is simple. Sigmund’s will do direct mail, banner ads, and inserts, with inserts in the Register-Guard likely to be the most successful of the campaigns.

Lastly, Sigmund’s will leverage personal relationships to get an article about the opening of Sigmund’s in the Register-Guard business section. Previously, friends who have had their restaurant featured in the Register-Guard have seen a dramatic increase of sales immediately after the article was published.

5.4 Sales Strategy

The sales strategy will be to allow people to try the superior product and service for themselves. In essence, the product will speak for itself. The marketing campaign will attract people into Sigmund’s and the sales strategy will be to let people experience Sigmund’s, this will be sufficient to turn the person into a long-term customer.

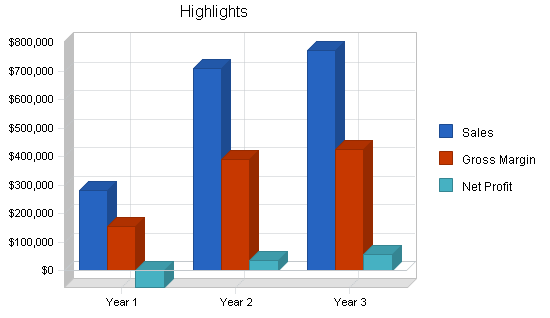

5.4.1 Sales Forecast

The first two months will be used to get the restaurant up and running. By month three things will get a bit busier. Sales will gradually increase, and by the end of the first year we will be running at 2/3 capacity. We will approach full capacity in year two (full capacity for a restaurant being 90% full), and the introduction of new, higher price-point items in the third year accounts for that year’s increase.

| Sales Forecast | |||

| Year 1 | Year 2 | Year 3 | |

| Sales | |||

| Individuals | $103,710 | $262,527 | $286,024 |

| Families | $150,304 | $380,474 | $414,528 |

| Take away | $25,401 | $64,300 | $70,055 |

| Total Sales | $279,415 | $707,301 | $770,608 |

| Direct Cost of Sales | Year 1 | Year 2 | Year 3 |

| Individuals | $46,669 | $118,137 | $128,711 |

| Families | $67,637 | $171,213 | $186,538 |

| Take away | $11,431 | $28,935 | $31,525 |

| Subtotal Direct Cost of Sales | $125,737 | $318,286 | $346,773 |

Management Summary

Kevin Lewis, President, CPA

- Duties: strategic development, back-office administration, financial analysis, internal control, server, and line cook.

- Education: BS general science and BS accounting, University of Oregon.

- Restaurant experience: two years as a server and busser.

- Business experience: staff accountant (Arthur Andersen) and controller (Hollywood Video).

Chef Darryl Darci, Executive Chef

- Duties: manages the back of the house, product development, kitchen hiring, kitchen training, and inventory management.

- Education: Western Culinary Institute.

- Restaurant Experience: fifteen years of restaurant experience at Harrah’s & JQ Hammonds. At JQ Hammonds ran an opening crew for new properties, also the executive sous chef managing 20 and plated 800 meals a day.

Erika Lewis, General Manager

- Duties: manages the front of the house, human resources, server hiring, server training, and quality control.

- Education: BS sociology, University of Oregon.

- Business experience: office and facilities manager, nCube Inc., managed a staff of five, managed system implementation and construction projects and negotiated satellite office lease.

Advisory Board

- John Stevens, VP Food Starbucks Coffee Co., Inc.

- Arthur Johnson, Former VP Real Estate Starbucks Coffee Co., Inc.

- Donald Davis, franchise owner of Sheraton Hotel and Tony Roma’s.

- Jerry Slippery, CPA, Partner, Arthur Anderson.

6.1 Personnel Plan

Kevin, Darryl, and Erika will all be working full time. In addition to this management team, there will be four other full-time employees brought on board during the end of the third month for the first store. The second store will see the hiring of five additional employees.

| Personnel Plan | |||

| Year 1 | Year 2 | Year 3 | |

| Kevin | $30,000 | $37,800 | $39,690 |

| Erika | $30,000 | $37,800 | $39,690 |

| Darryl | $62,000 | $75,600 | $79,380 |

| Full time employee | $11,480 | $13,440 | $13,440 |

| Full time employee | $11,480 | $13,440 | $13,440 |

| Full time employee | $11,480 | $13,440 | $13,440 |

| Full time employee | $10,472 | $13,440 | $13,440 |

| Full time employee | $0 | $13,440 | $13,440 |

| Full time employee | $0 | $13,440 | $13,440 |

| Full time employee | $0 | $13,440 | $13,440 |

| Full time employee | $0 | $13,440 | $13,440 |

| Full time employee | $0 | $13,440 | $13,440 |

| Total People | 7 | 12 | 12 |

| Total Payroll | $166,912 | $272,160 | $279,720 |

Financial Plan

The following sections will outline important financial information.

7.1 Important Assumptions

The following table details important financial assumptions.

| General Assumptions | |||

| Year 1 | Year 2 | Year 3 | |

| Plan Month | 1 | 2 | 3 |

| Current Interest Rate | 10.00% | 10.00% | 10.00% |

| Long-term Interest Rate | 10.00% | 10.00% | 10.00% |

| Tax Rate | 30.00% | 30.00% | 30.00% |

| Other | 0 | 0 | 0 |

7.2 Break-even Analysis

The following topic and table shows our Break-even Analysis.

| Break-even Analysis | |

| Monthly Revenue Break-even | $31,017 |

| Assumptions: | |

| Average Percent Variable Cost | 45% |

| Estimated Monthly Fixed Cost | $17,059 |

7.3 Projected Profit and Loss

The following table will indicate projected profit and loss.

| Pro Forma Profit and Loss | |||

| Year 1 | Year 2 | Year 3 | |

| Sales | $279,415 | $707,301 | $770,608 |

| Direct Cost of Sales | $125,737 | $318,286 | $346,773 |

| Other Production Expenses | $0 | $0 | $0 |

| Total Cost of Sales | $125,737 | $318,286 | $346,773 |

| Gross Margin | $153,678 | $389,016 | $423,834 |

| Gross Margin % | 55.00% | 55.00% | 55.00% |

| Expenses | |||

| Payroll | $166,912 | $272,160 | $279,720 |

| Sales and Marketing and Other Expenses | $2,400 | $2,400 | $2,400 |

| Depreciation | $15,000 | $15,000 | $15,000 |

| Leased Equipment | $0 | $0 | $0 |

| Utilities | $0 | $0 | $0 |

| Insurance | $2,400 | $3,600 | $3,600 |

| Rent | $18,000 | $36,000 | $36,000 |

| Payroll Taxes | $0 | $0 | $0 |

| Other | $0 | $0 | $0 |

| Total Operating Expenses | $204,712 | $329,160 | $336,720 |

| Profit Before Interest and Taxes | ($51,034) | $59,856 | $87,114 |

| EBITDA | ($36,034) | $74,856 | $102,114 |

| Interest Expense | $8,000 | $8,000 | $8,000 |

| Taxes Incurred | $0 | $15,557 | $23,734 |

| Net Profit | ($59,034) | $36,299 | $55,380 |

| Net Profit/Sales | -21.13% | 5.13% | 7.19% |

7.4 Projected Cash Flow

The following chart and table will indicate projected cash flow.

| Pro Forma Cash Flow | |||

| Year 1 | Year 2 | Year 3 | |

| Cash Received | |||

| Cash from Operations | |||

| Cash Sales | $279,415 | $707,301 | $770,608 |

| Subtotal Cash from Operations | $279,415 | $707,301 | $770,608 |

| Additional Cash Received | |||

| Sales Tax, VAT, HST/GST Received | $0 | $0 | $0 |

| New Current Borrowing | $0 | $0 | $0 |

| New Other Liabilities (interest-free) | $0 | $0 | $0 |

| New Long-term Liabilities | $0 | $0 | $0 |

| Sales of Other Current Assets | $0 | $0 | $0 |

| Sales of Long-term Assets | $0 | $0 | $0 |

| New Investment Received | $0 | $0 | $0 |

| Subtotal Cash Received | $279,415 | $707,301 | $770,608 |

| Expenditures | Year 1 | Year 2 | Year 3 |

| Expenditures from Operations | |||

| Cash Spending | $166,912 | $272,160 | $279,720 |

| Bill Payments | $136,690 | $372,140 | $417,494 |

| Subtotal Spent on Operations | $303,602 | $644,300 | $697,214 |

| Additional Cash Spent | |||

| Sales Tax, VAT, HST/GST Paid Out | $0 | $0 | $0 |

| Principal Repayment of Current Borrowing | $0 | $0 | $0 |

| Other Liabilities Principal Repayment | $0 | $0 | $0 |

| Long-term Liabilities Principal Repayment | $0 | $0 | $0 |

| Purchase Other Current Assets | $0 | $0 | $0 |

| Purchase Long-term Assets | $0 | $0 | $0 |

| Dividends | $0 | $0 | $0 |

| Subtotal Cash Spent | $303,602 | $644,300 | $697,214 |

| Net Cash Flow | ($24,187) | $63,001 | $73,394 |

| Cash Balance | $63,713 | $126,714 | $200,107 |

7.5 Projected Balance Sheet

The following table will indicate the projected balance sheet.

| Pro Forma Balance Sheet | |||

| Year 1 | Year 2 | Year 3 | |

| Assets | |||

| Current Assets | |||

| Cash | $63,713 | $126,714 | $200,107 |

| Other Current Assets | $0 | $0 | $0 |

| Total Current Assets | $63,713 | $126,714 | $200,107 |

| Long-term Assets | |||

| Long-term Assets | $75,000 | $75,000 | $75,000 |

| Accumulated Depreciation | $15,000 | $30,000 | $45,000 |

| Total Long-term Assets | $60,000 | $45,000 | $30,000 |

| Total Assets | $123,713 | $171,714 | $230,107 |

| Liabilities and Capital | Year 1 | Year 2 | Year 3 |

| Current Liabilities | |||

| Accounts Payable | $19,846 | $31,549 | $34,562 |

| Current Borrowing | $0 | $0 | $0 |

| Other Current Liabilities | $0 | $0 | $0 |

| Subtotal Current Liabilities | $19,846 | $31,549 | $34,562 |

| Long-term Liabilities | $80,000 | $80,000 | $80,000 |

| Total Liabilities | $99,846 | $111,549 | $114,562 |

| Paid-in Capital | $85,000 | $85,000 | $85,000 |

| Retained Earnings | ($2,100) | ($61,134) | ($24,835) |

| Earnings | ($59,034) | $36,299 | $55,380 |

| Total Capital | $23,866 | $60,165 | $115,545 |

| Total Liabilities and Capital | $123,713 | $171,714 | $230,107 |

| Net Worth | $23,866 | $60,165 | $115,545 |

7.6 Business Ratios

The following table outlines some of the more important ratios from the restaurant industry. The final column, Industry Profile, details specific ratios based on the industry as it is classified by the Standard Industry Classification (SIC) code, 5812, Eating Places.

| Ratio Analysis | ||||

| Year 1 | Year 2 | Year 3 | Industry Profile | |

| Sales Growth | 0.00% | 153.14% | 8.95% | 7.60% |

| Percent of Total Assets | ||||

| Other Current Assets | 0.00% | 0.00% | 0.00% | 35.60% |

| Total Current Assets | 51.50% | 73.79% | 86.96% | 43.70% |

| Long-term Assets | 48.50% | 26.21% | 13.04% | 56.30% |

| Total Assets | 100.00% | 100.00% | 100.00% | 100.00% |

| Current Liabilities | 16.04% | 18.37% | 15.02% | 32.70% |

| Long-term Liabilities | 64.67% | 46.59% | 34.77% | 28.50% |

| Total Liabilities | 80.71% | 64.96% | 49.79% | 61.20% |

| Net Worth | 19.29% | 35.04% | 50.21% | 38.80% |

| Percent of Sales | ||||

| Sales | 100.00% | 100.00% | 100.00% | 100.00% |

| Gross Margin | 55.00% | 55.00% | 55.00% | 60.50% |

| Selling, General & Administrative Expenses | 91.28% | 55.14% | 51.74% | 39.80% |

| Advertising Expenses | 0.43% | 0.17% | 0.16% | 3.20% |

| Profit Before Interest and Taxes | -18.26% | 8.46% | 11.30% | 0.70% |

| Main Ratios | ||||

| Current | 3.21 | 4.02 | 5.79 | 0.98 |

| Quick | 3.21 | 4.02 | 5.79 | 0.65 |

| Total Debt to Total Assets | 80.71% | 64.96% | 49.79% | 61.20% |

| Pre-tax Return on Net Worth | -247.35% | 86.19% | 68.47% | 1.70% |

| Pre-tax Return on Assets | -47.72% | 30.20% | 34.38% | 4.30% |

| Additional Ratios | Year 1 | Year 2 | Year 3 | |

| Net Profit Margin | -21.13% | 5.13% | 7.19% | n.a |

| Return on Equity | -247.35% | 60.33% | 47.93% | n.a |

| Activity Ratios | ||||

| Accounts Payable Turnover | 7.89 | 12.17 | 12.17 | n.a |

| Payment Days | 27 | 24 | 29 | n.a |

| Total Asset Turnover | 2.26 | 4.12 | 3.35 | n.a |

| Debt Ratios | ||||

| Debt to Net Worth | 4.18 | 1.85 | 0.99 | n.a |

| Current Liab. to Liab. | 0.20 | 0.28 | 0.30 | n.a |

| Liquidity Ratios | ||||

| Net Working Capital | $43,866 | $95,165 | $165,545 | n.a |

| Interest Coverage | -6.38 | 7.48 | 10.89 | n.a |

| Additional Ratios | ||||

| Assets to Sales | 0.44 | 0.24 | 0.30 | n.a |

| Current Debt/Total Assets | 16% | 18% | 15% | n.a |

| Acid Test | 3.21 | 4.02 | 5.79 | n.a |

| Sales/Net Worth | 11.71 | 11.76 | 6.67 | n.a |

| Dividend Payout | 0.00 | 0.00 | 0.00 | n.a |

Appendix

| Sales Forecast | |||||||||||||

| Month 1 | Month 2 | Month 3 | Month 4 | Month 5 | Month 6 | Month 7 | Month 8 | Month 9 | Month 10 | Month 11 | Month 12 | ||

| Sales | |||||||||||||

| Individuals | 0% | $0 | $0 | $3,895 | $6,813 | $7,906 | $9,286 | $10,057 | $10,664 | $12,044 | $13,424 | $14,804 | $14,817 |

| Families | 0% | $0 | $0 | $5,645 | $9,874 | $11,458 | $13,458 | $14,575 | $15,455 | $17,455 | $19,455 | $21,455 | $21,474 |

| Take away | 0% | $0 | $0 | $954 | $1,669 | $1,936 | $2,274 | $2,463 | $2,612 | $2,950 | $3,288 | $3,626 | $3,629 |

| Total Sales | $0 | $0 | $10,494 | $18,356 | $21,300 | $25,018 | $27,095 | $28,731 | $32,449 | $36,167 | $39,885 | $39,920 | |

| Direct Cost of Sales | Month 1 | Month 2 | Month 3 | Month 4 | Month 5 | Month 6 | Month 7 | Month 8 | Month 9 | Month 10 | Month 11 | Month 12 | |

| Individuals | $0 | $0 | $1,753 | $3,066 | $3,558 | $4,179 | $4,526 | $4,799 | $5,420 | $6,041 | $6,662 | $6,668 | |

| Families | $0 | $0 | $2,540 | $4,443 | $5,156 | $6,056 | $6,559 | $6,955 | $7,855 | $8,755 | $9,655 | $9,663 | |

| Take away | $0 | $0 | $429 | $751 | $871 | $1,023 | $1,108 | $1,175 | $1,327 | $1,480 | $1,632 | $1,633 | |

| Subtotal Direct Cost of Sales | $0 | $0 | $4,722 | $8,260 | $9,585 | $11,258 | $12,193 | $12,929 | $14,602 | $16,275 | $17,948 | $17,964 | |

| Personnel Plan | |||||||||||||

| Month 1 | Month 2 | Month 3 | Month 4 | Month 5 | Month 6 | Month 7 | Month 8 | Month 9 | Month 10 | Month 11 | Month 12 | ||

| Kevin | 0% | $2,500 | $2,500 | $2,500 | $2,500 | $2,500 | $2,500 | $2,500 | $2,500 | $2,500 | $2,500 | $2,500 | $2,500 |

| Erika | 0% | $2,500 | $2,500 | $2,500 | $2,500 | $2,500 | $2,500 | $2,500 | $2,500 | $2,500 | $2,500 | $2,500 | $2,500 |

| Darryl | 0% | $3,500 | $3,500 | $5,500 | $5,500 | $5,500 | $5,500 | $5,500 | $5,500 | $5,500 | $5,500 | $5,500 | $5,500 |

| Full time employee | 0% | $0 | $280 | $1,120 | $1,120 | $1,120 | $1,120 | $1,120 | $1,120 | $1,120 | $1,120 | $1,120 | $1,120 |

| Full time employee | 0% | $0 | $280 | $1,120 | $1,120 | $1,120 | $1,120 | $1,120 | $1,120 | $1,120 | $1,120 | $1,120 | $1,120 |

| Full time employee | 0% | $0 | $280 | $1,120 | $1,120 | $1,120 | $1,120 | $1,120 | $1,120 | $1,120 | $1,120 | $1,120 | $1,120 |

| Full time employee | 0% | $0 | $280 | $112 | $1,120 | $1,120 | $1,120 | $1,120 | $1,120 | $1,120 | $1,120 | $1,120 | $1,120 |

| Full time employee | 0% | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| Full time employee | 0% | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| Full time employee | 0% | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| Full time employee | 0% | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| Full time employee | 0% | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| Total People | 3 | 7 | 7 | 7 | 7 | 7 | 7 | 7 | 7 | 7 | 7 | 7 | |

| Total Payroll | $8,500 | $9,620 | $13,972 | $14,980 | $14,980 | $14,980 | $14,980 | $14,980 | $14,980 | $14,980 | $14,980 | $14,980 | |

| General Assumptions | |||||||||||||

| Month 1 | Month 2 | Month 3 | Month 4 | Month 5 | Month 6 | Month 7 | Month 8 | Month 9 | Month 10 | Month 11 | Month 12 | ||

| Plan Month | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 | 11 | 12 | |

| Current Interest Rate | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | |

| Long-term Interest Rate | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | |

| Tax Rate | 30.00% | 30.00% | 30.00% | 30.00% | 30.00% | 30.00% | 30.00% | 30.00% | 30.00% | 30.00% | 30.00% | 30.00% | |

| Other | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | |

| Pro Forma Profit and Loss | |||||||||||||

| Month 1 | Month 2 | Month 3 | Month 4 | Month 5 | Month 6 | Month 7 | Month 8 | Month 9 | Month 10 | Month 11 | Month 12 | ||

| Sales | $0 | $0 | $10,494 | $18,356 | $21,300 | $25,018 | $27,095 | $28,731 | $32,449 | $36,167 | $39,885 | $39,920 | |

| Direct Cost of Sales | $0 | $0 | $4,722 | $8,260 | $9,585 | $11,258 | $12,193 | $12,929 | $14,602 | $16,275 | $17,948 | $17,964 | |

| Other Production Expenses | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Total Cost of Sales | $0 | $0 | $4,722 | $8,260 | $9,585 | $11,258 | $12,193 | $12,929 | $14,602 | $16,275 | $17,948 | $17,964 | |

| Gross Margin | $0 | $0 | $5,772 | $10,096 | $11,715 | $13,760 | $14,902 | $15,802 | $17,847 | $19,892 | $21,937 | $21,956 | |

| Gross Margin % | 0.00% | 0.00% | 55.00% | 55.00% | 55.00% | 55.00% | 55.00% | 55.00% | 55.00% | 55.00% | 55.00% | 55.00% | |

| Expenses | |||||||||||||

| Payroll | $8,500 | $9,620 | $13,972 | $14,980 | $14,980 | $14,980 | $14,980 | $14,980 | $14,980 | $14,980 | $14,980 | $14,980 | |

| Sales and Marketing and Other Expenses | $200 | $200 | $200 | $200 | $200 | $200 | $200 | $200 | $200 | $200 | $200 | $200 | |

| Depreciation | $1,250 | $1,250 | $1,250 | $1,250 | $1,250 | $1,250 | $1,250 | $1,250 | $1,250 | $1,250 | $1,250 | $1,250 | |

| Leased Equipment | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Utilities | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Insurance | $200 | $200 | $200 | $200 | $200 | $200 | $200 | $200 | $200 | $200 | $200 | $200 | |

| Rent | $1,500 | $1,500 | $1,500 | $1,500 | $1,500 | $1,500 | $1,500 | $1,500 | $1,500 | $1,500 | $1,500 | $1,500 | |

| Payroll Taxes | 15% | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| Other | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Total Operating Expenses | $11,650 | $12,770 | $17,122 | $18,130 | $18,130 | $18,130 | $18,130 | $18,130 | $18,130 | $18,130 | $18,130 | $18,130 | |

| Profit Before Interest and Taxes | ($11,650) | ($12,770) | ($11,350) | ($8,034) | ($6,415) | ($4,370) | ($3,228) | ($2,328) | ($283) | $1,762 | $3,807 | $3,826 | |

| EBITDA | ($10,400) | ($11,520) | ($10,100) | ($6,784) | ($5,165) | ($3,120) | ($1,978) | ($1,078) | $967 | $3,012 | $5,057 | $5,076 | |

| Interest Expense | $667 | $667 | $667 | $667 | $667 | $667 | $667 | $667 | $667 | $667 | $667 | $667 | |

| Taxes Incurred | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Net Profit | ($12,317) | ($13,437) | ($12,017) | ($8,701) | ($7,081) | ($5,037) | ($3,894) | ($2,995) | ($950) | $1,095 | $3,140 | $3,159 | |

| Net Profit/Sales | 0.00% | 0.00% | -114.51% | -47.40% | -33.25% | -20.13% | -14.37% | -10.42% | -2.93% | 3.03% | 7.87% | 7.91% | |

| Pro Forma Cash Flow | |||||||||||||

| Month 1 | Month 2 | Month 3 | Month 4 | Month 5 | Month 6 | Month 7 | Month 8 | Month 9 | Month 10 | Month 11 | Month 12 | ||

| Cash Received | |||||||||||||

| Cash from Operations | |||||||||||||

| Cash Sales | $0 | $0 | $10,494 | $18,356 | $21,300 | $25,018 | $27,095 | $28,731 | $32,449 | $36,167 | $39,885 | $39,920 | |

| Subtotal Cash from Operations | $0 | $0 | $10,494 | $18,356 | $21,300 | $25,018 | $27,095 | $28,731 | $32,449 | $36,167 | $39,885 | $39,920 | |

| Additional Cash Received | |||||||||||||

| Sales Tax, VAT, HST/GST Received | 0.00% | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| New Current Borrowing | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| New Other Liabilities (interest-free) | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| New Long-term Liabilities | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Sales of Other Current Assets | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Sales of Long-term Assets | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| New Investment Received | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Subtotal Cash Received | $0 | $0 | $10,494 | $18,356 | $21,300 | $25,018 | $27,095 | $28,731 | $32,449 | $36,167 | $39,885 | $39,920 | |

| Expenditures | Month 1 | Month 2 | Month 3 | Month 4 | Month 5 | Month 6 | Month 7 | Month 8 | Month 9 | Month 10 | Month 11 | Month 12 | |

| Expenditures from Operations | |||||||||||||

| Cash Spending | $8,500 | $9,620 | $13,972 | $14,980 | $14,980 | $14,980 | $14,980 | $14,980 | $14,980 | $14,980 | $14,980 | $14,980 | |

| Bill Payments | $86 | $2,567 | $2,724 | $7,407 | $10,871 | $12,208 | $13,856 | $14,784 | $15,551 | $17,224 | $18,898 | $20,515 | |

| Subtotal Spent on Operations | $8,586 | $12,187 | $16,696 | $22,387 | $25,851 | $27,188 | $28,836 | $29,764 | $30,531 | $32,204 | $33,878 | $35,495 | |

| Additional Cash Spent | |||||||||||||

| Sales Tax, VAT, HST/GST Paid Out | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Principal Repayment of Current Borrowing | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Other Liabilities Principal Repayment | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Long-term Liabilities Principal Repayment | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Purchase Other Current Assets | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Purchase Long-term Assets | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Dividends | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Subtotal Cash Spent | $8,586 | $12,187 | $16,696 | $22,387 | $25,851 | $27,188 | $28,836 | $29,764 | $30,531 | $32,204 | $33,878 | $35,495 | |

| Net Cash Flow | ($8,586) | ($12,187) | ($6,202) | ($4,031) | ($4,551) | ($2,169) | ($1,741) | ($1,033) | $1,918 | $3,962 | $6,007 | $4,425 | |

| Cash Balance | $79,314 | $67,128 | $60,926 | $56,895 | $52,344 | $50,175 | $48,434 | $47,401 | $49,318 | $53,281 | $59,288 | $63,713 | |

| Pro Forma Balance Sheet | |||||||||||||

| Month 1 | Month 2 | Month 3 | Month 4 | Month 5 | Month 6 | Month 7 | Month 8 | Month 9 | Month 10 | Month 11 | Month 12 | ||

| Assets | Starting Balances | ||||||||||||

| Current Assets | |||||||||||||

| Cash | $87,900 | $79,314 | $67,128 | $60,926 | $56,895 | $52,344 | $50,175 | $48,434 | $47,401 | $49,318 | $53,281 | $59,288 | $63,713 |

| Other Current Assets | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| Total Current Assets | $87,900 | $79,314 | $67,128 | $60,926 | $56,895 | $52,344 | $50,175 | $48,434 | $47,401 | $49,318 | $53,281 | $59,288 | $63,713 |

| Long-term Assets | |||||||||||||

| Long-term Assets | $75,000 | $75,000 | $75,000 | $75,000 | $75,000 | $75,000 | $75,000 | $75,000 | $75,000 | $75,000 | $75,000 | $75,000 | $75,000 |

| Accumulated Depreciation | $0 | $1,250 | $2,500 | $3,750 | $5,000 | $6,250 | $7,500 | $8,750 | $10,000 | $11,250 | $12,500 | $13,750 | $15,000 |

| Total Long-term Assets | $75,000 | $73,750 | $72,500 | $71,250 | $70,000 | $68,750 | $67,500 | $66,250 | $65,000 | $63,750 | $62,500 | $61,250 | $60,000 |

| Total Assets | $162,900 | $153,064 | $139,628 | $132,176 | $126,895 | $121,094 | $117,675 | $114,684 | $112,401 | $113,068 | $115,781 | $120,538 | $123,713 |

| Liabilities and Capital | Month 1 | Month 2 | Month 3 | Month 4 | Month 5 | Month 6 | Month 7 | Month 8 | Month 9 | Month 10 | Month 11 | Month 12 | |

| Current Liabilities | |||||||||||||

| Accounts Payable | $0 | $2,481 | $2,481 | $7,046 | $10,466 | $11,747 | $13,364 | $14,267 | $14,979 | $16,596 | $18,214 | $19,831 | $19,846 |

| Current Borrowing | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| Other Current Liabilities | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| Subtotal Current Liabilities | $0 | $2,481 | $2,481 | $7,046 | $10,466 | $11,747 | $13,364 | $14,267 | $14,979 | $16,596 | $18,214 | $19,831 | $19,846 |

| Long-term Liabilities | $80,000 | $80,000 | $80,000 | $80,000 | $80,000 | $80,000 | $80,000 | $80,000 | $80,000 | $80,000 | $80,000 | $80,000 | $80,000 |

| Total Liabilities | $80,000 | $82,481 | $82,481 | $87,046 | $90,466 | $91,747 | $93,364 | $94,267 | $94,979 | $96,596 | $98,214 | $99,831 | $99,846 |

| Paid-in Capital | $85,000 | $85,000 | $85,000 | $85,000 | $85,000 | $85,000 | $85,000 | $85,000 | $85,000 | $85,000 | $85,000 | $85,000 | $85,000 |

| Retained Earnings | ($2,100) | ($2,100) | ($2,100) | ($2,100) | ($2,100) | ($2,100) | ($2,100) | ($2,100) | ($2,100) | ($2,100) | ($2,100) | ($2,100) | ($2,100) |

| Earnings | $0 | ($12,317) | ($25,753) | ($37,770) | ($46,471) | ($53,553) | ($58,589) | ($62,484) | ($65,478) | ($66,428) | ($65,333) | ($62,193) | ($59,034) |

| Total Capital | $82,900 | $70,583 | $57,147 | $45,130 | $36,429 | $29,347 | $24,311 | $20,416 | $17,422 | $16,472 | $17,567 | $20,707 | $23,866 |

| Total Liabilities and Capital | $162,900 | $153,064 | $139,628 | $132,176 | $126,895 | $121,094 | $117,675 | $114,684 | $112,401 | $113,068 | $115,781 | $120,538 | $123,713 |

| Net Worth | $82,900 | $70,583 | $57,147 | $45,130 | $36,429 | $29,347 | $24,311 | $20,416 | $17,422 | $16,472 | $17,567 | $20,707 | $23,866 |