Recycled Dreams

Executive Summary

Recycled Dreams – a Bridal Repository is a Portland, OR based retail rental shop of bridal dresses and accessories. Founded and operated by Connie Jugal, Recycled Dreams will meet the unmet market demand of formal wedding wear that is rented as opposed to purchased. Traditionally, participants in the bride’s wedding party are required to buy their dresses for the wedding, yet they have no input as to what the dress looks like. They are told exactly what dress they need to purchase. More often than not the dresses are horrendous looking and after the occasion they remain in the closet collecting dust indefinitely. It is therefore very practical to provide people with the option of renting a dress in light of the fact that the dress will only be used once. This makes the event far more cost effective, yet just as fashionable. Men can rent tuxedos, now women can rent bridal dresses.

The Services

Recycled Dreams rents dresses, shoes, head pieces and veils. For the bride and others if they so choose, the dresses can be purchased. However most customers will be overjoyed with the option of renting these one time pieces of clothing. In addition to providing the wedding party will the ability to rent all the necessary clothing pieces and accessories, Recycled Dreams has established strategic partnerships with top-flight local wedding related service providers such as invitations, flowers, catering, and photographers. Not only do these alliances provide a one stop shopping option for customers where all preparations can be accomplished at Recycled Dreams, but Recycled Dreams earns a commission on the referrals creating an additional revenue source.

The Market and Competition

Recycled Dreams will be targeting two distinct market segments, the bridal couple and the parents of the bridal couple. Couples as a market segment is growing at 9% a year with 114,584 potential customers, and the parents of the couple have a 8% growth rate with over 112,000 possible customers.

Recycled Dreams faces competition from traditional bridal shops that sell the products. While these are competitors, Recycled Dreams sees them as indirect competitors since Recycled Dreams believes that the ability to rent the dresses is a huge value added service. Currently, there are no other bridal rental facilities in Portland. The concept is brand new. It has been tested to great success in San Francisco and Recycled Dreams is the first to offer it in Portland.

Competitive Edge

Recycled Dreams has two competitive advantages that will help them quickly grow their customer base and validate this new concept. The first is the idea that indeed, like men’s tuxedo’s, women’s bridal wear can be rented. This is particularly intuitive since the dresses are only worn once. Although some might feel that there is a social stigma attached with women renting clothing, there is no way for anyone other than the renting customer to know that the dress that they are wearing is rented. Their second competitive edge is their benchmarked customer service. Recycled Dreams sees their role in the entire process as the one to hold the client’s hand and walk them through the entire event, meeting all of their needs. This philosophy has been engrained within the entire organization.

Management

Beyond the fact that Recycled Dreams is a great idea, the company has a seasoned founder and manager at the helm to guide the company to profitability. Connie has years of retail management experience. Her experience was at the Salvation Army where she was the manager of several stores. While manager, Connie was responsible for growth up to 46% a year per store. Connie will leverage this outstanding industry experience to make Recycled Dreams a success.

Recycled Dreams is an exciting concept that acknowledges the fact that most bridal party dresses are not the prettiest creations, are quite expensive, and almost never worn after the intended wedding. Recycled Dreams will reach profitability by month 10 with healthy sales for year one and more than doubling by the end of year three.

1.1 Objectives

The objectives for the first three years of operation include:

- To create a service-based company whose primary goals is to exceed customer’s expectations.

- To increase the number of clients by 20% per year through superior service.

- To develop a sustainable start-up business providing cost effective bridal dresses.

1.2 Mission

Recycled Dreams’ mission is to provide cost effective use of bridal dresses and accessories for weddings. Our services will exceed the expectations of our customers.

Company Summary

Recycled Dreams is a bridal wear store that provides dresses for rent for the Portland, Oregon market. Most people agree that bridesmaids dresses are unattractive and are not usually worn again. Recycled Dreams will offer bridal gowns (for sale and for rent) and bridesmaid, matron and maid of honor, and flower girl dresses, as well as shoes for rental for the special event.

2.1 Start-up Summary

Recycled Dreams will incur the following start-up costs:

- Computer with a point of sale terminal.

- Back office terminal including printer, CD-RW.

- Microsoft Office, QuickBooks Pro, POS software.

- Display racks and shelving.

- Three couches.

- Desk, chair and filing cabinets.

- Materials to construct a plush series of changing rooms.

- Full-length mirrors.

- Website development.

- Inventory of dresses, shoes, head pieces and veils.

Please note that the following items which are considered assets to be used for more than a year will labeled long-term assets and will be depreciated using G.A.A.P. approved straight-line depreciation method.

| Start-up Requirements | |

| Start-up Expenses | |

| Legal | $100 |

| Stationery etc. | $100 |

| Website development | $500 |

| Other | $0 |

| Total Start-up Expenses | $700 |

| Start-up Assets | |

| Cash Required | $31,300 |

| Other Current Assets | $0 |

| Long-term Assets | $18,000 |

| Total Assets | $49,300 |

| Total Requirements | $50,000 |

| Start-up Funding | |

| Start-up Expenses to Fund | $700 |

| Start-up Assets to Fund | $49,300 |

| Total Funding Required | $50,000 |

| Assets | |

| Non-cash Assets from Start-up | $18,000 |

| Cash Requirements from Start-up | $31,300 |

| Additional Cash Raised | $0 |

| Cash Balance on Starting Date | $31,300 |

| Total Assets | $49,300 |

| Liabilities and Capital | |

| Liabilities | |

| Current Borrowing | $0 |

| Long-term Liabilities | $20,000 |

| Accounts Payable (Outstanding Bills) | $0 |

| Other Current Liabilities (interest-free) | $0 |

| Total Liabilities | $20,000 |

| Capital | |

| Planned Investment | |

| Investor 1 | $30,000 |

| Investor 2 | $0 |

| Other | $0 |

| Additional Investment Requirement | $0 |

| Total Planned Investment | $30,000 |

| Loss at Start-up (Start-up Expenses) | ($700) |

| Total Capital | $29,300 |

| Total Capital and Liabilities | $49,300 |

| Total Funding | $50,000 |

2.2 Company Ownership

Recycled Dreams is a sole proprietorship owned by Connie Jugal.

Services

Recycled Dreams will provide rentals for all the necessary dresses required for a wedding including the bridal gown, bridesmaid, matron or maid of honor, and flower girl dresses. In addition to the dresses, shoes can be rented as well. The bridesmaid’s dresses are particularly useful for rental since the bridesmaids do not get a choice in the dress they will wear, and even if they do not have to pay for the dress themselves, the dress usually is only worn once and then is stored in the back of the closet for many years, so it is not a good investment to purchase. Recycled Dreams has an on-staff seamstress to make any alterations necessary.

The bridal dress, headpiece, and veil can be rented, or purchased, depending on the whim of the bride. Often the bride will want to keep these items as there is a strong emotional connection with the dress from their wedding.

In addition to the dresses which can be rented or bought, Recycled Dreams will have formed strategic relationships with local service providers for the following services: invitations, flowers, cake, catering, photographer, and travel arrangements for the honeymoon. All of these service providers are researched and tested to ensure top-level service. For each referral made to the strategic partners, Recycled Dreams will receive a small commission.

Market Analysis Summary

Recycled Dreams has two segmented groups that they will be targeting. The first group is the bridal couple that is responsible for the production of the wedding. This population typically has limited financial resources so they are particularly interested in ways of maximizing the money they can spend on the wedding. The other group is the parents of the bride. While they are likely to be more financially secure then the wedding couple themselves, they still typically have a limited budget. Usually the parents will solicit information from the couple and they (if they have been in a wedding party before) will relay the sentiment that buying the attendees dresses is a waste of money as the individuals really do not care if they own the dress if it is a gift, and if it they have to buy it they are bordering on resentment, tempered only by tradition that they have to purchase this ugly dress to wear once.

4.1 Market Segmentation

Recycled Dreams will be targeting low- to middle-income brides to be as well as the parents of the bride. Traditionally, it is the parents of the bride who are responsible for the costs associated with the wedding. Not everyone follows tradition however, it is increasingly the trend for the wedding couple to be responsible for the costs associated with the wedding production. For this reason both the couple, and the bride’s parents, will be targeted.

The wedding couple is likely to be interested in the rental of attendee’s bridal wear because the couple is usually young, just getting started, and not yet financially secure. A wedding in general is a large expense and the couple is typically looking for ways in which costs can be cut, yet will have no real effect on the event. In addition, the couple has other financial responsibilities such as the wedding rings and honeymoon that money is obviously tight. Even if the couple does not pay for the rentals and pass the costs onto the attendees, the attendees are likely to be in similar financial conditions as the couple and could in theory put the money saved from the rental into a nicer gift.

The other group to be targeted is the parents of the bride. This segment is likely to appreciate the option of renting bridal wear instead of purchasing it for several reasons. They are likely to recognize that the attendees of the bridal party do not typically care about the dresses that they must wear. With this in mind, they are more likely to spend the saved money from the rental on some other expense in the wedding that will be more meaningful. This is assuming that they will end up spending the money saved in some other way. They may also choose the renting option as a way to save the money. As many know, weddings can get very expensive upwards of $20,000-30,000 is not unheard of. Saving a few thousand dollars is certainly appealing.

| Market Analysis | |||||||

| Year 1 | Year 2 | Year 3 | Year 4 | Year 5 | |||

| Potential Customers | Growth | CAGR | |||||

| Bridal couple | 9% | 114,584 | 124,897 | 136,138 | 148,390 | 161,745 | 9.00% |

| Parents of the wedding couple | 8% | 112,547 | 121,551 | 131,275 | 141,777 | 153,119 | 8.00% |

| Other | 0% | 0 | 0 | 0 | 0 | 0 | 0.00% |

| Total | 8.51% | 227,131 | 246,448 | 267,413 | 290,167 | 314,864 | 8.51% |

4.2 Target Market Segment Strategy

Recycled Dreams will be targeting its chosen segments through an advertising campaign that involves advertisements in the local newspaper. Weddings in general are very social occassions and the social scene is captured in several different sections within the newspaper. People that are having a wedding typically page through the local newspaper, looking at the other wedding announcements. The local newspaper is also a good resource for finding local services and people use the paper as a resource guide.

Recycled Dreams will also be targeting these groups through advertisements in the yellow pages. The yellow pages are a fantastic resource guide, although it is at times not all that refined in terms of searching for information.

Lastly, Recycled Dreams will be relying on their website to increase visibility regarding their services. The website provides Recycled Dreams with a very controlled way to raise awareness of Recycled Dreams’ service offerings.

4.2.1 Competition and Buying Patterns

Recycled Dreams’ main competition comes from traditional bridal stores. These stores can be broken down into various types:

- Franchise stores: these shops are national or regional franchises that use buying power of a multi-shop establishment to lower prices as well as increase selection.

- Sole proprietor shops: this style is a single outlet. It is hard to categorize much beyond this. There are some high-end independent shops as well as some budget ones. These stores are often relying on knowledge of local tastes as well as being a member of the community.

Currently Portland has no bridal wear rental facilities. There are rental facilities for men’s wear such as tuxedos, however, the rental trend has not extended to bridal wear. Entrepreneurs have been afraid to venture into women’s rentals out of fear that women are too fashion conscious to be willing to rent a dress, that would simply be a fashion faux pas.

As people’s finances become tighter and tighter, women are making decisions as to how to spend their money. As disposable income becomes more and more of a scarce resource, they are now more than ever willing to sacrifice what someone else might think of the idea of wearing a rental in return for freeing up their cash to do with it as they choose.

Strategy and Implementation Summary

Recycled Dreams will meet Portland’s latent demand for bridal wear rentals. Currently, there are no stores that allow people to rent dresses and shoes for wedding parties, you are forced to buy them, use them once, and then let them sit in the closet. Recycled Dreams will supply this service with incredible attention to detail regarding customer service. Connie recognizes that the success of a business is totally dependant on customer service and will train her employees accordingly.

5.1 Competitive Edge

Recycled Dreams’ competitive edge is a service offering that has been so far shunned by the Portland market. As indicated before, it is the business owners, or entrepreneurs, that are shunning the concept, not the consumers. For this reason, having a service offering that supports a latent demand is truly a competitive advantage.

Recycled Dreams’ other competitive advantage is their recognition that superior customer attention is required to succeed. This holds true for two fundamental reasons, a business can only succeed if it meets or exceeds their customers needs. A company might offer the most wonderful service in the world, but if it does not meet their customer’s needs, they will not succeed. The other fundamental reason particular to the bridal industry is more often than not, people only get married once so traditional repeat customers is unusual. Recycled Dreams is hoping that positive word-of-mouth referrals will continue to bring customers in the door. With this in mind, a lot of business will be based in referrals from already married friends. Offering the highest customer service will ensure a steady stream of referrals.

5.2 Sales Strategy

Recycled Dreams’ sales strategy will be based on their ability to convince prospective clients on the economies of rentals as well as the misnomer regarding the fashion faux pas of rental dresses. Typically people will call in and request information regarding rentals. While many stores will attempt to make the phone inquiry as short as possible, Connie believes that this is the best opportunity to turn an information seeker into a customer. This can get time consuming because a large number of people will call seeking information, however, Connie recognizes that the time spent now will pay off significantly in the future. For this reason, employees will not receive commissions on sales, instead employees will receive bonuses for positive feedback that Recycled Dreams receives from customers.

5.2.1 Sales Forecast

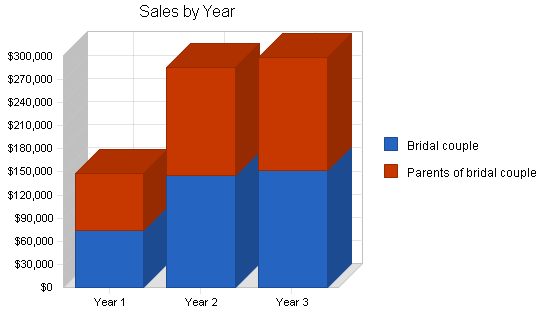

The first month will be used to set up the store front, interview and hire employees and start up a media campaign to build awareness. Month two will see limited sales activity as people are just becoming aware of Recycled Dreams. Month four will see an increase in sales and subsequent months will build off of month four sales.

| Sales Forecast | |||

| Year 1 | Year 2 | Year 3 | |

| Sales | |||

| Bridal couple | $74,208 | $145,744 | $151,474 |

| Parents of bridal couple | $73,636 | $139,874 | $147,875 |

| Total Sales | $147,844 | $285,618 | $299,349 |

| Direct Cost of Sales | Year 1 | Year 2 | Year 3 |

| Bridal couple | $18,552 | $36,436 | $37,869 |

| Parents of bridal couple | $18,409 | $34,969 | $36,969 |

| Subtotal Direct Cost of Sales | $36,961 | $71,405 | $74,837 |

5.3 Milestones

Recycled Dreams will have several milestones early on including:

- Business plan completion. This will be done as a roadmap for the organization. This will be an indispensable tool for the ongoing performance and improvement of the company.

- Set up of the store front.

- The first month of profitability.

- Revenues exceeding $100,000.

| Milestones | |||||

| Milestone | Start Date | End Date | Budget | Manager | Department |

| Business plan completion | 1/1/2001 | 2/1/2001 | $0 | ABC | Marketing |

| Set up of the store front | 1/1/2001 | 2/1/2001 | $0 | ABC | Department |

| The first month of profitability | 1/1/2001 | 10/1/2001 | $0 | ABC | Department |

| Revenues exceeding $100,000 | 1/1/2001 | 11/1/2001 | $0 | ABC | Department |

| Totals | $0 | ||||

Management Summary

Connie Jugal received her undergraduate degree in communications from Portland State University. Connie put herself through school financially by working at the Salvation Army thrift store. Initially Connie worked at the Salvation Army as a register attendant. Within a year of working, she moved up to assistant manager first and then manager because of her attention to detail, her people skills, and her general management ability.

After graduating Connie was offered a regional manager position that put her in charge of three different stores. While Connie was not wanting to stay at the Salvation Army forever, she saw this offer as a unique opportunity, particularly for someone her age. While Connie was the regional manager, she was instrumental in raising revenues through sophisticated marketing and merchandising. She increased revenue 46% at store one over the previous year, 33% for store two, and 23% at store three. All three stores had between 1-5% revenue growth for the previous eight years. This revenue growth was quite a surprise relative to all the stores in Oregon for the last 10 years so Connie was offered an even larger territory for management the following year. While Connie was flattered to say the least, she recognized her need start her own business, to be her own boss. This was the beginning of Recycled Dreams.

6.1 Personnel Plan

Connie will work for Recycled Dreams full time. During month two Connie will hire one full-time person and one part-time person. The headcount will remain at four until month five when Connie will hire an additional full-time person. Connie has designed Recycled Dreams to be a very decentralized organization allowing all employees to share in responsibility for almost all tasks. Connie will also hire a part-time seamstress to make all the necessary alterations beginning in month two.

| Personnel Plan | |||

| Year 1 | Year 2 | Year 3 | |

| Connie | $42,000 | $45,000 | $48,000 |

| Full-time employee | $21,120 | $22,000 | $22,000 |

| Part-time employee | $10,560 | $11,000 | $11,000 |

| Seamstress | $12,200 | $14,400 | $14,400 |

| Full-time employee | $13,440 | $22,000 | $22,000 |

| Total People | 5 | 5 | 5 |

| Total Payroll | $99,320 | $114,400 | $117,400 |

Financial Plan

The following sections will outline important financial information.

7.1 Important Assumptions

The following table details important financial assumptions.

| General Assumptions | |||

| Year 1 | Year 2 | Year 3 | |

| Plan Month | 1 | 2 | 3 |

| Current Interest Rate | 10.00% | 10.00% | 10.00% |

| Long-term Interest Rate | 10.00% | 10.00% | 10.00% |

| Tax Rate | 30.00% | 30.00% | 30.00% |

| Other | 0 | 0 | 0 |

7.2 Break-even Analysis

The Break-even Analysis indicates what will be needed in monthly revenue to reach the break-even point.

| Break-even Analysis | |

| Monthly Revenue Break-even | $15,944 |

| Assumptions: | |

| Average Percent Variable Cost | 25% |

| Estimated Monthly Fixed Cost | $11,958 |

7.3 Projected Profit and Loss

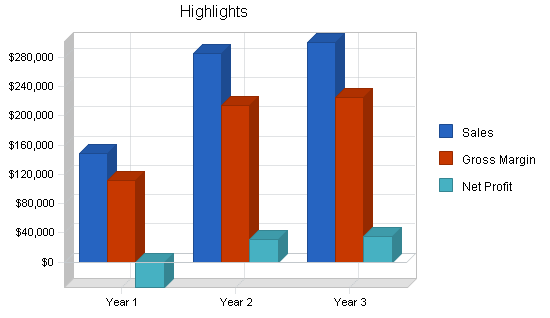

The following table and charts display the projected profit and loss.

| Pro Forma Profit and Loss | |||

| Year 1 | Year 2 | Year 3 | |

| Sales | $147,844 | $285,618 | $299,349 |

| Direct Cost of Sales | $36,961 | $71,405 | $74,837 |

| Other Production Expenses | $0 | $0 | $0 |

| Total Cost of Sales | $36,961 | $71,405 | $74,837 |

| Gross Margin | $110,883 | $214,214 | $224,512 |

| Gross Margin % | 75.00% | 75.00% | 75.00% |

| Expenses | |||

| Payroll | $99,320 | $114,400 | $117,400 |

| Sales and Marketing and Other Expenses | $3,600 | $11,200 | $11,200 |

| Depreciation | $7,728 | $7,728 | $7,728 |

| Leased Equipment | $0 | $0 | $0 |

| Utilities | $1,750 | $1,750 | $1,750 |

| Insurance | $1,800 | $1,800 | $1,800 |

| Rent | $14,400 | $14,400 | $14,400 |

| Payroll Taxes | $14,898 | $17,160 | $17,610 |

| Other | $0 | $0 | $0 |

| Total Operating Expenses | $143,496 | $168,438 | $171,888 |

| Profit Before Interest and Taxes | ($32,613) | $45,776 | $52,624 |

| EBITDA | ($24,885) | $53,504 | $60,352 |

| Interest Expense | $1,934 | $1,809 | $1,671 |

| Taxes Incurred | $0 | $13,190 | $15,286 |

| Net Profit | ($34,547) | $30,777 | $35,667 |

| Net Profit/Sales | -23.37% | 10.78% | 11.91% |

7.4 Projected Cash Flow

The following chart and table will indicate projected cash flow.

| Pro Forma Cash Flow | |||

| Year 1 | Year 2 | Year 3 | |

| Cash Received | |||

| Cash from Operations | |||

| Cash Sales | $147,844 | $285,618 | $299,349 |

| Subtotal Cash from Operations | $147,844 | $285,618 | $299,349 |

| Additional Cash Received | |||

| Sales Tax, VAT, HST/GST Received | $0 | $0 | $0 |

| New Current Borrowing | $0 | $0 | $0 |

| New Other Liabilities (interest-free) | $0 | $0 | $0 |

| New Long-term Liabilities | $0 | $0 | $0 |

| Sales of Other Current Assets | $0 | $0 | $0 |

| Sales of Long-term Assets | $0 | $0 | $0 |

| New Investment Received | $0 | $0 | $0 |

| Subtotal Cash Received | $147,844 | $285,618 | $299,349 |

| Expenditures | Year 1 | Year 2 | Year 3 |

| Expenditures from Operations | |||

| Cash Spending | $99,320 | $114,400 | $117,400 |

| Bill Payments | $66,822 | $130,326 | $138,074 |

| Subtotal Spent on Operations | $166,142 | $244,726 | $255,474 |

| Additional Cash Spent | |||

| Sales Tax, VAT, HST/GST Paid Out | $0 | $0 | $0 |

| Principal Repayment of Current Borrowing | $1,237 | $1,345 | $1,421 |

| Other Liabilities Principal Repayment | $0 | $0 | $0 |

| Long-term Liabilities Principal Repayment | $0 | $0 | $0 |

| Purchase Other Current Assets | $0 | $0 | $0 |

| Purchase Long-term Assets | $0 | $0 | $0 |

| Dividends | $0 | $0 | $0 |

| Subtotal Cash Spent | $167,380 | $246,071 | $256,895 |

| Net Cash Flow | ($19,536) | $39,547 | $42,454 |

| Cash Balance | $11,764 | $51,311 | $93,766 |

7.5 Projected Balance Sheet

The following table will indicate the projected balance sheet.

| Pro Forma Balance Sheet | |||

| Year 1 | Year 2 | Year 3 | |

| Assets | |||

| Current Assets | |||

| Cash | $11,764 | $51,311 | $93,766 |

| Other Current Assets | $0 | $0 | $0 |

| Total Current Assets | $11,764 | $51,311 | $93,766 |

| Long-term Assets | |||

| Long-term Assets | $18,000 | $18,000 | $18,000 |

| Accumulated Depreciation | $7,728 | $15,456 | $23,184 |

| Total Long-term Assets | $10,272 | $2,544 | ($5,184) |

| Total Assets | $22,036 | $53,855 | $88,582 |

| Liabilities and Capital | Year 1 | Year 2 | Year 3 |

| Current Liabilities | |||

| Accounts Payable | $8,521 | $10,908 | $11,388 |

| Current Borrowing | ($1,237) | ($2,582) | ($4,003) |

| Other Current Liabilities | $0 | $0 | $0 |

| Subtotal Current Liabilities | $7,283 | $8,326 | $7,385 |

| Long-term Liabilities | $20,000 | $20,000 | $20,000 |

| Total Liabilities | $27,283 | $28,326 | $27,385 |

| Paid-in Capital | $30,000 | $30,000 | $30,000 |

| Retained Earnings | ($700) | ($35,247) | ($4,470) |

| Earnings | ($34,547) | $30,777 | $35,667 |

| Total Capital | ($5,247) | $25,530 | $61,197 |

| Total Liabilities and Capital | $22,036 | $53,855 | $88,582 |

| Net Worth | ($5,247) | $25,530 | $61,197 |

7.6 Business Ratios

The following tables shows a variety of standard business analysis ratios, as calculated for the years of this plan. The Industry Profile column shows, for comparison, typical ratios for other businesses in the Formal Wear and Costume Rental industry, NAICS code 532220.

| Ratio Analysis | ||||

| Year 1 | Year 2 | Year 3 | Industry Profile | |

| Sales Growth | 0.00% | 93.19% | 4.81% | 11.37% |

| Percent of Total Assets | ||||

| Other Current Assets | 0.00% | 0.00% | 0.00% | 49.84% |

| Total Current Assets | 53.39% | 95.28% | 105.85% | 64.51% |

| Long-term Assets | 46.61% | 4.72% | -5.85% | 35.49% |

| Total Assets | 100.00% | 100.00% | 100.00% | 100.00% |

| Current Liabilities | 33.05% | 15.46% | 8.34% | 26.03% |

| Long-term Liabilities | 90.76% | 37.14% | 22.58% | 26.31% |

| Total Liabilities | 123.81% | 52.60% | 30.91% | 52.34% |

| Net Worth | -23.81% | 47.40% | 69.09% | 47.66% |

| Percent of Sales | ||||

| Sales | 100.00% | 100.00% | 100.00% | 100.00% |

| Gross Margin | 75.00% | 75.00% | 75.00% | 100.00% |

| Selling, General & Administrative Expenses | 98.37% | 64.22% | 63.09% | 67.07% |

| Advertising Expenses | 1.62% | 0.70% | 0.67% | 1.87% |

| Profit Before Interest and Taxes | -22.06% | 16.03% | 17.58% | 3.67% |

| Main Ratios | ||||

| Current | 1.62 | 6.16 | 12.70 | 1.69 |

| Quick | 1.62 | 6.16 | 12.70 | 1.21 |

| Total Debt to Total Assets | 123.81% | 52.60% | 30.91% | 61.69% |

| Pre-tax Return on Net Worth | 658.41% | 172.22% | 83.26% | 6.99% |

| Pre-tax Return on Assets | -156.77% | 81.64% | 57.52% | 18.25% |

| Additional Ratios | Year 1 | Year 2 | Year 3 | |

| Net Profit Margin | -23.37% | 10.78% | 11.91% | n.a |

| Return on Equity | 0.00% | 120.55% | 58.28% | n.a |

| Activity Ratios | ||||

| Accounts Payable Turnover | 8.84 | 12.17 | 12.17 | n.a |

| Payment Days | 27 | 27 | 29 | n.a |

| Total Asset Turnover | 6.71 | 5.30 | 3.38 | n.a |

| Debt Ratios | ||||

| Debt to Net Worth | 0.00 | 1.11 | 0.45 | n.a |

| Current Liab. to Liab. | 0.27 | 0.29 | 0.27 | n.a |

| Liquidity Ratios | ||||

| Net Working Capital | $4,481 | $42,986 | $86,381 | n.a |

| Interest Coverage | -16.86 | 25.30 | 31.50 | n.a |

| Additional Ratios | ||||

| Assets to Sales | 0.15 | 0.19 | 0.30 | n.a |

| Current Debt/Total Assets | 33% | 15% | 8% | n.a |

| Acid Test | 1.62 | 6.16 | 12.70 | n.a |

| Sales/Net Worth | 0.00 | 11.19 | 4.89 | n.a |

| Dividend Payout | 0.00 | 0.00 | 0.00 | n.a |

Appendix

| Sales Forecast | |||||||||||||

| Month 1 | Month 2 | Month 3 | Month 4 | Month 5 | Month 6 | Month 7 | Month 8 | Month 9 | Month 10 | Month 11 | Month 12 | ||

| Sales | |||||||||||||

| Bridal couple | 0% | $0 | $2,547 | $3,254 | $3,654 | $4,789 | $5,587 | $6,987 | $7,845 | $8,547 | $9,654 | $10,457 | $10,887 |

| Parents of bridal couple | 0% | $0 | $2,214 | $3,356 | $3,785 | $4,678 | $5,687 | $7,125 | $7,765 | $8,978 | $9,545 | $9,658 | $10,845 |

| Total Sales | $0 | $4,761 | $6,610 | $7,439 | $9,467 | $11,274 | $14,112 | $15,610 | $17,525 | $19,199 | $20,115 | $21,732 | |

| Direct Cost of Sales | Month 1 | Month 2 | Month 3 | Month 4 | Month 5 | Month 6 | Month 7 | Month 8 | Month 9 | Month 10 | Month 11 | Month 12 | |

| Bridal couple | $0 | $637 | $814 | $914 | $1,197 | $1,397 | $1,747 | $1,961 | $2,137 | $2,414 | $2,614 | $2,722 | |

| Parents of bridal couple | $0 | $554 | $839 | $946 | $1,170 | $1,422 | $1,781 | $1,941 | $2,245 | $2,386 | $2,415 | $2,711 | |

| Subtotal Direct Cost of Sales | $0 | $1,190 | $1,653 | $1,860 | $2,367 | $2,819 | $3,528 | $3,903 | $4,381 | $4,800 | $5,029 | $5,433 | |

| Personnel Plan | |||||||||||||

| Month 1 | Month 2 | Month 3 | Month 4 | Month 5 | Month 6 | Month 7 | Month 8 | Month 9 | Month 10 | Month 11 | Month 12 | ||

| Connie | 0% | $3,500 | $3,500 | $3,500 | $3,500 | $3,500 | $3,500 | $3,500 | $3,500 | $3,500 | $3,500 | $3,500 | $3,500 |

| Full-time employee | 0% | $0 | $1,920 | $1,920 | $1,920 | $1,920 | $1,920 | $1,920 | $1,920 | $1,920 | $1,920 | $1,920 | $1,920 |

| Part-time employee | 0% | $0 | $960 | $960 | $960 | $960 | $960 | $960 | $960 | $960 | $960 | $960 | $960 |

| Seamstress | 0% | $0 | $800 | $900 | $1,000 | $1,100 | $1,200 | $1,200 | $1,200 | $1,200 | $1,200 | $1,200 | $1,200 |

| Full-time employee | 0% | $0 | $0 | $0 | $0 | $0 | $1,920 | $1,920 | $1,920 | $1,920 | $1,920 | $1,920 | $1,920 |

| Total People | 1 | 4 | 4 | 4 | 4 | 5 | 5 | 5 | 5 | 5 | 5 | 5 | |

| Total Payroll | $3,500 | $7,180 | $7,280 | $7,380 | $7,480 | $9,500 | $9,500 | $9,500 | $9,500 | $9,500 | $9,500 | $9,500 | |

| General Assumptions | |||||||||||||

| Month 1 | Month 2 | Month 3 | Month 4 | Month 5 | Month 6 | Month 7 | Month 8 | Month 9 | Month 10 | Month 11 | Month 12 | ||

| Plan Month | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 | 11 | 12 | |

| Current Interest Rate | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | |

| Long-term Interest Rate | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | |

| Tax Rate | 30.00% | 30.00% | 30.00% | 30.00% | 30.00% | 30.00% | 30.00% | 30.00% | 30.00% | 30.00% | 30.00% | 30.00% | |

| Other | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | |

| Pro Forma Profit and Loss | |||||||||||||

| Month 1 | Month 2 | Month 3 | Month 4 | Month 5 | Month 6 | Month 7 | Month 8 | Month 9 | Month 10 | Month 11 | Month 12 | ||

| Sales | $0 | $4,761 | $6,610 | $7,439 | $9,467 | $11,274 | $14,112 | $15,610 | $17,525 | $19,199 | $20,115 | $21,732 | |

| Direct Cost of Sales | $0 | $1,190 | $1,653 | $1,860 | $2,367 | $2,819 | $3,528 | $3,903 | $4,381 | $4,800 | $5,029 | $5,433 | |

| Other Production Expenses | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Total Cost of Sales | $0 | $1,190 | $1,653 | $1,860 | $2,367 | $2,819 | $3,528 | $3,903 | $4,381 | $4,800 | $5,029 | $5,433 | |

| Gross Margin | $0 | $3,571 | $4,958 | $5,579 | $7,100 | $8,456 | $10,584 | $11,708 | $13,144 | $14,399 | $15,086 | $16,299 | |

| Gross Margin % | 0.00% | 75.00% | 75.00% | 75.00% | 75.00% | 75.00% | 75.00% | 75.00% | 75.00% | 75.00% | 75.00% | 75.00% | |

| Expenses | |||||||||||||

| Payroll | $3,500 | $7,180 | $7,280 | $7,380 | $7,480 | $9,500 | $9,500 | $9,500 | $9,500 | $9,500 | $9,500 | $9,500 | |

| Sales and Marketing and Other Expenses | $300 | $300 | $300 | $300 | $300 | $300 | $300 | $300 | $300 | $300 | $300 | $300 | |

| Depreciation | $644 | $644 | $644 | $644 | $644 | $644 | $644 | $644 | $644 | $644 | $644 | $644 | |

| Leased Equipment | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Utilities | $100 | $150 | $150 | $150 | $150 | $150 | $150 | $150 | $150 | $150 | $150 | $150 | |

| Insurance | $150 | $150 | $150 | $150 | $150 | $150 | $150 | $150 | $150 | $150 | $150 | $150 | |

| Rent | $1,200 | $1,200 | $1,200 | $1,200 | $1,200 | $1,200 | $1,200 | $1,200 | $1,200 | $1,200 | $1,200 | $1,200 | |

| Payroll Taxes | 15% | $525 | $1,077 | $1,092 | $1,107 | $1,122 | $1,425 | $1,425 | $1,425 | $1,425 | $1,425 | $1,425 | $1,425 |

| Other | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Total Operating Expenses | $6,419 | $10,701 | $10,816 | $10,931 | $11,046 | $13,369 | $13,369 | $13,369 | $13,369 | $13,369 | $13,369 | $13,369 | |

| Profit Before Interest and Taxes | ($6,419) | ($7,130) | ($5,859) | ($5,352) | ($3,946) | ($4,914) | ($2,785) | ($1,662) | ($225) | $1,030 | $1,717 | $2,930 | |

| EBITDA | ($5,775) | ($6,486) | ($5,215) | ($4,708) | ($3,302) | ($4,270) | ($2,141) | ($1,018) | $419 | $1,674 | $2,361 | $3,574 | |

| Interest Expense | $166 | $165 | $164 | $163 | $162 | $162 | $161 | $160 | $159 | $158 | $157 | $156 | |

| Taxes Incurred | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Net Profit | ($6,585) | ($7,295) | ($6,023) | ($5,515) | ($4,108) | ($5,075) | ($2,946) | ($1,821) | ($384) | $872 | $1,560 | $2,774 | |

| Net Profit/Sales | 0.00% | -153.23% | -91.11% | -74.14% | -43.40% | -45.02% | -20.87% | -11.67% | -2.19% | 4.54% | 7.76% | 12.76% | |

| Pro Forma Cash Flow | |||||||||||||

| Month 1 | Month 2 | Month 3 | Month 4 | Month 5 | Month 6 | Month 7 | Month 8 | Month 9 | Month 10 | Month 11 | Month 12 | ||

| Cash Received | |||||||||||||

| Cash from Operations | |||||||||||||

| Cash Sales | $0 | $4,761 | $6,610 | $7,439 | $9,467 | $11,274 | $14,112 | $15,610 | $17,525 | $19,199 | $20,115 | $21,732 | |

| Subtotal Cash from Operations | $0 | $4,761 | $6,610 | $7,439 | $9,467 | $11,274 | $14,112 | $15,610 | $17,525 | $19,199 | $20,115 | $21,732 | |

| Additional Cash Received | |||||||||||||

| Sales Tax, VAT, HST/GST Received | 0.00% | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| New Current Borrowing | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| New Other Liabilities (interest-free) | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| New Long-term Liabilities | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Sales of Other Current Assets | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Sales of Long-term Assets | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| New Investment Received | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Subtotal Cash Received | $0 | $4,761 | $6,610 | $7,439 | $9,467 | $11,274 | $14,112 | $15,610 | $17,525 | $19,199 | $20,115 | $21,732 | |

| Expenditures | Month 1 | Month 2 | Month 3 | Month 4 | Month 5 | Month 6 | Month 7 | Month 8 | Month 9 | Month 10 | Month 11 | Month 12 | |

| Expenditures from Operations | |||||||||||||

| Cash Spending | $3,500 | $7,180 | $7,280 | $7,380 | $7,480 | $9,500 | $9,500 | $9,500 | $9,500 | $9,500 | $9,500 | $9,500 | |

| Bill Payments | $81 | $2,501 | $4,248 | $4,716 | $4,947 | $5,476 | $6,229 | $6,926 | $7,303 | $7,779 | $8,191 | $8,424 | |

| Subtotal Spent on Operations | $3,581 | $9,681 | $11,528 | $12,096 | $12,427 | $14,976 | $15,729 | $16,426 | $16,803 | $17,279 | $17,691 | $17,924 | |

| Additional Cash Spent | |||||||||||||

| Sales Tax, VAT, HST/GST Paid Out | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Principal Repayment of Current Borrowing | $98 | $99 | $100 | $101 | $102 | $103 | $103 | $104 | $105 | $106 | $107 | $108 | |

| Other Liabilities Principal Repayment | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Long-term Liabilities Principal Repayment | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Purchase Other Current Assets | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Purchase Long-term Assets | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Dividends | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Subtotal Cash Spent | $3,680 | $9,780 | $11,628 | $12,197 | $12,529 | $15,079 | $15,832 | $16,531 | $16,909 | $17,385 | $17,797 | $18,032 | |

| Net Cash Flow | ($3,680) | ($5,019) | ($5,018) | ($4,758) | ($3,062) | ($3,805) | ($1,720) | ($921) | $616 | $1,814 | $2,318 | $3,700 | |

| Cash Balance | $27,620 | $22,601 | $17,583 | $12,825 | $9,763 | $5,958 | $4,238 | $3,317 | $3,934 | $5,747 | $8,065 | $11,764 | |

| Pro Forma Balance Sheet | |||||||||||||

| Month 1 | Month 2 | Month 3 | Month 4 | Month 5 | Month 6 | Month 7 | Month 8 | Month 9 | Month 10 | Month 11 | Month 12 | ||

| Assets | Starting Balances | ||||||||||||

| Current Assets | |||||||||||||

| Cash | $31,300 | $27,620 | $22,601 | $17,583 | $12,825 | $9,763 | $5,958 | $4,238 | $3,317 | $3,934 | $5,747 | $8,065 | $11,764 |

| Other Current Assets | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| Total Current Assets | $31,300 | $27,620 | $22,601 | $17,583 | $12,825 | $9,763 | $5,958 | $4,238 | $3,317 | $3,934 | $5,747 | $8,065 | $11,764 |

| Long-term Assets | |||||||||||||

| Long-term Assets | $18,000 | $18,000 | $18,000 | $18,000 | $18,000 | $18,000 | $18,000 | $18,000 | $18,000 | $18,000 | $18,000 | $18,000 | $18,000 |

| Accumulated Depreciation | $0 | $644 | $1,288 | $1,932 | $2,576 | $3,220 | $3,864 | $4,508 | $5,152 | $5,796 | $6,440 | $7,084 | $7,728 |

| Total Long-term Assets | $18,000 | $17,356 | $16,712 | $16,068 | $15,424 | $14,780 | $14,136 | $13,492 | $12,848 | $12,204 | $11,560 | $10,916 | $10,272 |

| Total Assets | $49,300 | $44,976 | $39,313 | $33,651 | $28,249 | $24,543 | $20,094 | $17,730 | $16,165 | $16,138 | $17,307 | $18,981 | $22,036 |

| Liabilities and Capital | Month 1 | Month 2 | Month 3 | Month 4 | Month 5 | Month 6 | Month 7 | Month 8 | Month 9 | Month 10 | Month 11 | Month 12 | |

| Current Liabilities | |||||||||||||

| Accounts Payable | $0 | $2,359 | $4,091 | $4,552 | $4,766 | $5,270 | $5,998 | $6,683 | $7,044 | $7,506 | $7,910 | $8,131 | $8,521 |

| Current Borrowing | $0 | ($98) | ($198) | ($298) | ($399) | ($501) | ($603) | ($707) | ($811) | ($916) | ($1,022) | ($1,129) | ($1,237) |

| Other Current Liabilities | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| Subtotal Current Liabilities | $0 | $2,261 | $3,893 | $4,254 | $4,367 | $4,769 | $5,395 | $5,977 | $6,234 | $6,590 | $6,888 | $7,001 | $7,283 |

| Long-term Liabilities | $20,000 | $20,000 | $20,000 | $20,000 | $20,000 | $20,000 | $20,000 | $20,000 | $20,000 | $20,000 | $20,000 | $20,000 | $20,000 |

| Total Liabilities | $20,000 | $22,261 | $23,893 | $24,254 | $24,367 | $24,769 | $25,395 | $25,977 | $26,234 | $26,590 | $26,888 | $27,001 | $27,283 |

| Paid-in Capital | $30,000 | $30,000 | $30,000 | $30,000 | $30,000 | $30,000 | $30,000 | $30,000 | $30,000 | $30,000 | $30,000 | $30,000 | $30,000 |

| Retained Earnings | ($700) | ($700) | ($700) | ($700) | ($700) | ($700) | ($700) | ($700) | ($700) | ($700) | ($700) | ($700) | ($700) |

| Earnings | $0 | ($6,585) | ($13,880) | ($19,903) | ($25,418) | ($29,526) | ($34,601) | ($37,547) | ($39,368) | ($39,753) | ($38,881) | ($37,321) | ($34,547) |

| Total Capital | $29,300 | $22,715 | $15,420 | $9,397 | $3,882 | ($226) | ($5,301) | ($8,247) | ($10,068) | ($10,453) | ($9,581) | ($8,021) | ($5,247) |

| Total Liabilities and Capital | $49,300 | $44,976 | $39,313 | $33,651 | $28,249 | $24,543 | $20,094 | $17,730 | $16,165 | $16,138 | $17,307 | $18,981 | $22,036 |

| Net Worth | $29,300 | $22,715 | $15,420 | $9,397 | $3,882 | ($226) | ($5,301) | ($8,247) | ($10,068) | ($10,453) | ($9,581) | ($8,021) | ($5,247) |