QuickReturns

Executive Summary

The handling of e-returns is one of the most serious problems currently facing e-tailers and catalog merchants. E-returns not only are expensive, time consuming, and labor intensive for retailers to process, but the potential hassles to consumers impair sales and slow customer growth. As a result, pure-play e-tailers and catalog merchants are at a significant disadvantage to brick-and-mortar and click-and-mortar retailers that allow customers to return purchases made online to their physical store locations. QuickReturns fills the role of an outsourced solution provider, as it is the first company to provide consumers with a no-hassle and cost-free method to return and exchange merchandise ordered from virtual stores, while saving retailers money on returns handling.

QuickReturns will provide its retailer partners with physical points of presence at which their customers can return unwanted or defective merchandise. To minimize capital expenditures, operating costs, and scalability time, QuickReturns will utilize a distribution partner model. Retailer partners will pay annual membership fees and transaction-based return and exchange fees. The latter two fees will be shared with the QuickReturns distribution partners.

By partnering with QuickReturns, retailers will benefit from reduced return handling costs, increased sales, and improved customer service. Distribution centers will benefit by adding a low-cost revenue stream that will also drive desired, but otherwise inaccessible, customers into their stores. Finally, consumers will enjoy saving time and efforts with the product return process and instant refunds.

QuickReturns was founded by four individuals, each of whom has had many years in management consulting. At the moment, the company seeks major seed financing. Additional rounds of financing will be required to fund future marketing activities and technological development.

1.1 Mission

QuickReturns offers its clients, electronic retailers, and catalog merchants, a possibility to reduce costs associated with reverse logistics and thus increase customer service and enhance customer loyalty. By providing ‘no-hassle’ product return or exchange facilities it will help consumers become more comfortable with the Internet and catalog shopping. Customer service and profitable growth are two major cornerstones of QuickReturns.

1.2 Keys to Success

While there are risks associated with all new businesses, QuickReturns has identified three particular issues, unique to its model, that will improve the company’s chances of success:

- Successful technology development.

This will require the work of a dedicated team over several months. The software application will need to be simple and user-friendly for the end user, but robust enough to integrate easily into retailers’ disparate database systems. It is estimated that a working application prototype can be built and tested in 4-6 months. If development takes longer than six months, it will delay the roll out of the QuickReturns service. Any delays will give competitors time to become established and reduce any first mover or near-first-mover advantage QuickReturns will have. The company will also need to control the amount of time it takes to integrate into the retailer partners’ databases. The application will be designed to be as “plug and play” as possible, but integration will still need to be customized for each retailer partner. - Striking favorable agreements with proper distribution partners.

While financial analyses and projections indicate that QuickReturns would be a very profitable ancillary business to distribution partners, their management may decide to design their own e-returns program, partner with another business similar to QuickReturns, or not enter the space at all. It is not likely that distribution partners will try to build an e-returns program like that of QuickReturns without partnering because of the difficulties involved in designing, maintaining, and integrating the requisite technology. With few exceptions, the potential distribution partners identified by QuickReturns have chosen to partner with other companies to execute technology initiatives which are outside of (but synergistic to) their core businesses. In addition, there are no known companies currently offering this service to potential distribution partners. - Capturing market share.

Formidable competitors are entering the e-returns space, including well-capitalized companies such as UPS and Mailboxes, Etc. While no company has established itself as the dominant e-returns player as of yet, QuickReturns should get to market in time and capture the market share it predicts. This will strongly depend on the execution of the QuickReturns’ management team as well as on the attention and resources its competitors devote to their e-returns programs.

Company Summary

QuickReturns is a start-up company that plans to capitalize on the growing market of product returns to the pure Internet based retailers and traditional catalog merchants. This market segment has been overlooked by industry players and QuickReturns’ management has reason to believe the company will be able to rapidly capture market share. At this point, the company seeks major seed funding to facilitate initial technology development and marketing activities.

2.1 Company Ownership

QuickReturns, Inc. was incorporated in the state of California. The company’s senior management owns 100% of the company. The majority of shares belongs to [name omitted]. The other three investors [names omitted] are minority shareholders.

2.2 Start-up Summary

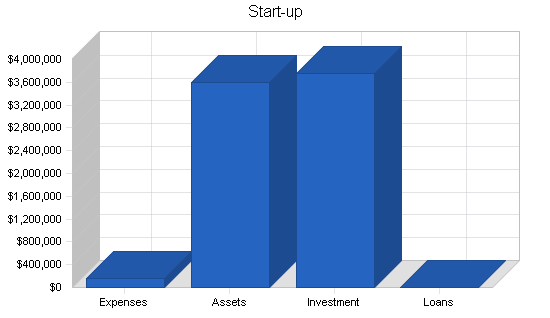

Senior management has invested heavily, which covers the start-up expenses, with the remaining amount contributed towards the cash requirements. At this stage, the company seeks seed financing to begin technology development, pay salaries, and cover professional services fees. As the technology development nears completion, another round of financing will be sought to fund business development and marketing activities.

| Start-up | |

| Requirements | |

| Start-up Expenses | |

| Legal | $5,000 |

| Stationery, etc. | $3,000 |

| Brochures | $10,000 |

| Consultants | $50,000 |

| Insurance | $10,000 |

| Rent | $2,900 |

| Research and Development | $20,000 |

| Expensed Equipment | $30,000 |

| Other | $19,100 |

| Total Start-up Expenses | $150,000 |

| Start-up Assets | |

| Cash Required | $3,550,000 |

| Other Current Assets | $50,000 |

| Long-term Assets | $0 |

| Total Assets | $3,600,000 |

| Total Requirements | $3,750,000 |

| Start-up Funding | |

| Start-up Expenses to Fund | $150,000 |

| Start-up Assets to Fund | $3,600,000 |

| Total Funding Required | $3,750,000 |

| Assets | |

| Non-cash Assets from Start-up | $50,000 |

| Cash Requirements from Start-up | $3,550,000 |

| Additional Cash Raised | $0 |

| Cash Balance on Starting Date | $3,550,000 |

| Total Assets | $3,600,000 |

| Liabilities and Capital | |

| Liabilities | |

| Current Borrowing | $0 |

| Long-term Liabilities | $0 |

| Accounts Payable (Outstanding Bills) | $0 |

| Other Current Liabilities (interest-free) | $0 |

| Total Liabilities | $0 |

| Capital | |

| Planned Investment | |

| Senior Managers | $750,000 |

| Seed Investment | $3,000,000 |

| Additional Investment Requirement | $0 |

| Total Planned Investment | $3,750,000 |

| Loss at Start-up (Start-up Expenses) | ($150,000) |

| Total Capital | $3,600,000 |

| Total Capital and Liabilities | $3,600,000 |

| Total Funding | $3,750,000 |

2.3 Company Locations and Facilities

QuickReturns locations will be located in the pack & ship areas of distribution partner stores. Each location will be equipped with two terminals:

- Returns processing terminal (RPT), for use by the QuickReturns agent, and

- QuickExchange terminal, for use by the customer.

The RPT will contain proprietary software and privileged network access to the retailer partners’ databases. Customer order information, product inspection criteria, Return Merchandise Authorization (RMA) numbers, and shipping addresses will be retrieved through this terminal, allowing the QuickReturns agents to inspect and authorize each return on behalf of the retailer partners. The process will be guided by proprietary software designed to maximize return processing speed and minimize the amount of discretion required by QuickReturns agents. At no charge to distribution partners, QuickReturns will equip each location with the computers, printers and collateral materials necessary for operation.

QuickReturns will provide the following equipment at each location.

- Network PC and monitor (RPT)

- Network PC and monitor (QuickExchange)

- Inkjet printer

- Surge-protected power strip

- Dedicated phone line

- Signage and collateral materials

- Employee manuals

Services

QuickReturns will provide its retailer partners with physical points of presence at which their customers can return unwanted or defective merchandise. To minimize capital expenditures, operating costs, and scalability time, QuickReturns will utilize a distribution partner model. Its centers will be located inside of stores owned by its distribution partners (e.g., Kinko’s, Staples, Pak Mail) and will utilize their employees as QuickReturns agents. Agents will use stand-alone terminals linked directly into the back-end systems of QuickReturns affiliated retailers to electronically obtain return authorization, inspect and approve merchandise for return, arrange for shipping back to the merchant or manufacturer, and initiate instant refunds to customer credit cards–-all at no charge to consumers. For those customers wishing instead to exchange merchandise they’ve returned, dedicated “QuickExchange” terminals will provide access to each retailer partner’s website, where customers can make new purchases using credits received for their returns.

Retailer partners will pay an annual fee as well as a per-transaction processing fee that is based on the number of return criteria that must be met before the QuickReturns agent approves the return. It is projected that retailers will require more conditions be met for returns of expensive merchandise; thus, the returns processing fees will loosely correlate with the price of the returned merchandise. Finally, retailers will pay a standard 10% commission on new purchases made through QuickExchange terminals.

Retailer partners will benefit by retaining existing customers, 80% of whom claim to increase spending at sites where they receive positive customer care, and by driving new sales from the large segment of consumers that now avoids buying online because of potential return hassles. Moreover, QuickReturns can help retailer partners reduce supply chain costs by as much as 61%, by eliminating call centers, multiple shipping destinations and extraneous processing.

Distribution partners will benefit in three ways. First, they will receive 50% of return processing fees and product exchange commissions. Second, they will retain 100% of revenues resulting from customer purchases of packaging materials and services. Estimated profit margins for distribution partners are projected to be 62% from average per-transaction revenues of $8.32. Finally, QuickReturns will act as a targeted marketing channel, driving an attractive demographic-–wired consumers-–into their stores.

Consumers will benefit from the availability of a fast and convenient return channel that does not require calling ahead or being confined to a single location to coordinate pick-ups that could occur any time during the day. Moreover, consumers will pay no shipping charges when returning merchandise and will enjoy the peace of mind brought from instant refunds. QuickReturns will aggressively develop its brand into a customer service seal of approval that consumers will consider when selecting among retailers.

3.1 Competitive Comparison

A number of companies are beginning to focus on providing returns solutions to e-tailers, but none offers a business model as compelling to consumers or as cost-effective to retailers as the QuickReturns model. Start-ups such as The Return Exchange have built regional warehouses to help e-tailers with reverse logistics management, but such models are not convenient for consumers and add unnecessary steps to the reverse logistics supply chain.

Parcel delivery carriers such as FedEx, UPS, and USPS are developing programs directed at returns. However, their focus remains on the first step of the returns supply chain, pickup requests by customers. This limits the channels through which consumers can return goods, and provides little added value to consumers or retailers.

The most significant brick-and-mortar competitor is Mailboxes, Etc., with its existing 3,300 U.S. locations. Mailboxes, Etc. has announced intentions to pursue online returns, but its strategy lacks many of the compelling features of QuickReturns. Moreover, the company has had trouble with execution, due in part to the difficulty of coordinating independent franchisees and in part by repeated corporate restructuring of its parent company, U.S. Office Products. Launch of the Mailboxes, Etc. returns program is currently six months behind schedule, and a new roll-out date has not yet been determined.

3.2 Service Description

Return procedure

When the customer decides to make a return, he or she will take the product and receipt to a QuickReturns location. The QuickReturns agent will select the retailer from which the product was purchased. The agent will then look up the customer’s order number from his or her receipt or packing slip and enter it into the RPT. The RPT will automatically download the order data from the retailer and display the products purchased in that order. Finally, the clerk will select which product is to be returned, triggering the RPT to display product-specific inspection criteria prepared by the retailer. Each criterion must be met in order for the return to be approved.

Criteria will include rules (e.g., the return is made within 30 days of purchase, the original package is unopened) and attributes that must be considered when inspecting the product (e.g., list of sub-components that should be present, whether merchandise is damaged). Criteria will be set forth by each retailer partner and can be customized by product type (e.g., all DVD players) or by product model (e.g., Sony DVD player model #DVP-S7700). For the convenience of retailer partners, QuickReturns will provide a database of default criteria that may be used in lieu of original criteria from the retailer. QuickReturns personnel will use information gathered from manufacturers to develop the default criteria database, which will then be offered to retailer partners free of charge. Default criteria will be developed first for those product categories that are best suited for QuickReturns, followed by categories that will be allowed by, but not ideally suited for, QuickReturns.

Retailers will have the option of providing digital photographs of products to aid clerks in their inspection. Product photographs will be particularly important for complex merchandise with which clerks may not be intimately familiar (e.g., consumer electronics, computer hardware, etc.).

If a product does not meet all criteria, on-screen instructions will direct the QuickReturns agent to refuse the return, and the RPT will automatically generate a pre-formatted letter written by the retailer partner describing why the product cannot be accepted for return and inviting the customer to use an onsite telephone to call the retailer’s customer service line if he or she wishes to further discuss the matter. This is important for two reasons:

- It will deflect anger over the failed return from the QuickReturns brand and agent to the retailer.

- The clerk will likely not have enough information about the retailer’s return policy or the product being returned to decide whether to override the standard criteria. Only the retailer’s customer service department will be authorized to override a return decision.

If all criteria are met, the software will instruct the agent to approve the return and automatically download the RMA number from the retailer. The software will then automatically generate and print a shipping label. The address on the label will be based on the product being returned as well as the reason for its return. For example, a retailer partner may choose to direct unopened items back to itself, damaged items back to the manufacturer, and opened but unsalable items to a liquidator. The shipping label will include the product’s RMA number (to facilitate tracking by the retailer and its agents), the retailer’s shipping account number (to facilitate direct billing by a shipping carrier, such as UPS), and other product description and tracking information specified by the retailer. Finally, the QuickReturns agent will affix the specially-printed QuickReturns label to the package, which will be ready for pickup by the shipping carrier.

Through QuickReturns, retailers can offer customers three ways to be credited for a return:

- Credit card refund,

- Retailer credit, or

- Product exchange.

If the customer chooses credit card refund, a command will be sent from the RPT to the retailer to initiate an immediate refund to the customer’s credit card account. If the customer selects retailer credit, he or she will receive a printed “gift certificate” coded for the value of the return which can be used on the next purchase. If the customer selects product exchange, the customer will be directed to the self-service QuickExchange terminal (see below for discussion of product exchange process).

A return processing fee will be charged to the retailer after each return. The processing fee will average $5.00, and will be charged regardless of whether or not the return was approved. Distribution partners will receive 50% of the return processing fee and QuickReturns will retain the remainder. Retailer partners will be electronically debited every 30 days to pay for QuickReturns services. Distribution partners will be paid their share immediately upon collection of payments from the retailer partners.

Packing and shipping

Consumers who did not save their original packing materials (e.g., box, bubble wrap) will be given the opportunity to purchase materials and packing services directly from the distribution partners. This will be a separate transaction, independent of QuickReturns or the services it offers. For customers who bring the returned merchandise to QuickReturns locations with the original packing materials, packing tape will be provided to seal the package after inspection.

A shipping carrier (e.g., UPS, FedEx) will pick up packages at QuickReturns locations throughout each business day. Ground service will be used unless expedited is specified by the retailer partner for a given item. Retailer partners will be expected to pay for shipping charges and be billed directly by the shipping carrier using the retailer’s account number printed on the return label. It is anticipated that QuickReturns will reduce the cost of returns handling sufficiently that retailers will be able to absorb shipping costs and still save money in comparison to the cost of handling a return without QuickReturns.

Upon receiving the return, QuickReturns retailer partners or their designated agents will merely need to scan the label on the box to notify their computers that the merchandise has been received. Customer refunds will have already been processed, and the inventory management system updated. It is estimated that QuickReturns can save retailers up to 61% on returns processing costs through its optimized handling procedure.

Product exchange procedure

QuickExchange terminals will be available at all QuickReturns locations. The terminals will run a modified Internet browser that allows access only to QuickReturns retailer partner websites. Customers wishing to exchange products will be given a printed exchange code that can be entered into the section of the retailer’s website that asks for gift certificates or coupons (instructions for using the exchange code will be clearly printed on the sheet, along with the code itself). The exchange code will activate a store credit in the amount of the returned merchandise, allowing customers to apply the credit against the cost of the new purchases. Product purchases made through the QuickExchange terminal will generate a commission from the retailer for 10% of the purchase price. Distribution partners will receive 50% of commission revenue and QuickReturns will retain the remainder.

It is projected that 20% of people returning products will prefer a product exchange rather than a refund, particularly if they received the product as a gift and cannot receive the refund on their own credit card. The QuickExchange terminal will make this easy and convenient, and will provide retailer partners with the opportunity to recoup what would otherwise have been lost sales.

3.3 Future Services

QuickReturns will maintain rapid growth by quickly expanding beyond its core business model into new markets and services. The following are services QuickReturns intends to offer after the core service is rolled out across domestic markets.

International expansion

While the U.S. leads countries in Internet usage and e-commerce, other countries are rapidly catching up. Western Europe and Japan in particular are experiencing dramatic e-commerce growth. E-commerce revenues in Western Europe are expected to grow from $8.9 billion this year to $64 billion by 2003, while Japan’s is expected to grow from $11 billion to $45 billion. QuickReturns intends to apply its business model to overseas markets soon after its U.S. roll out.

Delivery destination and holding

Many consumers have been reluctant to order products online because they cannot be present to receive deliveries. The inconvenience and delays caused by missed deliveries is a frustrating problem, especially for working households. Customers will be allowed to have deliveries sent to any QuickReturns location, where they can be held for customers. Customers will be charged a nominal fee for this service. In addition, the service will increase brand awareness and drive traffic to distribution partner locations.

Sale of returns data

QuickReturns will collect and aggregate detailed data from thousands of returns transactions. Over time, a sizeable database of returns transactions will be generated, which will be used to generate individually tailored reports for sale to manufacturers, market research groups, and retailers. Detailed data analyses will highlight trends among consumers, products, and industries that can be used to make forecasting and other business decisions. For example, a manufacturer could learn which of its products are returned most often and why. That information could then be used to modify the product specifications in order to lower its return rate and increase profitability.

Product liquidation

Some products, such as music CDs, cost retailers more money to take back and return to inventory than to buy anew. Other products may be functional but unsalable because they have been opened. U.S. retailers now lose $35 billion each year by destroying or discarding returned merchandise. Product liquidation or auction services allow retailers to salvage some value from returned products, cutting costs and increasing profits. One of the first ancillary services QuickReturns will offer to its retailer partners is the ability to liquidate products that are not profitable to resell.

QuickReturns will offer to send returned products to a central recovery center, operated by a third party, where they can be sorted for parts, reconditioned, or auctioned to the public. QuickReturns also will form partnerships with returned merchandise auction sites (e.g., ClickReturns, The Return Exchange) to extract maximum possible value for opened or damaged products on behalf of retailer partners. QuickReturns will earn revenue in the form of commissions from its liquidator and auction partners.

Home/office pickup service

Multiple distribution channels will allow QuickReturns to meet the needs of different consumers. Some customers prefer to have their returns picked up at their homes or offices. To meet this demand, QuickReturns plans to partner with same-day fulfillment companies. These companies currently realize poor capital utilization because their vehicles leave warehouses with full loads but come back empty. By picking up returns along their delivery route, they will increase revenue with little marginal cost.

Same-day fulfillment services are in the process of rolling out across the U.S. cities. Sameday.com, Kozmo.com, WebVan, Peapod, and Streamline all have set up operations in major cities to deliver goods at specified times. Kozmo, for instance, promises to deliver music, videos, books, and convenience items in under one hour. It already has rolled out operations in eight cities and plans to be in 22 more by the end of the year. Moreover, it recently began delivering products for Amazon.com, in an attempt to squeeze additional profit from their growing distribution network. A partnership with QuickReturns would be a logical next step for same-day fulfillment services, given their strategy of leveraging their fixed infrastructure.

QuickReturns will outfit delivery partners with wireless devices, allowing their drivers to remotely process returns, including inspection and refund authorization. The merchandise will then be brought to a central location where it can be packed and shipped to the address specified by the retailer partner. Customers will pay an additional fee for home pickups. Also, centralization of packing and shipping operations will allow returns going to the same destination to be bundled and shipped in bulk, lowering shipping costs to retailers.

Returned product storage

Under pressure to lower working capital and inventory levels, many forward-looking retailers are exploring ways to carry minimal or no inventory, a model exemplified by Cisco Systems in the business-to-business arena. Retailers utilizing this model sell products to customers, but order the products’ manufacturers to ship them directly to consumers. Business 2.0 magazine recently predicted that, “in the future, manufacturers will manage the electronic shelves or aisles that display their wares on hundreds or thousands of retailers’ websites … some retailers might want the manufacturer to handle fulfillment.”

One difficulty with this model arises with returns handling. Manufacturers are not equipped to receive individual product returns, and the retailers will be unprepared to store them. QuickReturns, through partnerships with reverse logistics companies (e.g., UPS Worldwide Logistics, Genco) or through company owned warehouses, will solve this problem by inspecting, storing and refurbishing returned products for retailers until the products are resold. Once the retailer resells the products, warehouse personnel will ship them directly to the new customers. By offering a storage service, QuickReturns will offer its retailer partners a more complete reverse logistics solution.

Dynamic product recommendations

A significant advantage that brick-and-mortar retailers have over e-tailers and catalog merchants is their ability to convert returns into exchanges. Sales clerks often recommend different products to customers making returns, enabling the store to recoup what otherwise would have been a lost sale. Although QuickExchange terminals will address this opportunity, exchanges will be dependent on the ability of customers to find substitute goods without assistance. To offer customers more support with the exchange process, QuickReturns plans to leverage the personalization and recommendation engines that many e-tailers use on their sites. QuickReturns will have the ability to download product recommendations tailored to individual customers. In this way, customers will be proactively directed to purchase products using the QuickExchange terminal.

Point of sale opportunities

QuickReturns will offer retailers the chance to provide promotional or informational materials to customers making returns. For example, e-tailers wishing to provide selected customers with coupons or special offers could have them printed directly onto the return receipts given to customers after each transaction. A supplemental fee will be charged for this service.

Distribution partnerships with fulfillment and customer service providers

QuickReturns will seek partnerships with business service firms that would benefit by adding returns handling to their service offerings. Customer service providers (e.g., PeopleSupport) currently do not offer returns handling as an option to their customers. Returns handling is a crucial customer service component, making a partnership with QuickReturns a natural fit. Similarly, logistics suppliers (e.g., Fingerhut) allow retailers to outsource elements of their supply chain. Many logistics providers do not currently offer reverse logistics services; QuickReturns fills in that void, allowing them to provide turnkey solutions to their customers.

Technology partnerships with software companies

Many e-tailers and catalog vendors purchase off-the-shelf software solutions rather than build their own. QuickReturns will seek partnerships with companies such as Bea Systems, OpenMarket, and Marimba that sell stand-alone commerce packages. If “hooks” for the QuickReturns system are built into future versions of software applications subsequent to integration, it will be extremely fast and inexpensive. In return, QuickReturns would offer such software companies a share of revenues from new retailer partners that use their applications.

3.4 Technology

Using off-the-shelf solutions wherever possible, QuickReturns plans to outsource development of a robust software application that integrates QuickReturns’ terminals into the inventory, payment processing, and customer database systems of retailer partners. This application will be hosted on a middleware server, which will be linked, through a web-based interface, to network PCs at each QuickReturns location. The end-user interface on the network PCs will be designed to be intuitive, user-friendly, and simple. The business logic, inspection criteria, and shipping address information will be housed on a central QuickReturns server, while the customer order records will continue to be housed on the retailer partners’ own systems.

Market Analysis Summary

QuickReturns will target Web-based retailers (“e-tailers”), paper-based catalog vendors, and click-and-mortar retailers in the business-to-consumer space. Through the late 1990s, the e-tailer segment experienced spectacular growth that is expected to continue over the next five years as new users come onto the Internet and existing users increase their frequency of online shopping. In 1999, 39 million U.S. consumers averaged 13 purchases on the Internet, spending a total of $20.3 billion. Of that, 57.4% was from purchases of small or medium sized products, QuickReturns’ target market.

4.1 Market Segmentation

The customer segments QuickReturns targets–catalog merchants, e-tailers, and click-and-mortar stores–are expected to produce 170 million returns this year and 370 million by 2003. These projections are considered conservative, as the rate of e-returns is projected to reach parity with return rates of brick & mortar stores, which currently are twice as high.

E-tailers

Assuming a $42 average product price and an average of 2.5 products per order, 480 million products were ordered online in 1999, representing a 400% increase from a year earlier. The rapid pace of online sales growth is expected to continue as 2003 e-commerce revenues top $144 billion from 3.5 billion online purchases.

Catalog merchants

QuickReturns will also aggressively target consumer catalog merchants, a sector whose 1999 sales was nearly three times as great as those of B2C e-commerce. From the returns standpoint, catalog merchants represent an attractive market since many have return rates higher than those of e-tailers. For instance, BMG Direct, a direct marketer of pre-recorded music, processes 40,000 returns daily, requiring a staff of 140 people to inspect products and credit customers’ accounts. Largely due to the adoption of Internet sales, the mail-order catalog industry is projected to grow only moderately in coming years, but will continue to represent a sizeable distribution channel.

Click-and-mortar stores

Virtual retailers face a growing competitive threat from brick-and-mortar retailers, which are increasingly pursuing online (click-and-mortar) strategies. Such retailers can use their physical infrastructure as a returns channel for goods purchased online, giving them leverage over pure-play e-tailers. But with the growth of their catalog and website businesses, many traditional brick-and-mortar retailers will face a similar returns problem as their virtual counterparts: not all of their Internet and catalog customers will have access to physical locations to return merchandise. Companies such as J. Crew and Nordstrom have relatively few store locations, leaving the majority of their Web and catalog customers without a place to return goods. Such click-and-mortar retailers therefore would benefit from partnerships with QuickReturns.

The chart and table below summarize the total market potential for e-returns market in the U.S.

| Market Analysis | |||||||

| Year 1 | Year 2 | Year 3 | Year 4 | Year 5 | |||

| Potential Customers | Growth | CAGR | |||||

| E-tailers | 50% | 30 | 45 | 68 | 102 | 153 | 50.28% |

| Catalog merchants | 20% | 120 | 144 | 173 | 208 | 250 | 20.14% |

| Click-and-mortar merchants | 40% | 20 | 28 | 39 | 55 | 77 | 40.08% |

| Total | 29.63% | 170 | 217 | 280 | 365 | 480 | 29.63% |

4.2 Target Market Segment Strategy

Recent surveys reveal that 89% of consumers say return policies influence their decision to shop online, and 67% consider potential return hassles to be a barrier to online shopping. As a result, pure-play e-tailers and catalog merchants are at a significant disadvantage to brick-and-mortar and click-and-mortar retailers that allow customers to return purchases made online to their physical store locations. Moreover, 30% of e-tailers have identified returns handling as their biggest logistical challenge going forward, demonstrating a substantial need for an outsourced solution provider.

Return rates in QuickReturns’ target markets described above are projected to increase until they reach parity with brick-and-mortar return rates, due to the following three factors:

- Many shoppers refuse to use the Internet to shop–-especially when purchasing gifts-–because of the difficulty and expense involved with returning merchandise. Such shoppers will be more likely to shop online if a convenient and cost-effective way to return becomes available.

- Online shoppers currently avoid goods, such as clothing, which are more likely to be returned. If an easier returns method becomes available, shoppers will be more likely to purchase such products, thereby driving up the average e-return rate.

- Women tend to return more merchandise than men. Currently, women represent only 39% of the U.S. online shopper population, but this is quickly changing. In 2000, for the first time, more women will use the Internet than men.

QuickReturns has excluded large products (e.g., furniture, bicycles, tires) from the market estimate because they will not be accepted at QuickReturns locations; they take up an unacceptable amount of floor space, are difficult to handle, and are generally aesthetically displeasing in a store environment. Instead, QuickReturns will target retailers selling common products with higher-than-average return rates. These retailers are particularly disadvantaged now because consumers are reluctant to buy products with high return rates since returns are so difficult to carry out. The categories that are best suited to QuickReturns are clothing, shoes, and toys because their value is highly subjective, they are vulnerable to changing tastes, and they are often purchased as gifts for others (who may value them differently). Moreover, such products are easy for QuickReturns clerks to inspect because problems with the merchandise are more easily identifiable and the clerks are more likely to be familiar with the products. Within the group of retailers selling these product types, QuickReturns will pursue those most focused on customer service and satisfaction.

A second segment of desirable retailers includes those selling specialty gifts, consumer electronics, books, music, videos, computer hardware and software, sporting goods, and health and beauty supplies. Although their return rates are not quite as high, these categories comprise 37.6% of e-commerce revenues, and thus generate a large number of returns.

Initially, QuickReturns will approach mid-size retailers that can act as beta test partners. These partners will work closely with QuickReturns for a limited time to optimize operational processes, technology integration, and reporting requirements. In return, QuickReturns will provide its services free of charge for one year from integration.

After the QuickReturns model has been proven by beta test partners, larger catalog merchants (e.g., Lands’ End, L.L. Bean) will be more likely to sign up for the QuickReturns service. At this time, QuickReturns will aggressively market its services to the market leaders of each product category.

Finally, QuickReturns will seek partnerships with shopping marketplaces such as Yahoo! Shops, Shopnow.com, Z-Shops, and Shopping.com. These sites provide Web hosting, commerce tools, and product search functionality for micro e-tailers, aggregating thousands of online shops into one entity. Partnerships between QuickReturns and aggregators will bring the benefits of QuickReturns partnership to more specialized retailers, who otherwise would be too small for QuickReturns to serve. Aggregators will enable thousands of individual merchants to gain access to QuickReturns with a single system integration, saving time and money. QuickReturns’ ability to tailor shipping destinations to individual product SKUs will assure that products will be returned to the right merchant. For billing purposes, all processing fees will be paid directly by the shopping aggregators, who will pass along the charges to the appropriate micro e-tailers.

4.2.1 Market Needs

Market needs of e-tailers and catalog merchants are very similar in regards to the reverse logistics associated with product returns. Surveys have shown that 89% of consumers say return policies influence their decision to shop online, and 67% consider potential return hassles to be a barrier to online shopping. By eliminating such a barrier retailers can satisfy their needs in:

- Providing better customer service,

- Increasing customer retention rates,

- Increasing new customer acquisition,

- Converting product returns into exchanges, and

- Focusing on their core competencies.

4.3 Service Business Analysis

Despite the boom in the Internet shopping, reverse logistic business associated with such purchases has been overlooked by industry participants. This creates a strong barrier for the next step in Internet and catalog shopping. Currently, this market is not well defined. The few companies that try to get established in this market have very different backgrounds (shipping carriers, parcel depots, express deliverers, to name a few) and have very different financial and marketing resources.

4.3.1 Competition and Buying Patterns

A number of competitors, both established and start-up, have announced intentions to capture share in the growing product returns market. However, none are pursuing the business model used by QuickReturns. While the market for returns processing has largely been overlooked, competition is expected to increase significantly as retailers concentrate on fulfillment, back-end operations and customer service as sources of competitive advantage. Competitive threats may arise from other start-ups operating in secrecy and from incumbents in related industries such as parcel delivery carriers, parcel depots, residential delivery services, and brick-and-mortar retailing. However, the same attributes that make many of these firms formidable competitors also make them attractive partners, enabling QuickReturns to “co-opt” potential competitors.

To date, no company has established itself as a dominant player in the reverse logistics market for e-tailers or catalog merchants. Each of the competing returns programs discussed below is either still in the planning phase or has just recently begun operations. At this point, first-mover status has not been claimed in a growing market that will be capable of handling multiple players. Competitors can be grouped into four categories: parcel depots, shipping carriers, reverse logistics handlers, and same-day deliverers (see table below).

| Competitor Type | Examples |

| Parcel Depots | Mailboxes, Etc. |

| Shipping Carriers | UPS, FedEx, U.S. Postal Service |

| Reverse Logistics | Genco, The Return Exchange |

| Same-day Delivery | Kozmo.com, Sameday.com, WebVan.com |

4.3.2 Main Competitors

United Parcel Service (UPS)

UPS handles 55% of the e-commerce delivery market, delivering 12 million packages daily through an integrated network of air and ground delivery. Services include early-morning, same-day, and next-day air delivery. The Worldwide Logistics unit provides supply chain management, warehousing, and other services relating to order fulfillment. UPS also plans to test stand-alone retail outlets to further its reach in the residential market. However, to avoid backlash from parcel depots, the company is proceeding cautiously; only two locations have been announced thus far.

UPS offers two types of returns services. The Call Tag service allows consumers or retailers to request a UPS Ground driver to retrieve packages from customers’ homes at a cost of $4.50 per package. The Return Service allows retailers to include a return label which the customer can use to call and request a UPS home return pickup. The cost is the same as the Call Tag service, except the service is automatically billed to the retailer. While these services are convenient for some customers, they generally require the sender to be at the specified location for the pickup. The pickup time window can span eight business days, making the service inconvenient for working families and single households. The services also lack other benefits provided by QuickReturns, such as instant refunds, product inspections, free shipping (for consumers), flexible shipping destinations based on reason for return, and ability to exchange merchandise.

UPS also offers a service called eLogistics, targeting small and medium size businesses that wish to outsource portions of their operations. For retailers, UPS handles warehousing, order picking and packing, shipping, customer service, and returns handling. On the latter point, UPS Ground drivers pick up products at customers’ homes and deliver them to UPS warehouses, where they are inspected, processed, refurbished, and restocked. While this service may have some cost saving benefits to retailers, it is just as inconvenient to consumers as the Call Tag service. Moreover, it does not allow for the flexibility of the QuickReturns system: products must be shipped back to the central UPS warehouse, regardless of the reason for return.

With these services, UPS provides an alternative to QuickReturns, but its target market is not consumers and merchants seeking physical locations to receive product returns. Nonetheless, UPS must be considered a serious competitor due to its large size and market clout with e-tailers and catalog merchants.

U.S. Postal Service (USPS)

Handling 32% of e-tailer shipments, the U.S. Postal Service is the second largest shipper of products ordered online. The USPS has an extremely strong geographic presence through its 38,000 post offices nationwide and mail delivery services. The Postal Service recently launched an advertising blitz for its new Returns@Ease program, which lets customers print pre-addressed shipping labels from their home printers, and affix them to boxes which can be dropped off at local post offices or left for mail carriers. Retailers enrolling in this program can establish advance-deposit accounts with their postmasters.

While the USPS plans to become more entrepreneurial with new initiatives like the Returns@Ease program, these services are still provided out of traditional post offices, which continue to suffer from long lines, uneven customer service, and poor reputations. As a result, the Postal Service has struggled to sign up retailers for its returns program. As returns are not a core business for the USPS, there is no indication that the Postal Service will attempt to move further backward along the returns supply chain to provide more value-added services.

Federal Express (FedEx)

FedEx Corporation currently offers retailers a program called Net Returns, which enables them to electronically order home pickups for their customers. FedEx drivers print return shipping labels from handheld devices, and shipping and service charges are billed to retailers. The service adds little value beyond the standard call tag pickup that has been available for years.

FedEx currently controls just 10% of the e-commerce delivery market. Most of its annual revenues of $17 billion come from overnight air deliveries. FedEx is making an attempt to expand its FedEx Ground Service (formerly Roadway Package System [RPS]), but it reaches fewer than 50% of American households. Moreover, FedEx has experienced great difficulty integrating its ground and air services, resulting in operating margins that are less than half those of UPS. FedEx’s operational problems and its failure to capitalize on e-commerce has led its share price to fall over 30% in the past year alone.

FedEx has few retail locations for customers to drop off returns, limiting its potential to be a direct threat to QuickReturns. However, it recently signed a deal with Kinko’s in which FedEx employees will operate pack and ship centers in selected Kinko’s stores. No plans have been announced to accept product returns at these locations.

Mailboxes, Etc. (MBE)

Mailboxes, Etc. is the world’s largest franchiser of postal/shipping services. Its franchised stores (more than 3,300 in the U.S. and another 700 internationally) offer packaging, parcel shipping, 24-hour mailbox access, copying, printing, faxing, paging, office supplies, and other related postal and business products and services. Its customers are small and home-based businesses and general consumers. MBE has system-wide sales of about $1.5 billion and handles over 100 million customer transactions annually, although the corporation itself only retains revenues of approximately $72 million and EBITDA of $20 million. MBE currently has e-commerce relationships with companies including eBay, iShip, and boxLot.com.

MBE is in the process of wiring its franchise locations to the Internet using Hughes Network Systems satellite connections. The company plans to link store cash registers to the corporate computer system and to e-commerce partners. Through this integration, MBE employees will electronically generate RMA numbers and shipping labels for customers. However, in its current form, MBE’s e-returns program is expected to offer limited value to e-tailers and consumers. Consumers will neither receive instant refunds nor be able to exchange products; retailers will not be allowed to provide inspection criteria for product inspections, limiting their ability to separate appropriate from inappropriate returns (see table below).

MBE may have certain early advantages in the e-returns space. First, the company’s large distribution network provides access to consumers without having to sign additional distribution partnerships. Second, MBE has an established brand name and mindshare of consumers, some of whom already use MBE to ship returned merchandise. Third, it has already begun work on its e-returns program.

Comparison of Business Models, QuickReturns and Mailboxes, Etc.

| Service | QuickReturns | Mail Boxes, Etc. |

| Access customer order information | Yes | Yes |

| Free shipping | Yes | Varies |

| Instant refund | Yes | No |

| Product exchange option | Yes | No |

| Product inspection | Yes | No |

| Shipping address based on reason for return | Yes | No |

| Product liquidation service | Yes | No |

Nonetheless, MBE has not been successful in executing on its returns program. The program is already six months behind schedule, and franchisee interviews indicate the program now may be delayed until Winter, 2000. One barrier to the program’s success has been coordinating 3,300 independently owned franchise locations. Franchisee awareness of the company’s e-commerce initiative varies widely, with some franchisees reporting they are completely unaware of the program. Moreover, franchise relations have soured in the past two months, as 200 franchisees have joined together to create an independent franchise association for franchisees to protest MBE corporate policies and capital outlay requirements. The group expects to have 800 franchisees signed by the end of 2000.

Compounding the organizational issues facing MBE, parent company US Office Products has, over the past two years, undergone continual restructurings and has seen its stock plunge to a point where the company is being threatened with de-listing by NASDAQ. In March 2000, US Office Products announced its intention to sell off the entire Mailboxes, Etc. unit. Over the next several months, corporate restructuring issues may well distract management from focusing on new initiatives.

When MBE does launch its returns program, growth will be constrained by the number of e-tailers that can be integrated into the MBE network. Moreover, e-tailers using MBE’s service likely will be confined to MBE locations, since MBE will have little incentive to form outside distribution partnerships, which would direct traffic away from its locations.

The Return Exchange

The Return Exchange (TRE) is a Santa Ana-based start-up that plans to offer a suite of reverse logistics services to e-tailers. It is currently in beta testing with approximately ten e-tailers, but already has begun to advertise its services in industry trade journals. It offers three primary services:

- Returns management software

- Regional return centers to manage reverse logistics

- Online B2C auction to liquidate returned merchandise that cannot be resold as new.

TRE’s software program, called Verify, allows retailers to automate the providing of RMA numbers to customers seeking to return merchandise. Verify is linked to each e-tailer’s database, where it confirms order records and identifies the customer making the return. It then checks the customer against The Return Exchange’s own proprietary database which stores individual customer purchase and return histories across retailers signed up with TRE. Using intelligent algorithms, the software can deny return requests from individuals with histories of frequent returns. At the other extreme, customers with long order histories and low return rates may be considered premium customers and receive instant refunds, even before they return the merchandise to the e-tailers.

While TRE claims its customer return rating feature reduces fraud and facilitates customer relationship management, the company recently has come under fire for violating shoppers’ privacy. JunkBusters, a privacy-advocacy organization, has charged that TRE’s database could “lead to fear of individual redlining,” as customers are discriminated against because of their past behaviors. Indeed, the Industry Standard conjectured that retailers who use TRE may face a backlash from their customers. The article concludes that, “choosy retailers can only hope their own dealings with The Return Exchange won’t one day reflect poorly on them.”

While TRE’s process of receiving and processing returns may be of some benefit to e-tailers, it does very little for their customers. Customers must register their intention to return at the e-tailer’s website, and only “premium” customers are eligible to receive instant refunds. In addition, sending returned goods through TRE’s regional warehouses increases the time it takes to resell a product and results in unnecessary shipping costs. A recent Forrester Research report criticized this model, stating, “getting product back into inventory often means the difference between gaining and losing a sale. The Return Exchange currently adds a step to the process.” By contrast, QuickReturns customers will drop off products with no advance notice, and all customers will be eligible to receive instant refunds because QuickReturns agents will take possession of the returned merchandise before the refund is authorized. Moreover, QuickReturns will process returns before they are shipped, allowing merchandise to be sent to the proper destination with no intermediate step.

The third service TRE offers is liquidation or auction of returned products that cannot be resold as new. Such products are posted on an internal site, www.finalcallauction.com, and external sites, such as eBay. This type of service creates opportunities for e-tailers to salvage value from products that otherwise would be destroyed. QuickReturns will offer a similar service to its retailer partners soon after its initial launch, most likely in partnership with a returned merchandise auction service such as ClickReturns.

Genco

Pittsburgh-based Genco Distribution System is the largest of the traditional logistics providers, with services including contract distribution, order fulfillment, freight forwarding, warehousing, call centers, merchandise liquidation. Revenues from these services in 1999 were estimated to be $200 million. The company has traditionally focused on large, established brick-and-mortar retailers and manufacturers, including Wal-Mart, Kmart, Macy’s, Sears, Target, and HomeBase. Genco has announced intentions to pursue the online returns market. While it is a competitor, indications are that Genco management continues to focus on large, established retailers rather than start-up e-tailers and catalog merchants. Moreover, its lack of physical locations to serve consumers make it more of a potential partner than a competitor to QuickReturns.

Residential Delivery Services

Home delivery services, such as WebVan, Peapod, HomeGrocer, Streamline.com, Kozmo, and Sameday.com (formerly Shipper.com) deliver groceries and other products to residences. These companies are beginning to extend their services to include pickups of their own returned items. For example, WebVan customers can call to request a return pickup, and receive instant credit refunds at pickup. HomeGrocer offers free pickup of returned items with refunds processed in three days. Streamline.com picks up outgoing packages, holiday shipping, and catalog returns. Kozmo picks up returned videos from homes for a $1 fee. These home deliverers later could develop relationships with retailers to pick up returned merchandise. However, most of these delivery services are not nationwide, limiting their usefulness to retailers who have national distribution. Moreover, the delivery companies are currently focused on expanding their geographic networks rather than adding new services (e.g., systems integration with retailers) outside of their core competencies.

Strategy and Implementation Summary

QuickReturns will focus its marketing efforts on e-tailers, catalog merchants and click-and-mortar stores selling common products with higher-than-average return rates. Revenues will be generated through return and exchange processing fees and membership fees.

5.1 Competitive Edge

QuickReturns will approach the returns market with the following competitive advantages:

- Strict focus on returns. QuickReturns will focus solely on the returns services market. Its management will not be distracted by competing priorities within the organization, making it more responsive to changing market conditions and customer requirements.

- Better value proposition to retailers and their customers. QuickReturns will offer a service array broader than that of any other company. Only QuickReturns offers consumers physical return locations with instant refunds, free shipping, and the opportunity to exchange merchandise; and only QuickReturns offers retailers product inspections, return processing, and shipping destinations tailored to the product and the reason for its return.

- Brand differentiation. The QuickReturns brand will be promoted as a consumer seal of approval, focused solely on returns, and undiluted by unrelated service offerings. The branding strategy will be aimed at developing a virtuous cycle in which consumers demand QuickReturns affiliation when choosing among retailers, and retailers advertise their QuickReturns affiliation in order to drive sales.

- Distribution partnerships. By partnering with multiple distribution channels ranging from brick-and-mortar stores to home delivery services, consumers will have more return channels to choose from than are offered by any other company. QuickReturns will benefit from a wide range of points of presence through which consumers can access the services.

5.2 Marketing Strategy

Consumer marketing strategy

Two factors will alow QuickReturns to build consumer awareness of its services with less advertising than typical start-ups:

- Retailer partners will have every incentive to inform their customers of the QuickReturns service. QuickReturns affiliation will differentiate them in the marketplace as merchants committed to customer care. Moreover, retailers will receive a higher ROI on their annual fee to the extent that more of their customers use QuickReturns. To this end, it is expected that retailer partners will promote QuickReturns in their own advertising campaigns. QuickReturns will also develop a graphic seal for retailer partners to display on their websites and in their catalogs. The electronic version of this seal will link to the QuickReturns website, where consumers can obtain information about the QuickReturns program.

- Consumers wishing to return merchandise will likely discover QuickReturns on their own when they read instructions from the retailer on how to return merchandise. Receipts or packing slips from QuickReturns partners will describe how to use the QuickReturns service and list the nearest location for each customer based on his or her ZIP code. Customers who contact the retailer directly to inquire about returns likewise will be informed about the QuickReturns service.

QuickReturns website

QuickReturns will have a website at www.quickreturns.net with information on the QuickReturns services, procedures, benefits to consumers, links to retailer partners categorized by product category, and a location finder linked to online maps. The site will be designed for easy navigation and access to company information.

Advertising campaign

QuickReturns media advertising will convey two key concepts:

- It will describe the service and its benefits to consumers in order to raise customer awareness.

- It will position the brand as a seal of approval that denotes convenient, hassle-free returns and high-quality customer service.

Advertisements also will contrast the positive experience of returning products through QuickReturns against the potential pitfalls of returning products through other means. Marketing campaigns will be intensified around the holiday season, when the majority of returns occur. Radio, magazines, and billboards will be emphasized over television as the preferred marketing channels in order to realize greater return on marketing investment.

Retailer partner marketing strategy

Retailer partners will be approached once a relatively firm technology completion date has been set and a distribution partner secured. Business development and operations executives will be contacted directly at retailers that are best suited for QuickReturns. The table below outlines the desirable retailer partner characteristics.

| Characteristic | Rationale |

| Sells merchandise with high return rates | More returns generated per retailer partner |

| Simple and ordinary products | Faster and more accurate inspections |

| Return difficulties act as barrier to sales | Looking for solutions to returns problem |

| Customer service focused | More likely to become QuickReturns partner |

Distribution partner marketing strategy

Striking favorable agreements with the proper distribution partners is critical to the success of QuickReturns. A number of attractive potential distribution partners have been identified. Soon after securing its funding and technology partner, QuickReturns intends to approach the senior management of these companies. Approaching potential distribution partners at that time will strengthen QuickReturns’ negotiating position and minimize intellectual property risks.

In its initial roll out, QuickReturns will focus business development efforts on office superstores and parcel depots. Not only do these stores offer the shipping services necessary for QuickReturns operations, but they share synergies with QuickReturns customer segments. Consumer traffic accounts for 40% of sales for office superstores, and likely accounts for an even higher portion in the parcel depot market. Five chain stores have been selected as the top choices for QuickReturns partnership.

5.2.1 Pricing Strategy

Initially, retailer partners will incur four different fees, as summarized in the following table, and discussed in detail below.

| Charge to retailer | Timing |

| Annual membership fee | Annually (instituted after year two) |

| Technology integration fee | At systems integration (abolished after year two) |

| Return processing fee | At returns processing |

| Product exchange fee | At purchases with QuickExchange terminal |

Annual membership fee

QuickReturns will charge each retailer partner an annual fee of $250,000, approximately the cost of a single 30-second network TV commercial. The annual fee will be waived in QuickReturns’ first two years of operation in order to acquire a critical mass of retailer partners. This fee will be used to cover technology development and maintenance, liability costs, and marketing expenses. Payment of the annual fee will include:

- Right to offer their customers the option of using QuickReturns

- License to use the QuickReturns brand in their marketing campaigns/materials

- Monthly return analysis reports.

Technology integration fee

In lieu of the annual fee for the first two years, QuickReturns will charge retailer partners a one-time $60,000 technology integration fee, intended to cover the costs of integrating the retailers’ databases with the QuickReturns system. The fee is based on estimates of labor and material costs incurred by QuickReturns personnel who will be on-site through the integration period. The fee will be eliminated after year two, when it will be incorporated into the annual fee.

Return processing fee

The return processing fee will be incurred after each return transaction and will be based on the number of inspection criteria set forth by the retailer for a given product return. A base fee of $4.80 will be charged for each return handled by QuickReturns. The base fee will cover up to five inspection criteria, specified by the retailer, which QuickReturns agents will ensure are met before accepting a return. A surcharge of $0.50 will be levied for each criteria over the fifth.

Processing fee rates are designed to reflect the cost structure of returns. Returns with more criteria will result in higher liability exposure for QuickReturns because of the higher likelihood of human error. Returns with more criteria also will be more costly to distribution partners because of the additional employee time required to complete each transaction.

It is projected that retailer partners generally will establish higher numbers of criteria for products that are more complex and thus more expensive. In this way, the fee should correlate loosely with the product’s purchase price. QuickReturns projects that retailers will choose to pay the base rate of $4.80 for 80% of products, and will choose to pay for an average of two additional criteria for the remaining 20% of products, resulting in an average fee of $5.80 for the latter group.

Return processing fees will rise by five percent per year, starting in year three.

Product exchange commissions

QuickReturns will charge a product exchange commission of 10% of the purchase price for purchases made through QuickExchange terminals. This commission is in line with the standard 10% to 15% commission that e-tailers now pay referring websites. For the same commission, QuickReturns offers greater value than the average referring website, by providing customers with a computer, Internet connection, and direct link to retailers’ website.

5.3 Sales Strategy

To initiate and close sales, QuickReturns’ top management will be personally contacting the marketing and business development managers of the selected list of target retailers. Customer service and quality control will be the key factors in determining the clients’ decision to outsource their reverse logistics to QuickReturns. Sales and marketing efforts will be directed to ensure the ongoing relationships with such retailers.

5.3.1 Sales Forecast

Our sales revenues will be derived from three primary sources:

- Annual fees from retailer partners

- Return processing fees

- Commissions from purchases and exchanges made at QuickReturns locations.

The following sales forecast is based on the following assumptions:

- Annual retailer partner fees are waived in years one and two. Starting from year three, annual fees are $250,000 per retailer. These fees will be pro-rated for new retailers based on their activation date. (Note: by the end of year three, QuickReturns estimates to have 76 retailer partners; however, the table below shows a different number in order to accommodate for the lower total annual revenues due to pro-rating of such fees.)

- In years one and two, each new client pays a one-time technology integration fee in the amount of $60,000 in order to recover direct costs of integrating QuickReturns system into the retailer’s database. These fees are not pro-rated. Neither annual partner fees nor technology integration fees are shared with franchisees.

- It is estimated that on average one new retailer per month will join the QuickReturns program in year one and three retailers per month will join in years two and three.

- Return processing fees are shared with the distribution partners at a ratio of 1:1 (i.e., QuickReturns receives 50% of those fees).

- Product exchange fees are based on a 10% commission off the average product exchange value of $42. These fees are also shared with the distribution partners at a 1:1 ratio (i.e., QuickReturns receives 50% of those fees).

| Sales Forecast | |||

| Year 1 | Year 2 | Year 3 | |

| Unit Sales | |||

| Technology Integration Fee (one-time) | 4 | 36 | 0 |

| Annual Membership Fee | 0 | 0 | 60 |

| Return Processing Fees | 66,180 | 6,337,390 | 20,677,114 |

| Product Exchange Fees | 13,236 | 1,267,477 | 4,135,419 |

| Total Unit Sales | 79,420 | 7,604,903 | 24,812,593 |

| Unit Prices | Year 1 | Year 2 | Year 3 |

| Technology Integration Fee (one-time) | $60,000.00 | $60,000.00 | $0.00 |

| Annual Membership Fee | $0.00 | $0.00 | $250,000.00 |

| Return Processing Fees | $2.50 | $2.50 | $2.63 |

| Product Exchange Fees | $2.10 | $2.10 | $2.10 |

| Sales | |||

| Technology Integration Fee (one-time) | $240,000 | $2,160,000 | $0 |

| Annual Membership Fee | $0 | $0 | $14,875,000 |

| Return Processing Fees | $165,450 | $15,843,475 | $54,277,424 |

| Product Exchange Fees | $27,796 | $2,661,702 | $8,684,380 |

| Total Sales | $433,246 | $20,665,177 | $77,836,804 |

| Direct Unit Costs | Year 1 | Year 2 | Year 3 |

| Technology Integration Fee (one-time) | $0.00 | $0.00 | $0.00 |

| Annual Membership Fee | $0.00 | $0.00 | $0.00 |

| Return Processing Fees | $0.00 | $0.00 | $0.00 |

| Product Exchange Fees | $0.00 | $0.00 | $0.00 |

| Direct Cost of Sales | |||

| Technology Integration Fee (one-time) | $0 | $0 | $0 |

| Annual Membership Fee | $0 | $0 | $0 |

| Return Processing Fees | $0 | $0 | $0 |

| Product Exchange Fees | $0 | $0 | $0 |

| Subtotal Direct Cost of Sales | $0 | $0 | $0 |

Management Summary

The company’s founders have had many years of valuable experience at the top-notch value-added consulting firms. They have helped their clients to succeed in many industries and have first-hand exposure to the Internet business. As the company reaches its sales and market share goals, additional management will be hired to handle the increased business volume.

6.1 Management Team

[Name Omitted] is Founder and CEO of QuickReturns. Most recently, [name omitted] was a Business Analyst at MacKlinkey & Company in the Los Angeles, California office. At MacKlinkey, [name omitted] specialized in Internet start-up and e-commerce consulting engagements, working at companies in the Internet, software, banking, and entertainment industries. Much of his client work centered on consumer and retail distribution strategies, giving him the general supply chain background necessary to start QuickReturns. Before working at MacKlinkey, [name omitted] worked as an analyst at the Doltko Group, a high profile corporate lobbing firm in Washington, D.C., and as an assistant to Kashel Offenbautten, the Majority Leader of the U.S. House of Representatives. [Name omitted] graduated Magna Cum Laude and Phi Beta Kappa from Duke University, where he received a B.A. in Public Policy, Economics, and Markets & Management.

[Name Omitted] is President. [Name omitted] most recently served as an Associate Vice President at Cataillus Development, where she started up and led the $750 million San Diego project, managing efforts in strategy, marketing, business development, legal, engineering, and operations. She also oversaw due diligence efforts and structured and negotiated corporate acquisitions and joint ventures. [Name omitted] previously served as Director of Business Development at PaWES Corporation and as Director of Public Affairs at HNTB Corporation. [Name omitted] attended UCLA for her M.B.A. as well as for her Masters of Urban Planning, in which she specialized in urban economics. [Name omitted] earned her B.A. in Comparative Area Studies at Duke University.

[Name Omitted] is Software Development Director. [Name omitted] is currently a Senior Consultant at BarkurAnonym LLP in the Los Angeles, California office. At BarkurAnonym, [Name omitted] has led Monocle implementations, e-commerce designs, and new consultant instruction classes. He has worked with clients in the retail and software industries. Prior to working at BarkurAnonym, [name omitted] worked as a Technical Sales Consultant for Monocle Corporation, where he supported the mobile field sales force by developing technical presentations based on business requirements gathered by field representatives. [Name omitted] graduated from Carnegie Mellon University, where he received a B.S. in Industrial Management.

[Name Omitted] is VP, Operations. [Name omitted] is currently an Associate at MonZonite Associates in their Chicago, Illinois office. At MonZonite, [name omitted] has specialized in operations consulting for retail, manufacturing, and banking clients. Prior to working at MonZonite, [name omitted] was a Partner at Parbuckle Services, LLP, a diversified group of retail and service businesses in North Carolina. At Parbuckle, [name omitted] performed due diligence on acquisition targets and negotiated their purchase prices, in addition to managing growth of six stores in the group. [Name omitted] has also worked as a Project Researcher at the Center for Syzygy Systems, a biotechnology laboratory in Boca Raton, Florida. [Name omitted] holds an M.B.A. from The Wharton School, where he received a Howard E. Mitchell Academic Fellowship. [Name omitted] also has a Masters in Public Policy from Duke University and a B.A. in Psychology from University of North Carolina at Chapel Hill.

6.2 Personnel Plan

The company’s prime goals in marketing and technological development will be reflected in the structure of QuickReturns’ personnel and future hiring needs. As the company grows, additional staff will be hired. Efforts in preserving the entrepreneurial company culture will be important to ensure the future growth. The table below outlines the personnel plan for the first three years.

| Personnel Plan | |||

| Year 1 | Year 2 | Year 3 | |

| Managers | $693,996 | $1,563,500 | $2,304,000 |

| Administrative personnel | $277,596 | $625,400 | $921,600 |

| Technical personnel | $416,400 | $938,100 | $1,382,400 |

| Total People | 40 | 75 | 115 |

| Total Payroll | $1,387,992 | $3,127,000 | $4,608,000 |

Financial Plan

Our financial success depends on reaching desired market share and maintaining superb customer retention rate. Additional rounds of investor financing must be secured in years one and two to ensure the company growth until it reaches the self-sustaining level of sales. At the moment, the company seeks seed financing to cover the initial costs.

7.1 Projected Profit and Loss

The following table summarizes the estimated income statement of QuickReturns for three years.

| Pro Forma Profit and Loss | |||

| Year 1 | Year 2 | Year 3 | |

| Sales | $433,246 | $20,665,177 | $77,836,804 |

| Direct Cost of Sales | $0 | $0 | $0 |

| Other | $0 | $0 | $0 |

| Total Cost of Sales | $0 | $0 | $0 |

| Gross Margin | $433,246 | $20,665,177 | $77,836,804 |

| Gross Margin % | 100.00% | 100.00% | 100.00% |

| Expenses | |||

| Payroll | $1,387,992 | $3,127,000 | $4,608,000 |

| Sales and Marketing and Other Expenses | $1,637,496 | $14,240,500 | $15,151,000 |

| Depreciation | $0 | $0 | $0 |

| Telephone | $12,000 | $70,000 | $100,000 |

| Software and Web site development | $777,000 | $600,000 | $800,000 |

| Office supplies and subscriptions | $82,404 | $350,000 | $450,000 |

| Rent | $34,800 | $60,000 | $99,600 |

| Legal & Accounting | $55,956 | $72,000 | $84,000 |

| Equipment Rental | $230,000 | $2,280,000 | $3,000,000 |

| Utilities | $6,960 | $12,000 | $19,920 |

| Payroll Taxes | $208,199 | $469,050 | $691,200 |

| Hardware & Maintenance | $322,500 | $54,000 | $403,500 |

| Other | $240,000 | $600,000 | $700,000 |

| Total Operating Expenses | $4,995,307 | $21,934,550 | $26,107,220 |

| Profit Before Interest and Taxes | ($4,562,061) | ($1,269,373) | $51,729,584 |

| EBITDA | ($4,562,061) | ($1,269,373) | $51,729,584 |

| Interest Expense | $0 | $0 | $0 |

| Taxes Incurred | $0 | $0 | $13,147,936 |

| Net Profit | ($4,562,061) | ($1,269,373) | $38,581,648 |

| Net Profit/Sales | -1053.00% | -6.14% | 49.57% |

7.2 Break-even Analysis

QuickReturns will generate sufficient monthly revenues to cover its average monthly fixed expenses. The company will reach that sales level at the beginning of year two.

| Break-even Analysis | |

| Monthly Units Break-even | 76,309 |

| Monthly Revenue Break-even | $416,276 |

| Assumptions: | |

| Average Per-Unit Revenue | $5.46 |

| Average Per-Unit Variable Cost | $0.00 |

| Estimated Monthly Fixed Cost | $416,276 |

7.3 Projected Cash Flow

QuickReturns’ estimated Cash Flow Analysis for the next three years in shown below. As stated before, the company plans to attract additional rounds of investor financing in years one and two.

| Pro Forma Cash Flow | |||

| Year 1 | Year 2 | Year 3 | |

| Cash Received | |||

| Cash from Operations | |||

| Cash Sales | $0 | $0 | $0 |

| Cash from Receivables | $187,419 | $9,185,433 | $45,397,211 |

| Subtotal Cash from Operations | $187,419 | $9,185,433 | $45,397,211 |

| Additional Cash Received | |||

| Sales Tax, VAT, HST/GST Received | $0 | $0 | $0 |

| New Current Borrowing | $0 | $0 | $0 |

| New Other Liabilities (interest-free) | $0 | $0 | $0 |

| New Long-term Liabilities | $0 | $0 | $0 |

| Sales of Other Current Assets | $0 | $0 | $0 |

| Sales of Long-term Assets | $0 | $0 | $0 |

| New Investment Received | $2,000,000 | $11,500,000 | $0 |

| Subtotal Cash Received | $2,187,419 | $20,685,433 | $45,397,211 |

| Expenditures | Year 1 | Year 2 | Year 3 |

| Expenditures from Operations | |||

| Cash Spending | $1,387,992 | $3,127,000 | $4,608,000 |

| Bill Payments | $3,316,887 | $17,552,152 | $33,345,271 |

| Subtotal Spent on Operations | $4,704,879 | $20,679,152 | $37,953,271 |

| Additional Cash Spent | |||

| Sales Tax, VAT, HST/GST Paid Out | $0 | $0 | $0 |

| Principal Repayment of Current Borrowing | $0 | $0 | $0 |

| Other Liabilities Principal Repayment | $0 | $0 | $0 |

| Long-term Liabilities Principal Repayment | $0 | $0 | $0 |

| Purchase Other Current Assets | $0 | $0 | $0 |

| Purchase Long-term Assets | $0 | $0 | $0 |

| Dividends | $0 | $0 | $0 |

| Subtotal Cash Spent | $4,704,879 | $20,679,152 | $37,953,271 |