MedNexis, Inc.

Executive Summary

MedNexis, Inc. (the company) is a medical device development company that has designed and patented medical devices which it plans to produce and market. A magnetic muscle stimulator/field generator has been designed with the participation of leading medical personnel and biomedical engineers. One patent is initially incorporated.

Allopathic Medicine

One market addresses the unanswered need of atrophy prevention/treatment in conditions resulting in patient immobilization for greater than two weeks. After two weeks of immobilization, the average muscle loses over 30% of its mass, resulting in an increased time to complete recovery. A new and innovative design, dubbed the MedStim system, has been created to answer this need for an effective, easy-to-use atrophy prevention/treatment device. The number of indications for this device is expected to rise as further research on the benefits of pulsed magnetic fields unfolds. For example, pulsed field magnetism has recently been shown in controlled studies to be an effective treatment in accelerating the healing of skeletal fractures.

The market for magnetic stimulation devices in allopathic medicine is existent, but in the embryonic stages and subject to explosive growth once the technology proves cost-effective. This potential market has reached an estimated 4.2 million patients in the United States. The new and innovative device designed to target this market has been named the MedStim system.

Alternative Medicine

Another market addresses an unanswered need in the alternative medicine market for a device which will provide a more powerful and consistent therapeutic magnetic field. Dynamic magnetic field therapy (the treatment of soft tissue with variable magnetic pulses) is currently thought to have beneficial effects on circulation, immune system function, wound healing, etc., in the alternative healthcare sector and these effects are thought to be proportional to the strength of the magnetic field generated. The new and innovative design created to answer this need for a more powerful therapeutic magnetic field in alternative medicine has been named the TheraMag system. This market is in existence and is expected to have the potential of approximately 40 million customers in the United States on our starting date.

Technology

Patent applications on the company’s first market entries have been filed using a patent agent specializing in biomedical device patents. MedNexis’ technology utilizes the principal that a current in a coil will generate a magnetic field which will, in turn, generate a current in any conductive material within this field. This model is currently effectively applied in diagnostic studies in which single nerves are stimulated with magnetism for diagnostic purposes alone. Using this model, and considering the human nerve to be the conductive material, MedNexis has developed an electromagnetic device which will painlessly stimulate human muscles to contract. Applications of this technology are numerous, with the following devices being those initially marketed:

MedNexis’ patented device will be tailored to effectively stimulate muscle. This will require larger electrical currents, greater functionality, and a wider range of settings. This device will be marketed for mainstream, allopathic medicine

TheraMag- MedNexis’ patented device will bathe tissue in a magnetic field without causing contraction of the muscle. This device will be marketed for alternative applications.

Strategy

MedNexis will target the following two markets: allopathic and alternative medicine. In order to effectively distance the two products from possible negative connotations associated with alternative medicine in the field of allopathic medicine, the two devices will be given separate and distinct names: MedStim for the allopathic medicine device and TheraMag for the alternative medicine device.

MedStim will be distributed through channels dominated by large distributors and strategic association with these players will be key to gaining acceptance in this market. Furthermore, physicians will demand randomized, controlled study data, the production of which will be the focus of the bulk of MedNexis’ early efforts in this market.

TheraMag will be distributed to alternative medicine centers which are less centralized and direct sales will also be possible. Less scientific proof is required by this market, and entrance will be immediate once the FDA issues an Investigational Device Exemption.

Regulatory Issues

Through obtaining an Investigational Device Exemption and clearly labeling the product “For Investigational Use Only,” FDA regulations will be satisfied and market entrance will be expedited. Acceptance of these products based on successful research results will drastically increase demand and allow for expansion to foreign markets

Major Milestones

Animal stage Research and Development underway, early Year One.

- Extend patent coverage to Australia, Europe and Canada, middle Year One

- Human clinical trials underway, middle Year Two.

- Research studies published, end of Year Two.

- TheraMag for sale, end of Year One.

- MagnaStim for sale, labeled as ‘For Investigational Use Only’, end of Year Two.

- Profitability established by Year Four.

Competitive Advantage

While the MagnaStim and TheraMag devices are effective and user-friendly, with multiple home healthcare applications, all the competing devices currently on the market are only partially effective or difficult and awkward to use for the recommended therapeutic treatment. MedNexis will use its patented designs to fill the need in the market for an easier to use, more effective magnetic stimulator/field generator.

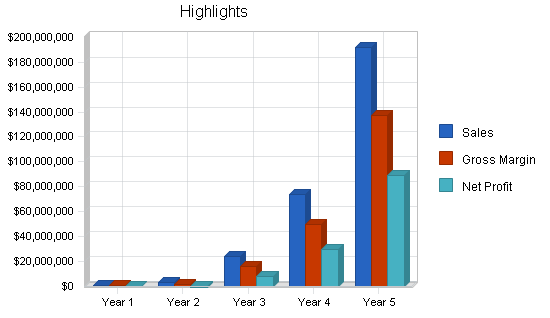

Financial

Based on detailed financial projections, if the company receives the $750,000 in funding, it will operate profitably by Year 3. The company projects $23.5 million in sales with a formidable net profit in Year 3, with projections based on penetration of less than 3% in any market segment.