Malone's Maternity

Executive Summary

Malone’s Maternity, a start-up company, is a boutique style retailer of maternity and child clothing and accessories. Malone’s Maternity will offer its customers a wide range of upscale products to choose from. The business has been formed as an Ohio corporation by Sandy Malone. By offering a nice selection of upper-end merchandise with benchmarked customer service, Malone’s Maternity will quickly gain market share.

The Market

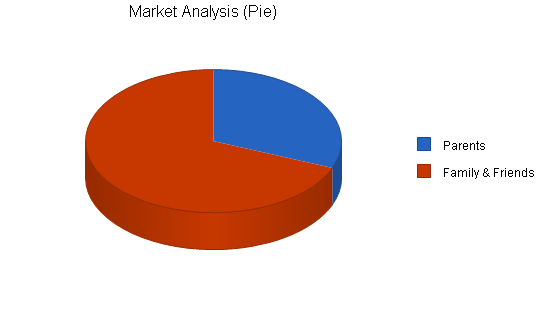

Malone’s Maternity has identified two distinct market segments to target. The first segment is the actual parents, those that are buying the products for themselves or for their spouses. This segment is growing at an impressive 9% annual rate and contains 135,457 potential customers. The second group are friends and other people buying gifts. This market segment has a 8% annual growth rate with 299,454 potential customers.

The Concept

Imagine this. You walk into a new retail space and it is an upscale boutique, as if you were on Fifth Avenue or Beverly Hills Drive. But wait, the clothes are not for upscale models, but for expecting moms and their infants/kids. While this may seem a bit unusual, it is truly needed. Fashion conscious women have been looking for an upscale boutique where they can get good looking, chic clothing for themselves as well as fashionable clothes for the toddlers and a wide range of gifts and accessories. While there is one other store in the Cleveland Metropolitan area that sells clothes at a similar price point, the store itself does not communicate the feeling of an exclusive boutique. Malone’s Maternity will thrive by offering upscale products to upscale clients.

Management

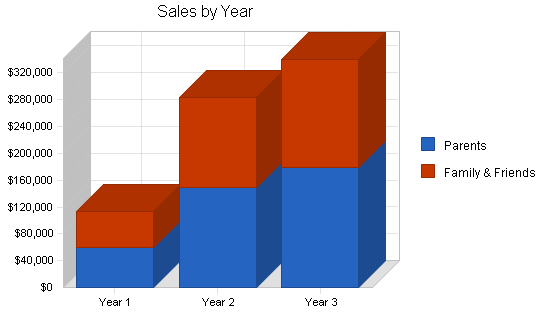

Malone’s Maternity will be led by its founder Sandy Malone. Sandy has an undergraduate degree in Sociology. Upon graduation Sandy went to work for Saks Fifth Avenue, an upscale retail chain. Within four years Sandy was one of the main buyers for the entire chain, a job that provided her with unique insight into the retail industry. Sandy spent several years in this position, collecting a wealth of knowledge and developing important skills. Then Sandy underwent the necessary practical experience for this venture, she had three children. Sandy became keenly aware of the lack of high end offerings available in the Cleveland area for expecting mothers and their small children. With this insight, industry experience, and important skill sets, Sandy will lead Malone’s Maternity to become the premier boutique in the area. Malone’s Maternity will achieve strong sales for years two and three while earning moderate net profit for those years.

1.1 Objectives

- To create a maternity clothes and accessory boutique.

- Quickly gain market share by addressing the upper-end price point of maternity and infant clothing.

- To become profitable within two years.

1.2 Mission

It is Malone’s Maternity’s mission to become the premier maternity boutique for the upscale expectant mother and her child. This will be accomplished by offering the newest fashions and the highest level of customer attention.

1.3 Keys to Success

- Offer the finest maternity clothing and accessories for the mothers and children.

- Pamper the customers.

- Develop a strict financial control regime for the business.

Company Summary

Malone’s Maternity was formed by Sandy Malone as an Ohio registered corporation.

2.1 Company Ownership

Sandy Malone is the primary shareholder in Malone’s Maternity.

2.2 Start-up Summary

Malone’s Maternity will incur the following start-up expenses:

- Point of purchase computer with back-end server.

- Additional computer for the office with an Internet connection and laser printer. Required software is Business Plan Pro, Microsoft Office, QuickBooks Pro.

- Three extension phone system.

- Copier and fax machine.

- Two office desk setups.

- Various shelving on the walls

- Build-out expenses including the shelving units, store fixtures, changing rooms, various chairs and couches, etc.

| Start-up Funding | |

| Start-up Expenses to Fund | $65,950 |

| Start-up Assets to Fund | $74,050 |

| Total Funding Required | $140,000 |

| Assets | |

| Non-cash Assets from Start-up | $22,500 |

| Cash Requirements from Start-up | $51,550 |

| Additional Cash Raised | $0 |

| Cash Balance on Starting Date | $51,550 |

| Total Assets | $74,050 |

| Liabilities and Capital | |

| Liabilities | |

| Current Borrowing | $0 |

| Long-term Liabilities | $0 |

| Accounts Payable (Outstanding Bills) | $0 |

| Other Current Liabilities (interest-free) | $0 |

| Total Liabilities | $0 |

| Capital | |

| Planned Investment | |

| Investor 1 | $55,000 |

| Investor 2 | $45,000 |

| Other | $40,000 |

| Additional Investment Requirement | $0 |

| Total Planned Investment | $140,000 |

| Loss at Start-up (Start-up Expenses) | ($65,950) |

| Total Capital | $74,050 |

| Total Capital and Liabilities | $74,050 |

| Total Funding | $140,000 |

| Start-up | |

| Requirements | |

| Start-up Expenses | |

| Legal | $2,500 |

| Stationery etc. | $500 |

| Brochures | $250 |

| Consultants | $0 |

| Insurance | $200 |

| Rent | $2,500 |

| Research and Development | $0 |

| Build-out | $50,000 |

| Inventory | $10,000 |

| Total Start-up Expenses | $65,950 |

| Start-up Assets | |

| Cash Required | $51,550 |

| Start-up Inventory | $0 |

| Other Current Assets | $3,500 |

| Long-term Assets | $19,000 |

| Total Assets | $74,050 |

| Total Requirements | $140,000 |

Products

Malone’s Maternity is a new boutique that offers a wide range of fancy maternity clothes and accessories as well as baby clothing. The concept is to offer high-end products for both the mother and child in one store. This level of convenience is not offered by anyone else. While there is one other store that offers upscale maternity clothing, no one offers products for both mother and child in the same store. Some of Malone’s Maternity’s product offerings include:

- Maternity clothes.

- Baby clothes.

- New mother gift baskets.

- Gift registries.

- Fancy photo albums.

- New baby pamper kits (a nice assortment of oils, soaps, and other luxuries).

- Assorted fancy containers for diapers and wet wipes.

Market Analysis Summary

Malone’s Maternity has identified two distinct attractive market segments. The first segment includes expecting and just delivered mothers. The second segment encompasses family, friends, coworkers, and others purchasing gifts. Malone’s Maternity operates within the large maternity industry, which offers a wide range of products for mothers and children. Malone’s Maternity will compete within the upper echelon of this market.

4.1 Market Segmentation

Malone’s Maternity has identified two particularly attractive market segments.

Parents – This segment is primarily the expecting mother, and also includes the father.

- Ages 24-34, median age 32.

- Household income above $80,000.

- Go out to eat 2.3 times a week.

- 89% have an undergraduate degree.

- 39% have a graduate degree.

- Spend $350 a month on clothing for themselves.

Family & Friends – This segment is buying gifts for the new parents and child. They are looking for something upscale, something that would be really enjoyed.

- Ages 32-57.

- Household income greater than $83,000.

- Go out to eat 2.1 times a week.

- 83% have an undergraduate degree.

- 23% have a graduate degree.

| Market Analysis | |||||||

| Year 1 | Year 2 | Year 3 | Year 4 | Year 5 | |||

| Potential Customers | Growth | CAGR | |||||

| Parents | 4% | 135,457 | 140,875 | 146,510 | 152,370 | 158,465 | 4.00% |

| Family & Friends | 4% | 299,454 | 311,432 | 323,889 | 336,845 | 350,319 | 4.00% |

| Total | 4.00% | 434,911 | 452,307 | 470,399 | 489,215 | 508,784 | 4.00% |

4.2 Target Market Segment Strategy

Malone’s Maternity has chosen parents, and family and friends, as the two most attractive segments to target. These segments are the most desirable because they have high levels of disposable income, and they spend it. The parents are used to having fashionable clothes and accessories and it is totally consistent with their purchasing patterns that this preference would remain unchanged once they get pregnant. Many expecting parents like to reward or pamper themselves with nice gifts when they’re pregnant.

Family and friends are interested in buying nice gifts for their expecting friends. This segment recognizes their friend’s appreciation for nice things and are looking for something that they know they will enjoy. The gifts are meant to be something nice, and luxurious. Much of the current maternity wear and accessories are utility based, and while they serve their purpose, they are not the most engaging gift. Family and friends are looking for something that will stand out, that the new parents will truly enjoy.

4.3 Industry Analysis

The retail maternity and child industry is made up very specific retailers that generally do not have much crossover. This means that a retailer will concentrate on either maternity or children; it is rare for a retailer to offer products for both mother and child in the same store. While this is somewhat intuitive because it allows the retailer to remain focused on one thing, Malone’s Maternity believes that there are many lost opportunities in that case since maternity and children go hand in hand. Malone’s Maternity will capitalize on these missed opportunities and allow one-stop shopping for both mother and child.

Industry Trends

- There is a shift in the new millennium toward a younger mom, beginning at age 20.

- 82% of 20-24 year olds think motherhood is the most important job in the world compared with 72% of women age 24-34.

- Molded cup nursing bras are the fastest growing product. They tend to give mothers a fresh, young look while keeping them pretty and confident.

- There is an increase in active wear as a result of two factors:

- New research indicates it is beneficial for women to exercise during and after pregnancy.

- Women are becoming more athletic.

- Cotton/Lycra blend has become the fabric of choice for comfort.

- Cotton- for superior breathability.

- Lycra- its body sculpting properties offer youthful, natural looking support, forgiving fit and easy-care properties.

4.3.1 Competition and Buying Patterns

Malone’s Maternity faces competition from several sources.

- Mail order/Internet – Many retailers sell their products from remote locations that are accessible either by catalog or a Website. This provides the consumer with a wide selection. While this works for certain general items, it causes problems for clothing that must be tried on first. Especially for the expecting mother whose size is changing rapidly. Some mothers do not know what their size is due to fluctuation.

- Local retailers – There are six different retailers within a 20 mile radius of Malone’s Maternity. Five of them cater to the mid-price point. The sixth is a higher end store carrying some of the same merchandise for the mother Malone’s Maternity will carry. While this store has similar stock, the store itself does not feel like a boutique. They have high-end merchandise but the store experience does not translate into high-end boutique. The store is somewhat drab. All of the local competing stores sell only maternity items. They do not offer anything for children.

Strategy and Implementation Summary

Malone’s Maternity will leverage their competitive edge of product selection for both women and children to gain market share. Malone’s Maternity is the only store offering clothing and accessories for expectant and new mothers, as well as for infants and children. This will create unmatched convenience and lead to higher customer tickets.

The marketing strategy will be two-pronged in its attempt to increase the target customer’s awareness of Malone’s Maternity; a focused advertising campaign and the location of the retail space.

The sales strategy will be to offer the highest level of customer service. The ideal customer is accustomed to excellent service and Malone’s Maternity has the goal of impressing every customer with their benchmarked level of customer attention.

5.1 Competitive Edge

Malone’s Maternity’s competitive edge of product offerings for both mother and child offers two distinct advantages:

- Convenience – Having items for both mother and child makes a trip to Malone’s Maternity convenient. Gifts for both groups can be purchased at once.

- Higher tickets per customer – Because there are products for mothers and children, the ticket prices per customer will be higher as customers buy gifts for both as instead of only one. These customers typically buy gifts for both, but ordinarily have to travel to different stores to satisfy both needs.

5.2 Marketing Strategy

The marketing strategy has several approaches to develop awareness of this new boutique.

- Advertising – Ads will be placed in several different media, but primarily in the fashion section of Cleveland’s The Plain Dealer, the region’s largest newspaper. The Plain Dealer also has a child birth/care section each week and advertisements will be placed there as well.

- Location – Malone’s Maternity is located the store in an upscale mall that attracts a large amount of foot traffic. The additional money spent on rent will assist the marketing effort. By strategically locating the store in a posh, busy center Malone’s Maternity will increase awareness and traffic within the store.

5.3 Sales Strategy

The sales strategy will rely on customer service. All employees will receive training on customer attention. The overriding maxim is that all customers be given as much attention as they need, and, no customers should leave the store unsatisfied, even if they do not make a purchase. Employees will be taught how to handle any type of problem that may arise. All employees are empowered to remedy most problems. If something occurs that the employee is unable to fix, they will pass the issue on to the manager. The net effect of this approach is that customers are immediately greeted upon entering the store and in a subtle but helpful way their needs are met. Ensuring all customers are both satisfied and impressed with the service that they received, will ensure a steady increase in sales.

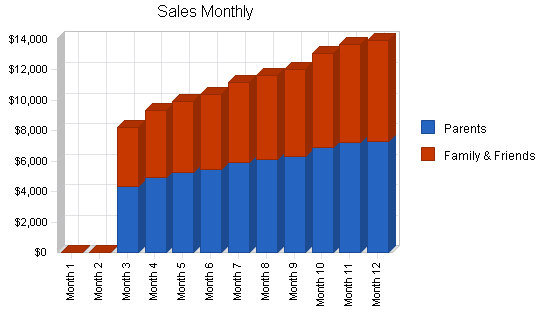

5.3.1 Sales Forecast

Malone’s Maternity has developed a sales forecast that is fairly conservative in its projections. This approach was chosen to increase the likelihood of achieving the sales goals. The following chart indicates that sales are expected to increase slowly. These forecasts will be monitored monthly to verify that the sales are rising as expected. The personnel needs, specifically for employees to help customers on the sales floor will be monitored to ensure that there are sufficient numbers of employees to serve the customers.

| Sales Forecast | |||

| Year 1 | Year 2 | Year 3 | |

| Sales | |||

| Parents | $59,671 | $149,090 | $178,998 |

| Family & Friends | $53,644 | $134,032 | $160,919 |

| Total Sales | $113,315 | $283,122 | $339,917 |

| Direct Cost of Sales | Year 1 | Year 2 | Year 3 |

| Parents | $23,868 | $59,636 | $71,599 |

| Family & Friends | $21,458 | $53,613 | $64,368 |

| Subtotal Direct Cost of Sales | $45,326 | $113,249 | $135,967 |

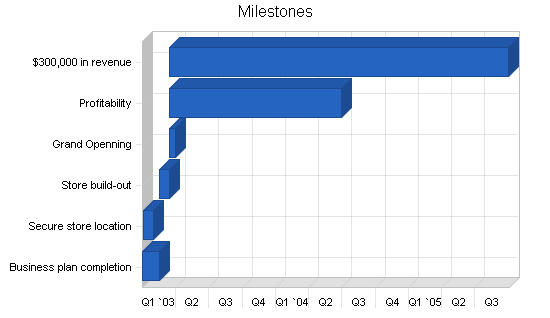

5.4 Milestones

Malone’s Maternity has identified four quantifiable milestones for the organization. By identifying four performance goals and setting the goals to be ambitious but obtainable, Malone’s Maternity will have developed a target for everyone to shoot for. The following table details the milestones.

| Milestones | |||||

| Milestone | Start Date | End Date | Budget | Manager | Department |

| Business plan completion | 1/1/2003 | 2/15/2003 | $0 | Sandy | Business formation |

| Secure store location | 1/2/2003 | 1/30/2003 | $0 | Sandy | Business formation |

| Store build-out | 2/15/2003 | 3/15/2003 | $0 | Sandy | Accounting |

| Grand Openning | 3/16/2003 | 3/31/2003 | $0 | Sandy | Accounting |

| Profitability | 3/16/2003 | 6/30/2004 | $0 | Sandy | Accounting |

| $300,000 in revenue | 3/16/2003 | 9/30/2005 | $0 | All | Sales |

| Totals | $0 | ||||

Management Summary

Sandy Malone is the leader of the organization. Sandy received her undergraduate degree in sociology from Case Western Reserve. After graduation Sandy began to work for the Saks Fifth Avenue Corporation. Initially, Sandy was on the sales floor but she quickly moved up in the organization. After four years Sandy was one of the main buyers for the chain, in charge of procurement of inventory valued at $55 million.

After three years in this position Sandy had the first of three children. What struck Sandy as being odd was how difficult is was to get nice maternity clothes and the fact that although the mother and child are intertwined, she was forced to go to two different stores when she wanted to get something for herself and for the upcoming child. This phenomenon was something that she was aware of throughout the pregnancy of all three children. While she saw a business opportunity after her first child, she was unable to act upon it since she was dedicating her time to raising the children. After the second child Sandy began taking several management courses thinking that once her children were older, she wanted to operate her own business, capitalizing on this market opportunity. By the time that the third child was two years old Sandy was seriously considering opening her own business. She recognized that it would occupy significant amount of her time initially, but that over time she would be able to build it into a thriving business.

6.1 Personnel Plan

Malone’s Maternity has identified the following people or positions that will be needed to smoothly operate the business:

- Sandy – As the owner, she will have a wide range of responsibilities including: purchasing, training and hiring, customer service, some accounting, and whatever else may come up.

- Sales staff – Malone’s Maternity will employ several sales staff to help assist customers.

- Manager – By year two Malone’s Maternity will hire a part-time manager to assist Sandy with operational responsibilities.

- Bookkeeper – This person will perform accounts payable and receivable functions.

| Personnel Plan | |||

| Year 1 | Year 2 | Year 3 | |

| Sandy | $24,000 | $20,000 | $24,000 |

| Sales staff | $14,000 | $16,800 | $16,800 |

| Sales staff | $12,600 | $16,800 | $16,800 |

| Sales staff | $9,800 | $16,800 | $16,800 |

| Bookkeeper | $8,000 | $9,600 | $9,600 |

| Manager | $0 | $14,000 | $14,000 |

| Total People | 5 | 6 | 6 |

| Total Payroll | $68,400 | $94,000 | $98,000 |

Financial Plan

The following sections outline important financial information.

7.1 Important Assumptions

The following table details important Financial Assumptions.

| General Assumptions | |||

| Year 1 | Year 2 | Year 3 | |

| Plan Month | 1 | 2 | 3 |

| Current Interest Rate | 10.00% | 10.00% | 10.00% |

| Long-term Interest Rate | 10.00% | 10.00% | 10.00% |

| Tax Rate | 30.00% | 30.00% | 30.00% |

| Other | 0 | 0 | 0 |

7.2 Projected Cash Flow

The following chart and table show the Projected Cash Flow.

| Pro Forma Cash Flow | |||

| Year 1 | Year 2 | Year 3 | |

| Cash Received | |||

| Cash from Operations | |||

| Cash Sales | $113,315 | $283,122 | $339,917 |

| Subtotal Cash from Operations | $113,315 | $283,122 | $339,917 |

| Additional Cash Received | |||

| Sales Tax, VAT, HST/GST Received | $0 | $0 | $0 |

| New Current Borrowing | $0 | $0 | $0 |

| New Other Liabilities (interest-free) | $0 | $0 | $0 |

| New Long-term Liabilities | $0 | $0 | $0 |

| Sales of Other Current Assets | $0 | $0 | $0 |

| Sales of Long-term Assets | $0 | $0 | $0 |

| New Investment Received | $0 | $0 | $0 |

| Subtotal Cash Received | $113,315 | $283,122 | $339,917 |

| Expenditures | Year 1 | Year 2 | Year 3 |

| Expenditures from Operations | |||

| Cash Spending | $68,400 | $94,000 | $98,000 |

| Bill Payments | $93,011 | $178,225 | $208,176 |

| Subtotal Spent on Operations | $161,411 | $272,225 | $306,176 |

| Additional Cash Spent | |||

| Sales Tax, VAT, HST/GST Paid Out | $0 | $0 | $0 |

| Principal Repayment of Current Borrowing | $0 | $0 | $0 |

| Other Liabilities Principal Repayment | $0 | $0 | $0 |

| Long-term Liabilities Principal Repayment | $0 | $0 | $0 |

| Purchase Other Current Assets | $0 | $0 | $0 |

| Purchase Long-term Assets | $0 | $0 | $0 |

| Dividends | $0 | $0 | $0 |

| Subtotal Cash Spent | $161,411 | $272,225 | $306,176 |

| Net Cash Flow | ($48,096) | $10,897 | $33,741 |

| Cash Balance | $3,454 | $14,350 | $48,092 |

7.3 Break-even Analysis

The Break-even Analysis indicates what will be needed in monthly revenue to achieve the break-even point.

| Break-even Analysis | |

| Monthly Revenue Break-even | $17,160 |

| Assumptions: | |

| Average Percent Variable Cost | 40% |

| Estimated Monthly Fixed Cost | $10,296 |

7.4 Projected Profit and Loss

The following table and charts illustrate the Projected Profit and Loss.

| Pro Forma Profit and Loss | |||

| Year 1 | Year 2 | Year 3 | |

| Sales | $113,315 | $283,122 | $339,917 |

| Direct Cost of Sales | $45,326 | $113,249 | $135,967 |

| Other Costs of Goods | $0 | $0 | $0 |

| Total Cost of Sales | $45,326 | $113,249 | $135,967 |

| Gross Margin | $67,989 | $169,873 | $203,950 |

| Gross Margin % | 60.00% | 60.00% | 60.00% |

| Expenses | |||

| Payroll | $68,400 | $94,000 | $98,000 |

| Sales and Marketing and Other Expenses | $4,200 | $4,400 | $4,600 |

| Depreciation | $3,792 | $3,792 | $3,792 |

| Rent | $30,000 | $30,900 | $31,827 |

| Utilities | $3,000 | $3,090 | $3,120 |

| Insurance | $2,400 | $2,400 | $2,400 |

| Payroll Taxes | $10,260 | $14,100 | $14,700 |

| Other | $1,500 | $1,500 | $1,500 |

| Total Operating Expenses | $123,552 | $154,182 | $159,939 |

| Profit Before Interest and Taxes | ($55,563) | $15,691 | $44,011 |

| EBITDA | ($51,771) | $19,483 | $47,803 |

| Interest Expense | $0 | $0 | $0 |

| Taxes Incurred | $0 | $4,707 | $13,203 |

| Net Profit | ($55,563) | $10,984 | $30,808 |

| Net Profit/Sales | -49.03% | 3.88% | 9.06% |

7.5 Projected Balance Sheet

The following table presents the Projected Balance Sheet.

| Pro Forma Balance Sheet | |||

| Year 1 | Year 2 | Year 3 | |

| Assets | |||

| Current Assets | |||

| Cash | $3,454 | $14,350 | $48,092 |

| Inventory | $6,119 | $15,288 | $18,355 |

| Other Current Assets | $3,500 | $3,500 | $3,500 |

| Total Current Assets | $13,073 | $33,138 | $69,947 |

| Long-term Assets | |||

| Long-term Assets | $19,000 | $19,000 | $19,000 |

| Accumulated Depreciation | $3,792 | $7,584 | $11,376 |

| Total Long-term Assets | $15,208 | $11,416 | $7,624 |

| Total Assets | $28,281 | $44,554 | $77,571 |

| Liabilities and Capital | Year 1 | Year 2 | Year 3 |

| Current Liabilities | |||

| Accounts Payable | $9,793 | $15,083 | $17,292 |

| Current Borrowing | $0 | $0 | $0 |

| Other Current Liabilities | $0 | $0 | $0 |

| Subtotal Current Liabilities | $9,793 | $15,083 | $17,292 |

| Long-term Liabilities | $0 | $0 | $0 |

| Total Liabilities | $9,793 | $15,083 | $17,292 |

| Paid-in Capital | $140,000 | $140,000 | $140,000 |

| Retained Earnings | ($65,950) | ($121,513) | ($110,529) |

| Earnings | ($55,563) | $10,984 | $30,808 |

| Total Capital | $18,487 | $29,471 | $60,279 |

| Total Liabilities and Capital | $28,281 | $44,554 | $77,571 |

| Net Worth | $18,487 | $29,471 | $60,279 |

7.6 Business Ratios

The following table indicates Business Ratios specific to Malone’s Maternity and to the industry. Their NAICS industry class is currently Woman’s clothing including, Maternity clothing 448120. Please note that the variance in gross margin between Malone’s Maternity and the industry as a whole can be explained by the fact that Malone’s Maternity is a high-end boutique that enjoys above industry margins.

| Ratio Analysis | ||||

| Year 1 | Year 2 | Year 3 | Industry Profile | |

| Sales Growth | 0.00% | 149.85% | 20.06% | -10.29% |

| Percent of Total Assets | ||||

| Inventory | 21.64% | 34.31% | 23.66% | 41.71% |

| Other Current Assets | 12.38% | 7.86% | 4.51% | 22.42% |

| Total Current Assets | 46.22% | 74.38% | 90.17% | 89.70% |

| Long-term Assets | 53.78% | 25.62% | 9.83% | 10.30% |

| Total Assets | 100.00% | 100.00% | 100.00% | 100.00% |

| Current Liabilities | 34.63% | 33.85% | 22.29% | 43.23% |

| Long-term Liabilities | 0.00% | 0.00% | 0.00% | 13.53% |

| Total Liabilities | 34.63% | 33.85% | 22.29% | 56.76% |

| Net Worth | 65.37% | 66.15% | 77.71% | 43.24% |

| Percent of Sales | ||||

| Sales | 100.00% | 100.00% | 100.00% | 100.00% |

| Gross Margin | 60.00% | 60.00% | 60.00% | 23.67% |

| Selling, General & Administrative Expenses | 109.03% | 56.12% | 50.94% | 14.57% |

| Advertising Expenses | 0.00% | 0.00% | 0.00% | 0.75% |

| Profit Before Interest and Taxes | -49.03% | 5.54% | 12.95% | 0.35% |

| Main Ratios | ||||

| Current | 1.33 | 2.20 | 4.05 | 1.84 |

| Quick | 0.71 | 1.18 | 2.98 | 0.72 |

| Total Debt to Total Assets | 34.63% | 33.85% | 22.29% | 1.03% |

| Pre-tax Return on Net Worth | -300.55% | 53.24% | 73.01% | 61.46% |

| Pre-tax Return on Assets | -196.47% | 35.22% | 56.74% | 2.68% |

| Additional Ratios | Year 1 | Year 2 | Year 3 | |

| Net Profit Margin | -49.03% | 3.88% | 9.06% | n.a |

| Return on Equity | -300.55% | 37.27% | 51.11% | n.a |

| Activity Ratios | ||||

| Inventory Turnover | 10.91 | 10.58 | 8.08 | n.a |

| Accounts Payable Turnover | 10.50 | 12.17 | 12.17 | n.a |

| Payment Days | 27 | 25 | 28 | n.a |

| Total Asset Turnover | 4.01 | 6.35 | 4.38 | n.a |

| Debt Ratios | ||||

| Debt to Net Worth | 0.53 | 0.51 | 0.29 | n.a |

| Current Liab. to Liab. | 1.00 | 1.00 | 1.00 | n.a |

| Liquidity Ratios | ||||

| Net Working Capital | $3,279 | $18,055 | $52,655 | n.a |

| Interest Coverage | 0.00 | 0.00 | 0.00 | n.a |

| Additional Ratios | ||||

| Assets to Sales | 0.25 | 0.16 | 0.23 | n.a |

| Current Debt/Total Assets | 35% | 34% | 22% | n.a |

| Acid Test | 0.71 | 1.18 | 2.98 | n.a |

| Sales/Net Worth | 6.13 | 9.61 | 5.64 | n.a |

| Dividend Payout | 0.00 | 0.00 | 0.00 | n.a |

Appendix

| Sales Forecast | |||||||||||||

| Month 1 | Month 2 | Month 3 | Month 4 | Month 5 | Month 6 | Month 7 | Month 8 | Month 9 | Month 10 | Month 11 | Month 12 | ||

| Sales | |||||||||||||

| Parents | 0% | $0 | $0 | $4,340 | $4,909 | $5,232 | $5,453 | $5,890 | $6,112 | $6,323 | $6,878 | $7,211 | $7,323 |

| Family & Friends | 0% | $0 | $0 | $3,902 | $4,413 | $4,704 | $4,902 | $5,295 | $5,495 | $5,684 | $6,183 | $6,483 | $6,583 |

| Total Sales | $0 | $0 | $8,242 | $9,322 | $9,936 | $10,355 | $11,185 | $11,607 | $12,007 | $13,061 | $13,694 | $13,906 | |

| Direct Cost of Sales | Month 1 | Month 2 | Month 3 | Month 4 | Month 5 | Month 6 | Month 7 | Month 8 | Month 9 | Month 10 | Month 11 | Month 12 | |

| Parents | $0 | $0 | $1,736 | $1,964 | $2,093 | $2,181 | $2,356 | $2,445 | $2,529 | $2,751 | $2,884 | $2,929 | |

| Family & Friends | $0 | $0 | $1,561 | $1,765 | $1,881 | $1,961 | $2,118 | $2,198 | $2,274 | $2,473 | $2,593 | $2,633 | |

| Subtotal Direct Cost of Sales | $0 | $0 | $3,297 | $3,729 | $3,974 | $4,142 | $4,474 | $4,643 | $4,803 | $5,225 | $5,477 | $5,563 | |

| Personnel Plan | |||||||||||||

| Month 1 | Month 2 | Month 3 | Month 4 | Month 5 | Month 6 | Month 7 | Month 8 | Month 9 | Month 10 | Month 11 | Month 12 | ||

| Sandy | 0% | $2,000 | $2,000 | $2,000 | $2,000 | $2,000 | $2,000 | $2,000 | $2,000 | $2,000 | $2,000 | $2,000 | $2,000 |

| Sales staff | 0% | $0 | $0 | $1,400 | $1,400 | $1,400 | $1,400 | $1,400 | $1,400 | $1,400 | $1,400 | $1,400 | $1,400 |

| Sales staff | 0% | $0 | $0 | $0 | $1,400 | $1,400 | $1,400 | $1,400 | $1,400 | $1,400 | $1,400 | $1,400 | $1,400 |

| Sales staff | 0% | $0 | $0 | $0 | $0 | $0 | $1,400 | $1,400 | $1,400 | $1,400 | $1,400 | $1,400 | $1,400 |

| Bookkeeper | 0% | $0 | $0 | $800 | $800 | $800 | $800 | $800 | $800 | $800 | $800 | $800 | $800 |

| Manager | 0% | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| Total People | 0 | 1 | 3 | 4 | 4 | 5 | 5 | 5 | 5 | 5 | 5 | 5 | |

| Total Payroll | $2,000 | $2,000 | $4,200 | $5,600 | $5,600 | $7,000 | $7,000 | $7,000 | $7,000 | $7,000 | $7,000 | $7,000 | |

| General Assumptions | |||||||||||||

| Month 1 | Month 2 | Month 3 | Month 4 | Month 5 | Month 6 | Month 7 | Month 8 | Month 9 | Month 10 | Month 11 | Month 12 | ||

| Plan Month | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 | 11 | 12 | |

| Current Interest Rate | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | |

| Long-term Interest Rate | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | |

| Tax Rate | 30.00% | 30.00% | 30.00% | 30.00% | 30.00% | 30.00% | 30.00% | 30.00% | 30.00% | 30.00% | 30.00% | 30.00% | |

| Other | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | |

| Pro Forma Profit and Loss | |||||||||||||

| Month 1 | Month 2 | Month 3 | Month 4 | Month 5 | Month 6 | Month 7 | Month 8 | Month 9 | Month 10 | Month 11 | Month 12 | ||

| Sales | $0 | $0 | $8,242 | $9,322 | $9,936 | $10,355 | $11,185 | $11,607 | $12,007 | $13,061 | $13,694 | $13,906 | |

| Direct Cost of Sales | $0 | $0 | $3,297 | $3,729 | $3,974 | $4,142 | $4,474 | $4,643 | $4,803 | $5,225 | $5,477 | $5,563 | |

| Other Costs of Goods | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Total Cost of Sales | $0 | $0 | $3,297 | $3,729 | $3,974 | $4,142 | $4,474 | $4,643 | $4,803 | $5,225 | $5,477 | $5,563 | |

| Gross Margin | $0 | $0 | $4,945 | $5,593 | $5,961 | $6,213 | $6,711 | $6,964 | $7,204 | $7,837 | $8,216 | $8,344 | |

| Gross Margin % | 0.00% | 0.00% | 60.00% | 60.00% | 60.00% | 60.00% | 60.00% | 60.00% | 60.00% | 60.00% | 60.00% | 60.00% | |

| Expenses | |||||||||||||

| Payroll | $2,000 | $2,000 | $4,200 | $5,600 | $5,600 | $7,000 | $7,000 | $7,000 | $7,000 | $7,000 | $7,000 | $7,000 | |

| Sales and Marketing and Other Expenses | $350 | $350 | $350 | $350 | $350 | $350 | $350 | $350 | $350 | $350 | $350 | $350 | |

| Depreciation | $316 | $316 | $316 | $316 | $316 | $316 | $316 | $316 | $316 | $316 | $316 | $316 | |

| Rent | $2,500 | $2,500 | $2,500 | $2,500 | $2,500 | $2,500 | $2,500 | $2,500 | $2,500 | $2,500 | $2,500 | $2,500 | |

| Utilities | $250 | $250 | $250 | $250 | $250 | $250 | $250 | $250 | $250 | $250 | $250 | $250 | |

| Insurance | $200 | $200 | $200 | $200 | $200 | $200 | $200 | $200 | $200 | $200 | $200 | $200 | |

| Payroll Taxes | 15% | $300 | $300 | $630 | $840 | $840 | $1,050 | $1,050 | $1,050 | $1,050 | $1,050 | $1,050 | $1,050 |

| Other | $125 | $125 | $125 | $125 | $125 | $125 | $125 | $125 | $125 | $125 | $125 | $125 | |

| Total Operating Expenses | $6,041 | $6,041 | $8,571 | $10,181 | $10,181 | $11,791 | $11,791 | $11,791 | $11,791 | $11,791 | $11,791 | $11,791 | |

| Profit Before Interest and Taxes | ($6,041) | ($6,041) | ($3,626) | ($4,588) | ($4,220) | ($5,578) | ($5,080) | ($4,827) | ($4,587) | ($3,954) | ($3,575) | ($3,447) | |

| EBITDA | ($5,725) | ($5,725) | ($3,310) | ($4,272) | ($3,904) | ($5,262) | ($4,764) | ($4,511) | ($4,271) | ($3,638) | ($3,259) | ($3,131) | |

| Interest Expense | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Taxes Incurred | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Net Profit | ($6,041) | ($6,041) | ($3,626) | ($4,588) | ($4,220) | ($5,578) | ($5,080) | ($4,827) | ($4,587) | ($3,954) | ($3,575) | ($3,447) | |

| Net Profit/Sales | 0.00% | 0.00% | -44.00% | -49.21% | -42.47% | -53.86% | -45.42% | -41.59% | -38.20% | -30.27% | -26.11% | -24.79% | |

| Pro Forma Cash Flow | |||||||||||||

| Month 1 | Month 2 | Month 3 | Month 4 | Month 5 | Month 6 | Month 7 | Month 8 | Month 9 | Month 10 | Month 11 | Month 12 | ||

| Cash Received | |||||||||||||

| Cash from Operations | |||||||||||||

| Cash Sales | $0 | $0 | $8,242 | $9,322 | $9,936 | $10,355 | $11,185 | $11,607 | $12,007 | $13,061 | $13,694 | $13,906 | |

| Subtotal Cash from Operations | $0 | $0 | $8,242 | $9,322 | $9,936 | $10,355 | $11,185 | $11,607 | $12,007 | $13,061 | $13,694 | $13,906 | |

| Additional Cash Received | |||||||||||||

| Sales Tax, VAT, HST/GST Received | 0.00% | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| New Current Borrowing | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| New Other Liabilities (interest-free) | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| New Long-term Liabilities | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Sales of Other Current Assets | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Sales of Long-term Assets | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| New Investment Received | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Subtotal Cash Received | $0 | $0 | $8,242 | $9,322 | $9,936 | $10,355 | $11,185 | $11,607 | $12,007 | $13,061 | $13,694 | $13,906 | |

| Expenditures | Month 1 | Month 2 | Month 3 | Month 4 | Month 5 | Month 6 | Month 7 | Month 8 | Month 9 | Month 10 | Month 11 | Month 12 | |

| Expenditures from Operations | |||||||||||||

| Cash Spending | $2,000 | $2,000 | $4,200 | $5,600 | $5,600 | $7,000 | $7,000 | $7,000 | $7,000 | $7,000 | $7,000 | $7,000 | |

| Bill Payments | $124 | $3,725 | $3,967 | $10,894 | $8,471 | $8,519 | $8,819 | $9,314 | $9,308 | $9,478 | $10,166 | $10,227 | |

| Subtotal Spent on Operations | $2,124 | $5,725 | $8,167 | $16,494 | $14,071 | $15,519 | $15,819 | $16,314 | $16,308 | $16,478 | $17,166 | $17,227 | |

| Additional Cash Spent | |||||||||||||

| Sales Tax, VAT, HST/GST Paid Out | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Principal Repayment of Current Borrowing | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Other Liabilities Principal Repayment | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Long-term Liabilities Principal Repayment | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Purchase Other Current Assets | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Purchase Long-term Assets | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Dividends | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Subtotal Cash Spent | $2,124 | $5,725 | $8,167 | $16,494 | $14,071 | $15,519 | $15,819 | $16,314 | $16,308 | $16,478 | $17,166 | $17,227 | |

| Net Cash Flow | ($2,124) | ($5,725) | $75 | ($7,172) | ($4,135) | ($5,164) | ($4,634) | ($4,707) | ($4,301) | ($3,417) | ($3,472) | ($3,321) | |

| Cash Balance | $49,426 | $43,701 | $43,776 | $36,604 | $32,468 | $27,305 | $22,671 | $17,964 | $13,663 | $10,247 | $6,775 | $3,454 | |

| Pro Forma Balance Sheet | |||||||||||||

| Month 1 | Month 2 | Month 3 | Month 4 | Month 5 | Month 6 | Month 7 | Month 8 | Month 9 | Month 10 | Month 11 | Month 12 | ||

| Assets | Starting Balances | ||||||||||||

| Current Assets | |||||||||||||

| Cash | $51,550 | $49,426 | $43,701 | $43,776 | $36,604 | $32,468 | $27,305 | $22,671 | $17,964 | $13,663 | $10,247 | $6,775 | $3,454 |

| Inventory | $0 | $0 | $0 | $3,626 | $4,102 | $4,372 | $4,556 | $4,921 | $5,107 | $5,283 | $5,747 | $6,025 | $6,119 |

| Other Current Assets | $3,500 | $3,500 | $3,500 | $3,500 | $3,500 | $3,500 | $3,500 | $3,500 | $3,500 | $3,500 | $3,500 | $3,500 | $3,500 |

| Total Current Assets | $55,050 | $52,926 | $47,201 | $50,902 | $44,205 | $40,340 | $35,361 | $31,093 | $26,571 | $22,446 | $19,494 | $16,300 | $13,073 |

| Long-term Assets | |||||||||||||

| Long-term Assets | $19,000 | $19,000 | $19,000 | $19,000 | $19,000 | $19,000 | $19,000 | $19,000 | $19,000 | $19,000 | $19,000 | $19,000 | $19,000 |

| Accumulated Depreciation | $0 | $316 | $632 | $948 | $1,264 | $1,580 | $1,896 | $2,212 | $2,528 | $2,844 | $3,160 | $3,476 | $3,792 |

| Total Long-term Assets | $19,000 | $18,684 | $18,368 | $18,052 | $17,736 | $17,420 | $17,104 | $16,788 | $16,472 | $16,156 | $15,840 | $15,524 | $15,208 |

| Total Assets | $74,050 | $71,610 | $65,569 | $68,954 | $61,941 | $57,760 | $52,465 | $47,881 | $43,043 | $38,602 | $35,334 | $31,824 | $28,281 |

| Liabilities and Capital | Month 1 | Month 2 | Month 3 | Month 4 | Month 5 | Month 6 | Month 7 | Month 8 | Month 9 | Month 10 | Month 11 | Month 12 | |

| Current Liabilities | |||||||||||||

| Accounts Payable | $0 | $3,601 | $3,601 | $10,612 | $8,187 | $8,225 | $8,508 | $9,004 | $8,993 | $9,139 | $9,824 | $9,890 | $9,793 |

| Current Borrowing | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| Other Current Liabilities | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| Subtotal Current Liabilities | $0 | $3,601 | $3,601 | $10,612 | $8,187 | $8,225 | $8,508 | $9,004 | $8,993 | $9,139 | $9,824 | $9,890 | $9,793 |

| Long-term Liabilities | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| Total Liabilities | $0 | $3,601 | $3,601 | $10,612 | $8,187 | $8,225 | $8,508 | $9,004 | $8,993 | $9,139 | $9,824 | $9,890 | $9,793 |

| Paid-in Capital | $140,000 | $140,000 | $140,000 | $140,000 | $140,000 | $140,000 | $140,000 | $140,000 | $140,000 | $140,000 | $140,000 | $140,000 | $140,000 |

| Retained Earnings | ($65,950) | ($65,950) | ($65,950) | ($65,950) | ($65,950) | ($65,950) | ($65,950) | ($65,950) | ($65,950) | ($65,950) | ($65,950) | ($65,950) | ($65,950) |

| Earnings | $0 | ($6,041) | ($12,082) | ($15,708) | ($20,296) | ($24,515) | ($30,093) | ($35,173) | ($40,000) | ($44,587) | ($48,541) | ($52,116) | ($55,563) |

| Total Capital | $74,050 | $68,009 | $61,968 | $58,342 | $53,754 | $49,535 | $43,957 | $38,877 | $34,050 | $29,463 | $25,509 | $21,934 | $18,487 |

| Total Liabilities and Capital | $74,050 | $71,610 | $65,569 | $68,954 | $61,941 | $57,760 | $52,465 | $47,881 | $43,043 | $38,602 | $35,334 | $31,824 | $28,281 |

| Net Worth | $74,050 | $68,009 | $61,968 | $58,342 | $53,754 | $49,535 | $43,957 | $38,877 | $34,050 | $29,463 | $25,509 | $21,934 | $18,487 |