Laser Tag

Executive Summary

Laser Tag will be located in the Big Mall shopping center, which serves many of the 115,000 people who live in the MyTown metropolitan area. Big Mall shopping center is well located at 415 North West Birch Road, a road that carries well over 30,000 vehicles per day.

Laser Tag is a state-of-the-art “laser” tag game played in a darkened 4,500 square foot arena in which the players seek to capture the opponents’ base. Smoke swirls around your feet. Lights flash. Music pounds. You fire your “laser” through the din to strike your opponents and capture their base while trying to avoid being shot. Laser Tag is a heart-pounding, adrenalin-pumping game, in which strategy and luck are joined to defeat your opponents.

After playing, the players collect their score sheets in the lobby that is elaborately decorated with a theme that will create a “WOW” effect. While in the lobby, they can also choose, for two tokens (50 cents) each, among the 20 leading video games. If they are members of corporate groups recognizing achievements, or individuals celebrating birthday parties, they may be renting one of three party rooms, at 90 minutes for $119.

The Zone Systems Company will provide the laser tag gaming equipment that has been featured on one of MTV’s Battle of The Sexes TV episodes, and by Walt Disney World. Zone Systems provides 24-hour operational assistance for the state-of-the-art laser tag equipment, and software system that Zone Systems manufactures and is used by facilities centers around the world. Zone Systems has been in business for over 16 years and is the leading manufacturer of laser tag equipment worldwide. Zone Systems provides the turn-key Zone Systems software, along with a companion point-of-sale system; these will be used to manage all aspects of the facilities operation.

Laser Tag will be an Ohio subchapter S corporation. John Smith will own 100% of the Corporation and will be the manager. John Smith is a self-employed entrepreneur who has previously opened two successful businesses. John Smith is a successful 20-year business veteran with experience in marketing, accountability, management, training, and supervision.

There is a demand in this area for high-quality, state-of-the-art, electronic entertainment. The principals will have the necessary skills and training in order to operate the laser tag complex. At this point in time, the necessary start-up costs have been identified. They are either exact figures or estimates based on preliminary conversations with potential suppliers.

Having put this plan together, the principals have every reason to believe the business will be successful. It is a proven franchise operation. The management team has a proven record of business skills and an ability to work with people. The principals are confident that the loan will be repaid back in a timely manner, within 7 years, at an assumed annual interest rate of 11%.

The Highlights chart below is based on a worst case projections – 35% of full capacity.

1.1 Objectives

Laser Tag will create a “stand-alone” Laser Tag facility that will provide a unique form of entertainment to Prosperous County/MyTown, Ohio and other surrounding communities. Laser tag games will generate the majority of the revenue with the remaining revenue coming from video games and other peripherial devices. Within one year, the company will reinvest 60% of its anticipated Return on Investment to make state-of-the-art improvements, enabling Laser Tag to “lead from the front” in an ever-changing and enticing laser tag market. In the second year, Laser Tag will expand its food and beverage capability and build upon the top-quality video games, while also providing souvenir shirts, sweats, caps, mugs, and posters to its members and patrons.

1.2 Mission

Laser tag players will enjoy playing the exciting game in a safe, low-light, 4,500 square feet arena that is enhanced with flashing lights, theatrical haze, pounding music, and surprising special effects. Laser Tag will offer an enjoyable, pleasant atmosphere while being committed to maintaining an environment enticing to not only teens and young adults, but also to the entire family. Our trained staff will welcome our patrons as special guests and assist with various group functions such as birthday parties or scout recognition and achievement events, ensuring that everyone has a fun, enjoyable experience.

1.3 Keys to Success

The key success factors are themed environments, staff training, customer satisfaction, marketing and the equipment.

Themed Environments include the WOW! factor in a facility. Zone Systems is a company that truly understands the WOW! factor. The concepts that Zone Systems promotes tend to be visually stimulating and on-the-edge, topics which today’s teen males relate to very easily.

Staff Training is critical to the goal of excellent customer service. An improperly trained staff member can destroy the chances of booking a several hundred dollar corporate event or a $150 birthday party.

Customer Satisfaction is critical for the long-term success of the facility. The ability to be polite, ensure the guests’ safety and satisfaction, and take pride in providing a pleasant experience are all vital to achieving long-term profit and converting this from a fad into a business.

Marketing is one of the greatest issues in the industry. Too many people think that they are Kevin Costner in the “Field of Dreams:” Build It And They Will Come! People spend thousands of dollars on their facility and not a dime on marketing and wonder why they are closing down.

Equipment is the touchy, feely part of this business. Your customers will be handling and wearing the gear for 10 minutes and longer. Their entire experience will rely on the gear’s ability to enhance their enjoyment of the event.

Company Summary

Laser Tag is a start-up company that will be located in the Big Mall shopping center, which serves many of the 115,000 people who live in the MyTown metropolitan area.

Laser Tag will purchase laser tag equipment from Zone System, and become a member of the North American branch of the “Zone” group; a fast-growing, international network of laser game companies utilizing the futuristic technology designed by P&C Micros of Melbourne, Australia. Pioneers of arena laser games, P&C principals, Patrick and Catherine Holms, have maintained a relentless focus on technical innovation. They are avid laser game players and their immersion in the game has given them insight into what keeps players coming back for more. As a result, they have developed dozens of game enhancements and a menu of practically thousands of customizing options, making Zone hardware and software the most reliable and advanced in the industry.

P&C Micros currently licenses and operates Zone 3 laser arena sites in every major city in Australia. In just over six years, with 29 sites, Zone 3 has captured over 95% of the Australian marketplace. In fact, several of Zone 3’s current sites have converted from other game systems in order to take advantage of the superior “Zone” technology, equipment and game features. In addition, new “Zone” sites are either planned or are currently under construction in Singapore, China, the Philippines, South Africa, Canada, Mexico and South America. MEGAZONE, the company holding the master license for “Zone” products in Europe, is the fastest growing Laser Company in Europe. Megazone now has 18 sites operating throughout the United Kingdom, as well as Italy, Norway, Holland, Finland, Sweden and Spain.

Zone System is now in position to take the U.S. market by storm. As a member of the international group of Zone companies, Zone System draws on a history of success in Europe and Australia, as well as truly outstanding entry in the U.S. market.

Zone System’s focus is on technology, because innovation and flexibility are the cornerstones of tomorrow’s success. Superior technology provides it with staying power. It keeps the game interesting and challenging no matter how many times a “Zonehead” has played. Software upgrades can be installed in minutes and are often available over the phone by modem. Thousands of game enhancements and options can be activated through a simple menu selection. Zone System provides its members with a full set of manuals detailing everything necessary to operate the franchise successfully. The manuals include:

- Pre-Opening Manual

- Personnel Manual

- Game Operations Manual

- Business Operations Manual

- Marketing Manual Accounting Manual

The manuals cover all aspects of operations from site selection, facility design, ordering equipment, staffing, Grand Opening planning, game operations, equipment maintenance, troubleshooting, bookkeeping, monthly accounting reports, customer service, merchandising, promotional events . . . These manuals are the result of years of compilation from existing site locations throughout the world.

Perhaps the most important aspect of Zone System’s support for its members is in the area of technical support. Electronics and computers make the game real. They must be durable. The game pack is made of polycarbonate (bullet proof glass). Hand pieces are designed to military specifications. Over five years of experience with the hardware has shown it has the ability to endure abuse. In the event of an equipment problem, the unique game system and its modular components, with built-in diagnostic testing routines, minimize down time. Failed components can be replaced without special tools. Zone System’s software experience indicates that it is extremely reliable and operates virtually trouble-free. In the event a problem arises, Zone System’s corporate headquarters provides technical support by modem. Corrections can be downloaded in a matter of minutes in most situations, thereby minimizing any downtime in the “Zone”. Zone System has addressed obsolescence. The game is software driven. Enhancements to the game can be implemented with software updates. The hardware operates off of the software. This assures a long life for the equipment.

SUMMARY

A capable management team has been assembled. Mr. Smith has the necessary entrepreneurship skills to make the project successful. Mr. Smith’s philosophy includes the belief that the complex should provide cutting-edge family entertainment at an attractive price. His objective is to have the finest facility of its kind.

2.1 Start-up Summary

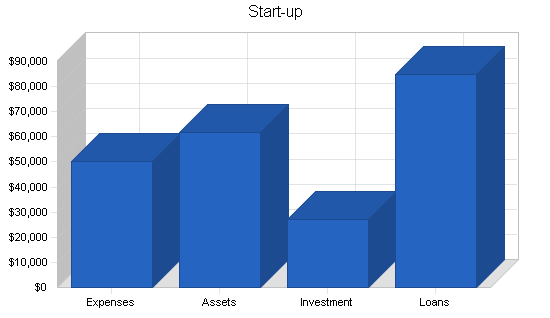

Our start-up costs will be $138,844, of which the owner plans to invest $27,000 . The funds will be used for:

- General Expenses (Insurance, rent during renovations, etc.): $12,097

- Initial Renovation: $38,000

- Furnishings and Fixtures (Assets): $51,747

- Cash for Start-up: $10,000

The start-up funding will be financed by loans arranged through a lending agency that Small Business Administration has qualified as a guarantor. Start-up assumptions are shown in the following table and chart.

| Start-up | |

| Requirements | |

| Start-up Expenses | |

| Legal | $250 |

| Insurance | $1,000 |

| Rent | $4,617 |

| Renovation | $38,000 |

| CPA | $75 |

| Marketing | $5,000 |

| Utilities | $845 |

| Phone | $310 |

| Total Start-up Expenses | $50,097 |

| Start-up Assets | |

| Cash Required | $10,000 |

| Start-up Inventory | $0 |

| Other Current Assets | $4,480 |

| Long-term Assets | $47,267 |

| Total Assets | $61,747 |

| Total Requirements | $111,844 |

2.2 Company Ownership

Laser Tag will be an Ohio subchapter S corporation that will incorporate in this year of 2004. John Smith will own 100% of the corporation.

Products and Services

This chapter describes Zone System’s laser tag game. The description cannot properly instill an appreciation of the adrenalin-pumping thrill a participant gets from the game. This can only be understood by playing the game. Consistent with the principals’ philosophy and objective, the complex will also offer the area’s finest selection of video games to its customers for their amusement before and after they play laser tag. Modest food and beverage offerings are also planned. Another important feature of the complex will be its party room, available for rent. Finally, some thought has been given to offering a “Makoto,” a unique new form of interactive technology, which challenges participants physically and mentally! Today’s consumer is always looking for the newest, hottest product and by combining challenge with entertainment “Makoto” exceeds the desires of consumers! That customers can also use for their enjoyment. “Makoto” is not anticipated to be part of the initial complex.

LASER TAG

A qualified staff member will give a briefing to the players in a ready room prior to donning the game’s gear. After the players have been briefed about the game, they will enter into the arena.

Stepping into the laser tag arena is like walking through a life-size video screen into a futuristic labyrinth filled with unfriendly forces. Your senses are bombarded by pulsating music, sirens and intermittent flashes of light and color breaking through the foggy darkness. Enemies crouch in shadows, intent on your destruction. For an instant you consider retreat — then you remind yourself this is just a game. The object of the game is to score points while defending yourself and your team’s base from attack. Players are grouped into three teams of up to 10 members, identified by the color of the flashing lights on their electronic vests–green, red or yellow. A typical play experience is 30 minutes, including a briefing on rules and strategy, a stop in the vesting room to pick up a laser and vest displaying targets on the shoulders, chest and back, and 15 minutes of intense competition in the arena. Points are scored by hitting the opposing teams’ targets and deactivating their base stations, while avoiding being hit by an opponent or a beam from an electronic sentinel, programmed to shoot randomly. Reload stations for replenishing ammunition make it possible for all players to stay in the game for the entire session. The Zone Systems lasers and vests are the most technologically advanced equipment available in the industry. Players always know if they’ve been hit or scored points because, when a target is hit, the chest pack in the vest vibrates, sounds a “power down” alarm and emits a flash of white light. The scoring player’s ID number and team are displayed on the chest pack, and scores are stored instantly for automatic downloading to the main computer. When the game is over, players receive personalized score sheets detailing all aspects of their performance.

PERIPHERALS

Peripheral entertainment and services include video games, vending machines and souvenir shirts, sweats, caps and mugs. One upcoming innovative entertainment venue machine is called “Makoto.” Constructed of three arena towers with 10 square lighted panels, which illuminate various colors and emit audible tones, “Makoto” is sure to engage and thrill while bringing physical, mental and spiritual benefits. Armed with a staff and a desire to dominate, participants tap the panels as they light up randomly around them. As one becomes more proficient, they can choose different levels and degrees of difficulty, making the machine move faster, which shortens the players’ response time between taps. Engaging all the senses, “Makoto” promises to deliver a rounded and rewarding opportunity for the whole being: body, mind and spirit.

PARTY ROOM

Part of the exceptional success that a Zone systems laser tag center has had worldwide is attributed to its party room. The room is available for groups. Typical groups include birthday parties, office parties and activities such as Boy Scouts and Girl Scouts outings. The room will normally be rented for two hours at a time. It will include snacks (pizza and soft-drinks) and a game in the “Zone.” This has proven to be exceptionally successful in Family Entertainment Centers. The management team believes it will be instrumental in achieving the target revenues projected in this plan.

Location

Laser Tag will be located in Big Mall shopping center, in a space between Reaction Fitness center and Big Mall. The address is 4415 Suite B, North West Birch Road, MyTown, Ohio.

This is an excellent location to serve our target market. The shopping center is centrally located and easy to reach from anywhere in the metropolitan area. Traffic at this location is one of the highest in the MyTown area, with a count of over 37,000 cars passing by east and over 34,000 passing by west daily. Laser Tag will have over 3,300 potential patrons between the age of 10-24, and a total population of 55,302 within only 3 square miles. The Big Mall shopping center is centrally located on Birch Road between the few entertainment venues available and within less than 2 miles of MyTown ’s premier restaurant facilities, such as Applebee’s and Chili’s. The Big Mall shopping center is well known to our market and will be easy to identify in our advertisements. The shopping center is located at the corner of Birch Road and 44th Street, both of which are high-traffic thoroughfares. Locating on these streets makes it easy for our customers to reach us by car. There are over 5 entrances to the shopping center parking lot from these streets. Parking is ample around the shopping center and more than 30 spaces are available immediately in front of the Laser Tag entrance. The MyTown Area Transit bus line also serves the Big Mall Shopping center.

4.1 Space and Access

11,080 square feet is available for development. Access to the main lobby is from the main entrance at the front of the building, with a separate entrance to the party room venue from the front parking area for event patrons.

4.2 Facility Design and Development

The concept of the laser tag arena is that players are inside a starship of the future, engaged in combat with alien invaders.

To enhance its entertainment value, the entire facility will be laid out and decorated in a manner consistent with this concept. Similar to a Disney amusement park theme, such as Tomorrowland, everything in the facility will present visitors with a look and feel that is consistent with the starship concept. The entertainment goal is to invite patrons to suspend belief and imagine that while in the facility they are actually inside a starship.

The design for the facility’s layout is provided by Zone Systems, the supplier of the turnkey laser tag game system.

Patrons first enter the spacious starship-themed lobby that is populated with the video games and filled with the sounds of teen music and games. The lobby also contains the counter, computer, cash register, and an overhead video screen.

Three rooms are dedicated to the laser tag experience. The first room (briefing room) is where the customers get a dramatic briefing on their preparations to do battle with the invading aliens. The second room (armory) is where players put on their Zone Systems gear (vests and phasers). The third room is the combat zone (arena). When the game ends, customers return to the armory to hang up their gear, and then return to the lobby. As they pass through the armory, the next group of players is being briefed. Three additional rooms are for special events, such as birthday parties.

3,500 square feet of the 11,080 available will be used for the lobby, ticket counter (“Mission Control Center”), and arcade (video games). 219 square feet will be used for the briefing room. The armory will be a 275 square feet room. 4,600 square feet will be used for the combat zone arena.

The 3 special event rooms will total approximately 1,080 square feet each and another 1,406 square feet will be used for employee, business use, and restrooms.

4.3 Renovation

After consulting with 3 local firms, the Dan Schwartz Construction Company was selected to remodel the interior. For $38,000, the walls and doors will be built to create the rooms needed. The construction includes preparing the walls and ceilings for their final covering, laying carpeting throughout, and installing the counter and restrooms.

Zone Systems, the leading laser tag equipment and services firm provided the basic design for the facility and arena. That company is also supplying its internationally-recognized game system and equipment. The walls, ceilings, and doors will be decorated with the Hollywood-quality special effects; the ideas for the effects come from Zone Systems and other Laser Tag companies observed. These special effects give game players the feeling that they are on a futuristic starship.

The counter and display area will be built large enough to house the “Mission Control Center” of the laser tag on one side and have the same capacity for soft drink fountains, pizza menu’s, and condiments for dine-in-only delivery by a local pizza company on the other. A portion of the pizza menu side of the counter will also be built to display ticket redemption items for the young party patrons as they receive tickets from the machines.

Frontier Music of MyTown will provide the sound and light systems for the arena and a separated system for the arcade and party rooms.

MyTown Novelty will provide the Arcade machines and will ensure that electrical supply by the contractor is adequate.

Renovation will commence one week from approval of the loan and will finish within 30 days. The special effects and game system will then be installed, with a planned finish date of 1 weeks of remodeling. Games will be run daily for the first week to confirm that all systems are operational, and to train employees. The grand opening is scheduled for no more than 60 days from the beginning.

Operations

The hours of operation during the months of September to May will be from 4:30 PM to 9:00 PM Monday through Thursday, 4:30 PM to 12:00 PM Friday, 9:00 AM to 12:00 PM Saturday, and 12:00PM to 7:00 PM on Sunday. In the months of June through August, the hours will change to 2:00 PM to 10:00 PM from Monday through Thursday, and 2:00 to 12:00 on Friday. The president or day manager will enter the business one hour before opening to begin the startup procedures. Daily operating procedures and cash handling will conform to the checklists identified in Appendix D – Operations. The prime hours of operation will be 6:00 PM to midnight on Friday and all day Saturday and Sunday, about 156 hours a month.

5.1 Board of Directors

Establishing policies, directing the company, and approving budgets is the role of the board of directors. Submitting the budget at the first board meeting, the president will use the financial projections contained in this document as the basis for the budget.

The board of directors will meet every quarter, following the closing of the quarter’s books. The president will make a report to the board about the accomplishments of the previous quarter and propose any changes in budget or direction. Board members will be paid $250 for attending each meeting. The president will be responsible for arranging the meetings.

5.2 President’s Duties

The president will supervise daily operations and is expected to reach the financial objectives set by the board. The president will recruit, hire and train all employees necessary to operate the business.

Each month, the president will establish marketing objectives and assure that appropriate steps are taken to reach those objectives. Opportunities to incorporate seasonal and holiday promotions, such as Halloween, will be sought. Local news reports will be monitored to discover promotional tie-in opportunities or to offer special event packages, such as winning season party packages for sports teams.

Each quarter, the president will review the status of agreements with vendors, suppliers, and insurers.

5.3 Employee Relations

Laser Tag will be an equal employment employer. Solicitations for employees will not refer to any prohibited categories and copies of all ads will be kept on file. Even though we expect that most employees will be young, between the ages of 16 and 22, no recruiting advertising or information will express a preference for younger people. All responses to employment ads will receive a reply. Applications must be completed by all prospective employees on forms approved by the Company’s attorney. Interviews will be fully documented and interviewer notes will be kept. Offers of employment must be in writing in an approved format. The employment contract will contain non-compete and non-disclosure provisions and will make no reference to probationary periods or suggest that employment is anything but “at will.” The company will develop and maintain an employees’ guide that will describe the company’s employment policies and practices. The guide, which will include all employment forms, will describe the Company’s sexual harassment prohibitions and complaint handling procedure.

Recruiting for employees will begin at the same time as construction. The president will use a word-of-mouth campaign among his network of friends and associates to solicit applicants. A more mature employee will be selected to serve as a shift manager, to help manage the operation with, or in substitution of, the president. This individual will help with such tasks as opening, closing, operations, and supervision of part-time workers.

Most of the part-time workers will be “on call.” This means that they will agree to respond within an hour to a call to report for duty. This gives the business the flexibility to staff-up in real-time so, as more patrons appear, more workers will be on duty. Operators of other video games centers report that this approach works well.

Finding employees for a video games business is relatively easy because so many of the people who are enamored of the game want to work in this environment. This means that the business usually will have a good number of applicants from which to choose. This also means that wages can be kept low and, due to their part-time status, few employee benefits are required. Most of the workers will be pleased to have the opportunity to play the video games as a supplement to their compensation.

5.4 Equipment Repair

Any equipment failures will be recorded on the Work Order Form. Authorized employees can attempt repairs if the failure appears to be routine. The manager will be trained in basic level repairs. If the manager cannot complete the repair, the designated repair service for the failed equipment will be notified. The form will be kept in the pending Work Order Form file until repairs are completed and approved by the authorized manager. Upon approval, payment to the repair service will be made. Spare equipment will be kept on-hand for quick substitution if needed.

Market Analysis Summary

Laser Tag will be well located on Birch Road, a road that carries well over 30,000 vehicles per day. The College’s average student between the ages of 18-20 will provide Laser Tag with one of its prime customers. These students have a steady income and are lacking in entertainment venues in the MyTown area.

Size of Market

According to the MyTown Chamber of Commerce and Industry, 114,996 people reside within 58 square miles of the Big Mall shopping center. Based on the 2000 Census averages, 25,000 of these residents are ages 10 to 25, the age range for the typical individual customers. The typical laser tag customer is a 15-year-old boy who visits the video games center twice a month. Spending $20 during each visit, this teenager, who serves as the primary target market, accounts for about 60% of the center’s video games income and 50% of its video game income. Other customers include: young male video game players spending $20 a month and accounting for about 10% of the center’s video game revenue; corporate event coordinators who will generate 10% of total video games and video game revenue in their team building visits; mothers of the 6,682 area youths who celebrate their 9th through 14th birthday each month, who contribute 20% of the center’s laser tag revenue and 10% of its video game revenue; and the 6,459 18 to 21-year-old male walk-in customer who will spend enough to account for 10% of the center’s video games revenue and 20% of its video game revenue. Drawing on a base of 25,000 residents aged 10 to 25, the center needs fewer than 4% of these potential patrons in order to produce excellent profits.

Target Market

Laser tag Patron. While this plan identifies the laser tag customer as a typical 15-year-old, we know that younger people are the primary consumers of sports activities, including video games. There will be an aggressive plan to target the young adults between 16 to 20-years-old that are able to drive themselves to the facility. The MyTown community has an abundance of alcohol-related facilities that caters to the young students of the College. It is our belief that these young adults, and students would also become a typical laser tag patron.

6.1 Market Segmentation

Laser tag Patrons. Younger people are the primary consumers of sports activities, including laser tag. The typical customer is a 15-year-old boy who visits the laser tag center twice a month. This customer lives within 5 miles of the laser tag center, in a household with an income over $30,000 per year, and is driven to the site by his parents.

The teen spends $20 during each visit, which represents about 10% of the teen’s monthly disposable income. According to a survey conducted for the U.S. Bureau of Labor Statistics, American teenagers receive an average of $50 a week from their parents.

When the 15-year-old visits, he plays 2 laser tag games (at $5.75 each) and 17 video games (at 50 cents each), spending his entire $20.

This teenager, who serves as the primary target market, accounts for about 60% of the center’s laser tag income and 50% of its video game income. The remaining revenue is generated by a combination of video game patrons, party attendees, group participants, and the public (walk-ins).

Video Game Patron. The average video game patron, also 15 years old, visits the center 2 times per month, spending a total of $20 on 40 video game plays. This customer accounts for about 10% of video game revenue.

Party Patron. The typical party customer is a mother who reserves a birthday party room for her 10 year old son and 9 of his friends. The party attendees generate about 50% of the center’s laser tag revenue and 40% of its video game revenue. Other party prospects to be approached are people who are celebrating anniversaries, winning seasons, personal achievements, and other accomplishments.

Group Patron. The representative group patron is an event coordinator for a sales organization involved in team building. The members of this group account for nearly 10% of the center’s laser tag revenue and 10% of its video game revenue. Activity directors who are always looking for a site that provides their members with a place to meet and have fun will be regularly contacted. One of the key objectives of marketing to groups is to arrange group business during non-peak hours.

Public Patron. The usual walk-in is a 19 year old, who lives in an apartment with 2 roommates, who is taking advantage of a promotional coupon. These walk-ins generate about 10% of the center’s laser tag revenue and 20% of its video game revenue.

Each of these typical customers can be reached through marketing targeted at them. There are enough members of these market segments in MyTown to support the laser tag center.

| Market Analysis | |||||||

| Year 1 | Year 2 | Year 3 | Year 4 | Year 5 | |||

| Potential Customers | Growth | CAGR | |||||

| 10-14 year old | 7% | 5,813 | 6,220 | 6,655 | 7,121 | 7,619 | 7.00% |

| 15-17 year old | 6% | 3,325 | 3,525 | 3,737 | 3,961 | 4,199 | 6.01% |

| 18-21 year old | 5% | 3,339 | 3,506 | 3,681 | 3,865 | 4,058 | 5.00% |

| 22-34 year old | 6% | 12,781 | 13,548 | 14,361 | 15,223 | 16,136 | 6.00% |

| Total | 6.10% | 25,258 | 26,799 | 28,434 | 30,170 | 32,012 | 6.10% |

6.2 Target Market Segment Strategy

Laser Tag will be promoted in such a way as to maximize the efficiency of its advertising dollar. Laser Tag provides customer-tracking software to monitor key demographics. This enables a more efficient targeting of the local market. The computerized tracking will enable management to generate mailing lists to its customer base or any part — for example, customers who play an average of 6 or more times a month. Direct mail to these customers will prove to be extremely efficient revenue generators. Customer loyalty will be developed through Laser Tag’s unique Membership Programs. In addition to saving on daily rates, annual members get a membership card with a special coded button device containing a computer chip. The “button” gives them access to statistics on their personal performance history.

For hard-core “Zoneheads,” Laser Tag has the elite, Role-Playing Membership with programmable buttons. These buttons entitle the player to special game enhancements and records a code name of their choice such as Ultraman, Nemesis, etc… Laser Tag will be promoted as a facility to host birthday parties, office parties and events for groups such as the Boy Scouts and Girl Scouts. It is anticipated that groups will reserve the party room for two hours at a time. This will include snacks (pizza and soft-drinks, for example) and a game in the “Zone.” The management team has tentatively set the party room at a price of $ 10-15 per person, depending on the snacks and number of games to be played in the “Zone.” Other aspects of promotion, including Grand Opening strategies and league play are discussed in detail in Chapter V.

6.3 Service Business Analysis

There are few entertainment venues that will compete for the same target market as Laser Tag. Among the entertainment choices for youths are 1 roller-skating rink, 3 bowling centers, 5 movie theaters, a water park, and an outdoor paintball park.

6.4 Competition and Buying Patterns

The closest laser tag facility to MyTown is LaserTrek, a 45 minute one way drive. Other facilities closest to MyTown are LaserQuest and LazerXtreme, close to a 1 hour travel time one way. The laser tag centers charge $7.00 a game. There is little to no competition from these laser tag companies, due to the price and distance of their facilities from MyTown.

None of the bowling centers or the skating rink attempts to deliver an exciting entertainment experience to their youthful customers. The facilities and staff alike have a “here it is, take it or leave it” attitude. Laser Tag will easily compete with these businesses, with both competition and video games. Teens will find the Laser Tag environment more enticing and the staff trained to serve them as guests entitled to expect and enjoy a good entertainment value.

The movie theaters are likely the strongest competition for the youth dollar, throughout the year. Films are more popular than ever since Hollywood has become more capable of segmenting and serving its movie-going markets. The typical 15-year old male customer of Laser Tag is interested in action, sci-fi, comedies, high school, and coming of age movies, but avoids the dramas, love stories, and adult themes. The current film production schedule seems to be putting 3 movies a month onto the MyTown theater screens that appeal to the 15-year old males. Two of the theaters offer a video game arcade, one of which has old machines while the other is small in size.

One Water Park provides an alternative choice during the summer months, but it is little competition for the night-time entertainment.

The Arena Paintball Park could be a competitor for laser tag, but the focus by this business is on adult players. The owners’ market segments include present and former military personnel, along with avid gun enthusiasts. Few teens are seen at the Arena Paintball Park paintball events. It is an outdoor venue and business is dictated by the seasons. Another downfall to paintball is the fact that it stings when hit.

In the Hallowe’en season, a number of organizations offer haunted houses, as Laser Tag plans to do. Most of these facilities are temporary, makeshift presentations that appeal to a wide range of young people. The Laser Tag haunted house will incorporate the existing, professionally-built arena with its safe lighting, sound, fog, and special effects systems and continue to appeal to its primary male teen market. Parents can be assured that the Laser Tag “house” is safe and well maintained. The Big Mall shopping center location is also more convenient than most of the competing houses.

Strategy and Implementation Summary

Customer service is paramount in the laser tag business. The starting point to accomplishing this is to have a trained and motivated staff that enjoys working directly with the public. It is always easier to please your customers when the facility is spotless and all of the equipment is in proper working order. The center will establish community involvement to demonstrate how the business will contribute to a better quality of life. Community projects using the Laser Tag facility will be developed to help civic groups obtain their financial goals. School, church, and other groups will be welcomed for tours of Laser Tag.

7.1 Competitive Edge

Our competitive edge is that Laser Tag will be the ONLY laser tag facility within 50 miles. Makoto will also offer the community a unique new form of entertainment that will also only be found at Laser Tag. The fact that there are no Family Entertainment Centers in MyTown will give us the unparalleled ability to draw on the overall family entertainment and not just birthday party events.

7.2 Marketing Strategy

Grand Opening

Prior to actually opening for business, the principals will invite the local media (print, radio and television) to assemble their own teams to enter a competition of King of Laser Tag. This competition will serve several purposes. The media will naturally cover the event. Their enthusiasm for the game will carry over into advertising done on radio, especially when tied to a live remote broadcast. In order to assure that the actual Grand Opening gathers the desired attention of the community, the plan calls for $5,000 to be spent on advertising for a two-week period before the Grand Opening. Laser Tag will work with the radio stations to be sure that it has live remotes going on during the Grand Opening. We will seek promotional trade consideration with the radio stations, whereby patrons will receive gifts for playing. For example, the first 25 players will receive tickets to see the movie of their choice. The next 25 will receive a free 6″ sub from Subway. These types of promotional trades are routinely done in the local market. Laser Tag will take advantage of these inexpensive ways to get its name out in the community.

Laser Tag will also take advantage of a marketing package that is provided by Zone Systems, the supplier of the laser tag equipment. This package describes the steps to take to assure that a well-executed grand opening program will leverage publicity to obtain extensive free advertising. The approach is to exploit the media’s interest in new and novel businesses. A key objective is arranging live coverage by a TV news show in which representative targeted customers are interviewed while they are enjoying the excitement.

Ongoing Marketing

Word of mouth (WOM) spreads fast in the youth market. The grand opening will launch WOM within this market. Managing the ongoing word-of-mouth advertising campaign will involve rewarding players for bringing in friends (with coupons), but the most effective approach is to keep the game exciting and the staff responsive to the patrons. Keeping the games interesting requires that the arena be regularly rearranged so that players discover new features (and hiding places). Keeping the staff responsive requires ongoing staff reminder training that emphasizes their key role in the customer’s entertainment experience.

$5,000 a month is budgeted for ongoing marketing activities that are aimed at the target market. In addition to the dozens of various printing forms (coupons, passes, flyers) available on CD-ROM from Zone Systems, this equipment supplier also provides access to low-cost mail and e-mail lists than can be used to reach the identified target markets. Marketing Creations, Inc., of MyTown will assist with “guerrilla marketing” strategies provided by Zone Systems that are aimed at generating business such as –

- Birthday and other parties in the planned party room followed by reserved playing times in the “Zone”.

- Enlisting the support and cross promotion of popular fast food outlets.

- Engaging the business community in endorsing competitive events.

- Building leagues and growing tournament excitement.

- Winning the cooperation of schools, charities, and other organizations.

- Building Corporate sponsorships.

- Donating games and time to special groups such as children with terminal illnesses and persons with disabilities.

By maintaining a constant presence in the community through league play and parties in the party room, the complex will assure itself of establishing a loyal following. Games and time donated to terminally ill children and others is part of the principals’ belief in their social responsibility. The donation of the party room and game time to disabled children and other worthy groups is not being done with any ulterior motive. The principals believe that people in the community will recognize their actions and be quick to tell others about the good deeds. The kind words said about Laser Tag will help establish itself as a positive force in the community.

Group Patron. Direct mail and broadcast faxes are the preferred means to reach the typical corporate event coordinator. The usual offer is to host team-building parties during which the attendees play laser tag games together. Sports, schools, and other organizations will join the corporate groups to participate with Laser Tag each month.

Public Patron. The “pizza pass” promotion works well to attract the walk-in patron. Arrangements are made with local pizza outlets to attach the Laser Tag coupon to the outside of pizza delivery boxes. When redeemed, a portion of the discounted price is shared with the pizza firm.

The advertising and promotional efforts are projected to draw over 750 people a month from outside the MyTown metropolitan area, drawing on the population of over 56,000 in the eight-county Retail Trade Area.

7.3 Web Plan Summary

Laser Tag’s website will be a resource/information-only area to help build our professional legitimacy.

7.4 Sales Strategy

Laser Tag will provide a venue in which the entire family can enjoy their leisure time, participating in a competitive sport that requires minimum strength and athletic ability. The light exercise will help improve their health, and they will experience a clean facility where the service is the best in the industry, at a fair price.

The management team has determined that the average price being charged for a game at existing laser tag locations is $6.30 per player. In addition, a day’s membership costs an additional $2.33, on average. We will initially set our game prices at $5.50 per player; the average price will be $5 a game, after coupons and specials. This will be a competitive price for the MyTown, Ohio community. Annual membership fees will be $48.00. A $1.00-off discount coupons will be offered through Laser Tag for player members. The average membership fee is the result of an anticipated repeat play by the customers on any given day. The basis for this number was the history of existing laser tag locations in the country.

Peripherals. Video game prices will be set so as to be consistent with the competition. Their range will generally be $0.50 per game. Soft drinks and snacks will be offered behind the counter. Their price will be consistent with area prices and will generally range from $0.50 to $0.75 per item. Laser Tag souvenirs will include t-shirts, sweatshirts, caps, mugs . . . All will include the Laser Tag logo. These are expected to range in price from $7.95 to $29.95. Makoto will be $1.00 for a 2 minute period of play.

7.5 Sales Forecast

The chart and table below show Laser Tag’s projected Sales Forecast. Annual projections for five years are shown here, with first year monthly figures in the appendices.

Laser Tag Revenue Assumptions: Each paid admission or price per game is $5.50. This amount will be occasionally reduced through the use of promotional coupons, quantity discounts, and party package offers. The average price of $5.00 is used in the forecast of sales and revenue.

20 players can plan in the arena at a time. The game, called a mission, lasts for 12 minutes. Allowing time for players to exit the arena, a new mission is possible every 15 minutes. This means that, ideally, maximum revenue per hour could reach $440.

We assume that on an average day, 14 missions will be run with an average of 12 players each. In fact, the weekends will produce the greatest activity and the number of games and players will regularly exceed this average.

Peripherial Revenue Assumptions: 20 video games and pinball machines will be obtained. An average of 10% of capacity at 2 plays an hour are used to estimate potential revenue. $.50 per play is used for sales forecasting, although some machines cost more than $.50 to play. Assuming that each game lasts 3 minutes, 20 games per hour could be played, generating $10.00 in revenue per machine. The maximum revenue for the 20 machines would be $200. A revenue-sharing arrangement will be worked out with a video game distributor who will provide the games. A typical arrangement of 50% for the laser tag center and 50% for the game owner is assumed for these projections. A 5% increase in sales is used for annual projections.

Makoto will generate a separate customer base interested in a new form of entertainment. We assume that Makoto will run at 30% capacity. At $1.00 for 2 minutes, this will average to 15 minutes of play time per day. Maximum potential for Makoto is $177 a day. A 20% increase in sales is used for annual projections due to the uniqueness of this venue.

Soft drinks and snacks were calculated at 10% of total laser tag sales with purchases at $0.75. A 5% increase in sales is used for annual projections.

The following laser tag industry statistics have been compiled by the International Laser Tag Association (ILTA). Laser tag games have been broken down to an overall average and reduced to single months. Increases in sales by approximately 20% from the previous month generally occur for the months of March, August, and December. Decreases in sales by approximately 20% from the previous month generally occur for the months of January, May, and September.

These averages were compiled based on various sources including hundreds of interviews with site operators, surveys by VCI, surveys by the ILTA, and information provided by the manufacturers. All information is believed to be accurate and factual; however, there is no independent way to either confirm or deny the validity to the average plays provided. All numbers should be valid for the purpose of this business plan though variations are quite probable.

On the Second Year Income Statement, all numbers are reduced by at least 10% based on an Industry Trend. The first year sales are always the best sales of the facility due in part to the higher percentage of casual non-discounted customers, the second year sales are “respectable,” and the third year sales drop to approximately 80% of the first year sales.

The change in revenues can be attributed to a variety of factors including:

- In the first year, a new facility enjoys a significantly higher customer base of non-discounted games. The customers are more willing to pay full price once just to try the event if there are no discounts available.

- During the first year most operators have not developed or acquired a customer list for birthday parties, churches, or youth groups. Those groups often have a lower per game price.

- By Year 2, the facility operator has started to market to the Core Market and the casual walk-in traffic slightly diminishes.

The averages plays per month are as follows:

| Stand-Along Laser Tag Centers | 5,300 Plays |

| Family Entertainment Centers | 4,100 Plays |

| Skating Centers | 2,600 Plays |

| Bowling Centers | 200 Plays |

Based on this industry data, we assume that the first year will show higher than average laser tag plays due to the uniqueness of laser tag to the MyTown area, and will settle to normal levels once party patrons and members are established.

| Sales Forecast | |||||

| Year 1 | Year 2 | Year 3 | Year 4 | Year 5 | |

| Unit Sales | |||||

| Lasertag | 71,534 | 64,380 | 60,088 | 63,092 | 66,247 |

| Video Games | 89,280 | 93,744 | 98,431 | 103,352 | 108,520 |

| Makoto | 19,227 | 23,072 | 27,687 | 33,224 | 39,869 |

| Soft Drinks and Snacks | 7,086 | 7,440 | 7,812 | 8,202 | 8,613 |

| Souvenirs | 60 | 63 | 66 | 70 | 73 |

| Total Unit Sales | 187,187 | 188,699 | 194,084 | 207,940 | 223,322 |

| Unit Prices | Year 1 | Year 2 | Year 3 | Year 4 | Year 5 |

| Lasertag | $5.00 | $5.00 | $5.00 | $5.00 | $5.00 |

| Video Games | $0.50 | $0.50 | $0.50 | $0.50 | $0.50 |

| Makoto | $1.00 | $1.00 | $1.00 | $1.00 | $1.00 |

| Soft Drinks and Snacks | $0.75 | $0.75 | $0.75 | $0.75 | $0.75 |

| Souvenirs | $9.50 | $9.50 | $9.50 | $9.50 | $9.50 |

| Sales | |||||

| Lasertag | $357,670 | $321,900 | $300,440 | $315,460 | $331,235 |

| Video Games | $44,640 | $46,872 | $49,216 | $51,676 | $54,260 |

| Makoto | $19,227 | $23,072 | $27,687 | $33,224 | $39,869 |

| Soft Drinks and Snacks | $5,315 | $5,580 | $5,859 | $6,152 | $6,460 |

| Souvenirs | $570 | $599 | $627 | $665 | $694 |

| Total Sales | $427,422 | $398,023 | $383,829 | $407,177 | $432,517 |

| Direct Unit Costs | Year 1 | Year 2 | Year 3 | Year 4 | Year 5 |

| Lasertag | $0.50 | $0.50 | $0.50 | $0.50 | $0.50 |

| Video Games | $0.25 | $0.25 | $0.25 | $0.25 | $0.25 |

| Makoto | $0.10 | $0.10 | $0.10 | $0.10 | $0.10 |

| Soft Drinks and Snacks | $0.10 | $0.38 | $0.38 | $0.38 | $0.38 |

| Souvenirs | $7.13 | $7.13 | $7.13 | $7.13 | $7.13 |

| Direct Cost of Sales | |||||

| Lasertag | $35,767 | $32,190 | $30,044 | $31,546 | $33,124 |

| Video Games | $22,320 | $23,436 | $24,608 | $25,838 | $27,130 |

| Makoto | $1,923 | $2,307 | $2,769 | $3,322 | $3,987 |

| Soft Drinks and Snacks | $728 | $2,790 | $2,930 | $3,076 | $3,230 |

| Souvenirs | $428 | $449 | $470 | $499 | $520 |

| Subtotal Direct Cost of Sales | $61,165 | $61,172 | $60,820 | $64,281 | $67,990 |

Management Summary

Management Team

John Smith, who will serve as the chairman and president of the Laser Tag board of directors and will manage the company’s daily operations. Mr. Smith is also a member of the International Laser Tag Association, a nonprofit group developed by experienced industry personnel that is dedicated to assisting with the successful operations of separate facilities world wide.

Board of Directors

In addition to John Smith, one other person has agreed to serve on the Laser Tag board of directors: Barry Stir. Barry Stir is an Attorney at law and has a background in accounting. His office is located on “D” Ave in MyTown. He is also a co-owner in an Internet company in MyTown.

Chairman

John Smith is a 20-year U.S. Army veteran with excellent management skills, who is well-qualified to run the Laser Tag. He has held a number of management positions and has been responsible for the professional development of numerous personnel and accountable for in excess of $11 million in military equipment. He served in the plans and operations section while in the military and has put together and executed various training and evaluation outlines. Mr. Smith has significant experience working with patrons and employees of entertainment businesses while opening and operating two low point beverage entertainment facilities in Small Town and Rural Town, Ohio. In addition to the entertainment experience, he has extensive experience with laser-based systems with the U.S. Army’s combat training, Military Integrated Laser Engagement System (MILES). MILES is a system the Army uses for war games.

Employees

Laser Tag will employ 7 people. The president will be the only full-time employee and 6 others will be part-time. One part-time worker will serve as a shift manager. All employees will be selected on the basis of their ability to work with young patrons. All employees will be expected to sign a non-disclosure and non-compete agreement.

8.1 Personnel Plan

The personnel plan will be as follows:

- One general manager to oversee shift manager and fill-in for all areas. The president of the corporation will fill the general manager position.

- One shift manager/leader to conduct opening, closing, operations, greet customers, receive payments for services/products, event planning, equipment checks, and schedule arena events.

Five part time employees will attend to arena supervision, and keep area clean. All three will work part time to ensure the facility has a full staff in case of an unanticipated event.

The following professionals have agreed to help Laser Tag:

[Proprietary and confidential information removed.]

| Personnel Plan | |||||

| Year 1 | Year 2 | Year 3 | Year 4 | Year 5 | |

| General Manager | $18,000 | $20,000 | $25,000 | $30,000 | $35,000 |

| Shift Manager | $17,316 | $18,500 | $19,500 | $20,500 | $21,500 |

| Laser Tag attendants | $21,460 | $19,314 | $18,026 | $18,928 | $19,874 |

| Arcade attendants | $19,195 | $20,155 | $21,163 | $22,221 | $23,332 |

| Total People | 7 | 7 | 7 | 7 | 7 |

| Total Payroll | $75,971 | $77,969 | $83,689 | $91,648 | $99,706 |

Financial Plan

The premier element in our financial plan is initiating, maintaining, and improving the factors that create, stabilize, and increase our cash flow:

- We must create visibility so as to create customer flow.

- We must ensure the theme creates a “WOW” effect to bolster attendance.

- We must maintain a dependable, cheerful employee force so as to minimize turnover.

9.1 Start-up Funding

Total start-up requirements come to $111,844. The start-up costs are to be financed partially by the direct owner investment of $27,000 and financing in the amount of $84,844. The details are included in the following table.

| Start-up Funding | |

| Start-up Expenses to Fund | $50,097 |

| Start-up Assets to Fund | $61,747 |

| Total Funding Required | $111,844 |

| Assets | |

| Non-cash Assets from Start-up | $51,747 |

| Cash Requirements from Start-up | $10,000 |

| Additional Cash Raised | $0 |

| Cash Balance on Starting Date | $10,000 |

| Total Assets | $61,747 |

| Liabilities and Capital | |

| Liabilities | |

| Current Borrowing | $0 |

| Long-term Liabilities | $84,844 |

| Accounts Payable (Outstanding Bills) | $0 |

| Other Current Liabilities (interest-free) | $0 |

| Total Liabilities | $84,844 |

| Capital | |

| Planned Investment | |

| Owner | $27,000 |

| Investor | $0 |

| Additional Investment Requirement | $0 |

| Total Planned Investment | $27,000 |

| Loss at Start-up (Start-up Expenses) | ($50,097) |

| Total Capital | ($23,097) |

| Total Capital and Liabilities | $61,747 |

| Total Funding | $111,844 |

9.2 Important Assumptions

The key underlying assumptions of our financial plan shown in the following general assumption table are:

- We assume access to equity capital and financing to support our financial plan.

- We assume our financial progress based on realistic sales to minimum sales against highest expenses.

- We assume there will not be an economic crash that would greatly hinder our target market’s access to their personal luxury finds.

| General Assumptions | |||||

| Year 1 | Year 2 | Year 3 | Year 4 | Year 5 | |

| Plan Month | 1 | 2 | 3 | 4 | 5 |

| Current Interest Rate | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% |

| Long-term Interest Rate | 11.00% | 11.00% | 11.00% | 11.00% | 11.00% |

| Tax Rate | 30.00% | 30.00% | 30.00% | 30.00% | 30.00% |

| Other | 0 | 0 | 0 | 0 | 0 |

9.3 Break-even Analysis

Our break-even analysis is shown below.

| Break-even Analysis | |

| Monthly Units Break-even | 9,876 |

| Monthly Revenue Break-even | $22,551 |

| Assumptions: | |

| Average Per-Unit Revenue | $2.28 |

| Average Per-Unit Variable Cost | $0.33 |

| Estimated Monthly Fixed Cost | $19,324 |

9.4 Projected Profit and Loss

The company will make a profit early on. There are two important assumptions with our Projected Profit and Loss statement:

- Our revenue is based on minimum estimated averages against highest expense expectations.

- Our major expense of rent and utilities is fixed for the next five years.

The yearly analysis is indicated in the table below; monthly analyses can be found in the appendix.

| Pro Forma Profit and Loss | |||||

| Year 1 | Year 2 | Year 3 | Year 4 | Year 5 | |

| Sales | $427,422 | $398,023 | $383,829 | $407,177 | $432,517 |

| Direct Cost of Sales | $61,165 | $61,172 | $60,820 | $64,281 | $67,990 |

| Other Costs of Sales | $0 | $0 | $0 | $0 | $0 |

| Total Cost of Sales | $61,165 | $61,172 | $60,820 | $64,281 | $67,990 |

| Gross Margin | $366,256 | $336,850 | $323,008 | $342,896 | $364,527 |

| Gross Margin % | 85.69% | 84.63% | 84.15% | 84.21% | 84.28% |

| Expenses | |||||

| Payroll | $75,971 | $77,969 | $83,689 | $91,648 | $99,706 |

| Marketing/Promotion | $60,000 | $62,000 | $63,000 | $65,000 | $66,000 |

| Depreciation | $5,875 | $5,875 | $5,875 | $5,875 | $5,875 |

| Rent | $57,600 | $57,600 | $57,600 | $57,600 | $57,600 |

| Utilities | $7,340 | $8,000 | $8,200 | $8,400 | $8,600 |

| Insurance | $10,944 | $10,944 | $10,944 | $10,944 | $10,944 |

| Professional Fees | $2,400 | $2,400 | $2,400 | $2,400 | $2,400 |

| Telephone | $2,040 | $2,100 | $2,150 | $2,200 | $2,250 |

| Supplies | $4,800 | $4,800 | $4,800 | $4,800 | $4,800 |

| Bank & Credit Card Fees | $1,320 | $1,320 | $1,320 | $1,320 | $1,320 |

| New Game Software | $0 | $10,000 | $15,000 | $10,000 | $0 |

| Miscellaneous | $3,600 | $3,600 | $3,600 | $3,600 | $3,600 |

| Total Operating Expenses | $231,890 | $246,608 | $258,578 | $263,787 | $263,095 |

| Profit Before Interest and Taxes | $134,366 | $90,242 | $64,430 | $79,108 | $101,432 |

| EBITDA | $140,241 | $96,117 | $70,305 | $84,983 | $107,307 |

| Interest Expense | $8,611 | $7,333 | $6,000 | $4,667 | $3,333 |

| Taxes Incurred | $37,726 | $24,873 | $17,529 | $22,333 | $29,430 |

| Net Profit | $88,028 | $58,037 | $40,901 | $52,109 | $68,669 |

| Net Profit/Sales | 20.60% | 14.58% | 10.66% | 12.80% | 15.88% |

9.5 Projected Cash Flow

The company’s estimated cash flow analysis is outlined in the following table. Laser Tag’s popularity will instantly show profitability, which will ensure positive cash balance. The Cash Flow table also shows planned sales tax received and paid out, and the estimated repayment for the requested loan.

| Pro Forma Cash Flow | |||||

| Year 1 | Year 2 | Year 3 | Year 4 | Year 5 | |

| Cash Received | |||||

| Cash from Operations | |||||

| Cash Sales | $320,566 | $298,517 | $287,871 | $305,382 | $324,388 |

| Cash from Receivables | $96,929 | $100,188 | $96,287 | $101,252 | $107,541 |

| Subtotal Cash from Operations | $417,495 | $398,705 | $384,158 | $406,634 | $431,929 |

| Additional Cash Received | |||||

| Sales Tax, VAT, HST/GST Received | $0 | $0 | $0 | $0 | $0 |

| New Current Borrowing | $0 | $0 | $0 | $0 | $0 |

| New Other Liabilities (interest-free) | $0 | $0 | $0 | $0 | $0 |

| New Long-term Liabilities | $0 | $0 | $0 | $0 | $0 |

| Sales of Other Current Assets | $0 | $0 | $0 | $0 | $0 |

| Sales of Long-term Assets | $0 | $0 | $0 | $0 | $0 |

| New Investment Received | $0 | $0 | $0 | $0 | $0 |

| Subtotal Cash Received | $417,495 | $398,705 | $384,158 | $406,634 | $431,929 |

| Expenditures | Year 1 | Year 2 | Year 3 | Year 4 | Year 5 |

| Expenditures from Operations | |||||

| Cash Spending | $75,971 | $77,969 | $83,689 | $91,648 | $99,706 |

| Bill Payments | $237,732 | $257,787 | $253,576 | $257,359 | $258,396 |

| Subtotal Spent on Operations | $313,703 | $335,756 | $337,265 | $349,007 | $358,102 |

| Additional Cash Spent | |||||

| Sales Tax, VAT, HST/GST Paid Out | $0 | $0 | $0 | $0 | $0 |

| Principal Repayment of Current Borrowing | $0 | $0 | $0 | $0 | $0 |

| Other Liabilities Principal Repayment | $0 | $0 | $0 | $0 | $0 |

| Long-term Liabilities Principal Repayment | $12,120 | $12,120 | $12,120 | $12,120 | $12,120 |

| Purchase Other Current Assets | $0 | $0 | $0 | $0 | $0 |

| Purchase Long-term Assets | $0 | $0 | $0 | $0 | $0 |

| Dividends | $0 | $0 | $0 | $0 | $0 |

| Subtotal Cash Spent | $325,823 | $347,876 | $349,385 | $361,127 | $370,222 |

| Net Cash Flow | $91,672 | $50,829 | $34,773 | $45,507 | $61,707 |

| Cash Balance | $101,672 | $152,501 | $187,274 | $232,781 | $294,487 |

9.6 Projected Balance Sheet

The table below presents the balance sheet for Laser Tag. This table reflects a positive cash position throughout the period of this financial plan and dramatic growth in net worth.

| Pro Forma Balance Sheet | |||||

| Year 1 | Year 2 | Year 3 | Year 4 | Year 5 | |

| Assets | |||||

| Current Assets | |||||

| Cash | $101,672 | $152,501 | $187,274 | $232,781 | $294,487 |

| Accounts Receivable | $9,926 | $9,244 | $8,914 | $9,456 | $10,045 |

| Inventory | $2,883 | $2,883 | $2,867 | $3,041 | $3,230 |

| Other Current Assets | $4,480 | $4,480 | $4,480 | $4,480 | $4,480 |

| Total Current Assets | $118,961 | $169,108 | $203,534 | $249,758 | $312,243 |

| Long-term Assets | |||||

| Long-term Assets | $47,267 | $47,267 | $47,267 | $47,267 | $47,267 |

| Accumulated Depreciation | $5,875 | $11,750 | $17,625 | $23,500 | $29,375 |

| Total Long-term Assets | $41,392 | $35,517 | $29,642 | $23,767 | $17,892 |

| Total Assets | $160,353 | $204,625 | $233,176 | $273,525 | $330,134 |

| Liabilities and Capital | Year 1 | Year 2 | Year 3 | Year 4 | Year 5 |

| Current Liabilities | |||||

| Accounts Payable | $22,698 | $21,053 | $20,823 | $21,182 | $21,243 |

| Current Borrowing | $0 | $0 | $0 | $0 | $0 |

| Other Current Liabilities | $0 | $0 | $0 | $0 | $0 |

| Subtotal Current Liabilities | $22,698 | $21,053 | $20,823 | $21,182 | $21,243 |

| Long-term Liabilities | $72,724 | $60,604 | $48,484 | $36,364 | $24,244 |

| Total Liabilities | $95,422 | $81,657 | $69,307 | $57,546 | $45,487 |

| Paid-in Capital | $27,000 | $27,000 | $27,000 | $27,000 | $27,000 |

| Retained Earnings | ($50,097) | $37,931 | $95,968 | $136,869 | $188,978 |

| Earnings | $88,028 | $58,037 | $40,901 | $52,109 | $68,669 |

| Total Capital | $64,931 | $122,968 | $163,869 | $215,978 | $284,647 |

| Total Liabilities and Capital | $160,353 | $204,625 | $233,176 | $273,525 | $330,134 |

| Net Worth | $64,931 | $122,968 | $163,869 | $215,978 | $284,647 |

9.7 Business Ratios

The company’s projected business ratios are provided in the table below. The final column, Industry Profile, shows significant ratios for the Amusement and Recreation industry for comparison, as determined by the Standard Industry Classification (SIC) code, 7999.

| Ratio Analysis | ||||||

| Year 1 | Year 2 | Year 3 | Year 4 | Year 5 | Industry Profile | |

| Sales Growth | 0.00% | -6.88% | -3.57% | 6.08% | 6.22% | 2.76% |

| Percent of Total Assets | ||||||

| Accounts Receivable | 6.19% | 4.52% | 3.82% | 3.46% | 3.04% | 4.27% |

| Inventory | 1.80% | 1.41% | 1.23% | 1.11% | 0.98% | 4.31% |

| Other Current Assets | 2.79% | 2.19% | 1.92% | 1.64% | 1.36% | 31.38% |

| Total Current Assets | 74.19% | 82.64% | 87.29% | 91.31% | 94.58% | 39.96% |

| Long-term Assets | 25.81% | 17.36% | 12.71% | 8.69% | 5.42% | 60.04% |

| Total Assets | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% |

| Current Liabilities | 14.15% | 10.29% | 8.93% | 7.74% | 6.43% | 23.98% |

| Long-term Liabilities | 45.35% | 29.62% | 20.79% | 13.29% | 7.34% | 24.53% |

| Total Liabilities | 59.51% | 39.91% | 29.72% | 21.04% | 13.78% | 48.51% |

| Net Worth | 40.49% | 60.09% | 70.28% | 78.96% | 86.22% | 51.49% |

| Percent of Sales | ||||||

| Sales | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% |

| Gross Margin | 85.69% | 84.63% | 84.15% | 84.21% | 84.28% | 100.00% |

| Selling, General & Administrative Expenses | 65.09% | 70.05% | 73.50% | 71.42% | 68.40% | 75.54% |

| Advertising Expenses | 1.37% | 0.00% | 0.00% | 0.00% | 0.00% | 3.11% |

| Profit Before Interest and Taxes | 31.44% | 22.67% | 16.79% | 19.43% | 23.45% | 1.52% |

| Main Ratios | ||||||

| Current | 5.24 | 8.03 | 9.77 | 11.79 | 14.70 | 1.04 |

| Quick | 5.11 | 7.90 | 9.64 | 11.65 | 14.55 | 0.68 |

| Total Debt to Total Assets | 59.51% | 39.91% | 29.72% | 21.04% | 13.78% | 64.79% |

| Pre-tax Return on Net Worth | 193.67% | 67.42% | 35.66% | 34.47% | 34.46% | 2.30% |

| Pre-tax Return on Assets | 78.42% | 40.52% | 25.06% | 27.22% | 29.71% | 6.54% |

| Additional Ratios | Year 1 | Year 2 | Year 3 | Year 4 | Year 5 | |

| Net Profit Margin | 20.60% | 14.58% | 10.66% | 12.80% | 15.88% | n.a |

| Return on Equity | 135.57% | 47.20% | 24.96% | 24.13% | 24.12% | n.a |

| Activity Ratios | ||||||

| Accounts Receivable Turnover | 10.76 | 10.76 | 10.76 | 10.76 | 10.76 | n.a |

| Collection Days | 29 | 35 | 35 | 33 | 33 | n.a |

| Inventory Turnover | 24.00 | 21.22 | 21.16 | 21.76 | 21.68 | n.a |

| Accounts Payable Turnover | 11.47 | 12.17 | 12.17 | 12.17 | 12.17 | n.a |

| Payment Days | 27 | 31 | 30 | 30 | 30 | n.a |

| Total Asset Turnover | 2.67 | 1.95 | 1.65 | 1.49 | 1.31 | n.a |

| Debt Ratios | ||||||

| Debt to Net Worth | 1.47 | 0.66 | 0.42 | 0.27 | 0.16 | n.a |

| Current Liab. to Liab. | 0.24 | 0.26 | 0.30 | 0.37 | 0.47 | n.a |

| Liquidity Ratios | ||||||

| Net Working Capital | $96,263 | $148,055 | $182,711 | $228,576 | $291,000 | n.a |

| Interest Coverage | 15.60 | 12.31 | 10.74 | 16.95 | 30.43 | n.a |

| Additional Ratios | ||||||

| Assets to Sales | 0.38 | 0.51 | 0.61 | 0.67 | 0.76 | n.a |

| Current Debt/Total Assets | 14% | 10% | 9% | 8% | 6% | n.a |

| Acid Test | 4.68 | 7.46 | 9.21 | 11.20 | 14.07 | n.a |

| Sales/Net Worth | 6.58 | 3.24 | 2.34 | 1.89 | 1.52 | n.a |

| Dividend Payout | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | n.a |

Appendix

| Sales Forecast | |||||||||||||

| Month 1 | Month 2 | Month 3 | Month 4 | Month 5 | Month 6 | Month 7 | Month 8 | Month 9 | Month 10 | Month 11 | Month 12 | ||

| Unit Sales | |||||||||||||

| Lasertag | 0% | 6,400 | 5,319 | 6,054 | 6,693 | 6,134 | 5,194 | 4,837 | 4,962 | 5,815 | 6,535 | 6,715 | 6,876 |

| Video Games | 0% | 8,345 | 8,973 | 8,076 | 7,806 | 7,537 | 7,178 | 6,550 | 5,832 | 5,832 | 6,999 | 8,076 | 8,076 |

| Makoto | 0% | 1,393 | 1,625 | 1,858 | 1,858 | 1,672 | 1,533 | 1,393 | 1,161 | 1,161 | 1,625 | 1,858 | 2,090 |

| Soft Drinks and Snacks | 0% | 656 | 547 | 609 | 662 | 550 | 591 | 537 | 508 | 518 | 590 | 651 | 667 |

| Souvenirs | 0% | 5 | 6 | 7 | 8 | 7 | 5 | 3 | 2 | 2 | 3 | 5 | 7 |

| Total Unit Sales | 16,799 | 16,470 | 16,604 | 17,027 | 15,900 | 14,501 | 13,320 | 12,465 | 13,328 | 15,752 | 17,305 | 17,716 | |

| Unit Prices | Month 1 | Month 2 | Month 3 | Month 4 | Month 5 | Month 6 | Month 7 | Month 8 | Month 9 | Month 10 | Month 11 | Month 12 | |

| Lasertag | $5.00 | $5.00 | $5.00 | $5.00 | $5.00 | $5.00 | $5.00 | $5.00 | $5.00 | $5.00 | $5.00 | $5.00 | |

| Video Games | $0.50 | $0.50 | $0.50 | $0.50 | $0.50 | $0.50 | $0.50 | $0.50 | $0.50 | $0.50 | $0.50 | $0.50 | |

| Makoto | $1.00 | $1.00 | $1.00 | $1.00 | $1.00 | $1.00 | $1.00 | $1.00 | $1.00 | $1.00 | $1.00 | $1.00 | |

| Soft Drinks and Snacks | $0.75 | $0.75 | $0.75 | $0.75 | $0.75 | $0.75 | $0.75 | $0.75 | $0.75 | $0.75 | $0.75 | $0.75 | |

| Souvenirs | $9.50 | $9.50 | $9.50 | $9.50 | $9.50 | $9.50 | $9.50 | $9.50 | $9.50 | $9.50 | $9.50 | $9.50 | |

| Sales | |||||||||||||

| Lasertag | $32,000 | $26,595 | $30,270 | $33,465 | $30,670 | $25,970 | $24,185 | $24,810 | $29,075 | $32,675 | $33,575 | $34,380 | |

| Video Games | $4,173 | $4,487 | $4,038 | $3,903 | $3,769 | $3,589 | $3,275 | $2,916 | $2,916 | $3,500 | $4,038 | $4,038 | |

| Makoto | $1,393 | $1,625 | $1,858 | $1,858 | $1,672 | $1,533 | $1,393 | $1,161 | $1,161 | $1,625 | $1,858 | $2,090 | |

| Soft Drinks and Snacks | $492 | $410 | $457 | $497 | $413 | $443 | $403 | $381 | $389 | $443 | $488 | $500 | |

| Souvenirs | $48 | $57 | $67 | $76 | $67 | $48 | $29 | $19 | $19 | $29 | $48 | $67 | |

| Total Sales | $38,105 | $33,174 | $36,689 | $39,799 | $36,590 | $31,583 | $29,284 | $29,287 | $33,560 | $38,271 | $40,007 | $41,075 | |

| Direct Unit Costs | Month 1 | Month 2 | Month 3 | Month 4 | Month 5 | Month 6 | Month 7 | Month 8 | Month 9 | Month 10 | Month 11 | Month 12 | |

| Lasertag | 10.00% | $0.50 | $0.50 | $0.50 | $0.50 | $0.50 | $0.50 | $0.50 | $0.50 | $0.50 | $0.50 | $0.50 | $0.50 |

| Video Games | 50.00% | $0.25 | $0.25 | $0.25 | $0.25 | $0.25 | $0.25 | $0.25 | $0.25 | $0.25 | $0.25 | $0.25 | $0.25 |

| Makoto | 10.00% | $0.10 | $0.10 | $0.10 | $0.10 | $0.10 | $0.10 | $0.10 | $0.10 | $0.10 | $0.10 | $0.10 | $0.10 |

| Soft Drinks and Snacks | 50.00% | $0.38 | $0.08 | $0.08 | $0.08 | $0.08 | $0.08 | $0.08 | $0.08 | $0.08 | $0.08 | $0.08 | $0.08 |

| Souvenirs | 75.00% | $7.13 | $7.13 | $7.13 | $7.13 | $7.13 | $7.13 | $7.13 | $7.13 | $7.13 | $7.13 | $7.13 | $7.13 |

| Direct Cost of Sales | |||||||||||||

| Lasertag | $3,200 | $2,660 | $3,027 | $3,347 | $3,067 | $2,597 | $2,419 | $2,481 | $2,908 | $3,268 | $3,358 | $3,438 | |

| Video Games | $2,086 | $2,243 | $2,019 | $1,952 | $1,884 | $1,795 | $1,638 | $1,458 | $1,458 | $1,750 | $2,019 | $2,019 | |

| Makoto | $139 | $163 | $186 | $186 | $167 | $153 | $139 | $116 | $116 | $163 | $186 | $209 | |

| Soft Drinks and Snacks | $246 | $41 | $46 | $50 | $41 | $44 | $40 | $38 | $39 | $44 | $49 | $50 | |

| Souvenirs | $36 | $43 | $50 | $57 | $50 | $36 | $21 | $14 | $14 | $21 | $36 | $50 | |

| Subtotal Direct Cost of Sales | $5,707 | $5,149 | $5,327 | $5,590 | $5,210 | $4,625 | $4,257 | $4,107 | $4,535 | $5,245 | $5,647 | $5,766 | |

| Personnel Plan | |||||||||||||

| Month 1 | Month 2 | Month 3 | Month 4 | Month 5 | Month 6 | Month 7 | Month 8 | Month 9 | Month 10 | Month 11 | Month 12 | ||

| General Manager | 50% | $1,500 | $1,500 | $1,500 | $1,500 | $1,500 | $1,500 | $1,500 | $1,500 | $1,500 | $1,500 | $1,500 | $1,500 |

| Shift Manager | 0% | $1,443 | $1,443 | $1,443 | $1,443 | $1,443 | $1,443 | $1,443 | $1,443 | $1,443 | $1,443 | $1,443 | $1,443 |

| Laser Tag attendants | 6% | $1,920 | $1,596 | $1,816 | $2,008 | $1,840 | $1,558 | $1,451 | $1,489 | $1,745 | $1,961 | $2,015 | $2,063 |

| Arcade attendants | 43% | $1,794 | $1,929 | $1,736 | $1,678 | $1,620 | $1,543 | $1,408 | $1,254 | $1,254 | $1,505 | $1,736 | $1,736 |

| Total People | 7 | 7 | 7 | 7 | 7 | 7 | 7 | 7 | 7 | 7 | 7 | 7 | |

| Total Payroll | $6,657 | $6,468 | $6,496 | $6,629 | $6,404 | $6,044 | $5,802 | $5,685 | $5,941 | $6,408 | $6,694 | $6,742 | |

| Pro Forma Profit and Loss | |||||||||||||

| Month 1 | Month 2 | Month 3 | Month 4 | Month 5 | Month 6 | Month 7 | Month 8 | Month 9 | Month 10 | Month 11 | Month 12 | ||

| Sales | $38,105 | $33,174 | $36,689 | $39,799 | $36,590 | $31,583 | $29,284 | $29,287 | $33,560 | $38,271 | $40,007 | $41,075 | |

| Direct Cost of Sales | $5,707 | $5,149 | $5,327 | $5,590 | $5,210 | $4,625 | $4,257 | $4,107 | $4,535 | $5,245 | $5,647 | $5,766 | |

| Other Costs of Sales | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Total Cost of Sales | $5,707 | $5,149 | $5,327 | $5,590 | $5,210 | $4,625 | $4,257 | $4,107 | $4,535 | $5,245 | $5,647 | $5,766 | |

| Gross Margin | $32,398 | $28,025 | $31,362 | $34,208 | $31,380 | $26,958 | $25,027 | $25,180 | $29,025 | $33,025 | $34,360 | $35,309 | |

| Gross Margin % | 85.02% | 84.48% | 85.48% | 85.95% | 85.76% | 85.36% | 85.46% | 85.98% | 86.49% | 86.29% | 85.89% | 85.96% | |

| Expenses | |||||||||||||

| Payroll | $6,657 | $6,468 | $6,496 | $6,629 | $6,404 | $6,044 | $5,802 | $5,685 | $5,941 | $6,408 | $6,694 | $6,742 | |

| Marketing/Promotion | $5,000 | $5,000 | $5,000 | $5,000 | $5,000 | $5,000 | $5,000 | $5,000 | $5,000 | $5,000 | $5,000 | $5,000 | |

| Depreciation | $490 | $490 | $490 | $490 | $490 | $490 | $490 | $490 | $490 | $490 | $490 | $490 | |

| Rent | $4,800 | $4,800 | $4,800 | $4,800 | $4,800 | $4,800 | $4,800 | $4,800 | $4,800 | $4,800 | $4,800 | $4,800 | |

| Utilities | $410 | $630 | $630 | $630 | $630 | $630 | $630 | $630 | $630 | $630 | $630 | $630 | |

| Insurance | $912 | $912 | $912 | $912 | $912 | $912 | $912 | $912 | $912 | $912 | $912 | $912 | |

| Professional Fees | $200 | $200 | $200 | $200 | $200 | $200 | $200 | $200 | $200 | $200 | $200 | $200 | |

| Telephone | $170 | $170 | $170 | $170 | $170 | $170 | $170 | $170 | $170 | $170 | $170 | $170 | |

| Supplies | $400 | $400 | $400 | $400 | $400 | $400 | $400 | $400 | $400 | $400 | $400 | $400 | |

| Bank & Credit Card Fees | $110 | $110 | $110 | $110 | $110 | $110 | $110 | $110 | $110 | $110 | $110 | $110 | |

| New Game Software | 15% | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| Miscellaneous | $300 | $300 | $300 | $300 | $300 | $300 | $300 | $300 | $300 | $300 | $300 | $300 | |

| Total Operating Expenses | $19,449 | $19,479 | $19,507 | $19,641 | $19,415 | $19,056 | $18,814 | $18,697 | $18,953 | $19,420 | $19,705 | $19,754 | |

| Profit Before Interest and Taxes | $12,949 | $8,545 | $11,855 | $14,567 | $11,965 | $7,902 | $6,213 | $6,482 | $10,072 | $13,605 | $14,655 | $15,555 | |

| EBITDA | $13,439 | $9,035 | $12,344 | $15,057 | $12,454 | $8,392 | $6,703 | $6,972 | $10,561 | $14,095 | $15,144 | $16,045 | |

| Interest Expense | $768 | $759 | $750 | $741 | $731 | $722 | $713 | $704 | $694 | $685 | $676 | $667 | |

| Taxes Incurred | $3,654 | $2,336 | $3,331 | $4,148 | $3,370 | $2,154 | $1,650 | $1,734 | $2,813 | $3,876 | $4,194 | $4,467 | |

| Net Profit | $8,526 | $5,450 | $7,773 | $9,679 | $7,863 | $5,026 | $3,850 | $4,045 | $6,564 | $9,044 | $9,785 | $10,422 | |

| Net Profit/Sales | 22.38% | 16.43% | 21.19% | 24.32% | 21.49% | 15.91% | 13.15% | 13.81% | 19.56% | 23.63% | 24.46% | 25.37% | |

| Pro Forma Cash Flow | |||||||||||||

| Month 1 | Month 2 | Month 3 | Month 4 | Month 5 | Month 6 | Month 7 | Month 8 | Month 9 | Month 10 | Month 11 | Month 12 | ||

| Cash Received | |||||||||||||

| Cash from Operations | |||||||||||||

| Cash Sales | $28,579 | $24,880 | $27,517 | $29,849 | $27,442 | $23,687 | $21,963 | $21,965 | $25,170 | $28,703 | $30,005 | $30,806 | |

| Cash from Receivables | $318 | $9,485 | $8,323 | $9,198 | $9,923 | $9,106 | $7,877 | $7,321 | $7,357 | $8,429 | $9,582 | $10,011 | |

| Subtotal Cash from Operations | $28,896 | $34,365 | $35,840 | $39,047 | $37,365 | $32,793 | $29,840 | $29,286 | $32,527 | $37,132 | $39,587 | $40,817 | |

| Additional Cash Received | |||||||||||||

| Sales Tax, VAT, HST/GST Received | 0.00% | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| New Current Borrowing | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| New Other Liabilities (interest-free) | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| New Long-term Liabilities | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Sales of Other Current Assets | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Sales of Long-term Assets | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| New Investment Received | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Subtotal Cash Received | $28,896 | $34,365 | $35,840 | $39,047 | $37,365 | $32,793 | $29,840 | $29,286 | $32,527 | $37,132 | $39,587 | $40,817 | |

| Expenditures | Month 1 | Month 2 | Month 3 | Month 4 | Month 5 | Month 6 | Month 7 | Month 8 | Month 9 | Month 10 | Month 11 | Month 12 | |

| Expenditures from Operations | |||||||||||||

| Cash Spending | $6,657 | $6,468 | $6,496 | $6,629 | $6,404 | $6,044 | $5,802 | $5,685 | $5,941 | $6,408 | $6,694 | $6,742 | |

| Bill Payments | $843 | $25,125 | $20,538 | $22,057 | $23,083 | $21,579 | $19,705 | $18,959 | $19,052 | $20,841 | $22,702 | $23,247 | |

| Subtotal Spent on Operations | $7,500 | $31,593 | $27,034 | $28,686 | $29,487 | $27,623 | $25,507 | $24,645 | $24,993 | $27,250 | $29,396 | $29,989 | |

| Additional Cash Spent | |||||||||||||

| Sales Tax, VAT, HST/GST Paid Out | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Principal Repayment of Current Borrowing | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Other Liabilities Principal Repayment | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Long-term Liabilities Principal Repayment | $1,010 | $1,010 | $1,010 | $1,010 | $1,010 | $1,010 | $1,010 | $1,010 | $1,010 | $1,010 | $1,010 | $1,010 | |

| Purchase Other Current Assets | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |