54 & Cloudy

Executive Summary

Overview

54 & Cloudy is a newly formed digital marketing agency that is run by two industry veterans, Tom and Stephen, who collectively have more than two decades of experience running e-commerce sites, working at digital marketing agencies, and helping small to medium size businesses achieve their digital growth goals.

While 54 & Cloudy has been operating as a small consultancy for the past two years, it is now looking to raise some funding and become a full-service digital marketing agency that will need to purchase technology assets and ramp up hiring to meet client demands. Additionally, once the 54 & Cloudy ramps up their marketing efforts, there will be a need for internal resources to manage all the new clients that they will onboard.

54 & Cloudy will operate initially as a fully remote organization with resources across various functional areas of the business including Search Engine Optimization (“SEO”), Conversion Rate Optimization (“CRO”), paid advertising (including social media and search), as well as contractors who will support auxiliary revenue streams such as content writing and design services.

54 & Cloudy is well-positioned to quickly become one of the most trusted digital marketing agencies in the industry given its existing reputation and the plans of building a proprietary technology solution that will bring meaningful value to clients. As 54 & Cloudy furthers their reputation in the market, 54 & Cloudy is poised for long-term success and will be able to increase hiring and expand service offerings to meet client demands with ease.

Service Offerings

After completing their fundraising, 54 & Cloudy will expand their operations to four main revenue streams:

- Search Engine Optimization

- SEO marketing services include SEO strategy development, technical SEO, keyword targeting, content marketing, and link building

- Paid Advertising

- Includes full-service PPC marketing efforts, including search engine advertising, paid shopping ads, display ads, paid social media ads, retargeting, and more

- Conversion Rate Optimization

- eCommerce CRO services will run over thousands of AB tests across a variety of eCommerce platforms with the goal of driving sales. Through targeted user research, a team of UX analysts, and psychological experts, 54 & Cloudy will grow not only transactions but average order and customer lifetime value for clients

- Copywriting & Design Services

- Industry-focused content writers and designers who excel in translating the voice and tone of a client’s business into conversion-driving copy or rich and engaging design

Expectations

Financing Needed

Given the management team’s long-standing success in the industry, 54 & Cloudy will be looking to secure an SBA loan in the amount of $300,000 to finance the acquisition of initial startup technology costs as well as cover initial cash flow needs as 54 & Cloudy ramps up customer acquisition and operates at a loss in Year 1.

Forecast

Given industry growth and the new technology platform 54 & Cloudy will develop, the projected next five years will see strong growth from DMA as they service new and existing clients while capturing additional wallet share with existing new services as 54 & Cloudy grows to become a one-stop-shop for all types of digital marketing. Across the company, 54 & Cloudy is projecting to ramp up meaningfully after securing their debt capital and hiring several resources to achieve 2022 revenue of $2,535,009, which will grow to $12.6 million by 2026. EBITDA will also grow from $738526 in 2022 to $5,115,174 by 2026.

Financial Highlights by Year

Opportunity

Business Overview

Service Offerings

At launch, 54 & Cloudy will operate across four main service categories all focused on digital marketing services for clients. The main categories are outlined below as well as their revenue assumptions used in the financial projections.

- Search Engine Optimization

- SEO marketing services include SEO strategy development, technical SEO, keyword targeting, content marketing, and link building

- Customers will pay a monthly recurring charge that averages out to $3,000

- Paid Advertising

- Includes full-service PPC marketing efforts, including search engine advertising, paid shopping ads, display ads, paid social media ads, retargeting, and more

- Customers pay the agency a fee of 15% of the client’s advertising budget, which was assumed to be an average of $10,000 per month

- Conversion Rate Optimization

- eCommerce CRO services will run over thousands of AB tests across a variety of eCommerce platforms with the goal of driving sales. Through targeted user research, a team of UX analysts, and psychological experts, 54 & Cloudy will grow not only transactions but average order and customer lifetime value for clients

- Customers will pay a monthly recurring charge that is tiered based on the number of tests and campaigns run per month but will average out to $4,000

- Copywriting & Design Services

- Industry-focused content writers and designers who excel in translating the voice and tone of a client’s business into conversion-driving copy or rich and engaging designs

- Customers will be charged per hour for design and writing services at an average rate of $100 per hour

Growth Strategy

Within the first five years of operations, 54 & Cloudy will look to drive revenue growth by not only acquiring new customers but also expanding their wallet share with existing customers. By reducing the churn rate and upselling customers on additional services, they will enhance the client LTV.

In addition to organic client growth, 54 & Cloudy will also be launching new service offerings, standalone product offerings, and will establish several partnerships for referral revenue. The main inorganic growth avenue is with the development of a proprietary reporting and marketing forecast dashboard. This will become an integral selling point in 54 & Cloudy’s service packages as a way to visualize audits, changes, and provide instant access/feedback to the user. 54 & Cloudy anticipates eventually launching this technology as a standalone product that will further its growth far in excess of the financial projections in this business plan.

Target Market

Market Size & Segments

Overall Market

Over the past five years, the Digital Advertising Agencies industry has benefited from the rapid shift from traditional print advertising to digital advertisements. In particular, strong demand for digital advertising services from the retail, financial services, automotive, and telecommunication sectors have bolstered industry revenue. As more consumers generate website traffic through the use of smartphones and tablets, many businesses have purchased digital advertising services to build brand awareness across multiple screens and platforms. Additionally, as more product manufacturers are directly selling their products online, many retailers are demanding industry activities such as search engine visibility services to help them compete. Over the five years to 2019, industry revenue is anticipated to grow at an annualized rate of 17.2%, including a 5.6% jump in 2019 to reach $15.7 billion. Over the five years to 2019 total industry operators are expected to increase at an annualized rate of 16.2% to 4,471.

Many businesses have demanded industry services to spread advertisements in digital formats, namely online for streamed video content. Furthermore, some industry clients have moved away from business models that require research and tangible results prior to the launch of an advertisement, in favor of a testing environment that has evaluated the commercial viability of new ideas. For example, clients have purchased digital advertising services that measure online traffic demographics related to their social media websites prior to launching a product, greatly benefiting the industry. Industry profit (measured as earnings before interest and taxes) is expected to be 6.1% in 2019, due to increased demand for specialized and niche digital advertising services. Total number of industry employees are expected to grow at an annualized rate of 16.5% to 71,049 in 2019.

Over the five years to 2024, digital advertising agencies that can develop innovative tools such as data mining, with applications for analyzing customer purchasing behavior, will experience strong demand. As online media streaming services and social media continue to generate substantial internet traffic, many businesses will strengthen their investments in digital advertising. As a result, industry revenue is forecast to increase at an annualized rate of 4.4% to $19.5 billion over the five years to 2024.

Key Market Drivers

Internet traffic volume

Internet traffic volumes represent the total data sent over the internet globally per month. As the amount of internet traffic increases due to more consumers accessing websites from their mobile devices, tablets, or computers, many businesses will expand their online presence. As a result, demand for digital advertising services will rise as more businesses use advertising to drive website traffic volumes. Internet traffic volume is expected to increase substantially in 2019, representing a potential opportunity for the industry.

Total advertising expenditure

Total advertising expenditure typically trends in line with corporate profit. When corporate profit rises, businesses are likely to revitalize their advertising budgets. In 2019, total advertising expenditure is expected to increase.

Consumer spending

A rise in consumer spending indicates that more consumers are making discretionary purchases. This trend encourages many businesses to invest in advertising services to boost brand awareness and remain competitive. As a result of these services, businesses benefit from a larger customer base. In 2019, consumer spending is expected to increase.

Corporate profit

As businesses become more profitable, they often expand their advertising budgets, since many digital advertising services result in a strong return on investment. Thus a rise in corporate profitability, particularly in the retail, finance, automotive, and telecommunications sectors, stimulates demand for digital advertising services. Corporate profit is expected to decline in 2019, representing a threat to the industry.

Investor uncertainty

Investor uncertainty is an important indicator of industry performance. The degree to which businesses invest in advertising is related to the confidence that decision-makers have in the market. As uncertainty increases, businesses may decide to reduce or suspend advertising activities. In 2019, investor uncertainty is expected to decline.

Industry Services

Digital display advertising makes up an estimated 50.0% of industry revenue in 2019.

This product segment includes various forms of advertising, including banner, which makes up 12.6% of total revenue, followed by video (10.5%), rich media (8.7%), and sponsorship (1.5%). Over the past five years, as more users have streamed videos online, video advertisements have steadily grown, as many advertising agencies have strategically placed advertisements either before, during, or after a video clip. Furthermore, sponsorship advertising has exhibited growth over the past five years, particularly for digital-only publications.

Search engine optimization

In 2019, search engine optimization (SEO) and search engine marketing services are expected to account for 28.9% of industry revenue.

SEO services help increase a company’s visibility in a search engine, such as Google, Yahoo, or Bing. Typically, websites that have favorably used SEO to appear in search engine result pages for certain keywords are more likely to have high online visitor traffic, which can increase clientele’s sales volumes. Digital advertising agencies that can build website algorithms with the highest relevancy can obtain favorable placing for their clients in search results. Over the past five years, this market has steadily grown, due to many businesses developing their online website presence. However, over the next five years, many clients will expand their online presence through other mediums, particularly video, which will cut into growth for this product segment.

Major End Markets

The industry primarily relies on corporate clients from the retail, finance, automotive, and telecommunications sectors.

Retail and telecommunications

In 2019, retail and telecommunications are expected to account for 21.9% and 10.5% of industry revenue, respectively.

Retail has comprised the largest share of digital advertising spending over the past five years, which can be partly attributed to many consumers making their retail purchasing decisions online. According to eMarketer, while retailers have demanded direct response advertisements over the past five years, many retailers will move toward brand advertising, such as advertisements via video, social display, and hybrid formats.

Comparatively, telecommunication-related advertising has steadily declined over the past five years, due to data privacy laws that have constrained the ability for advertisers to implement digital advertisements using user data from consumers’ mobile phones. Furthermore, consolidation among telecommunication providers has limited their demand for advertising services.

Automotive and financial services

Automotive and financial services are anticipated to make up 12.4% and 12.1% of industry revenue, respectively.

Over the past five years, demand for digital advertising services from the automotive sector has steadily increased, due to the revitalization in consumer demand for automobiles. In particular, many consumers have used the internet to shop for their next vehicle, which has prompted the automotive sector to purchase more digital advertising services. Additionally, demand for digital advertising services from the financial sector has remained relatively stagnant over the past five years, due to many digital advertising services, such as rich media and video formats, not being as effective with driving customer purchasing decisions, compared with other sectors, such as the automotive sector.

Consumer packaged goods and consumer products

In 2019, consumer packaged goods and consumer products are expected to generate 8.8% of industry revenue.

Over the past five years, this product segment has exhibited growth. For bigger brand products within this segment, demand for digital advertising services has increased in line with peak seasons, such as Christmas and the back-to-school period. Comparatively, retailers of lower-priced products within this market segment typically purchase display advertising campaigns to build brand awareness and encourage a strong customer base that makes repeat purchases.

Travel and media

Travel and media comprise an estimated 7.8% and 6.3% of industry revenue in 2019, respectively.

In the past five years, the travel and media sectors have increased their demand for digital advertising services. Over the next five years, the travel sector will demand digital advertising services that integrate well with consumers that access travel websites from their mobile device. Comparatively, media, which includes social media sites, have increasingly used digital advertising services to generate website traffic and monetize their websites.

Computing products and consumer electronics

In 2019, computing products and consumer electronics account for an estimated 8.0% of industry revenue.

Over the next five years, this product segment is expected to account for a larger share of industry revenue. As consumer electronics are expected to exhibit high growth over the next five years, many electronic companies that manufacture devices, such as digital and video cameras, telephones, and TVs, among other products, will increase their demand for digital advertising services.

Other sectors

Other sectors include the healthcare and pharmaceutical sector, as well as the entertainment sector, among others.

Over the next five years, many sectors, such as entertainment, will increasingly demand digital advertising services to attract users that increasingly access websites with their smartphone and tablet.

54 & Cloudy Initial Target Market

At launch, 54 & Cloudy will focus on businesses that are driving more than $1 million in e-commerce sales per year and looking to spend more than $5,000 per month on digital advertising. Many of these clients will have both a digital and retail presence and will be looking to grow their digital footprint across multiple channels without having to hire an internal team. While geographic location is not a barrier, 54 & Cloudy will initially focus on West Coast businesses due to the founders’ existing network. Lastly, 54 & Cloudy is not limiting themselves on the type of e-commerce product the client sells but will be looking to work with clients who have average order values (“AOV”) above $35, which will make digital advertising easier and more profitable.

Competition

Competitive Landscape

The digital marketing agency landscape is filled with thousands of small companies that have fewer than ten employees with only a handful of organizations that have reached scale to have more than 50 employees. Additionally, the market is rapidly becoming more reliant on various technology and software providers, who themselves are now some of the biggest competitors in the market. Detailed below are several of the large digital agencies as well as large service providers in the market.

Large Digital Marketing Agencies

- Ignite Visibility

- Ignite Visibility is one of the highest awarded digital marketing agency in the industry, specializing in digital marketing strategy, SEO, paid media, social media, email marketing, analytics, Amazon, and CRO.

- WebFX

- WebFX is a performance-focused digital marketing agency with services designed to increase qualified leads, phone calls, and transactions for clients. Founded in 1996 and headquartered in Harrisburg, Penn., they have over 250 digital marketing, design, and development experts who serve customers through SEO, PPC, web design, and more.

- Power Digital Marketing

- Power Digital is a digital marketing agency based in San Diego with an office in New York. The agency, founded in 2012, has more than 300 employees and provides content marketing, email marketing, PPC, SEO, social media marketing, web design, and PR services. Power Digital serves mid-market and other-sized companies in the consumer products & services, advertising & marketing, business services, and retail industries.

- Disruptive Advertising

- This Utah-based agency has a marketing team of 50+ that has conducted over 2,500 marketing campaign audits since 2011. Disruptive Advertising specializes in traffic, conversion, and analytics to help its clients outperform their competitors.

Service Providers That Displace Agencies

- SEMrush

- SEMrush is a leading online visibility management software-as-a-service platform. With over 7 million businesses having used the platform across 50 products, tools, and add-ons including tools for search, content, social media, and market research. The company tracks data from more than 140 countries, seamlessly integrates with Google and task management platforms.

- Ahrefs

- Ahrefs is a software company that develops online SEO tools and free educational materials for marketing professionals. Ahrefs database has over 11 billion keywords and more than 400 billion indexed pages.

- MailChimp/Klaviyo

- Both of these companies are best-in-class email marketing and growth marketing platforms that helps deliver more personalized experiences across owned marketing channels like email, SMS, in-app notifications, and web.

54 & Cloudy Advantages

While the market is highly competitive, 54 & Cloudy sets itself apart by leveraging proprietary technology and world-class third-party software. Additionally, 54 & Cloudy will only initially work with clients who operate within specific niches in the e-commerce space and this will allow 54 & Cloudy to develop a sector expertise and reputation for excellence that will drive organic growth.

Some of the key advantages that 54 & Cloudy will have when going head-to-head with competitors includes the following:

- Targeted user segments to conduct market research that is the exact audience of the client

- Relationships with BI data firms that help find the sweet spot in terms of pricing, sales, etc. These kinds of licenses cost nearly 6-figures but 54 & Cloudy has a sweetheart deal

- Custom reporting dashboard that brings in paid, organic and outbound sales touchpoints

- Custom dashboard for A/B split testing, which allows agency and customers to take analysis and turn into immediately actionable copy tests

- Direct integration with eCommerce platforms (WooCommerce, Shopify, Wix) or off-the-shelf CMS platform

Keys to Success

Given the competitive nature of the industry, 54 & Cloudy will need to be aware of the various keys to success that are critical for long-term growth in the market.

- Ability to quickly adopt new technology

- Digital agencies must stay up-to-date with the latest developments in technology, from the newest advertising platform to the latest software used to track and analyze campaigns

- Membership of an industry organization

- Membership in the American Association of Advertising Agencies may indicate a higher level of professionalism in operations and boost the agency’s credibility and image

- Ability to compete on tender

- As a highly competitive industry, digital advertising agencies must be able to develop professional proposals for work and accounts to secure contracts

- Having a good reputation

- Digital advertisers that develop a solid brand with a good reputation achieve a greater level of success within the industry

- Proprietary Technology

- Building and scaling tools and technology that are proprietary will allow 54 & Cloudy to scale and capture market share with a defensible offering that can increase LTV and reduce long-term churn

Execution

Marketing & Sales

Marketing Plan

Like other rapidly growing B2B companies, 54 & Cloudy will focus on targeted digital and print marketing, multiple advertising campaigns, conventions/trade shows, and strategic partnerships. Since 54 & Cloudy has already been offering its services on a consulting basis and has developed a loyal following, organic inbound traffic is already coming in and will continue to create a compounding effect that will propel 54 & Cloudy to strong and sustainable growth.

In order to continue growth and maintain their industry-leading reputation, 54 & Cloudy plans to utilize their own digital marketing knowledge to expand within their core markets, growing into new markets, and increase wallet share with existing customers.

Digital and Print Marketing

54 & Cloudy will launch a robust digital marketing campaign across paid search and through digital publications/blogs specific to their core demographics. With a unique skill set and offers, 54 & Cloudy will be able to gain meaningful momentum through paid search, providing them with business demographic information and contact information for re-targeting and promotional messaging. Additionally, by working with key online and print publications and blogs specific to the company’s various end-markets, 54 & Cloudy will be able to develop a strong industry presence that will be crucial for recurring customer growth. Some of the tactics that 54 & Cloudy will use to attract customers will include free site audits, industry-specific templates, and other free services to capture emails and upsell customers.

Strategic Partners

Relationships will be formed with multiple organizations that are selling to the same end customer including with design agencies, print media groups, traditional advertising agencies, and other non-marketing service providers like bankers, lawyers, and small business associations. By building a large team of strategic partners, 54 & Cloudy will be able to generate a stable and reliable customer base that will ultimately lead to repeat customers and an increased potential for larger contracts.

Customer Re-engagement

As with any business services company, recurring customers are a vital source of income as well as word-of-mouth for a growing business. As 54 & Cloudy continues to sell within their core demographic, they will be using various engagement tactics to drive retention and improve new referrals from existing customers. Through building a strong group of loyal customers, 54 & Cloudy will be able to identify key growth opportunities for the business including new product lines and end markets to work with.

Organic Marketing

As a leading digital marketing agency, 54 & Cloudy will be able to also publish onsite blogs, detailed landing pages, and other relevant content, as they would for any client, in order to drive organic rankings and new customer acquisition. By focusing on long-tail niche content in combination with highly competitive keywords and questions, 54 & Cloudy will generate strong SEO growth and generate meaningful organic traffic.

Trade Shows/Conventions

Many businesses find success with generating brand awareness and increasing sales conversion by attending trade shows and conventions to market their products and services. These gatherings allow businesses, consumers, and potential large partners to make a connection with the business and its leadership team before committing to a long-term contract. There are several large technologies, small business, and entrepreneur conventions and organizations held all over the United States that will provide a sizable pool of potential customers that 54 & Cloudy can interact with and demonstrate their services and product’s functionality.

Operations

Location

The business will be based out of the Bay Area where 54 & Cloudy’s two founders are located. Given office rent prices and the plan to hire resources independent of physical location, 54 & Cloudy is planning to operate as a fully remote organization for the near term. There will be a small rent expense to cover the founders’ rent but no other rent or office costs will be incurred by 54 & Cloudy in the projections.

Technology

54 & Cloudy will be utilizing many of the industry’s leading automation, data tracking, analytics software for handling client work. This technology will include SEO tools, paid advertising automation platforms, A/B testing systems, and other useful resources that can help clients achieve their growth targets. Additionally, 54 & Cloudy will utilize several internal tools including a CRM, Slack, an email marketing platform, and other services to grow the business and manage operations and a remote workforce at scale.

Milestones & Metrics

Milestones Table

Key Metrics

As with many B2B businesses, 54 & Cloudy will be tracking several key customer acquisition and customer retention metrics that will drive overall profitability and allow for more reliable hiring need forecasting.

The metrics 54 & Cloudy will be tracking include:

- Revenue by Service Line

- EBITDA

- Contribution Margin by Service Line

- Cost Per Acquisition (“CPA”)

- Churn Rate by Service Line

- Revenue Per Employee

- MRR and ARR

Company

Overview

Ownership & Structure

54 & Cloudy is co-owned by the two founders who each have a 50% ownership in the business. The company is based in the Bay Area and is a California LLC. There are no other ownership interests in the business at this time.

Team

Leadership Team

54 & Cloudy is currently being run as a small agency by the two founders who are looking to secure funding to make additional hiring and take on enterprise-level clients. The two founders, Tom and Stephen, have extensive experience in the market not only as e-commerce digital marketers but also as technical/UX engineers.

Tom was previously a technical/UX engineer at a successful digital marketing agency where he worked on building proprietary dashboards, reporting tools, and advertising automation for both internal and external use cases. Stephen, on the other hand, is 54 & Cloudy’s e-commerce marketing expert with more than a decade working at e-commerce companies including a fashion business in the Bay Area in 2013 that was later sold in 2019. Since the sale of that business, Stephen has worked as a contractor developing his product-side and marketing expertise for small to medium size businesses.

The two founders complement each other’s skillsets and both are looking to move 54 & Cloudy from a small contract consulting business to a full-service digital marketing agency.

Hiring Strategy

In addition to 54 & Cloudy’s leadership team, there will be a strong hiring strategy to handle all the new clients as the business grows over the five-year projection period. With a mix of full-time hires and contractors, the Company will look to scale hiring to meet client demand but not be overstaffed so that people are not fully utilized.

The following roles will be areas 54 & Cloudy will hire to handle client services.

- E-Commerce Product Engineer

- Acts as primary technical architect and engineer for all development, testing, and product development

- Analyst/ Technician

- Full-stack in-house marketer that is expert in all services the firm employs. Has extensive background and experience in search engine optimization, conversion rate optimization, paid search marketing, outbound email, and site analytics

- Paid Media Specialist

- Initially outsourced, this role handles all of the Google / Microsoft / LinkedIn / etc. ad management as well as its reporting

- Project Manager

- Liaisons the day-to-day relationships with our clients, working closely with technical and marketing leads to deliver on contract scope and goals. Managers the timelines and execution of all projects to ensure their success

- Account Manager

- In-house sales lead that possesses the ability to sell-in and move prospects through the buyer’s journey. Based on our target markets, this role has experience and knowledge specifically to help those business types grow

- Outsource Junior Roles

- Copywriting

- Design

- Paid Marketing

- CRO Analyst

54 & Cloudy anticipates growing from 13 resources in Year 1 to more than 45 by Year 5. As outlined in the chart below, this growth will result in Year 5 personnel expenses exceeding $3.8 million, up from $965,000 in Year 1. Revenue per employee will increase from $185,000 in Year 1 to $262,000 in Year 5.

Financial Plan

Forecast

Key Assumptions

54 & Cloudy developed the following financials utilizing their extensive industry knowledge and relevant historic financial performance.

At launch, 54 & Cloudy will operate across four main service categories all focused on digital marketing services for clients. The main categories are outlined below as well as their revenue assumptions used in the financial projections.

- Search Engine Optimization

- SEO marketing services include SEO strategy development, technical SEO, keyword targeting, content marketing, and link building

- Customers will pay a monthly recurring charge that averages out to $3,000

- Given the long-term nature of SEO, the churn rate is 5%

- Paid Advertising

- Includes full-service PPC marketing efforts, including search engine advertising, paid shopping ads, display ads, paid social media ads, retargeting, and more

- Customers pay the agency a fee of 15% of the client’s advertising budget, which was assumed to be an average of $10,000 per month

- Churn rate is slightly higher than SEO at 7.5%

- Conversion Rate Optimization

- eCommerce CRO services will run thousands of AB tests across a variety of eCommerce platforms with the goal of driving sales. Through targeted user research, a team of UX analysts, and psychological experts, 54 & Cloudy will grow not only transactions but average order and customer lifetime value for clients

- Customers will pay a monthly recurring charge that is tiered based on the number of tests and campaigns run per month but will average out to $4,000

- Churn rate is high at 20% due to the nature of the service line

- Copywriting & Design Services

- Industry-focused content writers and designers who excel in translating the voice and tone of a client’s business into conversion-driving copy or rich and engaging designs

- This is an ancillary service within 54 & Cloudy’s paid and optimization offerings but can be expanded to help clients develop all onsite and paid messaging

- Customers will be charged per hour for design and writing services at an average rate of $100 per hour

The financial projections assume an SBA loan for $300,000 at 8% over 10 years and those funds will be sufficient to cover all growth and hiring projections outlined in the business plan.

54 & Cloudy believes that the introduction of proprietary reporting and marketing forecast dashboards will help accelerate new customer acquisition and allow churn rates to remain low for existing customers. This will be an integral selling point in 54 & Cloudy’s service packages as a way to visualize audits, changes, and provide instant access/feedback to the user. In the future, 54 & Cloudy may look to offer the reporting and forecasting dashboard as a separate stand-alone service offering.

Revenue by Month

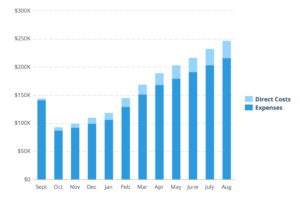

Expenses by Month

Net Profit (or Loss) by Year

Financing

Sources of Funds

Given the management team’s long-standing success in the industry, 54 & Cloudy will be looking to secure an SBA loan in the amount of $300,000 to finance the acquisition of initial startup technology costs, as well as cover initial cash flow, needs as they ramp up customer acquisition and operates at a loss in Year 1.

Use of Funds

54 & Cloudy is securing an SBA loan for $300,000 that will be used to fund initial technology asset purchases of $65,000, startup costs including licensing, legal, and other marketing costs of $50,000, as well as cover cash flow needs during Year 1 as 54 & Cloudy, grows from negative operating income to cash flow positive by year-end.