FireStarters

Executive Summary

Popular culture is no longer regional. The advent of cable television, syndicated radio programs, and the Internet has created a world where a fashion statement in New York will be on the streets in a small midwestern town in a matter days. The speed of our telecommunication system has increased young customers’ expectations and demands for products that represent their own cultural statement.

FireStarters will offer young customers, in small towns and communities around United States, the youth-oriented products and clothing that are popular nationwide but not available locally.

The difference between FireStarters and other youth-oriented e-commerce websites is that FireStarters is focused only on its small-town America customers. The target customer is a young person, age 11-18, who listens to alternative music and participates in youth sports like skateboarding and snowboarding. Our target customer will look toward alternative clothing trends in large urban areas as their inspiration. FireStarters will exclusively advertise in small communities with populations between 100,000 and 150,000 residents. Communities of this size already have small youth-oriented businesses, like skateboard shops and alternative CD stores, that FireStarters can utilize to promote its product line.

1.1 Mission

The mission of FireStarters is to offer distinctive youth-oriented fashion and products to small-town America.

1.2 Keys to Success

- Accessible website that is entertaining to surf. Like a trip to your favorite store where you always find something new that you want.

- Excellent vendor relationship that will facilitate quick shipment of orders.

- Establish an effective strategy for advertising in the communities’ youth-oriented businesses.

- Create a store image that our target customers sees as both attractive and trendy.

Company Summary

FireStarters will offer youth-oriented products and clothing, online, that are popular nationwide but not available locally. Jill Stranton and Bobbi Hanson, co-owners of FireStarters, will create a cost-effective operation that will quickly ship clothing and product purchases to the customer.

FireStarters will focus on marketing products to its target customers in small cities with populations between 100,000 and 150,000 residents. The key to marketing strategy will be staging events that will increase the visibility of the online store with the target customer base. We will use existing local businesses that serve the same target customer base to co-sponsor these events.

2.1 Company Ownership

Jill Stranton and Bobbi Hanson are the co-owners of FireStarters.

2.2 Start-up Summary

The start-up costs of FireStarters consists of product inventory, creating a promotion campaign and establishing its website. FireStarters is funding start up with owner investments and a long-term business loan.

| Start-up Funding | |

| Start-up Expenses to Fund | $155,400 |

| Start-up Assets to Fund | $194,600 |

| Total Funding Required | $350,000 |

| Assets | |

| Non-cash Assets from Start-up | $130,000 |

| Cash Requirements from Start-up | $64,600 |

| Additional Cash Raised | $0 |

| Cash Balance on Starting Date | $64,600 |

| Total Assets | $194,600 |

| Liabilities and Capital | |

| Liabilities | |

| Current Borrowing | $0 |

| Long-term Liabilities | $150,000 |

| Accounts Payable (Outstanding Bills) | $0 |

| Other Current Liabilities (interest-free) | $0 |

| Total Liabilities | $150,000 |

| Capital | |

| Planned Investment | |

| Jill Stranton | $100,000 |

| Bobbi Hanson | $100,000 |

| Additional Investment Requirement | $0 |

| Total Planned Investment | $200,000 |

| Loss at Start-up (Start-up Expenses) | ($155,400) |

| Total Capital | $44,600 |

| Total Capital and Liabilities | $194,600 |

| Total Funding | $350,000 |

| Start-up | |

| Requirements | |

| Start-up Expenses | |

| Legal | $2,000 |

| Stationery etc. | $400 |

| Website Development | $30,000 |

| Insurance | $1,000 |

| Rent | $2,000 |

| Marketing | $120,000 |

| Expensed Equipment | $0 |

| Other | $0 |

| Total Start-up Expenses | $155,400 |

| Start-up Assets | |

| Cash Required | $64,600 |

| Start-up Inventory | $80,000 |

| Other Current Assets | $0 |

| Long-term Assets | $50,000 |

| Total Assets | $194,600 |

| Total Requirements | $350,000 |

Products

FireStarters will offer young customers the following youth-oriented products and clothing:

- Shoes.

- Jackets.

- Sweaters.

- Shirts.

- Pants.

- Bags.

- Hats.

- T-Shirts.

- Dresses and skirts.

- Shorts.

- Eyewear.

- Time pieces.

Market Analysis Summary

According to the U.S. Census Bureau the population of teens (age 12-17), in 1999 was 23.4 million, which represents 8.6% of the total U.S. population. Teenagers influence $324 billion in spending annually, have $151 billion in disposable income, spend $24 billion annually, and will spend $1.2 billion online by 2002. Teens spend an average of $82 per week on entertainment, fashion, food, and technology. These young people dubbed “Generation Y” dominate almost all facets of popular culture and are the fastest-growing demographic under age 65.

Specialty youth clothing and products has grown into a billion dollar niche in the clothing industry. The popularity of the Internet with young people has been well documented and has generated the launching of a number of online stores by companies selling to that market segment. Most of these stores have retail outlets in large urban areas that serve as the promotional vehicles for online shopping.

The Internet is an accessible shopping tool for our target population. 64% of teens nationwide use the Net at home. The majority of teens, 55%, consider using the Internet better than watching TV. Families with teens are more likely to have Internet access than other households.

Online shopping by teenagers between 13 to 18 years in age is expected to total about $300 million this year (2000) and is accelerating at about twice the rate of online shopping by adults. By 2003, teenagers are expected to spend $2 billion annually online. By 2004, a clear majority of young consumers will shop online. The top five purchases made by teens [online], based on sales volume, are CDs/cassette tapes, clothing, books, computer software, toys and clothing.

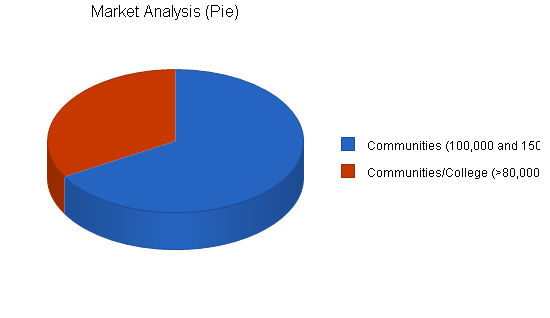

4.1 Market Segmentation

Over the past ten years, there has been a profound change in population dynamics in the U.S. The non-metropolitan population has been growing at almost the same rate as the urban population. The West Coast, Midwest, and the Northeast have the largest growth rate. Today, there are millions of young people who don’t live near a large urban center that offers the diversity in clothing products that the youth culture demands. This has created a small market niche for businesses to sell clothing and products to young people who live outside the urban areas. This is particularly true in communities with a major college located in the community.

Currently, only regional malls offer access to the fashion and styles that young people want. Unfortunately, the focus of these mall stores is only on the mainstream of the youth market. Alternative clothing and products are rarely available outside the urban area. This is true because the companies that create the clothing and products are small and sell primarily through urban specialty shops.

FireStarters will capitalize on the following characteristics of Generation Y:

- Subculture Affiliation: Though rebellious, teens also want to blend in and be accepted by peers. They seek a community of peers to welcome them in, as well as help them stand out.

- Attitude: Teenagers wear attitude like a uniform to give definition to their identity. This extends to clothing, hair style and the type of music listened to in public. They also react to humor, silliness, and irreverence more easily than to other styles.

It is FireStarters’ plan to bring alternative fashion and products to small-town America via the Internet. We will create a business identity that will capitalize on the subculture affiliation and attitude of our target customers.

FireStarters will focus marketing on two type of non-metropolitan communities:

- Non-metropolitan communities with populations between 100,000 and 150,000 residents.

- Non-metropolitan communities with a major college and population of at least 80,000.

| Market Analysis | |||||||

| Year 1 | Year 2 | Year 3 | Year 4 | Year 5 | |||

| Potential Customers | Growth | CAGR | |||||

| Communities (100,000 and 150,000) | 10% | 6,000 | 6,600 | 7,260 | 7,986 | 8,785 | 10.00% |

| Communities/College (>80,000) | 10% | 3,000 | 3,300 | 3,630 | 3,993 | 4,392 | 10.00% |

| Total | 10.00% | 9,000 | 9,900 | 10,890 | 11,979 | 13,177 | 10.00% |

Strategy and Implementation Summary

FireStarters’ will have a two track strategy.

- FireStarters will advertise in alternative magazines that are targeted at our customers and the ad rate is affordable. (For girls: Bust, Candy, Chick, and Girl magazines. For Boys: Thrashers and TransWorld.)

- FireStarters will also plan 15 events in select communities to raise its visibility with the target customers. The focus will be initially on the West Coast during the first year of operation. During the second year of operation, FireStarters will plan events in the Midwest and the East Coast. FireStarters will sponsor skateboard competitions and demonstrations. We will assemble groups of boy and girl skateboarders and sponsor them with the FireStarters logo. The groups will be scheduled to tour selected communities. FireStarters will sponsor the events but will also seek local businesses that target the same customer base to share the event’s sponsorship. FireStarters will book local popular alternative bands to play the event. At these events, FireStarters will distribute stickers, caps, t-shirts, and promotional material offering a 20% discount on purchases.

5.1 Competitive Edge

FireStarters’ competitive advantage is offering product lines that make a statement but won’t leave you broke. The major brands are expensive and not distinctive enough to satisfy the changing taste of our target customers. FireStarters offers products that are just ahead of the curve and so affordable that our customers will return to the website often to check out what’s new.

Another competitive factor is that products for this age group are part of a lifestyle statement. FireStarters is focused on serving youth outside the metropolitan areas. We want to represent their style and life choices. We believe that we will create a loyal customer base that will see Firestarters as part of their lives. To facilitate that connection, our website will have a chat section where our customers can share what is happening in their communities as well as comment on our products and what we should add to our product line in the future.

5.2 Sales Strategy

Sales will be flat for the first 45 days of operation. We anticipate that sales will begin at this point and increase as our marketing campaign progresses.

5.2.1 Sales Forecast

The following is the sales forecast for three years. First year monthly sales forecast is shown in the appendix.

| Sales Forecast | |||

| Year 1 | Year 2 | Year 3 | |

| Sales | |||

| Clothing | $209,000 | $280,000 | $340,000 |

| Shoes | $131,350 | $210,000 | $250,000 |

| Products | $55,300 | $120,000 | $160,000 |

| Total Sales | $395,650 | $610,000 | $750,000 |

| Direct Cost of Sales | Year 1 | Year 2 | Year 3 |

| Clothing | $63,000 | $90,000 | $110,000 |

| Shoes | $25,100 | $44,000 | $60,000 |

| Products | $12,640 | $30,000 | $40,000 |

| Subtotal Direct Cost of Sales | $100,740 | $164,000 | $210,000 |

Management Summary

Jill Stranton will manage the daily operations of FireStarters. Bobbi Hanson will be FireStarters’ buyer and will also be responsible for marketing. Jill and Bobbi have over fifteen years of experience in the retail clothing industry.

Jill has been the manager of Wild Women Clothing for five years. Wild Woman Clothing is a mail-order business that focuses on young urban women ages 18 to 35. She supervised a staff of 10 and was extremely effective in keeping the business cost effective as sales grew 50% over a two year period. Prior to her employment with Wild Woman Clothing, Jill was manager of Atomic Age Fashions, a women’s clothing shop, for three years.

Bobbi has been a buyer for Glamour Imports for the past four years. Glamour Imports sells to over 200 women’s shops nationwide and generated over 10 million in sales last year. In addition to her experience as a buyer, Bobbi was a marketing associate for Gap from 1994-1997.

6.1 Personnel Plan

FireStarters will have a staff of five:

- Operations manager.

- Buyer/marketing.

- Order processor/website manager.

- Processing staff (2).

| Personnel Plan | |||

| Year 1 | Year 2 | Year 3 | |

| Manager | $42,000 | $45,000 | $50,000 |

| Buyer/Marketing | $42,000 | $45,000 | $50,000 |

| Order Processor/Website Manager | $33,600 | $36,600 | $40,000 |

| Processing Staff (2) | $60,000 | $66,000 | $72,000 |

| Total People | 5 | 5 | 5 |

| Total Payroll | $177,600 | $192,600 | $212,000 |

Financial Plan

The following is the financial plan for FireStarters.

7.1 Break-even Analysis

The monthly break-even point, based on forecasted monthly expenses and costs, is shown in the table and chart below.

| Break-even Analysis | |

| Monthly Revenue Break-even | $27,657 |

| Assumptions: | |

| Average Percent Variable Cost | 25% |

| Estimated Monthly Fixed Cost | $20,615 |

7.2 Projected Profit and Loss

The following table and charts present the projected profit and loss for three years. First year monthlies are in the appendix.

| Pro Forma Profit and Loss | |||

| Year 1 | Year 2 | Year 3 | |

| Sales | $395,650 | $610,000 | $750,000 |

| Direct Cost of Sales | $100,740 | $164,000 | $210,000 |

| Other Production Expenses | $0 | $0 | $0 |

| Total Cost of Sales | $100,740 | $164,000 | $210,000 |

| Gross Margin | $294,910 | $446,000 | $540,000 |

| Gross Margin % | 74.54% | 73.11% | 72.00% |

| Expenses | |||

| Payroll | $177,600 | $192,600 | $212,000 |

| Sales and Marketing and Other Expenses | $0 | $130,000 | $150,000 |

| Depreciation | $7,140 | $7,140 | $7,140 |

| Leased Equipment | $0 | $0 | $0 |

| Utilities | $6,000 | $6,000 | $6,000 |

| Insurance | $6,000 | $6,000 | $6,000 |

| Rent | $24,000 | $24,000 | $24,000 |

| Payroll Taxes | $26,640 | $28,890 | $31,800 |

| Other | $0 | $0 | $0 |

| Total Operating Expenses | $247,380 | $394,630 | $436,940 |

| Profit Before Interest and Taxes | $47,530 | $51,370 | $103,060 |

| EBITDA | $54,670 | $58,510 | $110,200 |

| Interest Expense | $13,830 | $12,750 | $12,570 |

| Taxes Incurred | $10,110 | $11,586 | $27,147 |

| Net Profit | $23,590 | $27,034 | $63,343 |

| Net Profit/Sales | 5.96% | 4.43% | 8.45% |

7.3 Projected Cash Flow

The following table and chart is detail the projected cash flow for three years. The appendices include first year cash flow monthly estimates.

| Pro Forma Cash Flow | |||

| Year 1 | Year 2 | Year 3 | |

| Cash Received | |||

| Cash from Operations | |||

| Cash Sales | $395,650 | $610,000 | $750,000 |

| Subtotal Cash from Operations | $395,650 | $610,000 | $750,000 |

| Additional Cash Received | |||

| Sales Tax, VAT, HST/GST Received | $0 | $0 | $0 |

| New Current Borrowing | $0 | $0 | $0 |

| New Other Liabilities (interest-free) | $0 | $0 | $0 |

| New Long-term Liabilities | $0 | $0 | $0 |

| Sales of Other Current Assets | $0 | $0 | $0 |

| Sales of Long-term Assets | $0 | $0 | $0 |

| New Investment Received | $0 | $0 | $0 |

| Subtotal Cash Received | $395,650 | $610,000 | $750,000 |

| Expenditures | Year 1 | Year 2 | Year 3 |

| Expenditures from Operations | |||

| Cash Spending | $177,600 | $192,600 | $212,000 |

| Bill Payments | $103,957 | $364,975 | $463,540 |

| Subtotal Spent on Operations | $281,557 | $557,575 | $675,540 |

| Additional Cash Spent | |||

| Sales Tax, VAT, HST/GST Paid Out | $0 | $0 | $0 |

| Principal Repayment of Current Borrowing | $0 | $0 | $0 |

| Other Liabilities Principal Repayment | $0 | $0 | $0 |

| Long-term Liabilities Principal Repayment | $21,600 | $1,800 | $1,800 |

| Purchase Other Current Assets | $19,800 | $19,800 | $19,800 |

| Purchase Long-term Assets | $0 | $0 | $0 |

| Dividends | $0 | $0 | $0 |

| Subtotal Cash Spent | $322,957 | $579,175 | $697,140 |

| Net Cash Flow | $72,693 | $30,825 | $52,860 |

| Cash Balance | $137,293 | $168,118 | $220,978 |

7.4 Projected Balance Sheet

The following table shows the projected balance sheet for three years.

| Pro Forma Balance Sheet | |||

| Year 1 | Year 2 | Year 3 | |

| Assets | |||

| Current Assets | |||

| Cash | $137,293 | $168,118 | $220,978 |

| Inventory | $6,270 | $10,207 | $13,070 |

| Other Current Assets | $19,800 | $39,600 | $59,400 |

| Total Current Assets | $163,363 | $217,926 | $293,448 |

| Long-term Assets | |||

| Long-term Assets | $50,000 | $50,000 | $50,000 |

| Accumulated Depreciation | $7,140 | $14,280 | $21,420 |

| Total Long-term Assets | $42,860 | $35,720 | $28,580 |

| Total Assets | $206,223 | $253,646 | $322,028 |

| Liabilities and Capital | Year 1 | Year 2 | Year 3 |

| Current Liabilities | |||

| Accounts Payable | $9,633 | $31,822 | $38,661 |

| Current Borrowing | $0 | $0 | $0 |

| Other Current Liabilities | $0 | $0 | $0 |

| Subtotal Current Liabilities | $9,633 | $31,822 | $38,661 |

| Long-term Liabilities | $128,400 | $126,600 | $124,800 |

| Total Liabilities | $138,033 | $158,422 | $163,461 |

| Paid-in Capital | $200,000 | $200,000 | $200,000 |

| Retained Earnings | ($155,400) | ($131,810) | ($104,776) |

| Earnings | $23,590 | $27,034 | $63,343 |

| Total Capital | $68,190 | $95,224 | $158,567 |

| Total Liabilities and Capital | $206,223 | $253,646 | $322,028 |

| Net Worth | $68,190 | $95,224 | $158,567 |

7.5 Business Ratios

Business ratios for the years of this plan are shown below. Industry profile ratios based on the NAICS code 454111, Electronic Shopping, a subcategory of the Retail Trade, are shown for comparison.

| Ratio Analysis | ||||

| Year 1 | Year 2 | Year 3 | Industry Profile | |

| Sales Growth | 0.00% | 54.18% | 22.95% | 7.56% |

| Percent of Total Assets | ||||

| Inventory | 3.04% | 4.02% | 4.06% | 37.60% |

| Other Current Assets | 9.60% | 15.61% | 18.45% | 29.04% |

| Total Current Assets | 79.22% | 85.92% | 91.13% | 78.59% |

| Long-term Assets | 20.78% | 14.08% | 8.87% | 21.41% |

| Total Assets | 100.00% | 100.00% | 100.00% | 100.00% |

| Current Liabilities | 4.67% | 12.55% | 12.01% | 38.50% |

| Long-term Liabilities | 62.26% | 49.91% | 38.75% | 19.42% |

| Total Liabilities | 66.93% | 62.46% | 50.76% | 57.92% |

| Net Worth | 33.07% | 37.54% | 49.24% | 42.08% |

| Percent of Sales | ||||

| Sales | 100.00% | 100.00% | 100.00% | 100.00% |

| Gross Margin | 74.54% | 73.11% | 72.00% | 34.85% |

| Selling, General & Administrative Expenses | 68.58% | 68.68% | 63.55% | 16.95% |

| Advertising Expenses | 0.00% | 21.31% | 20.00% | 2.50% |

| Profit Before Interest and Taxes | 12.01% | 8.42% | 13.74% | 1.10% |

| Main Ratios | ||||

| Current | 16.96 | 6.85 | 7.59 | 1.79 |

| Quick | 16.31 | 6.53 | 7.25 | 0.70 |

| Total Debt to Total Assets | 66.93% | 62.46% | 50.76% | 65.04% |

| Pre-tax Return on Net Worth | 49.42% | 40.56% | 57.07% | 2.65% |

| Pre-tax Return on Assets | 16.34% | 15.23% | 28.10% | 7.59% |

| Additional Ratios | Year 1 | Year 2 | Year 3 | |

| Net Profit Margin | 5.96% | 4.43% | 8.45% | n.a |

| Return on Equity | 34.59% | 28.39% | 39.95% | n.a |

| Activity Ratios | ||||

| Inventory Turnover | 2.45 | 19.91 | 18.04 | n.a |

| Accounts Payable Turnover | 11.79 | 12.17 | 12.17 | n.a |

| Payment Days | 27 | 20 | 27 | n.a |

| Total Asset Turnover | 1.92 | 2.40 | 2.33 | n.a |

| Debt Ratios | ||||

| Debt to Net Worth | 2.02 | 1.66 | 1.03 | n.a |

| Current Liab. to Liab. | 0.07 | 0.20 | 0.24 | n.a |

| Liquidity Ratios | ||||

| Net Working Capital | $153,730 | $186,104 | $254,787 | n.a |

| Interest Coverage | 3.44 | 4.03 | 8.20 | n.a |

| Additional Ratios | ||||

| Assets to Sales | 0.52 | 0.42 | 0.43 | n.a |

| Current Debt/Total Assets | 5% | 13% | 12% | n.a |

| Acid Test | 16.31 | 6.53 | 7.25 | n.a |

| Sales/Net Worth | 5.80 | 6.41 | 4.73 | n.a |

| Dividend Payout | 0.00 | 0.00 | 0.00 | n.a |

Appendix

| Sales Forecast | |||||||||||||

| Month 1 | Month 2 | Month 3 | Month 4 | Month 5 | Month 6 | Month 7 | Month 8 | Month 9 | Month 10 | Month 11 | Month 12 | ||

| Sales | |||||||||||||

| Clothing | 0% | $0 | $8,000 | $10,000 | $21,000 | $24,000 | $26,000 | $17,000 | $25,000 | $30,000 | $30,000 | $10,000 | $8,000 |

| Shoes | 0% | $0 | $3,000 | $3,350 | $5,000 | $8,000 | $11,000 | $14,000 | $16,000 | $24,000 | $25,000 | $10,000 | $12,000 |

| Products | 0% | $0 | $1,500 | $1,800 | $2,000 | $4,000 | $6,000 | $5,000 | $7,000 | $13,000 | $4,000 | $5,000 | $6,000 |

| Total Sales | $0 | $12,500 | $15,150 | $28,000 | $36,000 | $43,000 | $36,000 | $48,000 | $67,000 | $59,000 | $25,000 | $26,000 | |

| Direct Cost of Sales | Month 1 | Month 2 | Month 3 | Month 4 | Month 5 | Month 6 | Month 7 | Month 8 | Month 9 | Month 10 | Month 11 | Month 12 | |

| Clothing | $0 | $3,000 | $4,000 | $5,000 | $6,000 | $7,000 | $5,000 | $7,000 | $10,000 | $10,000 | $4,000 | $2,000 | |

| Shoes | $0 | $1,000 | $1,200 | $1,000 | $1,500 | $2,000 | $3,000 | $4,000 | $5,200 | $2,000 | $2,000 | $2,200 | |

| Products | $0 | $400 | $500 | $600 | $1,000 | $1,500 | $1,250 | $1,800 | $2,000 | $890 | $1,200 | $1,500 | |

| Subtotal Direct Cost of Sales | $0 | $4,400 | $5,700 | $6,600 | $8,500 | $10,500 | $9,250 | $12,800 | $17,200 | $12,890 | $7,200 | $5,700 | |

| Personnel Plan | |||||||||||||

| Month 1 | Month 2 | Month 3 | Month 4 | Month 5 | Month 6 | Month 7 | Month 8 | Month 9 | Month 10 | Month 11 | Month 12 | ||

| Manager | 0% | $3,500 | $3,500 | $3,500 | $3,500 | $3,500 | $3,500 | $3,500 | $3,500 | $3,500 | $3,500 | $3,500 | $3,500 |

| Buyer/Marketing | 0% | $3,500 | $3,500 | $3,500 | $3,500 | $3,500 | $3,500 | $3,500 | $3,500 | $3,500 | $3,500 | $3,500 | $3,500 |

| Order Processor/Website Manager | 0% | $2,800 | $2,800 | $2,800 | $2,800 | $2,800 | $2,800 | $2,800 | $2,800 | $2,800 | $2,800 | $2,800 | $2,800 |

| Processing Staff (2) | 0% | $5,000 | $5,000 | $5,000 | $5,000 | $5,000 | $5,000 | $5,000 | $5,000 | $5,000 | $5,000 | $5,000 | $5,000 |

| Total People | 5 | 5 | 5 | 5 | 5 | 5 | 5 | 5 | 5 | 5 | 5 | 5 | |

| Total Payroll | $14,800 | $14,800 | $14,800 | $14,800 | $14,800 | $14,800 | $14,800 | $14,800 | $14,800 | $14,800 | $14,800 | $14,800 | |

| General Assumptions | |||||||||||||

| Month 1 | Month 2 | Month 3 | Month 4 | Month 5 | Month 6 | Month 7 | Month 8 | Month 9 | Month 10 | Month 11 | Month 12 | ||

| Plan Month | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 | 11 | 12 | |

| Current Interest Rate | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | |

| Long-term Interest Rate | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | |

| Tax Rate | 30.00% | 30.00% | 30.00% | 30.00% | 30.00% | 30.00% | 30.00% | 30.00% | 30.00% | 30.00% | 30.00% | 30.00% | |

| Other | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | |

| Pro Forma Profit and Loss | |||||||||||||

| Month 1 | Month 2 | Month 3 | Month 4 | Month 5 | Month 6 | Month 7 | Month 8 | Month 9 | Month 10 | Month 11 | Month 12 | ||

| Sales | $0 | $12,500 | $15,150 | $28,000 | $36,000 | $43,000 | $36,000 | $48,000 | $67,000 | $59,000 | $25,000 | $26,000 | |

| Direct Cost of Sales | $0 | $4,400 | $5,700 | $6,600 | $8,500 | $10,500 | $9,250 | $12,800 | $17,200 | $12,890 | $7,200 | $5,700 | |

| Other Production Expenses | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Total Cost of Sales | $0 | $4,400 | $5,700 | $6,600 | $8,500 | $10,500 | $9,250 | $12,800 | $17,200 | $12,890 | $7,200 | $5,700 | |

| Gross Margin | $0 | $8,100 | $9,450 | $21,400 | $27,500 | $32,500 | $26,750 | $35,200 | $49,800 | $46,110 | $17,800 | $20,300 | |

| Gross Margin % | 0.00% | 64.80% | 62.38% | 76.43% | 76.39% | 75.58% | 74.31% | 73.33% | 74.33% | 78.15% | 71.20% | 78.08% | |

| Expenses | |||||||||||||

| Payroll | $14,800 | $14,800 | $14,800 | $14,800 | $14,800 | $14,800 | $14,800 | $14,800 | $14,800 | $14,800 | $14,800 | $14,800 | |

| Sales and Marketing and Other Expenses | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Depreciation | $595 | $595 | $595 | $595 | $595 | $595 | $595 | $595 | $595 | $595 | $595 | $595 | |

| Leased Equipment | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Utilities | $500 | $500 | $500 | $500 | $500 | $500 | $500 | $500 | $500 | $500 | $500 | $500 | |

| Insurance | $500 | $500 | $500 | $500 | $500 | $500 | $500 | $500 | $500 | $500 | $500 | $500 | |

| Rent | $2,000 | $2,000 | $2,000 | $2,000 | $2,000 | $2,000 | $2,000 | $2,000 | $2,000 | $2,000 | $2,000 | $2,000 | |

| Payroll Taxes | 15% | $2,220 | $2,220 | $2,220 | $2,220 | $2,220 | $2,220 | $2,220 | $2,220 | $2,220 | $2,220 | $2,220 | $2,220 |

| Other | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Total Operating Expenses | $20,615 | $20,615 | $20,615 | $20,615 | $20,615 | $20,615 | $20,615 | $20,615 | $20,615 | $20,615 | $20,615 | $20,615 | |

| Profit Before Interest and Taxes | ($20,615) | ($12,515) | ($11,165) | $785 | $6,885 | $11,885 | $6,135 | $14,585 | $29,185 | $25,495 | ($2,815) | ($315) | |

| EBITDA | ($20,020) | ($11,920) | ($10,570) | $1,380 | $7,480 | $12,480 | $6,730 | $15,180 | $29,780 | $26,090 | ($2,220) | $280 | |

| Interest Expense | $1,235 | $1,220 | $1,205 | $1,190 | $1,175 | $1,160 | $1,145 | $1,130 | $1,115 | $1,100 | $1,085 | $1,070 | |

| Taxes Incurred | ($6,555) | ($4,121) | ($3,711) | ($122) | $1,713 | $3,218 | $1,497 | $4,037 | $8,421 | $7,319 | ($1,170) | ($416) | |

| Net Profit | ($15,295) | ($9,615) | ($8,659) | ($284) | $3,997 | $7,508 | $3,493 | $9,419 | $19,649 | $17,077 | ($2,730) | ($970) | |

| Net Profit/Sales | 0.00% | -76.92% | -57.16% | -1.01% | 11.10% | 17.46% | 9.70% | 19.62% | 29.33% | 28.94% | -10.92% | -3.73% | |

| Pro Forma Cash Flow | |||||||||||||

| Month 1 | Month 2 | Month 3 | Month 4 | Month 5 | Month 6 | Month 7 | Month 8 | Month 9 | Month 10 | Month 11 | Month 12 | ||

| Cash Received | |||||||||||||

| Cash from Operations | |||||||||||||

| Cash Sales | $0 | $12,500 | $15,150 | $28,000 | $36,000 | $43,000 | $36,000 | $48,000 | $67,000 | $59,000 | $25,000 | $26,000 | |

| Subtotal Cash from Operations | $0 | $12,500 | $15,150 | $28,000 | $36,000 | $43,000 | $36,000 | $48,000 | $67,000 | $59,000 | $25,000 | $26,000 | |

| Additional Cash Received | |||||||||||||

| Sales Tax, VAT, HST/GST Received | 0.00% | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| New Current Borrowing | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| New Other Liabilities (interest-free) | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| New Long-term Liabilities | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Sales of Other Current Assets | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Sales of Long-term Assets | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| New Investment Received | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Subtotal Cash Received | $0 | $12,500 | $15,150 | $28,000 | $36,000 | $43,000 | $36,000 | $48,000 | $67,000 | $59,000 | $25,000 | $26,000 | |

| Expenditures | Month 1 | Month 2 | Month 3 | Month 4 | Month 5 | Month 6 | Month 7 | Month 8 | Month 9 | Month 10 | Month 11 | Month 12 | |

| Expenditures from Operations | |||||||||||||

| Cash Spending | $14,800 | $14,800 | $14,800 | $14,800 | $14,800 | $14,800 | $14,800 | $14,800 | $14,800 | $14,800 | $14,800 | $14,800 | |

| Bill Payments | ($100) | ($19) | $2,333 | $2,833 | $6,349 | $8,158 | $9,540 | $7,946 | $10,994 | $28,398 | $21,266 | $6,259 | |

| Subtotal Spent on Operations | $14,700 | $14,781 | $17,133 | $17,633 | $21,149 | $22,958 | $24,340 | $22,746 | $25,794 | $43,198 | $36,066 | $21,059 | |

| Additional Cash Spent | |||||||||||||

| Sales Tax, VAT, HST/GST Paid Out | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Principal Repayment of Current Borrowing | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Other Liabilities Principal Repayment | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Long-term Liabilities Principal Repayment | $1,800 | $1,800 | $1,800 | $1,800 | $1,800 | $1,800 | $1,800 | $1,800 | $1,800 | $1,800 | $1,800 | $1,800 | |

| Purchase Other Current Assets | $0 | $1,800 | $1,800 | $1,800 | $1,800 | $1,800 | $1,800 | $1,800 | $1,800 | $1,800 | $1,800 | $1,800 | |

| Purchase Long-term Assets | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Dividends | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Subtotal Cash Spent | $16,500 | $18,381 | $20,733 | $21,233 | $24,749 | $26,558 | $27,940 | $26,346 | $29,394 | $46,798 | $39,666 | $24,659 | |

| Net Cash Flow | ($16,500) | ($5,881) | ($5,583) | $6,767 | $11,251 | $16,442 | $8,060 | $21,654 | $37,606 | $12,202 | ($14,666) | $1,341 | |

| Cash Balance | $48,100 | $42,219 | $36,637 | $43,404 | $54,654 | $71,097 | $79,157 | $100,811 | $138,416 | $150,618 | $135,953 | $137,293 | |

| Pro Forma Balance Sheet | |||||||||||||

| Month 1 | Month 2 | Month 3 | Month 4 | Month 5 | Month 6 | Month 7 | Month 8 | Month 9 | Month 10 | Month 11 | Month 12 | ||

| Assets | Starting Balances | ||||||||||||

| Current Assets | |||||||||||||

| Cash | $64,600 | $48,100 | $42,219 | $36,637 | $43,404 | $54,654 | $71,097 | $79,157 | $100,811 | $138,416 | $150,618 | $135,953 | $137,293 |

| Inventory | $80,000 | $80,000 | $75,600 | $69,900 | $63,300 | $54,800 | $44,300 | $35,050 | $22,250 | $18,920 | $14,179 | $7,979 | $6,270 |

| Other Current Assets | $0 | $0 | $1,800 | $3,600 | $5,400 | $7,200 | $9,000 | $10,800 | $12,600 | $14,400 | $16,200 | $18,000 | $19,800 |

| Total Current Assets | $144,600 | $128,100 | $119,619 | $110,137 | $112,104 | $116,654 | $124,397 | $125,007 | $135,661 | $171,736 | $180,997 | $161,932 | $163,363 |

| Long-term Assets | |||||||||||||

| Long-term Assets | $50,000 | $50,000 | $50,000 | $50,000 | $50,000 | $50,000 | $50,000 | $50,000 | $50,000 | $50,000 | $50,000 | $50,000 | $50,000 |

| Accumulated Depreciation | $0 | $595 | $1,190 | $1,785 | $2,380 | $2,975 | $3,570 | $4,165 | $4,760 | $5,355 | $5,950 | $6,545 | $7,140 |

| Total Long-term Assets | $50,000 | $49,405 | $48,810 | $48,215 | $47,620 | $47,025 | $46,430 | $45,835 | $45,240 | $44,645 | $44,050 | $43,455 | $42,860 |

| Total Assets | $194,600 | $177,505 | $168,429 | $158,352 | $159,724 | $163,679 | $170,827 | $170,842 | $180,901 | $216,381 | $225,047 | $205,387 | $206,223 |

| Liabilities and Capital | Month 1 | Month 2 | Month 3 | Month 4 | Month 5 | Month 6 | Month 7 | Month 8 | Month 9 | Month 10 | Month 11 | Month 12 | |

| Current Liabilities | |||||||||||||

| Accounts Payable | $0 | $0 | $2,339 | $2,720 | $6,176 | $7,934 | $9,374 | $7,697 | $10,137 | $27,768 | $21,158 | $6,027 | $9,633 |

| Current Borrowing | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| Other Current Liabilities | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| Subtotal Current Liabilities | $0 | $0 | $2,339 | $2,720 | $6,176 | $7,934 | $9,374 | $7,697 | $10,137 | $27,768 | $21,158 | $6,027 | $9,633 |

| Long-term Liabilities | $150,000 | $148,200 | $146,400 | $144,600 | $142,800 | $141,000 | $139,200 | $137,400 | $135,600 | $133,800 | $132,000 | $130,200 | $128,400 |

| Total Liabilities | $150,000 | $148,200 | $148,739 | $147,320 | $148,976 | $148,934 | $148,574 | $145,097 | $145,737 | $161,568 | $153,158 | $136,227 | $138,033 |

| Paid-in Capital | $200,000 | $200,000 | $200,000 | $200,000 | $200,000 | $200,000 | $200,000 | $200,000 | $200,000 | $200,000 | $200,000 | $200,000 | $200,000 |

| Retained Earnings | ($155,400) | ($155,400) | ($155,400) | ($155,400) | ($155,400) | ($155,400) | ($155,400) | ($155,400) | ($155,400) | ($155,400) | ($155,400) | ($155,400) | ($155,400) |

| Earnings | $0 | ($15,295) | ($24,910) | ($33,569) | ($33,852) | ($29,855) | ($22,348) | ($18,855) | ($9,436) | $10,213 | $27,290 | $24,560 | $23,590 |

| Total Capital | $44,600 | $29,305 | $19,691 | $11,032 | $10,748 | $14,745 | $22,253 | $25,746 | $35,164 | $54,813 | $71,890 | $69,160 | $68,190 |

| Total Liabilities and Capital | $194,600 | $177,505 | $168,429 | $158,352 | $159,724 | $163,679 | $170,827 | $170,842 | $180,901 | $216,381 | $225,047 | $205,387 | $206,223 |

| Net Worth | $44,600 | $29,305 | $19,691 | $11,032 | $10,748 | $14,745 | $22,253 | $25,746 | $35,164 | $54,813 | $71,890 | $69,160 | $68,190 |