Betcher Chiropractic

Executive Summary

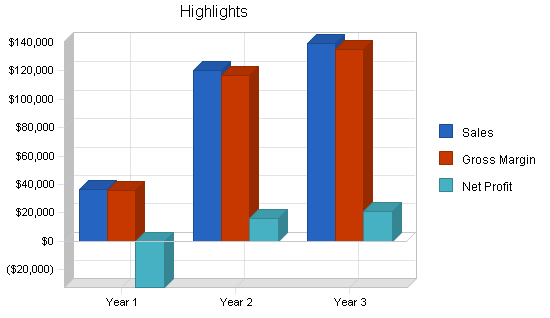

Betcher Chiropractic is an Oregon L.L.C. with doctor Tarri Betcher as the majority owner. Betcher Chiropractic is a start-up business that will achieve profitability by the second year of operation.

The Market

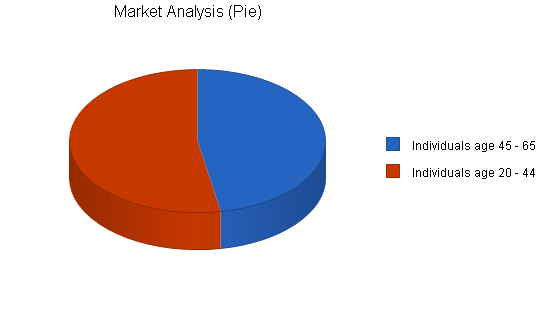

Demand for chiropractic medicine has been growing over the last few years. Growth is due to acceptance by many insurance policies, and an increase of published research that indicates the effectiveness for patients. Betcher Chiropractic has identified two distinct customer segments: individuals ages 45-65 and individuals ages 20-44.

Services

Chiropractors diagnose and treat patients whose health problems are associated with the body’s muscular, nervous, and skeletal systems, especially the spine. Chiropractors believe interference with these systems impairs normal functions and lowers resistance to disease. They also hold that the spinal or vertebral dysfunction alters many important body functions by affecting the nervous system and the skeletal imbalance through joint or articular dysfunction.

This chiropractor’s approach to health care is holistic, emphasizing the patient’s overall health and wellness. Betcher Chiropractic recognizes that there are many factors that can affect one’s wellness including but not limited to: exercise, diet, rest, environment, and hereditary. Betcher Chiropractic provides natural, drugless, nonsurgical health treatments, relying on the bodies inherent recuperative functions.

Competitive Edge

Betcher Chiropractic treats every patient with the philosophical approaches of individualism and holistic medicine. Wellness problems are generally affected by various systems working together and should be treated accordingly. Success is achieved by addressing and managing the problems that prompted the patient to visit the doctor.

1.1 Objectives

- To create a health care facility whose goal is to exceed patient’s expectations. This will be tracked with patient surveys as the feedback mechanism.

- To increase the number of clients served by at least 25% each year.

- To create a start-up business surviving off its own cash by month 20 of operation.

- To build a strong repeat and referral client base.

1.2 Mission

Betcher Chiropractic’s mission is simply to attract and maintain clients by offering the most uniquely individualized and professional care available, and to promote the well being of all patients while helping each to achieve and maintain the highest quality of life.

1.3 Keys to Success

1. Location: providing easy accessibility and amply parking for patients that may have physical limitations.

2. Environment: providing an environment that is both relaxing and professional.

3. Convenience: offering patients extended business hours.

4. Reputation: establishing an excellent reputation within the community.

Company Summary

Betcher Chiropractic has been established as an Oregon L.L.C. in 2003.

2.1 Company Ownership

Tarri Betcher D.C. has a majority ownership interest in Betcher Chiropractic.

2.2 Start-up Summary

Please see the following start-up chart and table for a detailed breakdown of the various expenses. Tarri brings $2,500 of already existing equipment.

The following equipment are needed for start up.

- One drop style adjusting table.

- One ultra sound/high volt physical therapy machine.

- Computer software including DSL connection, QuickBooks Pro, and Microsoft Office.

- Filing cabinet.

- Two phone lines with answering machine and fax machine.

- Copy machine.

- Reception area furniture and decorations.

Existing equipment:

- Two adjusting tables (one bench style and one portable).

- Computer system with printer.

- Desk.

- Activator chiropractic instrument.

- Welch Allyn oto-opthomoscope.

- Lettmann stethoscope.

- Tyco blood pressure instrument with all cuffs.

- Chiropractic and medical health care library.

| Start-up Funding | |

| Start-up Expenses to Fund | $21,500 |

| Start-up Assets to Fund | $58,500 |

| Total Funding Required | $80,000 |

| Assets | |

| Non-cash Assets from Start-up | $17,500 |

| Cash Requirements from Start-up | $41,000 |

| Additional Cash Raised | $0 |

| Cash Balance on Starting Date | $41,000 |

| Total Assets | $58,500 |

| Liabilities and Capital | |

| Liabilities | |

| Current Borrowing | $0 |

| Long-term Liabilities | $20,000 |

| Accounts Payable (Outstanding Bills) | $0 |

| Other Current Liabilities (interest-free) | $0 |

| Total Liabilities | $20,000 |

| Capital | |

| Planned Investment | |

| Investor 1 | $40,000 |

| Investor 2 | $20,000 |

| Additional Investment Requirement | $0 |

| Total Planned Investment | $60,000 |

| Loss at Start-up (Start-up Expenses) | ($21,500) |

| Total Capital | $38,500 |

| Total Capital and Liabilities | $58,500 |

| Total Funding | $80,000 |

| Start-up | |

| Requirements | |

| Start-up Expenses | |

| Legal | $300 |

| Advertising | $2,000 |

| Stationery etc. | $200 |

| Brochures | $150 |

| Consultants | $150 |

| Insurance | $800 |

| Rent deposit and 1st and last months rent | $2,700 |

| Rent for six months | $7,200 |

| Leasehold improvements | $5,000 |

| Expensed equipment | $2,000 |

| Other | $1,000 |

| Total Start-up Expenses | $21,500 |

| Start-up Assets | |

| Cash Required | $41,000 |

| Other Current Assets | $2,500 |

| Long-term Assets | $15,000 |

| Total Assets | $58,500 |

| Total Requirements | $80,000 |

Services

Chiropractors, also known as doctors of chiropractic or chiropractic physicians, diagnose and treat patients whose health problems are associated with the body’s muscular, nervous, and skeletal systems, especially the spine. Chiropractors believe interference with these systems impairs normal functions and lowers resistance to disease. They also hold that the spinal or vertebral dysfunction alters many important body functions by affecting the nervous system, and the skeletal imbalance through joint or articular dysfunction.

This chiropractor’s approach to health care is holistic, emphasizing the patient’s overall health and wellness. Betcher Chiropractic recognizes that there are many factors that can effect one’s wellness including but not limited to: exercise, diet, rest, environment, and hereditary. Betcher Chiropractic provides natural, drugless, nonsurgical health treatments, relying on the bodies inherent recuperative functions.

Betcher Chiropractic specializes in the following body areas for treatment:

- Back pain: Many factors can be responsible for back pain. Betcher Chiropractic will attempt to restore a more normal motion and position of affected spinal bones through specific chiropractic adjustments.

- Shoulder pain: There is a range of shoulder pain from a persistent ache that merely irritates to acute pain the affects daily activities.

- Neck pain: Betcher Chiropractic can have significant success in reducing a wide range of neck pains.

- Headaches: Some studies estimate that 25% of the population have a headache right now. Headaches are often caused by a malfunction of spinal bones in the neck and upper back.

- Whiplash: Whiplash is defined as an injury to the neck by a sudden movement of the head and a variety of directions. Betcher Chiropractic is often able to offer significant relief from pain caused by whiplash.

Market Analysis Summary

Betcher Chiropractic has identified two distinct market segments that it will target. The largest segment is individuals ages 45-65. This is the age group that begins to experience an increased incidence of health problems. The second market segment is individuals age 20-44. This group is interested in chiropractic medicine due their larger acceptance of alternative medicine.

4.1 Market Segmentation

Betcher Chiropractic has identified two distinct market segments that it will target services to.

Individuals age 45-65

This customer segment has experienced an increase in wellness issues, particularly those that are related to the vertebral dysfunction. This segment often has the disposable income to pay for visits in the event that their insurance does not cover chiropractic visits.

- Have a household income of at least $65,000

- 67% of the group have at least an undergraduate degree

- 29% of the customers have a graduate degree

- Tend to fall in the middle or slightly to the left politically

- Are open to try new treatments in search of a wellness program that will reduce their current pain levels

- 44% of the customer are vegetarian

- 67% of the customers are cognizant of their food intake and are careful to analyze their diet

Individuals age 25-44

This segment is in search of a wellness treatment/program to address their constant or intermittent pains. This segment may or may not have tried a more traditional medical treatment, with no relief. This is a more liberal group that is embracing alternative therapy in replace of more traditional western medicine regimes.

- Have an individual income of at least $35,000

- 76% of the group population have an undergraduate degree

- 24% of the group have a graduate degree or some graduate course work

- Are politically liberal

- 54% have tried another type of alternative treatments to address their wellness issues

- 49% of the group are vegetarians

| Market Analysis | |||||||

| Year 1 | Year 2 | Year 3 | Year 4 | Year 5 | |||

| Potential Customers | Growth | CAGR | |||||

| Individuals age 45 – 65 | 15% | 345,090 | 396,854 | 456,382 | 524,839 | 603,565 | 15.00% |

| Individuals age 20 – 44 | 10% | 387,090 | 425,799 | 468,379 | 515,217 | 566,739 | 10.00% |

| Total | 12.44% | 732,180 | 822,653 | 924,761 | 1,040,056 | 1,170,304 | 12.44% |

4.2 Target Market Segment Strategy

Betcher Chiropractic has targeted these groups for two separate but important reasons. Each factor applies more directly to one of the two different groups.

- Health Problems: A variety of health problems associated with the body’s muscular, nervous, and skeletal systems is the impetus for the majority of customers age 45-65. It is at this mid to late portion of a person’s life that they began to develop more wellness issues. This customer segment seeks out chiropractors to aid in the management of the pain/discomfort.

- Openness to alternative medicine: For individuals age 25-44, the willingness to try alternative medicine therapy is a significant motivator for the customers to use a chiropractor’s treatment. They are open to the possibility that an alternative form of treatment can be effective in allowing them to manage their pain. This openness to alternative treatment could be a result of western medicine’s ineffectiveness, or a willness to try non-conventional means.

4.3 Service Business Analysis

Chiropractors are licensed doctors of chiropractic medicine. All states regulate the practice of chiropractic and grant licenses to chiropractors who meet educational and examination requirements. Most state boards require a four year bachelors degree in additional to chiropractic college coursework from an accredited program for becoming a Doctor of Chiropractic. There are currently 16 accredited Chiropractic Education programs.

The job market for chiropractors is growing at a faster rate than the average of all occupations. There are about 50,000 licensed chiropractors, most in a solo practice, although some practice with a group. Median annual earnings of salaried chiropractors was $67,030 in 2000. The middle 50% earned between $44,030 and $105,520 a year.

Self employed doctors typically earn more than their salaried counterparts. Typically chiropractic doctors experience relatively low earnings initially, increasing as their practice grows.

4.3.1 Competition and Buying Patterns

There are approximately 2,300 chiropractic doctors in Oregon, 1,390 in Portland alone. In Portland, 89% of the chiropractors are in a solo practice. The direct competitors to Betcher Chiropractic are other local chiropractors. Indirect competitors are other alternative treatment providers as well as more traditional physicians.

Buying patterns of customers are usually dictated by the element of networking or word of mouth. Patients are more likely to visit a doctor that is recommended to them, however not everyone can get a referral. Patients that have success with a chiropractor are often quite vocal about their results thereby increasing the word of mouth effect.

Strategy and Implementation Summary

Betcher Chiropractic will leverage its competitive edge of a strict individual, holistic approach which is more successful than other doctors by truly concentrating on the individual and making specific analysis and recommendations for the particular individual. The marketing strategy will employ several different methods including free public seminars, print advertising, and networking activities. The sales effort will be a specific and conscious effort to exceed the customer’s expectations. This effort recognizes the significant value of word of mouth referrals and by adopting this approach fuels these customer base building activities.

5.1 Sales Strategy

The sales strategy is based on the need to exceed all of the customer’s expectations. By exceeding all expectations, customer’s will have only positive things to say about Betcher Chiropractic. Additionally, a patient that has been successfully treated is particularly vocal about the experience with their friends and aquaintances because the improvement of one’s wellness is so fundamental and apparent in one’s life.

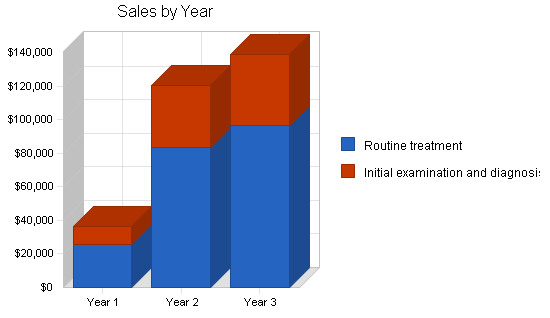

5.1.1 Sales Forecast

Betcher Chiropractic has developed a conservative forecast that recognizes growth in a doctor’s practice is slow, steady and incremental. This type of growth is acceptable because it adopts a long-term perspective as opposed to short-term profits that are unlikely to be sustainable. Please review the following chart and table for more detailed information of the sales forecasts.

| Sales Forecast | |||

| Year 1 | Year 2 | Year 3 | |

| Sales | |||

| Routine treatment | $25,432 | $83,455 | $96,554 |

| Initial examination and diagnosis | $11,190 | $36,720 | $42,484 |

| Total Sales | $36,622 | $120,175 | $139,038 |

| Direct Cost of Sales | Year 1 | Year 2 | Year 3 |

| Routine treatment | $509 | $1,669 | $1,931 |

| Initial examination and diagnosis | $509 | $1,669 | $1,931 |

| Subtotal Direct Cost of Sales | $1,017 | $3,338 | $3,862 |

5.2 Competitive Edge

Betcher Chiropractic’s competitive edge is the holistic individual approach to wellness. The basic assumptions of this approach are:

- Each patient is a distinct individual. While there are many common problems among people, each individual’s body reacts differently to different stimuli and the most effective treatment assumes that analysis must be made using traditional flow chart frameworks while taking into account the significant individual variance.

- All wellness treatments must be addressed in a holistic manner. The human body is a complex “ecosystem” of many interconnected systems. Wellness problems are rarely specific to an organ or system, they are generally affected by various systems working together and should be treated accordingly.

Betcher Chiropractic treats every patient with these philosophical approaches. Betcher Chiropractic is able to offer more effective treatment relative to other doctors because its mission is to treat patients in the most effective manner. Success is achieved by addressing the problems that prompted the patient to visit the doctor. By religiously following the above mentioned approaches Betcher Chiropractic can offer more effective care.

5.3 Marketing Strategy

The marketing strategy is based on three different types of activities:

- Public Seminars: Betcher Chiropractic will offer numerous free public seminars in an effort to increase visibility in the surrounding communities. Seminars are an effective way of introducing Betcher Chiropractic to prospective customers. They increase visibility of Betcher Chiropractic and provide a venue to develop a trust relationship with the individual, an important foundation of a doctor-patient relationship.

- Print Advertising: Betcher Chiropractic has identified several publications that Betcher Chiropractic will advertise in including The Oregonian and Willamette Weekly.

- Networking: This marketing effort recognizes that the buying patterns of patients are often based on who you know. By performing numerous networking activities both professional and personally, Betcher Chiropractic will be introduced to a larger number of people and this will increase the number of conversions from potential customer to patient.

5.4 Milestones

Betcher Chiropractic has identified four specific milestones that will be ambitious but achievable goals for the organization:

- Completion of the business plan.

- Secure and prepare the facilities.

- Full time status.

- Profitability.

| Milestones | |||||

| Milestone | Start Date | End Date | Budget | Manager | Department |

| Completion of business plan | 1/1/2003 | 2/1/2003 | $0 | Dr. Betcher | Marketing |

| Securing and preparing facilities | 1/1/2003 | 3/1/2003 | $0 | Dr. Betcher | Department |

| Full time status | 1/1/2003 | 8/1/2003 | $0 | Dr. Betcher | Department |

| Profitability | 1/1/2003 | 6/0/04 | $0 | Dr. Betcher | Department |

| Totals | $0 | ||||

Management Summary

Tarri Betcher received her undergraduate degree in Biology from the University of Oregon. Throughout school Tarri believed hat she wanted to serve in some sort of care taker role but was unsure in what capacity.

During her final year, Tarri assisted a chiropractor. What she really enjoyed about this line of work was the amount of success or progress that the doctor made with each patient.

Recognizing that most chiropractors are in solo practice, Tarri took an additional year of post undergraduate course work to strengthen her business/small business management skills in anticipation of a future practice.

Tarri began her four year chiropractic college course work at the Portland Chiropractic College. During this four year period where Tarri, was an honors student, earning all of her education requirements and participating in numerous clinics providing her with hands-on experience. Upon graduation Tarri began work on a business plan for the new solo practice, a recognition of the importance of a plan in the success of her future business venture.

6.1 Personnel Plan

Dr. Tarri Betcher will be the doctor and sole employee for the first part of year one. Once sufficient business has developed, Dr. Betcher will employ an office assistant that will help with scheduling and appointments, bookkeeping, answering phones, and other various activities. This will free up the doctors time to allow her to service the patients. Please review the following table which contains detailed personnel information.

| Personnel Plan | |||

| Year 1 | Year 2 | Year 3 | |

| Dr. Betcher | $26,500 | $40,000 | $50,000 |

| Office Assistant | $8,000 | $14,400 | $14,400 |

| Total People | 2 | 2 | 2 |

| Total Payroll | $34,500 | $54,400 | $64,400 |

Financial Plan

The following sections will outline important financial information.

7.1 Important Assumptions

The following table details important Financial Assumptions.

| General Assumptions | |||

| Year 1 | Year 2 | Year 3 | |

| Plan Month | 1 | 2 | 3 |

| Current Interest Rate | 10.00% | 10.00% | 10.00% |

| Long-term Interest Rate | 10.00% | 10.00% | 10.00% |

| Tax Rate | 25.42% | 25.00% | 25.42% |

| Other | 0 | 0 | 0 |

7.2 Projected Cash Flow

The following chart and table will indicate Projected Cash Flow.

| Pro Forma Cash Flow | |||

| Year 1 | Year 2 | Year 3 | |

| Cash Received | |||

| Cash from Operations | |||

| Cash Sales | $9,156 | $30,044 | $34,759 |

| Cash from Receivables | $18,697 | $70,124 | $99,762 |

| Subtotal Cash from Operations | $27,853 | $100,168 | $134,521 |

| Additional Cash Received | |||

| Sales Tax, VAT, HST/GST Received | $0 | $0 | $0 |

| New Current Borrowing | $0 | $0 | $0 |

| New Other Liabilities (interest-free) | $0 | $0 | $0 |

| New Long-term Liabilities | $0 | $0 | $0 |

| Sales of Other Current Assets | $0 | $0 | $0 |

| Sales of Long-term Assets | $0 | $0 | $0 |

| New Investment Received | $0 | $0 | $0 |

| Subtotal Cash Received | $27,853 | $100,168 | $134,521 |

| Expenditures | Year 1 | Year 2 | Year 3 |

| Expenditures from Operations | |||

| Cash Spending | $34,500 | $54,400 | $64,400 |

| Bill Payments | $28,678 | $45,596 | $50,229 |

| Subtotal Spent on Operations | $63,178 | $99,996 | $114,629 |

| Additional Cash Spent | |||

| Sales Tax, VAT, HST/GST Paid Out | $0 | $0 | $0 |

| Principal Repayment of Current Borrowing | $0 | $0 | $0 |

| Other Liabilities Principal Repayment | $0 | $0 | $0 |

| Long-term Liabilities Principal Repayment | $3,036 | $2,783 | $2,783 |

| Purchase Other Current Assets | $0 | $0 | $0 |

| Purchase Long-term Assets | $0 | $0 | $0 |

| Dividends | $0 | $0 | $0 |

| Subtotal Cash Spent | $66,214 | $102,779 | $117,412 |

| Net Cash Flow | ($38,361) | ($2,611) | $17,109 |

| Cash Balance | $2,639 | $28 | $17,138 |

7.3 Break-even Analysis

The Break-even Analysis indicates what is needed in monthly revenue to reach the break-even point.

| Break-even Analysis | |

| Monthly Revenue Break-even | $5,685 |

| Assumptions: | |

| Average Percent Variable Cost | 3% |

| Estimated Monthly Fixed Cost | $5,527 |

7.4 Projected Profit and Loss

The following table will indicate Projected Profit and Loss.

| Pro Forma Profit and Loss | |||

| Year 1 | Year 2 | Year 3 | |

| Sales | $36,622 | $120,175 | $139,038 |

| Direct Cost of Sales | $1,017 | $3,338 | $3,862 |

| Other | $0 | $0 | $0 |

| Total Cost of Sales | $1,017 | $3,338 | $3,862 |

| Gross Margin | $35,605 | $116,837 | $135,176 |

| Gross Margin % | 97.22% | 97.22% | 97.22% |

| Expenses | |||

| Payroll | $34,500 | $54,400 | $64,400 |

| Sales and Marketing and Other Expenses | $3,520 | $4,010 | $4,180 |

| Depreciation | $3,000 | $3,000 | $3,000 |

| Utilities (all) | $3,300 | $3,900 | $4,000 |

| Insurance – malpractice | $1,210 | $1,530 | $1,550 |

| Insurance – workers comp | $220 | $260 | $260 |

| Insurance – liability | $2,200 | $2,600 | $2,600 |

| Rent | $13,200 | $15,600 | $16,000 |

| Payroll Taxes | $5,175 | $8,160 | $9,660 |

| Total Operating Expenses | $66,325 | $93,460 | $105,650 |

| Profit Before Interest and Taxes | ($30,720) | $23,377 | $29,526 |

| EBITDA | ($27,720) | $26,377 | $32,526 |

| Interest Expense | $1,836 | $1,557 | $1,279 |

| Taxes Incurred | $0 | $5,455 | $7,179 |

| Net Profit | ($32,556) | $16,365 | $21,067 |

| Net Profit/Sales | -88.90% | 13.62% | 15.15% |

7.5 Projected Balance Sheet

The following table will indicate the Projected Balance Sheet.

| Pro Forma Balance Sheet | |||

| Year 1 | Year 2 | Year 3 | |

| Assets | |||

| Current Assets | |||

| Cash | $2,639 | $28 | $17,138 |

| Accounts Receivable | $8,769 | $28,776 | $33,293 |

| Other Current Assets | $2,500 | $2,500 | $2,500 |

| Total Current Assets | $13,908 | $31,305 | $52,931 |

| Long-term Assets | |||

| Long-term Assets | $15,000 | $15,000 | $15,000 |

| Accumulated Depreciation | $3,000 | $6,000 | $9,000 |

| Total Long-term Assets | $12,000 | $9,000 | $6,000 |

| Total Assets | $25,908 | $40,305 | $58,931 |

| Liabilities and Capital | Year 1 | Year 2 | Year 3 |

| Current Liabilities | |||

| Accounts Payable | $3,000 | $3,815 | $4,156 |

| Current Borrowing | $0 | $0 | $0 |

| Other Current Liabilities | $0 | $0 | $0 |

| Subtotal Current Liabilities | $3,000 | $3,815 | $4,156 |

| Long-term Liabilities | $16,964 | $14,181 | $11,398 |

| Total Liabilities | $19,964 | $17,996 | $15,554 |

| Paid-in Capital | $60,000 | $60,000 | $60,000 |

| Retained Earnings | ($21,500) | ($54,056) | ($37,691) |

| Earnings | ($32,556) | $16,365 | $21,067 |

| Total Capital | $5,944 | $22,309 | $43,376 |

| Total Liabilities and Capital | $25,908 | $40,305 | $58,931 |

| Net Worth | $5,944 | $22,309 | $43,376 |

7.6 Business Ratios

The following table outlines some of the more important ratios from the Office of Chiropractors industry. The final column, Industry Profile, details specific ratios based on the industry as it is classified by the Standard Industry Classification (SIC) code, 8041.

| Ratio Analysis | ||||

| Year 1 | Year 2 | Year 3 | Industry Profile | |

| Sales Growth | 0.00% | 228.15% | 15.70% | 5.93% |

| Percent of Total Assets | ||||

| Accounts Receivable | 33.85% | 71.40% | 56.50% | 21.14% |

| Other Current Assets | 9.65% | 6.20% | 4.24% | 45.36% |

| Total Current Assets | 53.68% | 77.67% | 89.82% | 71.11% |

| Long-term Assets | 46.32% | 22.33% | 10.18% | 28.89% |

| Total Assets | 100.00% | 100.00% | 100.00% | 100.00% |

| Current Liabilities | 11.58% | 9.46% | 7.05% | 29.10% |

| Long-term Liabilities | 65.48% | 35.18% | 19.34% | 19.50% |

| Total Liabilities | 77.06% | 44.65% | 26.39% | 48.60% |

| Net Worth | 22.94% | 55.35% | 73.61% | 51.40% |

| Percent of Sales | ||||

| Sales | 100.00% | 100.00% | 100.00% | 100.00% |

| Gross Margin | 97.22% | 97.22% | 97.22% | 100.00% |

| Selling, General & Administrative Expenses | 187.02% | 84.16% | 82.76% | 75.10% |

| Advertising Expenses | 3.00% | 1.00% | 0.86% | 0.61% |

| Profit Before Interest and Taxes | -83.88% | 19.45% | 21.24% | 3.98% |

| Main Ratios | ||||

| Current | 4.64 | 8.21 | 12.73 | 1.86 |

| Quick | 4.64 | 8.21 | 12.73 | 1.38 |

| Total Debt to Total Assets | 77.06% | 44.65% | 26.39% | 10.80% |

| Pre-tax Return on Net Worth | -547.68% | 97.81% | 65.12% | 60.83% |

| Pre-tax Return on Assets | -125.66% | 54.14% | 47.93% | 27.59% |

| Additional Ratios | Year 1 | Year 2 | Year 3 | |

| Net Profit Margin | -88.90% | 13.62% | 15.15% | n.a |

| Return on Equity | -547.68% | 73.35% | 48.57% | n.a |

| Activity Ratios | ||||

| Accounts Receivable Turnover | 3.13 | 3.13 | 3.13 | n.a |

| Collection Days | 55 | 76 | 109 | n.a |

| Accounts Payable Turnover | 10.56 | 12.17 | 12.17 | n.a |

| Payment Days | 27 | 27 | 29 | n.a |

| Total Asset Turnover | 1.41 | 2.98 | 2.36 | n.a |

| Debt Ratios | ||||

| Debt to Net Worth | 3.36 | 0.81 | 0.36 | n.a |

| Current Liab. to Liab. | 0.15 | 0.21 | 0.27 | n.a |

| Liquidity Ratios | ||||

| Net Working Capital | $10,908 | $27,490 | $48,774 | n.a |

| Interest Coverage | -16.74 | 15.01 | 23.09 | n.a |

| Additional Ratios | ||||

| Assets to Sales | 0.71 | 0.34 | 0.42 | n.a |

| Current Debt/Total Assets | 12% | 9% | 7% | n.a |

| Acid Test | 1.71 | 0.66 | 4.72 | n.a |

| Sales/Net Worth | 6.16 | 5.39 | 3.21 | n.a |

| Dividend Payout | 0.00 | 0.00 | 0.00 | n.a |

Appendix

| Sales Forecast | |||||||||||||

| Month 1 | Month 2 | Month 3 | Month 4 | Month 5 | Month 6 | Month 7 | Month 8 | Month 9 | Month 10 | Month 11 | Month 12 | ||

| Sales | |||||||||||||

| Routine treatment | 0% | $0 | $0 | $1,100 | $1,325 | $1,656 | $1,998 | $2,254 | $2,626 | $2,998 | $3,232 | $3,698 | $4,545 |

| Initial examination and diagnosis | 0% | $0 | $0 | $484 | $583 | $729 | $879 | $992 | $1,155 | $1,319 | $1,422 | $1,627 | $2,000 |

| Total Sales | $0 | $0 | $1,584 | $1,908 | $2,385 | $2,877 | $3,246 | $3,781 | $4,317 | $4,654 | $5,325 | $6,545 | |

| Direct Cost of Sales | Month 1 | Month 2 | Month 3 | Month 4 | Month 5 | Month 6 | Month 7 | Month 8 | Month 9 | Month 10 | Month 11 | Month 12 | |

| Routine treatment | $0 | $0 | $22 | $27 | $33 | $40 | $45 | $53 | $60 | $65 | $74 | $91 | |

| Initial examination and diagnosis | $0 | $0 | $22 | $27 | $33 | $40 | $45 | $53 | $60 | $65 | $74 | $91 | |

| Subtotal Direct Cost of Sales | $0 | $0 | $44 | $53 | $66 | $80 | $90 | $105 | $120 | $129 | $148 | $182 | |

| Personnel Plan | |||||||||||||

| Month 1 | Month 2 | Month 3 | Month 4 | Month 5 | Month 6 | Month 7 | Month 8 | Month 9 | Month 10 | Month 11 | Month 12 | ||

| Dr. Betcher | 0% | $0 | $2,000 | $2,000 | $2,000 | $2,300 | $2,300 | $2,400 | $2,500 | $2,500 | $2,700 | $2,800 | $3,000 |

| Office Assistant | 0% | $0 | $0 | $0 | $0 | $800 | $800 | $900 | $900 | $1,000 | $1,200 | $1,200 | $1,200 |

| Total People | 0 | 1 | 1 | 1 | 2 | 2 | 2 | 2 | 2 | 2 | 2 | 2 | |

| Total Payroll | $0 | $2,000 | $2,000 | $2,000 | $3,100 | $3,100 | $3,300 | $3,400 | $3,500 | $3,900 | $4,000 | $4,200 | |

| General Assumptions | |||||||||||||

| Month 1 | Month 2 | Month 3 | Month 4 | Month 5 | Month 6 | Month 7 | Month 8 | Month 9 | Month 10 | Month 11 | Month 12 | ||

| Plan Month | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 | 11 | 12 | |

| Current Interest Rate | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | |

| Long-term Interest Rate | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | |

| Tax Rate | 30.00% | 25.00% | 25.00% | 25.00% | 25.00% | 25.00% | 25.00% | 25.00% | 25.00% | 25.00% | 25.00% | 25.00% | |

| Other | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | |

| Pro Forma Profit and Loss | |||||||||||||

| Month 1 | Month 2 | Month 3 | Month 4 | Month 5 | Month 6 | Month 7 | Month 8 | Month 9 | Month 10 | Month 11 | Month 12 | ||

| Sales | $0 | $0 | $1,584 | $1,908 | $2,385 | $2,877 | $3,246 | $3,781 | $4,317 | $4,654 | $5,325 | $6,545 | |

| Direct Cost of Sales | $0 | $0 | $44 | $53 | $66 | $80 | $90 | $105 | $120 | $129 | $148 | $182 | |

| Other | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Total Cost of Sales | $0 | $0 | $44 | $53 | $66 | $80 | $90 | $105 | $120 | $129 | $148 | $182 | |

| Gross Margin | $0 | $0 | $1,540 | $1,855 | $2,318 | $2,797 | $3,156 | $3,676 | $4,197 | $4,525 | $5,177 | $6,363 | |

| Gross Margin % | 0.00% | 0.00% | 97.22% | 97.22% | 97.22% | 97.22% | 97.22% | 97.22% | 97.22% | 97.22% | 97.22% | 97.22% | |

| Expenses | |||||||||||||

| Payroll | $0 | $2,000 | $2,000 | $2,000 | $3,100 | $3,100 | $3,300 | $3,400 | $3,500 | $3,900 | $4,000 | $4,200 | |

| Sales and Marketing and Other Expenses | $0 | $320 | $320 | $320 | $320 | $320 | $320 | $320 | $320 | $320 | $320 | $320 | |

| Depreciation | $250 | $250 | $250 | $250 | $250 | $250 | $250 | $250 | $250 | $250 | $250 | $250 | |

| Utilities (all) | $0 | $300 | $300 | $300 | $300 | $300 | $300 | $300 | $300 | $300 | $300 | $300 | |

| Insurance – malpractice | $0 | $110 | $110 | $110 | $110 | $110 | $110 | $110 | $110 | $110 | $110 | $110 | |

| Insurance – workers comp | $0 | $20 | $20 | $20 | $20 | $20 | $20 | $20 | $20 | $20 | $20 | $20 | |

| Insurance – liability | $0 | $200 | $200 | $200 | $200 | $200 | $200 | $200 | $200 | $200 | $200 | $200 | |

| Rent | 15% | $0 | $1,200 | $1,200 | $1,200 | $1,200 | $1,200 | $1,200 | $1,200 | $1,200 | $1,200 | $1,200 | $1,200 |

| Payroll Taxes | 15% | $0 | $300 | $300 | $300 | $465 | $465 | $495 | $510 | $525 | $585 | $600 | $630 |

| Total Operating Expenses | $250 | $4,700 | $4,700 | $4,700 | $5,965 | $5,965 | $6,195 | $6,310 | $6,425 | $6,885 | $7,000 | $7,230 | |

| Profit Before Interest and Taxes | ($250) | ($4,700) | ($3,160) | ($2,845) | ($3,647) | ($3,168) | ($3,039) | ($2,634) | ($2,228) | ($2,360) | ($1,823) | ($867) | |

| EBITDA | $0 | ($4,450) | ($2,910) | ($2,595) | ($3,397) | ($2,918) | ($2,789) | ($2,384) | ($1,978) | ($2,110) | ($1,573) | ($617) | |

| Interest Expense | $165 | $162 | $160 | $158 | $156 | $154 | $152 | $150 | $148 | $146 | $143 | $141 | |

| Taxes Incurred | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Net Profit | ($415) | ($4,862) | ($3,320) | ($3,003) | ($3,803) | ($3,322) | ($3,191) | ($2,783) | ($2,375) | ($2,506) | ($1,966) | ($1,008) | |

| Net Profit/Sales | 0.00% | 0.00% | -209.62% | -157.40% | -159.47% | -115.46% | -98.32% | -73.61% | -55.02% | -53.84% | -36.92% | -15.41% | |

| Pro Forma Cash Flow | |||||||||||||

| Month 1 | Month 2 | Month 3 | Month 4 | Month 5 | Month 6 | Month 7 | Month 8 | Month 9 | Month 10 | Month 11 | Month 12 | ||

| Cash Received | |||||||||||||

| Cash from Operations | |||||||||||||

| Cash Sales | $0 | $0 | $396 | $477 | $596 | $719 | $811 | $945 | $1,079 | $1,164 | $1,331 | $1,636 | |

| Cash from Receivables | $0 | $0 | $0 | $40 | $1,196 | $1,443 | $1,801 | $2,167 | $2,448 | $2,849 | $3,246 | $3,507 | |

| Subtotal Cash from Operations | $0 | $0 | $396 | $517 | $1,792 | $2,162 | $2,612 | $3,112 | $3,527 | $4,013 | $4,578 | $5,144 | |

| Additional Cash Received | |||||||||||||

| Sales Tax, VAT, HST/GST Received | 0.00% | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| New Current Borrowing | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| New Other Liabilities (interest-free) | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| New Long-term Liabilities | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Sales of Other Current Assets | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Sales of Long-term Assets | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| New Investment Received | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Subtotal Cash Received | $0 | $0 | $396 | $517 | $1,792 | $2,162 | $2,612 | $3,112 | $3,527 | $4,013 | $4,578 | $5,144 | |

| Expenditures | Month 1 | Month 2 | Month 3 | Month 4 | Month 5 | Month 6 | Month 7 | Month 8 | Month 9 | Month 10 | Month 11 | Month 12 | |

| Expenditures from Operations | |||||||||||||

| Cash Spending | $0 | $2,000 | $2,000 | $2,000 | $3,100 | $3,100 | $3,300 | $3,400 | $3,500 | $3,900 | $4,000 | $4,200 | |

| Bill Payments | $5 | $246 | $2,614 | $2,655 | $2,667 | $2,838 | $2,850 | $2,888 | $2,916 | $2,945 | $3,011 | $3,043 | |

| Subtotal Spent on Operations | $5 | $2,246 | $4,614 | $4,655 | $5,767 | $5,938 | $6,150 | $6,288 | $6,416 | $6,845 | $7,011 | $7,243 | |

| Additional Cash Spent | |||||||||||||

| Sales Tax, VAT, HST/GST Paid Out | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Principal Repayment of Current Borrowing | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Other Liabilities Principal Repayment | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Long-term Liabilities Principal Repayment | $253 | $253 | $253 | $253 | $253 | $253 | $253 | $253 | $253 | $253 | $253 | $253 | |

| Purchase Other Current Assets | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Purchase Long-term Assets | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Dividends | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Subtotal Cash Spent | $258 | $2,499 | $4,867 | $4,908 | $6,020 | $6,191 | $6,403 | $6,541 | $6,669 | $7,098 | $7,264 | $7,496 | |

| Net Cash Flow | ($258) | ($2,499) | ($4,471) | ($4,391) | ($4,228) | ($4,029) | ($3,791) | ($3,429) | ($3,142) | ($3,085) | ($2,686) | ($2,353) | |

| Cash Balance | $40,742 | $38,242 | $33,772 | $29,381 | $25,153 | $21,124 | $17,333 | $13,905 | $10,763 | $7,678 | $4,992 | $2,639 | |

| Pro Forma Balance Sheet | |||||||||||||

| Month 1 | Month 2 | Month 3 | Month 4 | Month 5 | Month 6 | Month 7 | Month 8 | Month 9 | Month 10 | Month 11 | Month 12 | ||

| Assets | Starting Balances | ||||||||||||

| Current Assets | |||||||||||||

| Cash | $41,000 | $40,742 | $38,242 | $33,772 | $29,381 | $25,153 | $21,124 | $17,333 | $13,905 | $10,763 | $7,678 | $4,992 | $2,639 |

| Accounts Receivable | $0 | $0 | $0 | $1,188 | $2,579 | $3,172 | $3,887 | $4,520 | $5,189 | $5,979 | $6,620 | $7,368 | $8,769 |

| Other Current Assets | $2,500 | $2,500 | $2,500 | $2,500 | $2,500 | $2,500 | $2,500 | $2,500 | $2,500 | $2,500 | $2,500 | $2,500 | $2,500 |

| Total Current Assets | $43,500 | $43,242 | $40,742 | $37,460 | $34,460 | $30,824 | $27,511 | $24,353 | $21,594 | $19,242 | $16,798 | $14,860 | $13,908 |

| Long-term Assets | |||||||||||||

| Long-term Assets | $15,000 | $15,000 | $15,000 | $15,000 | $15,000 | $15,000 | $15,000 | $15,000 | $15,000 | $15,000 | $15,000 | $15,000 | $15,000 |

| Accumulated Depreciation | $0 | $250 | $500 | $750 | $1,000 | $1,250 | $1,500 | $1,750 | $2,000 | $2,250 | $2,500 | $2,750 | $3,000 |

| Total Long-term Assets | $15,000 | $14,750 | $14,500 | $14,250 | $14,000 | $13,750 | $13,500 | $13,250 | $13,000 | $12,750 | $12,500 | $12,250 | $12,000 |

| Total Assets | $58,500 | $57,992 | $55,242 | $51,710 | $48,460 | $44,574 | $41,011 | $37,603 | $34,594 | $31,992 | $29,298 | $27,110 | $25,908 |

| Liabilities and Capital | Month 1 | Month 2 | Month 3 | Month 4 | Month 5 | Month 6 | Month 7 | Month 8 | Month 9 | Month 10 | Month 11 | Month 12 | |

| Current Liabilities | |||||||||||||

| Accounts Payable | $0 | $159 | $2,525 | $2,566 | $2,573 | $2,743 | $2,754 | $2,791 | $2,818 | $2,845 | $2,910 | $2,940 | $3,000 |

| Current Borrowing | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| Other Current Liabilities | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| Subtotal Current Liabilities | $0 | $159 | $2,525 | $2,566 | $2,573 | $2,743 | $2,754 | $2,791 | $2,818 | $2,845 | $2,910 | $2,940 | $3,000 |

| Long-term Liabilities | $20,000 | $19,747 | $19,494 | $19,241 | $18,988 | $18,735 | $18,482 | $18,229 | $17,976 | $17,723 | $17,470 | $17,217 | $16,964 |

| Total Liabilities | $20,000 | $19,906 | $22,019 | $21,807 | $21,561 | $21,478 | $21,236 | $21,020 | $20,794 | $20,568 | $20,380 | $20,157 | $19,964 |

| Paid-in Capital | $60,000 | $60,000 | $60,000 | $60,000 | $60,000 | $60,000 | $60,000 | $60,000 | $60,000 | $60,000 | $60,000 | $60,000 | $60,000 |

| Retained Earnings | ($21,500) | ($21,500) | ($21,500) | ($21,500) | ($21,500) | ($21,500) | ($21,500) | ($21,500) | ($21,500) | ($21,500) | ($21,500) | ($21,500) | ($21,500) |

| Earnings | $0 | ($415) | ($5,277) | ($8,597) | ($11,601) | ($15,403) | ($18,725) | ($21,916) | ($24,700) | ($27,075) | ($29,581) | ($31,547) | ($32,556) |

| Total Capital | $38,500 | $38,085 | $33,223 | $29,903 | $26,899 | $23,097 | $19,775 | $16,584 | $13,800 | $11,425 | $8,919 | $6,953 | $5,944 |

| Total Liabilities and Capital | $58,500 | $57,992 | $55,242 | $51,710 | $48,460 | $44,574 | $41,011 | $37,603 | $34,594 | $31,992 | $29,298 | $27,110 | $25,908 |

| Net Worth | $38,500 | $38,085 | $33,223 | $29,903 | $26,899 | $23,097 | $19,775 | $16,584 | $13,800 | $11,425 | $8,919 | $6,953 | $5,944 |