Hass Irrigation Systems

Executive Summary

Hass Irrigation Systems will serve the irrigation needs of our customers. Hass Irrigation Systems will focus on the residential construction boom in Monroe’s Lake Charles section. The city has been growing by 9% annually for the past 10 years. With the population now at 900,000, the new construction in the Lake Charles section of the city is valued at $600 million in home sales next year alone.

Currently, Hass Irrigation Systems is a subcontractor with Bentwood Custom Homes, Greenridge Homes, and Landmark Homes to provide irrigation services to their new homes in the area. From this base, Hass Irrigation Systems will market its services to homeowners in the Lake Charles area.

The current population of the city’s Lake Charles area is 120,000 with an income range of $100,000 – $500,000. Hass Irrigation Systems is well positioned to capture a lion’s share of the irrigation business in this growing residential area.

1.1 Objectives

The objectives of Hass Irrigation Systems are:

- Capture the majority of the irrigation business in the Lake Charles area.

- Offer our customers a superior service, at a low price.

1.2 Mission

Hass Irrigation Systems’ emphasis will always be customer satisfaction. Putting our customers needs first, we will build our customer base. We will not do business in the way as other irrigation companies. We will not disappear at the end of October and reappear in March, we will be here when our customers need us.

1.3 Keys to Success

The keys to success for Hass Irrigation Systems are:

- Prompt and courteous service;

- An expertise in irrigation unmatched by any other company;

- Competitive pricing.

Company Summary

Hass Irrigation Systems tailors solutions to customer’s irrigation needs. Currently, Hass Irrigation Systems is a subcontractor with Bentwood Custom Homes, Greenridge Homes, and Landmark Homes to provide garden carpentry services to their new homes in the Lake Charles area.

Hass Irrigation Systems firmly believes that “you get what you pay for.” Not only in terms of customer irrigation systems, but also in terms of staff and equipment. We have invested a great deal of time and effort in hand picking the most qualified employees and then gave them the tools and support they need to excel at their job. This philosophy also extends to the equipment and hardware we use. Everything is top-of-the-line and has been chosen specifically for its ability to meet our customer’s exacting standards.

Andrew Hass, owner of Hass Irrigation Systems, has spent over 15 years developing his own program and protocols. The result is a comprehensive, custom-designed program. His experience will meet the customer’s needs faster than any other company.

2.1 Start-up Summary

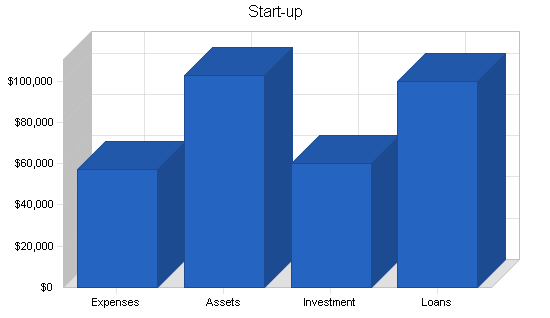

Andrew Hass will invest $60,000 in Hass Irrigation Systems. Andrew will also secure a $100,000 loan.

The following table and chart show projected initial start-up costs for Hass Irrigation Systems.

| Start-up Funding | |

| Start-up Expenses to Fund | $57,300 |

| Start-up Assets to Fund | $102,700 |

| Total Funding Required | $160,000 |

| Assets | |

| Non-cash Assets from Start-up | $90,000 |

| Cash Requirements from Start-up | $12,700 |

| Additional Cash Raised | $0 |

| Cash Balance on Starting Date | $12,700 |

| Total Assets | $102,700 |

| Liabilities and Capital | |

| Liabilities | |

| Current Borrowing | $0 |

| Long-term Liabilities | $100,000 |

| Accounts Payable (Outstanding Bills) | $0 |

| Other Current Liabilities (interest-free) | $0 |

| Total Liabilities | $100,000 |

| Capital | |

| Planned Investment | |

| Andrew Hass | $60,000 |

| Other | $0 |

| Additional Investment Requirement | $0 |

| Total Planned Investment | $60,000 |

| Loss at Start-up (Start-up Expenses) | ($57,300) |

| Total Capital | $2,700 |

| Total Capital and Liabilities | $102,700 |

| Total Funding | $160,000 |

| Start-up | |

| Requirements | |

| Start-up Expenses | |

| Legal | $2,000 |

| Stationery etc. | $300 |

| Brochures | $3,000 |

| Insurance | $1,000 |

| Rent | $1,000 |

| Equipment and Tools | $20,000 |

| Vans (2) | $30,000 |

| Total Start-up Expenses | $57,300 |

| Start-up Assets | |

| Cash Required | $12,700 |

| Start-up Inventory | $40,000 |

| Other Current Assets | $0 |

| Long-term Assets | $50,000 |

| Total Assets | $102,700 |

| Total Requirements | $160,000 |

2.2 Company Ownership

Hass Irrigation Systems is owned by Andrew Hass.

Services

Hass Irrigation Systems tailors solutions to customer’s irrigation needs. Through precision system design, Hass Irrigation Systems professionals can custom design a system that meets the customer’s landscaping needs, assuring the ultimate end result–a beautiful, green lawn.

Hass Irrigation Systems uses products from all the premier manufacturers of the irrigation industry. This provides our customers with a system that has been customized to meet all of their individual property needs. By utilizing products from all of the leading manufacturers, Hass Irrigation Systems can choose products that definitively meets our customer’s specific needs.

With these tools, the design professionals at Hass Irrigation Systems are able to design a system that can meet each and every design challenge presented. Granted, a beautiful, green lawn is the first objective of any irrigation system. But, equally important is the investment our clients have made in bedding plants, shrubbery and trees. Each has its own unique water requirement that must be taken into consideration when developing any irrigation system design. Hass Irrigation Systems knows the inherent strengths and weakness of every product manufactured today.

Market Analysis Summary

The city has been growing by 9% annually for the past 10 years. With the population now at 900,000, the new construction in the Lake Charles section of the city is valued at $600 million in home sales next year alone. New construction represents an important customer group for Hass Irrigation Systems.

The other significant customer group are the existing home owner in the Lake Charles area. The revitalization of the area has generated increase remodeling of existing homes. Last year, remodeling projects were up 20% over the previous year and accounted for $15 million paid for remodeling services in the area.

4.1 Market Segmentation

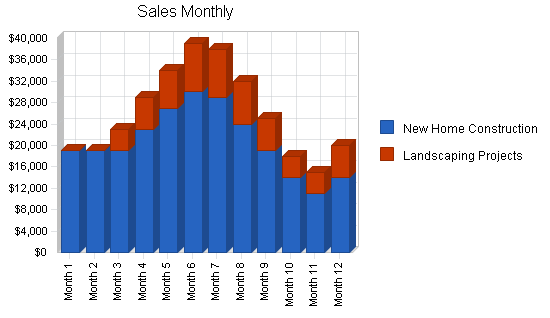

Hass Irrigation Systems will focus on two significant customer groups:

- New home construction;

- Landscaping projects.

| Market Analysis | |||||||

| Year 1 | Year 2 | Year 3 | Year 4 | Year 5 | |||

| Potential Customers | Growth | CAGR | |||||

| New Home Construction | 7% | 2,000 | 2,140 | 2,290 | 2,450 | 2,622 | 7.00% |

| Landscaping Projects | 5% | 2,200 | 2,310 | 2,426 | 2,547 | 2,674 | 5.00% |

| Total | 5.97% | 4,200 | 4,450 | 4,716 | 4,997 | 5,296 | 5.97% |

4.2 Service Business Analysis

The market for irrigation contracting services is very competitive. Among these, only five are competing for work in the Lake Charles area. These are small businesses with less than four full-time employees, except for J. Dodd Irrigation Services that has a staff of eight. Hass Irrigation Systems’ current niche is its strong relationship with Bentwood Custom Homes, Greenridge Homes, and Landmark Homes.

Andrew Hass’s unique landscaping program and protocols will also be a critical advantage in building Hass Irrigation Systems’ customer base.

Strategy and Implementation Summary

Hass Irrigation Systems’ strategy is simple and ambitious. First, build its base with new home construction that is planned in the Lake Charles area. From this secure footing, Hass Irrigation Systems will begin to market to new customers.

5.1 Competitive Edge

Andrew Hass’ reputation for quality work and excellent customer skills has been a hallmark of his work history in irrigation. Starting his own company is just another step in his quest to deliver services to customers that were second to none.

Andrew began his career in landscaping in 1985 with Burke Landscaping as a member of the installation crew. Within three years, Andrew was a Project Install Foreman. He held this position with Burke Landscaping for five years. His next position was with De Spain Irrigation. His initial position was Project Install Foreman but he was soon promoted to Field Operations Manager. In this position, Andrew began to develop his own program and protocols to improve irrigation services. Over the next five years, De Spain grew to become one of the biggest irrigation/landscaping businesses in Monroe.

5.2 Sales Strategy

For the first two months of operation, Hass Irrigation will focus on subcontract work with local builders. During that time period, we will be marketing our services to existing homeowners in the Lake Charles section.

We estimate that with current staff, Hass Irrigation can install up to six irrigation systems a month. Each system will, on average, generate $5,000 in sales. In most cases, the new irrigation system will be in place within 15 days of the order being finalized.

5.2.1 Sales Forecast

The following table will outline Hass Irrigation Systems sales forecast data.

| Sales Forecast | |||

| Year 1 | Year 2 | Year 3 | |

| Sales | |||

| New Home Construction | $248,000 | $262,000 | $285,000 |

| Landscaping Projects | $63,000 | $81,000 | $93,000 |

| Total Sales | $311,000 | $343,000 | $378,000 |

| Direct Cost of Sales | Year 1 | Year 2 | Year 3 |

| New Home Construction | $68,600 | $73,000 | $80,000 |

| Landscaping Projects | $18,400 | $22,000 | $21,000 |

| Subtotal Direct Cost of Sales | $87,000 | $95,000 | $101,000 |

Management Summary

Andrew Hass will manage the daily operations of Hass Irrigation Systems.

6.1 Personnel Plan

Hass Irrigation Systems will have a staff of four.

| Personnel Plan | |||

| Year 1 | Year 2 | Year 3 | |

| Andrew Hass | $30,000 | $34,000 | $42,000 |

| Irrigation Crew Members (3) | $90,000 | $102,000 | $124,000 |

| Total People | 0 | 0 | 0 |

| Total Payroll | $120,000 | $136,000 | $166,000 |

Financial Plan

The following is the financial plan for Hass Irrigation Systems.

7.1 Break-even Analysis

The monthly break-even point is shown below, taking into account monthly running costs.

| Break-even Analysis | |

| Monthly Revenue Break-even | $20,211 |

| Assumptions: | |

| Average Percent Variable Cost | 28% |

| Estimated Monthly Fixed Cost | $14,557 |

7.2 Business Ratios

Business ratios for the years of this plan are shown below. Industry profile ratios based on the Standard Industrial Classification (SIC) code 4971, Irrigation Systems, are shown for comparison.

The following is explanation of the plans divergence with industry ratio profile.

- Sales Growth and Profit Before Interest and Taxes: will be double the industry average because of the increased housing development in the Lake Charles area over the next five years.

- Short-term Assets: are higher than the average due the size of our start-up inventory.

- Long Term Assets: are below the industry average but will be more in-line after additional equipment is purchased which is planned during the fourth year of operation.

- Long Term Liabilities, and Expense of Sales: are higher than the industry average due to the start-up loan and the maintenance of a year-round staff.

| Ratio Analysis | ||||

| Year 1 | Year 2 | Year 3 | Industry Profile | |

| Sales Growth | 0.00% | 10.29% | 10.20% | 4.70% |

| Percent of Total Assets | ||||

| Accounts Receivable | 18.84% | 17.96% | 18.26% | 11.20% |

| Inventory | 4.64% | 4.38% | 4.30% | 1.40% |

| Other Current Assets | 0.00% | 0.00% | 0.00% | 36.30% |

| Total Current Assets | 66.72% | 73.93% | 78.43% | 48.90% |

| Long-term Assets | 33.28% | 26.07% | 21.57% | 51.10% |

| Total Assets | 100.00% | 100.00% | 100.00% | 100.00% |

| Current Liabilities | 8.57% | 9.01% | 8.87% | 26.90% |

| Long-term Liabilities | 65.52% | 50.34% | 40.65% | 22.20% |

| Total Liabilities | 74.09% | 59.36% | 49.52% | 49.10% |

| Net Worth | 25.91% | 40.64% | 50.48% | 50.90% |

| Percent of Sales | ||||

| Sales | 100.00% | 100.00% | 100.00% | 100.00% |

| Gross Margin | 72.03% | 72.30% | 73.28% | 64.10% |

| Selling, General & Administrative Expenses | 63.05% | 63.85% | 67.37% | 45.40% |

| Advertising Expenses | 3.86% | 4.37% | 4.76% | 0.20% |

| Profit Before Interest and Taxes | 15.86% | 14.55% | 10.43% | 5.20% |

| Main Ratios | ||||

| Current | 7.79 | 8.20 | 8.84 | 1.79 |

| Quick | 7.24 | 7.71 | 8.36 | 1.44 |

| Total Debt to Total Assets | 74.09% | 59.36% | 49.52% | 49.10% |

| Pre-tax Return on Net Worth | 111.96% | 64.12% | 36.71% | 4.70% |

| Pre-tax Return on Assets | 29.01% | 26.06% | 18.53% | 9.30% |

| Additional Ratios | Year 1 | Year 2 | Year 3 | |

| Net Profit Margin | 8.97% | 8.45% | 5.91% | n.a |

| Return on Equity | 78.37% | 44.88% | 25.70% | n.a |

| Activity Ratios | ||||

| Accounts Receivable Turnover | 9.01 | 9.01 | 9.01 | n.a |

| Collection Days | 58 | 39 | 39 | n.a |

| Inventory Turnover | 6.00 | 14.24 | 14.05 | n.a |

| Accounts Payable Turnover | 10.64 | 12.17 | 12.17 | n.a |

| Payment Days | 27 | 27 | 29 | n.a |

| Total Asset Turnover | 2.26 | 2.16 | 2.19 | n.a |

| Debt Ratios | ||||

| Debt to Net Worth | 2.86 | 1.46 | 0.98 | n.a |

| Current Liab. to Liab. | 0.12 | 0.15 | 0.18 | n.a |

| Liquidity Ratios | ||||

| Net Working Capital | $79,888 | $103,167 | $119,795 | n.a |

| Interest Coverage | 5.21 | 5.87 | 5.25 | n.a |

| Additional Ratios | ||||

| Assets to Sales | 0.44 | 0.46 | 0.46 | n.a |

| Current Debt/Total Assets | 9% | 9% | 9% | n.a |

| Acid Test | 5.05 | 5.72 | 6.30 | n.a |

| Sales/Net Worth | 8.74 | 5.31 | 4.35 | n.a |

| Dividend Payout | 0.00 | 0.00 | 0.00 | n.a |

7.3 Projected Profit and Loss

The following table and chart highlights the projected profit and loss for three years.

| Pro Forma Profit and Loss | |||

| Year 1 | Year 2 | Year 3 | |

| Sales | $311,000 | $343,000 | $378,000 |

| Direct Cost of Sales | $87,000 | $95,000 | $101,000 |

| Other Production Expenses | $0 | $0 | $0 |

| Total Cost of Sales | $87,000 | $95,000 | $101,000 |

| Gross Margin | $224,000 | $248,000 | $277,000 |

| Gross Margin % | 72.03% | 72.30% | 73.28% |

| Expenses | |||

| Payroll | $120,000 | $136,000 | $166,000 |

| Sales and Marketing and Other Expenses | $18,000 | $23,000 | $28,000 |

| Depreciation | $4,284 | $4,284 | $4,284 |

| Leased Equipment | $0 | $0 | $0 |

| Utilities | $2,400 | $2,400 | $2,400 |

| Insurance | $0 | $0 | $0 |

| Rent | $12,000 | $12,000 | $12,000 |

| Payroll Taxes | $18,000 | $20,400 | $24,900 |

| Other | $0 | $0 | $0 |

| Total Operating Expenses | $174,684 | $198,084 | $237,584 |

| Profit Before Interest and Taxes | $49,316 | $49,916 | $39,416 |

| EBITDA | $53,600 | $54,200 | $43,700 |

| Interest Expense | $9,459 | $8,501 | $7,501 |

| Taxes Incurred | $11,957 | $12,425 | $9,575 |

| Net Profit | $27,900 | $28,991 | $22,341 |

| Net Profit/Sales | 8.97% | 8.45% | 5.91% |

7.4 Projected Cash Flow

The following is the projected cash flow for three years.

| Pro Forma Cash Flow | |||

| Year 1 | Year 2 | Year 3 | |

| Cash Received | |||

| Cash from Operations | |||

| Cash Sales | $77,750 | $85,750 | $94,500 |

| Cash from Receivables | $207,375 | $254,588 | $280,588 |

| Subtotal Cash from Operations | $285,125 | $340,338 | $375,088 |

| Additional Cash Received | |||

| Sales Tax, VAT, HST/GST Received | $0 | $0 | $0 |

| New Current Borrowing | $0 | $0 | $0 |

| New Other Liabilities (interest-free) | $0 | $0 | $0 |

| New Long-term Liabilities | $0 | $0 | $0 |

| Sales of Other Current Assets | $0 | $0 | $0 |

| Sales of Long-term Assets | $0 | $0 | $0 |

| New Investment Received | $5,000 | $0 | $0 |

| Subtotal Cash Received | $290,125 | $340,338 | $375,088 |

| Expenditures | Year 1 | Year 2 | Year 3 |

| Expenditures from Operations | |||

| Cash Spending | $120,000 | $136,000 | $166,000 |

| Bill Payments | $113,424 | $171,757 | $184,870 |

| Subtotal Spent on Operations | $233,424 | $307,757 | $350,870 |

| Additional Cash Spent | |||

| Sales Tax, VAT, HST/GST Paid Out | $0 | $0 | $0 |

| Principal Repayment of Current Borrowing | $0 | $0 | $0 |

| Other Liabilities Principal Repayment | $0 | $0 | $0 |

| Long-term Liabilities Principal Repayment | $9,996 | $9,996 | $9,996 |

| Purchase Other Current Assets | $0 | $0 | $0 |

| Purchase Long-term Assets | $0 | $0 | $0 |

| Dividends | $0 | $0 | $0 |

| Subtotal Cash Spent | $243,420 | $317,753 | $360,866 |

| Net Cash Flow | $46,705 | $22,585 | $14,222 |

| Cash Balance | $59,405 | $81,990 | $96,212 |

7.5 Projected Balance Sheet

The following is the projected balance sheet for three years.

| Pro Forma Balance Sheet | |||

| Year 1 | Year 2 | Year 3 | |

| Assets | |||

| Current Assets | |||

| Cash | $59,405 | $81,990 | $96,212 |

| Accounts Receivable | $25,875 | $28,537 | $31,449 |

| Inventory | $6,380 | $6,967 | $7,407 |

| Other Current Assets | $0 | $0 | $0 |

| Total Current Assets | $91,660 | $117,494 | $135,068 |

| Long-term Assets | |||

| Long-term Assets | $50,000 | $50,000 | $50,000 |

| Accumulated Depreciation | $4,284 | $8,568 | $12,852 |

| Total Long-term Assets | $45,716 | $41,432 | $37,148 |

| Total Assets | $137,376 | $158,926 | $172,216 |

| Liabilities and Capital | Year 1 | Year 2 | Year 3 |

| Current Liabilities | |||

| Accounts Payable | $11,772 | $14,327 | $15,273 |

| Current Borrowing | $0 | $0 | $0 |

| Other Current Liabilities | $0 | $0 | $0 |

| Subtotal Current Liabilities | $11,772 | $14,327 | $15,273 |

| Long-term Liabilities | $90,004 | $80,008 | $70,012 |

| Total Liabilities | $101,776 | $94,335 | $85,285 |

| Paid-in Capital | $65,000 | $65,000 | $65,000 |

| Retained Earnings | ($57,300) | ($29,400) | ($409) |

| Earnings | $27,900 | $28,991 | $22,341 |

| Total Capital | $35,600 | $64,591 | $86,931 |

| Total Liabilities and Capital | $137,376 | $158,926 | $172,216 |

| Net Worth | $35,600 | $64,591 | $86,931 |

Appendix

| Sales Forecast | |||||||||||||

| Month 1 | Month 2 | Month 3 | Month 4 | Month 5 | Month 6 | Month 7 | Month 8 | Month 9 | Month 10 | Month 11 | Month 12 | ||

| Sales | |||||||||||||

| New Home Construction | 0% | $19,000 | $19,000 | $19,000 | $23,000 | $27,000 | $30,000 | $29,000 | $24,000 | $19,000 | $14,000 | $11,000 | $14,000 |

| Landscaping Projects | 0% | $0 | $0 | $4,000 | $6,000 | $7,000 | $9,000 | $9,000 | $8,000 | $6,000 | $4,000 | $4,000 | $6,000 |

| Total Sales | $19,000 | $19,000 | $23,000 | $29,000 | $34,000 | $39,000 | $38,000 | $32,000 | $25,000 | $18,000 | $15,000 | $20,000 | |

| Direct Cost of Sales | Month 1 | Month 2 | Month 3 | Month 4 | Month 5 | Month 6 | Month 7 | Month 8 | Month 9 | Month 10 | Month 11 | Month 12 | |

| New Home Construction | $5,000 | $5,000 | $5,000 | $6,400 | $7,800 | $9,000 | $8,000 | $6,400 | $5,000 | $4,000 | $3,000 | $4,000 | |

| Landscaping Projects | $0 | $0 | $1,000 | $1,800 | $2,200 | $2,700 | $2,700 | $2,000 | $1,800 | $1,200 | $1,200 | $1,800 | |

| Subtotal Direct Cost of Sales | $5,000 | $5,000 | $6,000 | $8,200 | $10,000 | $11,700 | $10,700 | $8,400 | $6,800 | $5,200 | $4,200 | $5,800 | |

| Personnel Plan | |||||||||||||

| Month 1 | Month 2 | Month 3 | Month 4 | Month 5 | Month 6 | Month 7 | Month 8 | Month 9 | Month 10 | Month 11 | Month 12 | ||

| Andrew Hass | 0% | $2,500 | $2,500 | $2,500 | $2,500 | $2,500 | $2,500 | $2,500 | $2,500 | $2,500 | $2,500 | $2,500 | $2,500 |

| Irrigation Crew Members (3) | 0% | $7,500 | $7,500 | $7,500 | $7,500 | $7,500 | $7,500 | $7,500 | $7,500 | $7,500 | $7,500 | $7,500 | $7,500 |

| Total People | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | |

| Total Payroll | $10,000 | $10,000 | $10,000 | $10,000 | $10,000 | $10,000 | $10,000 | $10,000 | $10,000 | $10,000 | $10,000 | $10,000 | |

| General Assumptions | |||||||||||||

| Month 1 | Month 2 | Month 3 | Month 4 | Month 5 | Month 6 | Month 7 | Month 8 | Month 9 | Month 10 | Month 11 | Month 12 | ||

| Plan Month | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 | 11 | 12 | |

| Current Interest Rate | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | |

| Long-term Interest Rate | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | |

| Tax Rate | 30.00% | 30.00% | 30.00% | 30.00% | 30.00% | 30.00% | 30.00% | 30.00% | 30.00% | 30.00% | 30.00% | 30.00% | |

| Other | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | |

| Pro Forma Profit and Loss | |||||||||||||

| Month 1 | Month 2 | Month 3 | Month 4 | Month 5 | Month 6 | Month 7 | Month 8 | Month 9 | Month 10 | Month 11 | Month 12 | ||

| Sales | $19,000 | $19,000 | $23,000 | $29,000 | $34,000 | $39,000 | $38,000 | $32,000 | $25,000 | $18,000 | $15,000 | $20,000 | |

| Direct Cost of Sales | $5,000 | $5,000 | $6,000 | $8,200 | $10,000 | $11,700 | $10,700 | $8,400 | $6,800 | $5,200 | $4,200 | $5,800 | |

| Other Production Expenses | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Total Cost of Sales | $5,000 | $5,000 | $6,000 | $8,200 | $10,000 | $11,700 | $10,700 | $8,400 | $6,800 | $5,200 | $4,200 | $5,800 | |

| Gross Margin | $14,000 | $14,000 | $17,000 | $20,800 | $24,000 | $27,300 | $27,300 | $23,600 | $18,200 | $12,800 | $10,800 | $14,200 | |

| Gross Margin % | 73.68% | 73.68% | 73.91% | 71.72% | 70.59% | 70.00% | 71.84% | 73.75% | 72.80% | 71.11% | 72.00% | 71.00% | |

| Expenses | |||||||||||||

| Payroll | $10,000 | $10,000 | $10,000 | $10,000 | $10,000 | $10,000 | $10,000 | $10,000 | $10,000 | $10,000 | $10,000 | $10,000 | |

| Sales and Marketing and Other Expenses | $1,500 | $1,500 | $1,500 | $1,500 | $1,500 | $1,500 | $1,500 | $1,500 | $1,500 | $1,500 | $1,500 | $1,500 | |

| Depreciation | $357 | $357 | $357 | $357 | $357 | $357 | $357 | $357 | $357 | $357 | $357 | $357 | |

| Leased Equipment | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Utilities | $200 | $200 | $200 | $200 | $200 | $200 | $200 | $200 | $200 | $200 | $200 | $200 | |

| Insurance | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Rent | $1,000 | $1,000 | $1,000 | $1,000 | $1,000 | $1,000 | $1,000 | $1,000 | $1,000 | $1,000 | $1,000 | $1,000 | |

| Payroll Taxes | 15% | $1,500 | $1,500 | $1,500 | $1,500 | $1,500 | $1,500 | $1,500 | $1,500 | $1,500 | $1,500 | $1,500 | $1,500 |

| Other | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Total Operating Expenses | $14,557 | $14,557 | $14,557 | $14,557 | $14,557 | $14,557 | $14,557 | $14,557 | $14,557 | $14,557 | $14,557 | $14,557 | |

| Profit Before Interest and Taxes | ($557) | ($557) | $2,443 | $6,243 | $9,443 | $12,743 | $12,743 | $9,043 | $3,643 | ($1,757) | ($3,757) | ($357) | |

| EBITDA | ($200) | ($200) | $2,800 | $6,600 | $9,800 | $13,100 | $13,100 | $9,400 | $4,000 | ($1,400) | ($3,400) | $0 | |

| Interest Expense | $826 | $819 | $813 | $806 | $799 | $792 | $785 | $778 | $771 | $764 | $757 | $750 | |

| Taxes Incurred | ($415) | ($413) | $489 | $1,631 | $2,593 | $3,585 | $3,587 | $2,480 | $862 | ($756) | ($1,354) | ($332) | |

| Net Profit | ($968) | ($964) | $1,141 | $3,806 | $6,051 | $8,366 | $8,371 | $5,786 | $2,010 | ($1,765) | ($3,160) | ($775) | |

| Net Profit/Sales | -5.10% | -5.07% | 4.96% | 13.12% | 17.80% | 21.45% | 22.03% | 18.08% | 8.04% | -9.80% | -21.07% | -3.87% | |

| Pro Forma Cash Flow | |||||||||||||

| Month 1 | Month 2 | Month 3 | Month 4 | Month 5 | Month 6 | Month 7 | Month 8 | Month 9 | Month 10 | Month 11 | Month 12 | ||

| Cash Received | |||||||||||||

| Cash from Operations | |||||||||||||

| Cash Sales | $4,750 | $4,750 | $5,750 | $7,250 | $8,500 | $9,750 | $9,500 | $8,000 | $6,250 | $4,500 | $3,750 | $5,000 | |

| Cash from Receivables | $0 | $475 | $14,250 | $14,350 | $17,400 | $21,875 | $25,625 | $29,225 | $28,350 | $23,825 | $18,575 | $13,425 | |

| Subtotal Cash from Operations | $4,750 | $5,225 | $20,000 | $21,600 | $25,900 | $31,625 | $35,125 | $37,225 | $34,600 | $28,325 | $22,325 | $18,425 | |

| Additional Cash Received | |||||||||||||

| Sales Tax, VAT, HST/GST Received | 0.00% | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| New Current Borrowing | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| New Other Liabilities (interest-free) | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| New Long-term Liabilities | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Sales of Other Current Assets | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Sales of Long-term Assets | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| New Investment Received | $0 | $5,000 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Subtotal Cash Received | $4,750 | $10,225 | $20,000 | $21,600 | $25,900 | $31,625 | $35,125 | $37,225 | $34,600 | $28,325 | $22,325 | $18,425 | |

| Expenditures | Month 1 | Month 2 | Month 3 | Month 4 | Month 5 | Month 6 | Month 7 | Month 8 | Month 9 | Month 10 | Month 11 | Month 12 | |

| Expenditures from Operations | |||||||||||||

| Cash Spending | $10,000 | $10,000 | $10,000 | $10,000 | $10,000 | $10,000 | $10,000 | $10,000 | $10,000 | $10,000 | $10,000 | $10,000 | |

| Bill Payments | $154 | $4,611 | $4,636 | $5,539 | $6,842 | $13,104 | $22,015 | $18,011 | $13,246 | $10,765 | $7,616 | $6,885 | |

| Subtotal Spent on Operations | $10,154 | $14,611 | $14,636 | $15,539 | $16,842 | $23,104 | $32,015 | $28,011 | $23,246 | $20,765 | $17,616 | $16,885 | |

| Additional Cash Spent | |||||||||||||

| Sales Tax, VAT, HST/GST Paid Out | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Principal Repayment of Current Borrowing | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Other Liabilities Principal Repayment | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Long-term Liabilities Principal Repayment | $833 | $833 | $833 | $833 | $833 | $833 | $833 | $833 | $833 | $833 | $833 | $833 | |

| Purchase Other Current Assets | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Purchase Long-term Assets | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Dividends | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Subtotal Cash Spent | $10,987 | $15,444 | $15,469 | $16,372 | $17,675 | $23,937 | $32,848 | $28,844 | $24,079 | $21,598 | $18,449 | $17,718 | |

| Net Cash Flow | ($6,237) | ($5,219) | $4,531 | $5,228 | $8,225 | $7,688 | $2,277 | $8,381 | $10,521 | $6,727 | $3,876 | $707 | |

| Cash Balance | $6,463 | $1,244 | $5,775 | $11,002 | $19,227 | $26,915 | $29,193 | $37,574 | $48,096 | $54,823 | $58,698 | $59,405 | |

| Pro Forma Balance Sheet | |||||||||||||

| Month 1 | Month 2 | Month 3 | Month 4 | Month 5 | Month 6 | Month 7 | Month 8 | Month 9 | Month 10 | Month 11 | Month 12 | ||

| Assets | Starting Balances | ||||||||||||

| Current Assets | |||||||||||||

| Cash | $12,700 | $6,463 | $1,244 | $5,775 | $11,002 | $19,227 | $26,915 | $29,193 | $37,574 | $48,096 | $54,823 | $58,698 | $59,405 |

| Accounts Receivable | $0 | $14,250 | $28,025 | $31,025 | $38,425 | $46,525 | $53,900 | $56,775 | $51,550 | $41,950 | $31,625 | $24,300 | $25,875 |

| Inventory | $40,000 | $35,000 | $30,000 | $24,000 | $15,800 | $11,000 | $12,870 | $11,770 | $9,240 | $7,480 | $5,720 | $4,620 | $6,380 |

| Other Current Assets | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| Total Current Assets | $52,700 | $55,713 | $59,269 | $60,800 | $65,227 | $76,752 | $93,685 | $97,738 | $98,364 | $97,526 | $92,168 | $87,618 | $91,660 |

| Long-term Assets | |||||||||||||

| Long-term Assets | $50,000 | $50,000 | $50,000 | $50,000 | $50,000 | $50,000 | $50,000 | $50,000 | $50,000 | $50,000 | $50,000 | $50,000 | $50,000 |

| Accumulated Depreciation | $0 | $357 | $714 | $1,071 | $1,428 | $1,785 | $2,142 | $2,499 | $2,856 | $3,213 | $3,570 | $3,927 | $4,284 |

| Total Long-term Assets | $50,000 | $49,643 | $49,286 | $48,929 | $48,572 | $48,215 | $47,858 | $47,501 | $47,144 | $46,787 | $46,430 | $46,073 | $45,716 |

| Total Assets | $102,700 | $105,356 | $108,555 | $109,729 | $113,799 | $124,967 | $141,543 | $145,239 | $145,508 | $144,313 | $138,598 | $133,691 | $137,376 |

| Liabilities and Capital | Month 1 | Month 2 | Month 3 | Month 4 | Month 5 | Month 6 | Month 7 | Month 8 | Month 9 | Month 10 | Month 11 | Month 12 | |

| Current Liabilities | |||||||||||||

| Accounts Payable | $0 | $4,458 | $4,453 | $5,318 | $6,416 | $12,366 | $21,409 | $17,566 | $12,883 | $10,510 | $7,393 | $6,479 | $11,772 |

| Current Borrowing | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| Other Current Liabilities | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| Subtotal Current Liabilities | $0 | $4,458 | $4,453 | $5,318 | $6,416 | $12,366 | $21,409 | $17,566 | $12,883 | $10,510 | $7,393 | $6,479 | $11,772 |

| Long-term Liabilities | $100,000 | $99,167 | $98,334 | $97,501 | $96,668 | $95,835 | $95,002 | $94,169 | $93,336 | $92,503 | $91,670 | $90,837 | $90,004 |

| Total Liabilities | $100,000 | $103,625 | $102,787 | $102,819 | $103,084 | $108,201 | $116,411 | $111,735 | $106,219 | $103,013 | $99,063 | $97,316 | $101,776 |

| Paid-in Capital | $60,000 | $60,000 | $65,000 | $65,000 | $65,000 | $65,000 | $65,000 | $65,000 | $65,000 | $65,000 | $65,000 | $65,000 | $65,000 |

| Retained Earnings | ($57,300) | ($57,300) | ($57,300) | ($57,300) | ($57,300) | ($57,300) | ($57,300) | ($57,300) | ($57,300) | ($57,300) | ($57,300) | ($57,300) | ($57,300) |

| Earnings | $0 | ($968) | ($1,932) | ($791) | $3,016 | $9,067 | $17,433 | $25,803 | $31,589 | $33,600 | $31,835 | $28,675 | $27,900 |

| Total Capital | $2,700 | $1,732 | $5,768 | $6,909 | $10,716 | $16,767 | $25,133 | $33,503 | $39,289 | $41,300 | $39,535 | $36,375 | $35,600 |

| Total Liabilities and Capital | $102,700 | $105,356 | $108,555 | $109,729 | $113,799 | $124,967 | $141,543 | $145,239 | $145,508 | $144,313 | $138,598 | $133,691 | $137,376 |

| Net Worth | $2,700 | $1,732 | $5,768 | $6,909 | $10,716 | $16,767 | $25,133 | $33,503 | $39,289 | $41,300 | $39,535 | $36,375 | $35,600 |