Wasatch Family Fun Center

Executive Summary

I&B Investments is a new limited liability company formed under the laws of the state of Utah.

This document has been prepared to provide the reader with information about our company, including business structure, company goals, projected growth, venture capital requirements, start-up costs, an investment analysis and the industry trends.

I&B Investments has identified the family entertainment industry as its primary interest and to that end the company has focused its efforts on the development of one or more family entertainment centers (FEC) to provide quality family entertainment activities to the communities in the Weber County, Utah area.

Focused on family entertainment in a family-oriented community, I&B Investments is a company primed to take advantage of an expanding and profitable industry.

Entertainment has become a buzzword of the new millennium. David L. Malmuth, senior vice president of the TrizenHahn Development Corp. has observed, “People are not just interested in buying things. They want an experience, adding that the keys to providing successful experiences are authenticity, fun and participation. Americans have money to spend and will spend it on entertaining themselves. In fact, statistics show that people in the United States spend more on entertainment than on health care or clothing.”

Quality family entertainment is the focus of I&B Investments. The construction and commercialization of one initial FEC is factored into the initial development phase detailed within. The company’s proposed FECs will be designed to provide the type of family entertainment and adventure the current market demands.

The first proposed site is a ten-acre parcel in Weber County, with a second site to follow within five years.

In addition to other funding and capitalization efforts detailed herein, the Company anticipates that it will seek funds from the Government Redevelopment Agency which may assist in the purchasing of land for development of the proposed sites.

A recent census conducted by the U.S. Census Bureau found that from 1990 to 1998, personal consumption and expenditures for amusement and recreation increased by $31.5 billion, with an overall industry gross of $56.2 billion. Source: U.S. Census Bureau, Statistical Abstract of the U.S: 2000 – The National Income and Product Accounts of the U.S., 1929-94, Vol.1.

Based on the current entertainment prices and cost of revenue structure in the local amusement and recreation industries, we believe that our anticipated FEC’s will have the potential of several million dollars in gross sales in the first year of operations.

With our strong management team and our aggressive marketing plan, we project a consistent and minimum annual growth of five percent.

1.1 Objectives

The company’s objective is to build quality, full-service FECs that will command the approval of the predominantly LDS community which it serves.

Our goals include:

- A 10% market share in our first year.

- An modest increase in our gross margins within the second year of operation

- An increase in our market share by a minimum of 10% for each of our first five years.

Currently, there ARE no quality FECs in Weber County, or the surrounding areas (for a radius of 50 miles). The company believes that by entering the marketplace first and by establishing quality facilities, it will become, and remain, a leader in the FEC industry in the Northern Wasatch Front.

Our fundamental objective is to realize how we impact the community that we do business in, knowing that we will stand the test of time if the local residents approve and support our center.

1.2 Mission

I&B Investments sole purpose is to establish a profitable and well managed company while at the same time creating an atmosphere of fun and excitement for the entire family, with activities designed to please the local residents, as well as the substantial tourist base of the Northern Wasatch Front.

1.3 Keys to Success

Based on our research, our primary targeted market is parents and their children (ages 5-15 to 54). With that in mind, we intend to design our facilities to address this primary market, while keeping in mind the secondary markets such a teens and young adults.

We believe that our main keys to success include:

- Providing popular and wide-ranging entertainment activities

- Ample and secure parking

- Indoor activities for year round entertainment

- The use of state-of-the-art technology

- Easy access

- Target high traffic areas for maximum public exposure

- Design facilities to curb overcrowding

- Seasoned management team

We believe that we can minimize certain risk factors by:

- Initial capitalization of the company to sustain operations through year one

- Low overhead through the use of multi-skilled employees and continual training

- Strong customer base through aggressive marketing

- Strong community ties and involvement

- Eliminate collection costs by establishing cash/credit/debit card only facilities

Company Summary

The company anticipates that its first FEC will be located in Weber County, Utah facing the Majestic Wasatch Front Mountains. The company’s FEC will be the most modern in the Northern Wasatch area.

Initially named the Wasatch Family Fun Center, the company anticipates that its facility will have a positive impact on the local environment and economy.

Mr. Bill Rameson, CEO of Palace Entertainment, the largest FEC chain in the world, has observed, “With most family entertainment centers having a 15 to 20 mile reach and in today’s climate, you’ve got to understand what you’re trying to accomplish. You’ve got to understand your market. You’ve got to understand construction. The attractions have to be both interactive and competitive.”

I&B Investments proposes to choose its locations after thoughtful and detailed research and demographic profiling.

2.1 Company Ownership

- Managing Partner – Mark D. Bergman

Limited Partners:

- Acting C.F.O.- Val R. Iverson

- Operations Manager & Public Relations – Senator Joseph L. Hull

- Retail Space Leasing Agent Gift Shop Manager.- Laura Strebel

- Director of Sales and Marketing – Roger Smout

- Manager of Treasury and General Accounting – Rod Schaffer

- Manager of Promotions & Customer Service – Darren Strebel

Consultants / Non-Partners (retained):

- General Entertainment Manager / Consultant – Harold Skripsky

- Redevelopment (RDA) Specialist – Randy Sant

2.2 Start-up Summary

For Phase 1 the Start-up table reflects the cost of the center, activities and 8.5 +/- acres.

All Construction cost are included in the gross loan, but not detailed in the “Start-up Cost table” because these costs happen before the projected pro forma begins.

In the Start-Up Funding table there are two forms/types of investors listed:

The Seed Investors/Partners that come under #1-11, are considered the seed funding group and company management team. Their investment is not secure and carries a greater risk of loss. Therefore, the percentage of the company that this group receives for their investment equals a much greater company ownership than the secure partners do for their investment (these partners are also earning sweat equity shares for their involvement/efforts rather than wages during development).

The Start-up Investors/Secure Partners that come under #1 -4, are considered the start-up funding partners. They may or may not be part of the company’s management team but are the voting and percentage controlling partners. Their investment will be escrowed and secure until the company has secured funding for the entire project. There is no risk of loss that is associated with these investors.

The Use of Funds table details many of the Start-up Expenses.

| Start-up Funding | |

| Start-up Expenses to Fund | $229,575 |

| Start-up Assets to Fund | $5,277,925 |

| Total Funding Required | $5,507,500 |

| Assets | |

| Non-cash Assets from Start-up | $5,077,925 |

| Cash Requirements from Start-up | $200,000 |

| Additional Cash Raised | $0 |

| Cash Balance on Starting Date | $200,000 |

| Total Assets | $5,277,925 |

| Liabilities and Capital | |

| Liabilities | |

| Current Borrowing | $890,000 |

| Long-term Liabilities | $3,652,500 |

| Accounts Payable (Outstanding Bills) | $0 |

| Other Current Liabilities (interest-free) | $0 |

| Total Liabilities | $4,542,500 |

| Capital | |

| Planned Investment | |

| Seed Investor/Partner #1 | $5,000 |

| Seed Investor/Partner #2 | $5,000 |

| Seed Investor/Partner #3 | $2,500 |

| Seed Investor/Partner #4 | $2,500 |

| Seed Investor/Partner #5 | $2,500 |

| Seed Investor/Partner #6 | $2,500 |

| Seed Investor/Partner #7 | $5,000 |

| Seed Investor/Partner #8 | $12,500 |

| Seed Investor/Partner #9 | $12,500 |

| Seed Investor/Partner #10 | $12,500 |

| Seed Investor/Partner #11 | $12,500 |

| Start-up Investor/Secure Partner #1 | $222,500 |

| Start-up Investor/Secure Partner #2 | $222,500 |

| Start-up Investor/Secure Partner #3 | $222,500 |

| Start-up Investor/Secure Partner #4 | $222,500 |

| Additional Investment Requirement | $0 |

| Total Planned Investment | $965,000 |

| Loss at Start-up (Start-up Expenses) | ($229,575) |

| Total Capital | $735,425 |

| Total Capital and Liabilities | $5,277,925 |

| Total Funding | $5,507,500 |

| Start-up | |

| Requirements | |

| Start-up Expenses | |

| Seed/Development Stage Cost | $35,000 |

| Professional Fees | $60,000 |

| Commercial Loan/Mortgage Points Cost | $109,575 |

| Sweat Equity Cost | $25,000 |

| Total Start-up Expenses | $229,575 |

| Start-up Assets | |

| Cash Required | $200,000 |

| Other Current Assets | $0 |

| Long-term Assets | $5,077,925 |

| Total Assets | $5,277,925 |

| Total Requirements | $5,507,500 |

| Use of Funds | |

| Use | Amount |

| Phase 1 Construction Cost Breakdown | $0 |

| Total Sq.Ft. Building (±) | $15,000 |

| Direct Construction Cost | $150,000 |

| Table Top Games/FoosBall | $50,000 |

| Redemption Games/Inventory | $50,000 |

| Bumper Boats | $175,000 |

| Batting Cage and Pitching Device | $140,000 |

| Miniature Golf Course | $225,000 |

| Street Construction | $800,000 |

| Storm Water and Infiltration Program | $217,000 |

| Building Permit/Subdivide/Connection | $35,000 |

| Parking Lot | $167,000 |

| Construction Insurance Cost | $4,000 |

| Property Cost 8.6 ± Acres | $688,000 |

| Drafting/Renderings | $90,000 |

| Site and Building Engineering | $45,000 |

| Computers/Desks Office Supplies | $14,000 |

| Signs | $20,000 |

| Go-carts and Tracks | $500,000 |

| First Year Operations Captial | $200,000 |

| Gross Cost of Equipment & Improvements | $3,570,000 |

| Construction Cost of Building | $1,000,000 |

| Construction Loan Cost | $300,000 |

| Cost + Building | $4,870,000 |

| 25% Loan (LT) Buy Down Cost | $1,217,500 |

| RDA Write Down | $0 |

| Retail Pads Sales | $0 |

| Net (LT) Loan | $3,652,500 |

| Loan Points Cost | $109,575 |

| Gross Cost | $1,327,075 |

| Loan + Points Cost/Gross Investment | $4,979,575 |

| Total | $24,611,225 |

2.3 Company Locations and Facilities

The first proposed site / property has two different aspects to it:

- We purchase a 10 acre parcel on the site and construct our center.

- We incorporate a Government Redevelopment Agency (RDA). Which can provide our company with a government grant (funds) that can help us purchase the entire 44.6 acres. This involves more risk but offers higher profits because we will need to resell 20 acres +/- once they are developed.

Therefore, within this business plan we will present a primary look at both possibilities, including the basic business structure, the start-up cost, the company’s projected growth, the market, the local demographics, the economic impact, the industry trends, the construction costs, the development of the land, the oversight of operations during the development of the infrastructure and the companies future management and marketing team.

Our proposed site is the 44.6 +/- acres running along the west side of the Interstate, with three planned future (roads) accesses/easements.

The entire property is zoned commercial and the owner has stated that he supports our project and will carry a contract. Phase 1 would place our FEC just north of the other existing commercial establishments.

The latest traffic figures report an average daily traffic count of 30,685 cars exiting and entering the interstate at this junction and the interstate (north and south bound) carries an average daily traffic count of 56,490 cars. Source: Utah Department of Transportation.

Services

Our FEC’s will provide customers with a wholesome environment that provides amusement, entertainment, excitement, competition, year round activities, souvenirs and great food all while forming lasting memories at affordable prices.

Although there is currently no competition in the immediate area in which we plan to establish our FECs, we believe that because the FEC industry is expanding exponentially, sooner or later competition will encroach.

To that end, the company plans to become profitable and retain a solid leadership position in the marketplace by providing:

- Indoor facilities – Cold weather will close the outdoor competition.

- Year round play with a wide variety of activities – Our season never stops.

- Seasoned, successful management team.

- Contracting top FEC consultants – To counsel on key attraction layout and design.

- Working with USU Extension Program – Determining tourism impact.

- Working with Utah Department of Tourism – National and international exposure.

- Family-oriented – Partnership-operated center gives the company local insight.

- Aggressive marketing.

- Customer Incentive Program – Reward frequent visitors/customers.

- Easy access and exposure.

3.1 Service Description

The ability of I&B Investments to accomplish its goals and lead the local family entertainment industry, depends upon the expertise and social conscience of the management team. Our management team understands these facts and several members of our management team have been recognized in the past for their outstanding community service and involvement.

Several local surveys have been reviewed and provide valuable information about a vast list of requirements that need to be met for an FEC to attract the local residents. We will strive to meet these desires and we will take future surveys with our customers to make sure that we are ahead of the curve. Source: USU Extension Program.

The Story of Dave & Busters – Family Entertainment Centers

“In 1982, Dave Corriveau and Buster Corley brought an idea to life. Create a place where adults can enjoy great food, terrific drinks and the latest interactive games – all in one place. They discovered a winning formula. Over the past 18 years, Dave & Buster’s has grown from one location in Dallas, Texas, to a nationwide organization. And with the help of our creative and dedicated employees, we’re able to keep growing and providing our guests with a unique experience.” Source: Dave & Busters.

I&B Investments intends on building an FEC with a 15,000 to 20,000 square-foot main building located in the Northern Utah area and provide such activities and services as: go-carts, miniature golf, climbing walls, batting cages, skycoaster or tower swing, air hockey, foosball, paint ball, laser and phazer tag, skateboard arena, outdoor bumper boats, gaming & redemption center, chess/backgammon playing areas, souvenir/gift shop, ice cream, pizza, pretzels, drinks, private party rooms (birthday & corporate), massage therapy center and a coffee shop.

I&B Investments anticipates entering into an agreement with Harris Miniature Golf Company (HMGC) to construct the course at its facility. The mini-golf course landscaping will depict the Wasatch Mountains area. The environment is casual and the design will capture the romantic era of a visit to the Olde West. The casual ambiance will be enhanced with mellow beat music and the sound of rushing water created by the falls and streams on the golf course. The quality of play and excellent service will ensure a large loyal following of customers.

“It’s an icon of the American landscape. It gives people a sense of other worldliness. And it’s non-gender and non-age biased,” says Steven W. Rix, executive director of San Antonio, Texas-based Miniature Golf Association of the United States.

“Miniature golf’s relatively low start-up cost – compared with theme parks, for example – have made it one of the most lucrative entertainment businesses around. Our latest figures show courses can return as much as 38 percent on an investment each year,” states Dave & Paul of the Professional Miniature Golf Association of Salt Lake City, Utah.

3.2 Future Services

I&B Investments will expand its family entertainment activities during its first year of operation, by adding bumper boats, go-carts and other attractions as discussed elsewhere in our plan.

In addition I&B Investments is already working on contingency plans for adding more facilities along the Wasatch Front.

To further increase revenues and public attraction, I&B Investments is working to establish several other entertainment (outdoor) activities that will be put in place using revenue-sharing programs, such as the Skycoaster.

Market Analysis Summary

Research has indicated that the prime market for a FEC is in urban areas close to neighborhoods with large concentrations of upper- to middle-income bracket population. Ease of access is important, but street frontage is not a crucial requirement.

Mr. Randy White, president of White Hutchinson Leisure & Learning Group, one of the leading FEC project developers in the United States has observed, “Just as entertainment is becoming an essential component of shopping centers, entertainment is the backbone of today’s urban redevelopment. Often referred to as urban or location-based entertainment centers, these projects integrate entertainment with retail, dining and cultural facilities to create a resident and tourist destination.”

A seven to ten mile radius is considered the radial market area of a FEC. However, depending on competition (or lack thereof) a market area can grow to a fifteen mile radius and with easy highway access to a radius of twenty miles from the FEC.

The U.S. Census Bureau, Census 2000, and the Weber County Economic Development provides us with the following demographic information about our area (15 mile radius).

| Counties | Gross pop. | Age 5-75 |

| Weber | 196,533 | 171,297 |

| Box Elder | 42,750 | 37,308 |

| Davis | 238,994 | 209,794 |

- The population in a fifteen-mile radius is in excess of 500,000

- Median age is 27

- The male/female share is 50% split

- Over 85% are white

- Over 40% are 25 to 50 years old

- Over 75% own or are buying their homes

- Average household size is 3.5 persons

- Average household adjusted gross income is $39,250

| Change in Utah Population, By Decade | + Change |

| 1950s | 20,410 |

| 1960s | 16,600 |

| 1970s | 40,800 |

| 1980s | 25,510 |

| 1990s | 42,111 |

| 2000s | 51,170 |

| 2010s | 52,149 |

| 2020s | 50,030 |

|

2030s |

65,703 |

4.1 Market Segmentation

I&B Investments’ primary targeted market consists of three main groups. These categories are: 15 to 24 year old, 25 to 34 and 35 to 54 years old. To better understand the size and breakdown of the local population see the following table and chart.

| Market Analysis | |||||||

| Year 1 | Year 2 | Year 3 | Year 4 | Year 5 | |||

| Potential Customers | Growth | CAGR | |||||

| Age 15 to 24 | 7% | 90,450 | 96,329 | 102,590 | 109,258 | 116,360 | 6.50% |

| Age 25 to 34 | 2% | 66,800 | 68,136 | 69,499 | 70,889 | 72,307 | 2.00% |

| Age 35 to 54 w/ older children | 9% | 125,250 | 136,523 | 148,810 | 162,203 | 176,801 | 9.00% |

| Total | 6.65% | 282,500 | 300,988 | 320,899 | 342,350 | 365,468 | 6.65% |

4.2 Target Market Segment Strategy

A full-time public relations coordinator is a vital part of I & B INVESTMENTS’ management team. The job will require this person to be responsible for assuring customer satisfaction, generating public awareness for the types of entertainment offered at our “FEC,” and attractively promoting the various activities to the public.

Even though, our customers can be considered all age groups, both sexes, all races, all income levels, local residents or tourist to the area. The most important factor behind our success is simply, THAT A PERSON CAN ENJOY THEMSELVES, while participating in the activity they choose.

4.2.1 Market Needs

Upon reviewing the local demographics of businesses in the Weber & Davis County area, we discovered that our proposed service will be filling a void that has existed for years in the local entertainment market.

Our primary targeted counties are Weber and Davis. These counties represent two of Utah’s top three counties with the highest personal income levels in Utah (Davis county being #1) which relates to more money available for entertainment.

1999 Average Household Adjusted Gross Income

| County | – |

| Davis | $42,500 |

| Morgan | $42,000 |

| Weber | $37,500 |

| Box Elder | $35,000 |

| Cache | $34,000 |

| Rich | $28,000 |

4.2.2 Market Trends

Historically if a market becomes controlled by a corporate entity, services are cut, prices are raised and core business is driven away as a result of the companies indifference to local customers concerns. To avoid this happening locally, I&B Investment’s desire is to create their niche in the Utah market before the national chains move in.

The Business Journal of Kansas City -1996. “During the past five years, large chains like The Blue Eagle Golf Centers Inc., and The Golden Bear Centers, have been buying up various FECs attempting to control the market.”

Parks & Attractions – January 29, 2001, Amusement Business.com (newsletter). “Right now we have 20 locations. They are all the typical FEC: batting cages, bumper boats, miniature golf, indoor arcades. There have been a lot of things tried and we’ve seen some things fail. We’ve seen Disney come and go with its Disney Club, their birthday-party type concept, and Discovery Zone has come and gone.” Taken from an interview with Mr. Bill Rameson, a FEC Pioneer and CEO of Palace Entertainment, the largest FEC chain in the world.

Utah’s Amusement and Recreation Industry is projected to employ an increase of 33,080 employees by 2030. This equals an average of 788 more employees per year being hired by Utah’s growing Amusement Industry. Source: State of Utah Economic and Demographic Research Database.

Page 11, of the 2001-2002 industry report complied by the International Association for the Leisure & Entertainment Industry, states that even after years of exponential growth, FECs are still a strong growing segment of the amusement industry. In 1990, there were only about 250 centers and today the count is around 10,000 to 12,000 with 19% of the establishments earning $1,000,000 to $3,000,000 and 16% making over $3,000,000 annually.

For more great information about the amusement industry and the positive upward tread, there are two main industry magazines that provide current industry statistics. They are Play Meter Magazine and Vending Times. The 2001 census of the Industry, by Vending Times is the 54th in a series that dates back to the dawn of the modern era in vending. It is based on a mailing to 12,000 operating entities that yielded 1,206 usable replies.

Fun Center Sector Remains Robust as Operators Pace Expansion Strategies – Vending Times, January 2002. “A complex but promising growth opportunity confronts the fun center market in 2002. Family entertainment centers, location-based entertainment sites, arcades, and game rooms all stand to create larger customer bases and have a solid chance to cement greater customer loyalty if they invest wisely to create the kinds of experiences that players actually want to have.”

4.2.3 Market Growth

As the population ages the potential market size increases and with the type of entertainment offered at our facilities, we are confident that our customer base will continue to grow and remain stable for the foreseeable years to come.

The market for a modern FEC center in the Weber/Davis County area is superior to most, partly due to the tremendous population growth which has occurred during the past five years. With the overwhelming majority of the population living and working within 15 miles of our first selected site. Additionally, there is not an FEC of this type within 50 +/- miles.

Population Growth: In the 10 year period of 1990-2000, Weber County experienced a 24% increase in residents, closing the millennium at 196,500 and this rate of growth is projected to continue through 2020.

Utah’s Resident Population

| 1850 | 1900 | 1920 | 1940 | 1960 | 1980 | 2000 |

| 100,000 | 250,000 | 400,000 | 500,000 | 800,000 | 1,500,000 | 2,300,000 |

4.3 Service Business Analysis

We requested Dr. DeeVon Bailey, of Utah State University, Professor of Economics to study our area and industry, then report and publish his findings. We requested Dr. DeeVon Bailey to publish his finding because, we wanted his non-bias review and we felt that informing the competition about his findings was a good thing. Here is an exact copy of that report,

Preliminary Assessment of the Economic Multipliers for

Amusement Companies in Weber County, Utah State University

By DeeVon Bailey, Ph. D.

Department of Economics

Utah State University

February 1, 2002

Dear Mark,

This document provides you information on the various economic multipliers you can use to assess the impact of your proposed business. The multipliers I am giving you were generated based on information from Weber County during 1998 (this is the latest information we had).

We were able to get information on two types of amusement companies – 1) Amusement and Recreation Services (ARS) and Membership Sports and Recreation Clubs (MSRC). I suspect that the first category, ARS, more closely fits your situation than the second.

The economic information and the economic multipliers were generated by IMPLAN, an internationally recognized input-output model that is widely used. Dr. Donald L. Snyder generated the information for us. The following table presents some of the base economic information for ARS and MSRC in Weber County in 1998:

| – | ARS | MSRC |

| Total Sales Mil. $ | 17.11 | 7.512 |

| Total Employment (Number) | 830 | 372 |

| Total Compensation Mil. $ | 5.128 | 2.051 |

| Employee Income Mil. $ | 1.820 | 0.680 |

| Proprietor Income Mil. $ | 3.552 | 0.255 |

| Indirect Business Tax Mil. $ | 0.866 | 0.203 |

| Total Value Added Mil. $ | 11.366 | 3.188 |

Let me interpret this table for you. In 1998, ARS had $17.111 million in total sales in Weber County and employed 830 people. The employment number is a person count and not full-time equivalents. You need to divide the employment number by perhaps “4” to get the full-time equivalents (jobs). Total compensation is employee income plus proprietor income plus rental income plus interest income generated by the business type.

So, in the case of ARS total compensation was $5.128 million of which $1.820 went to employees (wages and salaries) and $3.552 million went to owners (proprietors) as net profit. Indirect business taxes are basically sales taxes generated by the business types according to Don Snyder. So, ARS generated about $866,000 in sales taxes during in Weber County in 1998. Total value added is basically total sales less what would be equivalent to the cost of goods sold.

So, in 1998 ARS generated $17.111 million in sales of which $11.366 million could be attributed to the value added by labor, management, etc. by persons in Weber County. This suggests that ARS made purchases of about $5.745 million (17.111 – 11.366) from sources outside of the county to be able to generate $17.111 million in sales.

Economic Multipliers for Weber County Amusement Industries

The following are some of the key economic multipliers you should use to judge the impact of your proposed business.

Type and Value of Multiplier

| – | ARS | MSRC |

| Output Multiplier | 1.50 | 1.73 |

| Indirect Business Taxes | 1.57 | 2.65 |

| Employment Compensation | 1.52 | 1.82 |

| Total Value Added | 1.48 | 2.12 |

| Employment | 1.17 | 1.24 |

The interpretation on these would be as follows: The output multiplier of 1.50 for ARS would indicate that for each $1 in sales for this industry that an additional $0.50 is generated in sales in the County. For example, if your business generates $1 million in sales then that $1 and an additional $500,000 would be generated in sales for the County each year for a total of $1.5 million after the multiplier effect.

The indirect business taxes multiplier for ARS is 1.57. This means that for every $1 in sales taxes generated by your business that an additional $0.57 in sales taxes will be generated in Weber County. For example, if your company generates $10,000 in sales taxes an additional $5,700 in sales taxes will be generated by other economic activity in Weber County as a result of the economic multiplier effect (57% * $10,000).

The total value added multiplier for ARS is 1.48. This indicates that for each $1 in economic value generated by the business above the costs of inputs purchased from outside of the County would generate an additional $0.48 in value added for the County economy. This roughly means that if gross profit for the company is $1 then gross profit in the entire county will increase by $1.48 million (this figure includes the $1 in gross profit for your business and the $480,000 that would be generated for other businesses in the County)

The employment multiplier for ARS is 1.17. This suggests that for every person you employ in your business that another 0.17 jobs will be created in the county. So, if you employ 50 people then, besides your 50 jobs, another 8.5 jobs will be created in the County (0.17 * 50). Remember that these are jobs and not full-time equivalents since many of these people will be part timers.

4.3.1 Competition and Buying Patterns

The Amusement Industry is unique in that it has little inventory. Yet, should the need arise there exists a large network of suppliers for everything in the facility. All of these sources ship overnight which reduces the requirement for a large on-hand inventory.

“Being locally owned, you can design and operate your facility to be connected with the community and fine-tune to meet their needs. You have to be part of the community to be successful.” – Economy Affects FEC Biz – October 01, 2001 Amusement Business.com.

I&B Investments is a business focusing on family entertainment where there will be sports and activities that all ages can participate in and enjoy as individuals or as a group. It is where grandparents can take grandchildren of all ages (it makes a great date night or family outing).

The simplicity of the activities enables anyone to experience excitement without having to know how to play like a pro. Miniature golf and other related activities (that require minimum strength and athletic ability) are some of the highest-rated family participation sports in the United States.

By far, the most significant factor to affect the FEC business in the forthcoming decade is the dramatic growth of the 25 to 44 year old segment of the population. This age group represents the prime segment of the population that enjoys playing in tournaments. Our FEC will be high-tech, totally computerized centers. Pro play will be offered in the facility year round, increasing the profits for the center.

Competition in the amusement industry in Weber County is considered mild at best and most venues are remotely located. Our first choice of locations is superior and offers us an edge against future FECs or similar services. We will create our niche in the market place by being the first FEC in the surrounding area, but to keep our competitive edge we know we have to choose the right location.

Experts say, “If you require a big grand opening or spend a ton on advertising your center, then you are not in the right location. The public just needs to be able to see your location, make it look fun and they will know where you are and when to come.”

4.3.2 Main Competitors

Page 7 of the 2001-2002 annual industry report, complied by the International Association for the Leisure & Entertainment Industry, points out that there are NO TRUE FEC’s registered in the Rocky Mountain area and our research confirms this. This provides a prime awaiting customer base and helps assure that our facilities will be in command. We will be entering the market place as the leading company for amusement and entertainment to the area.

The other local, single activity establishments will not have much of an impact on our potential customer base, especially in the winter months when most of the local amusement businesses are closed.

None the less our facility will be competing with other established recreation and amusement activities for the consumer’s dollars. These venues are: movie theaters, bowling centers, roller skating, sports venues, theme parks, golf courses, fitness centers, night clubs, ski resorts and etc. Yet, none of these amusement activities truly compete with our facilities, because at our proposed facility we will offer more entertainment options custom-fit to the community and tourist.

Locally there are only two miniature golf courses (both built in the 1980s) and about ten golf courses. Many items like upgrades, new equipment, new attractions, websites or even having a fax machine, have not been a priority to some of these establishments. In others words, because there isn’t much competition, the existing venues do not see any reason to make customer satisfaction a priority.

I&B Investments will be the first of its kind in the area to address our underserved market, understanding that price is not the public’s only buying criterion. We at I&B Investments believes that customers want to feel a holistic process of having fun and they expect prompt service. Combine that with a clean environment and properly working equipment and we are ensured that our customers will come back again and again.

Strategy and Implementation Summary

Our services will be positioned to provide our customers with a premium amusement and entertainment experience.

Thus our pricing strategy will be to charge a premium price as per industry standards.

The following subtopics will present our sales strategy, marketing strategy, pricing strategy, daily customer projections and promotion strategy. To see comparison FECs and their current pricing refer to financials topics for projections and pro forma comparisons.

I & B INVESTMENTS will also work toward establishing community involvement programs that will demonstrate how the business can contribute to a better quality of community life. Such as: Community projects using the “FEC’s” facilities to help civic groups obtain their financial goals (by offering fund raising events). Schools, churches, and other groups will be welcomed for tours of the facilities and will be shown how the facility can be used to help raise funds for their needs.

5.1 Competitive Edge

The high standards set by our company and our location are going to make it very difficult for competitors to enter and survive in the market area.

I&B Investments research shows that the opportunity exists to provide a high-quality service in a family-oriented environment, where we can offer competitive pricing to our customers and still make an outstanding profit in this demanding market.

The keys to our competitive edge

There are several critical issues based on the lifestyles of the area for our business to be accepted and survive.

- Produce maximum profits, but still able to offer affordable entertainment

- Provide the best games/family sports

- Great food

- Little or no educational curve

- Repeat customers/tournaments/enjoyment

- Allow space for other retail tenants (reduce overhead)

- Do not compete with our tenants for the same dollar

- Provide activities for a large range of age groups

- Unique in design with comfortable ambience

- Exciting work environment

5.2 Marketing Strategy

Our customers can come from all age groups, male and female, all races, every income level and can be local residents or tourists to the area. That is why our marketing plan started at the construction phase; by keeping in mind, if it looks fun people will come. Thus the main factor to our success is simply that a person can enjoy themselves at our center while participating in an activity they choose.

Our full-time public relations manager is a vital part of our management team, by assuring that customer satisfaction is provided and gathering information from the public about the types of entertainment most desired. This can provide our company with the means to stay in touch with the community and ready to meet their desires.

5.2.1 Pricing Strategy

To establish the following detailed chart, we referred to several factory-pricing recommendations and the local competition.

The following details our pricing and the # of customers per month that we used for our cash flow projections. These projected numbers are 35% +/- of daily operation capacity and being open for business 26 days a month, closed on Sundays. It should also be noted, there maybe activities planned that are not included in our projections.

| – | Price | Quantity |

| Go-carts | $5.50 | 7,000/month |

| Mini-golf | $5.50 | 7,000/month |

| Driving range | $5.50 | 560/month |

| Arcade and redemption | $10.00 | 600/month |

| Sky-coaster | $15.00 | 560/month |

| Batting cages and pitching lanes | $1.00 | 1,620/month |

| Climbing walls | $1.50 | 600/month |

| Bumper boats | $4.50 | 560/month |

| Restaurant | $3.75 | 10,500/month |

| Souvenirs | $9.50 | 250/month |

| Party rooms | $25.00 | 240/month |

| Air hockey and foosball | $0.50 | 672/month |

All business expenses are detailed in the financials topics. All other direct cost were pre-calculated and added into the Sales Forecast table.

5.2.2 Promotion Strategy

I&B Investments’ first objective in promoting our center will be to capitalize on the power of the WORD OF MOUTH.

In every business it is a well-known fact that word-of-mouth advertising is any businesses’ best friend or worst enemy. Yet, this does not preclude the fact that announcements, placing advertisements in the local newspapers and our future planned website are not just as important in reaching new customers and will be employed as follows:

Advertising

Getting our positioning message to the public, “family recreation,” where fun and customer service is paramount.

Utah’s State Tourist Dept

Keeping them aware of our center and all current promotions.

Go-cart Track Signs

Local businesses can buy sign footage and have their signs placed around the track like you would see around any race track.

Freeway & Site Signs

Self explanatory.

Sales Brochure

Informing the public of all the activities found and offered at the center.

Player Rewards

Rewarding customers for spending money through establishing frequent player programs and sponsoring up to $50,000 a year towards prize money awarded through tournament playoff prizes.

Community Involvement

The activities of the center will be promoted as a place to bring your group to participate in events and raise funds for “project name here.” These types of fund raising events can request that a portion of each players expenses be donated to their organization (a standard amount will be established).

5.3 Sales Strategy

I&B Investments intends on providing a venue in which the entire family can really enjoy their leisure time by participating in fun and competitive activities that require minimum strength and athletic ability. Supported with great service and offered at competitive prices we have the winning combination.

At our facilities the value of entertainment experience that our customers receives would be considered high compared to per dollar spent (“Biggest bang for your buck” or “You get your moneys worth”), and by providing the best in the area, our management team expects to reach an even broader market than used for our cash flow projections.

Our sales strategy is set on the very basics of business, please our customers and they will return again and again.

5.3.1 Sales Forecast

Sales as per population (exclude tourist)

Using our minimal targeted market population of 418,399 people, we will detail how easily we can reach our projected income goals.

- 10% of 418,399 people = 41,839 customers per year, each spending $81.26 per year, or $8.50 per visit and visiting 9.5 times a year.

- Or, using our projected average per person expenditures = $8.50 x 1,225 customers daily = $10,412 x 313 days a year = $3,259,112 per year.

This means that we can meet or exceed our projected income if approximately one out of three possible customers visits our center once a year and spends a minimum of $8.50 on that visit.

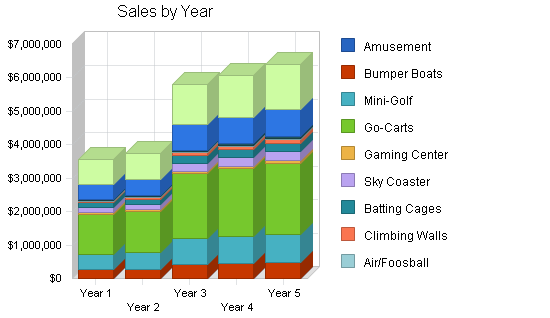

2006 shows increase in sales caused by the opening of Phase 2.

The following chart shows I&B Investments Projected Sales Forecast and the annual projections for the next five years. Monthly figures are detailed in the appendix. To see activities pricing break down & projected numbers used see topic 4.2.

| Sales Forecast | |||||

| Year 1 | Year 2 | Year 3 | Year 4 | Year 5 | |

| Sales | |||||

| Amusement | $0 | $0 | $0 | $0 | $0 |

| Bumper Boats | $260,463 | $273,486 | $423,904 | $445,099 | $467,354 |

| Mini-Golf | $466,907 | $490,252 | $759,891 | $797,886 | $837,780 |

| Go-Carts | $1,193,801 | $1,253,491 | $1,942,911 | $2,040,057 | $2,142,060 |

| Gaming Center | $38,584 | $40,513 | $62,795 | $65,935 | $69,232 |

| Sky Coaster | $154,350 | $162,068 | $251,205 | $263,765 | $276,953 |

| Batting Cages | $144,697 | $151,932 | $235,494 | $247,269 | $259,633 |

| Climbing Walls | $55,997 | $58,797 | $91,136 | $95,692 | $100,477 |

| Air/Foosball | $18,308 | $19,223 | $29,796 | $31,286 | $32,850 |

| Souvenirs | $28,175 | $29,584 | $45,855 | $48,148 | $50,555 |

| Party Rooms | $460,238 | $483,250 | $749,037 | $786,489 | $825,813 |

| Food & Drinks | $739,588 | $776,567 | $1,203,679 | $1,263,863 | $1,327,057 |

| Total Sales | $3,561,108 | $3,739,163 | $5,795,703 | $6,085,488 | $6,389,763 |

| Direct Cost of Sales | Year 1 | Year 2 | Year 3 | Year 4 | Year 5 |

| Amusement | $0 | $0 | $0 | $0 | $0 |

| Bumper Boats | $65,116 | $68,372 | $105,976 | $111,275 | $116,838 |

| Mini-Golf | $70,036 | $73,538 | $113,984 | $119,683 | $125,667 |

| Go-Carts | $298,450 | $313,373 | $485,728 | $510,014 | $535,515 |

| Gaming Center | $19,292 | $20,257 | $31,398 | $32,968 | $34,616 |

| Sky Coaster | $38,588 | $40,517 | $62,801 | $65,941 | $69,238 |

| Batting Cages | $21,705 | $22,790 | $35,324 | $37,090 | $38,945 |

| Climbing Walls | $13,999 | $14,699 | $22,784 | $23,923 | $25,119 |

| Air/Foosball | $2,746 | $2,884 | $4,469 | $4,693 | $4,928 |

| Souvenirs | $7,044 | $7,396 | $11,464 | $12,037 | $12,639 |

| Party Rooms | $230,119 | $241,625 | $374,518 | $393,244 | $412,907 |

| Food & Drinks | $369,794 | $388,284 | $601,840 | $631,932 | $663,528 |

| Subtotal Direct Cost of Sales | $1,136,888 | $1,193,733 | $1,850,286 | $1,942,800 | $2,039,940 |

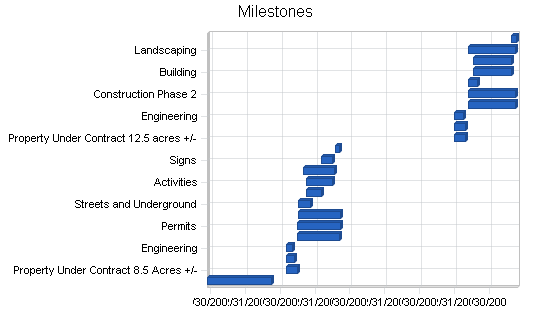

5.4 Milestones

Set forth below are the main milestones in the schedule of proposed development. We have carefully reviewed the timelines for start-up and firmly believe that once we are completely funded we can construct and open our initial FEC within less than one year of breaking ground.

- Purchase of property for FEC site by October 2002

- Preliminary architectural drawings

- Secure construction loan

- Approval of final architectural drawing

- Obtain all required permits

- Site preparation

- Order long lead items (i.e. go-carts, boats, skycoaster, etc.)

- Construction of center (construction phases are three and five-month timelines)

- Develop operations and employee manual

- Hire personnel

- Prepare and finalize marketing campaign

- Train staff

- Order inventory

- Soft open (training period 30 to 45 days)

- Grand Opening/Mothers Day weekend 2003

- Construction on Phase 2 Starts in 2005.

| Milestones | |||||

| Milestone | Start Date | End Date | Budget | Manager | Department |

| Write Business Plan | 6/15/2001 | 5/15/2002 | $25,000 | ABC | Marketing |

| Property Under Contract 8.5 Acres +/- | 8/1/2002 | 10/1/2002 | $680,000 | ABC | Marketing |

| Site Plans | 8/1/2002 | 9/15/2002 | $90,000 | ABC | Marketing |

| Engineering | 8/1/2002 | 9/1/2002 | $45,000 | ABC | Marketing |

| Insurances | 9/30/2002 | 5/5/2003 | $4,000 | ABC | Marketing |

| Permits | 10/1/2002 | 5/11/2003 | $25,000 | ABC | Marketing |

| Construction Phase 1 | 10/2/2002 | 5/14/2003 | $150,000 | ABC | Marketing |

| Streets and Underground | 10/2/2002 | 12/5/2002 | $175,000 | ABC | Marketing |

| Building | 11/15/2002 | 2/1/2003 | $905,000 | ABC | Marketing |

| Activities | 11/15/2002 | 4/1/2003 | $1,040,000 | ABC | Marketing |

| Landscaping | 11/1/2002 | 4/10/2003 | $117,000 | ABC | Marketing |

| Signs | 2/1/2003 | 4/1/2003 | $20,000 | ABC | Marketing |

| Open Go-cart Center | 4/14/2003 | 5/10/2003 | $200,000 | ABC | Marketing |

| Property Under Contract 12.5 acres +/- | 1/1/2005 | 3/1/2005 | $1,000,000 | ABC | Marketing |

| Expanded Site plans | 1/1/2005 | 3/1/2005 | $95,000 | ABC | Marketing |

| Engineering | 1/1/2005 | 2/15/2005 | $50,000 | ABC | Web |

| Permits | 3/15/2005 | 11/15/2005 | $35,000 | ABC | Web |

| Construction Phase 2 | 3/15/2005 | 11/15/2005 | $250,000 | ABC | Department |

| Streets & Underground | 3/15/2005 | 5/1/2005 | $200,000 | ABC | Department |

| Building | 4/10/2005 | 10/25/2005 | $1,500,000 | ABC | Department |

| Activities | 4/10/2005 | 10/25/2005 | $1,500,000 | ABC | Department |

| Landscaping | 3/15/2005 | 11/15/2005 | $150,000 | ABC | Department |

| Open Expanded (FEC) Center | 10/27/2005 | 11/21/2005 | $250,000 | ABC | Department |

| Totals | $8,506,000 | ||||

Management Summary

Our company philosophy is based on mutual respect for all contributions made by our participating or limited partners, investors, consultants, and employees without regard to the position held in the company. Those who work with I&B Investments will learn to enjoy and trust our partnership environment, because we all strive to create an environment that enables us to work smarter-not harder and suggestions are valued, appreciated and rewarded.

I&B Investments will also work toward establishing community involvement programs that will demonstrate how our business can contribute to a better quality of community life. Projects such as using the FEC facilities to help civic groups obtain their financial goals (by offering fundraising events); working with schools, churches, and other groups on programs for mutual benefit.

6.1 Management Team

Mark D. Bergman, Managing Partner

Mr. Bergman is a self starter and natural leader, he has been self employed in several different trades. He is an accomplished carpenter, strip mining operation director, welder, college-trained auto mechanic, structural architectural consultant, computer operator, human resource officer, safety director, patented inventor, proven business manager and started his training under his Father who was an engineer and a successful entrepreneur. During Mr. Bergman’s career he has received numerous state and community commendations for his involvement in community improvement and youth development programs. He is also bilingual with Spanish as a second language.

Mr. Bergman has had a successful career in the construction industry, is trained in a wide range of executive level positions and has served in a number of capacities including project management, construction site OSHA safety director, manufacturing start-up, and national marketing and promotions. Mr. Bergman’s strongest personality trait is his natural leadership ability.

Responsibilities: Design and manage the construction phase and serve as the operations director. Develop and implement the operation, safety, maintenance and training programs for the center.

Joseph L. Hull, Manager Operations (GM) & Public Relations Officer

Mr. Hull has degrees in chemistry, german and a masters degree in education. He is bilingual with German as a second language. He is also highly skilled in the art of negotiations, public relations, oversight of complex budgets, business management and problem solving. He was elected and served as a Utah State Representative for six years and as a Utah State Senator for eight years. He has served on several Federal & State Legislative committees and task-forces. He has been recognized and received awards from various Universities, School Districts, Highway Patrol Associations, the National Guard, State Parks Department, Utah’s Foreign Language Teacher of the Year, Utah’s Public Safety Department, Utah’s Legislative Award of Excellence, Friend Of Agriculture from Utah’s Farm Bureau and is on Utah’s Educations Honor Roll.

Responsibilities: Participate in the company’s strategic business plan; coordinate training and operation programs; act as opening (mornings to midday) operations director; customer service director and public relations consultant once the center is open.

Darren B. Strebel, Manager of Promotions and Media

Mr. Strebel has served on the board of directors on housing associations and has over six years of experience with developing and operating his own businesses, which include performing the services of an investment consultant and financial planner. His skills also encompass developing programs for company marketing, advertising, distribution and client fulfillment. Mr. Strebel has over thirteen years experience of working for the IRS and US Postal Service, where he acquired skills that included accounting, auditing, labor negotiations, customer service and office management.

Responsibilities: Implement the direction of the marketing with day-to-day management responsibility towards designing of art and graphics work and promoting of the company’s FECs.

Rod Schaffer, Treasurer/Comptroller

Mr. Schaffer is a certified public accountant (CPA) and has a B.S. degree in accounting as well as a B.S. in Music Education. He has worked as an independent public accountant and taxation consultant for over ten years and has extensive experience with tax filings of all types as well as budgeting and financial matters. Mr. Schaffer has also provided various corporate services including the preparation of corporate bylaws for various structures including LLCs, DBAs and both S and C corporations.

Responsibilities: Will serve as the company’s comptroller whose duties will include daily journal entries, corporate bookkeeping duties, revenue review, statements reconciliation, monthly P/L schedules, accounts payable and other related matters; is the point-of-contact for external payroll service contractor and independent CPA services.

Laura Strebel, Retail Space Agent and Gift Shop Manager

Ms. Strebel has owned and operated Laura Strebel Engraving & Gifts, a successful business of custom gifts and crafts, for over twenty years. In addition, she holds a Utah State Real Estate Brokers License and has been an active real estate agent for 12 years. Ms. Strebel has also been a notary public for over two decades and was a founding member and past board member of the influential Ogden Anti-Graffiti Task Force. She has worked with the local government on several youth outreach programs and she has sat on Utah State Legislative task forces that implemented new state laws.

Responsibilities: Seek, review and qualify tenants for leased spaces. List and sell any property that becomes available caused by our development, manage and operate the gift and souvenir shop, assist in oversight of company’s daily accounting.

Senior Staff Consultants

Harold D. Skripsky, Entertainment and Activities Consultant

Mr. Skripsky was the founding director and past president of International Association for the Leisure and Entertainment Industry (IALEI) and is the chairman of the board of Leisure and Entertainment Trade Show (LETS), a joint venture by three industry associations which own the Fun Expo.

Mr. Skripsky began his career with the McDonald Corporation, where he quickly rose to operations manager, overseeing 110 franchise operations. He was one of the partners who developed and opened Enchanted Castle in 1982 (a single FEC that grew to earn over $5,000,000 gross income a year). Originally developed as a 10,000 square foot theme-oriented restaurant and game room, Enchanted Castle was expanded to 40,000 square feet in 1989. In 1997 he sold Enchanted Castle to Ogden Entertainment, and now serves as a consultant to their entertainment division.

Responsibilities: Ongoing review of the company’s business plan and advise/consult on all aspects of entertainment activities, assist in building design, floor layout of activities, assist with training and explaining the general functions of our FEC.

Val R. Iverson, Financial Consultant/Advisor

Mr. Iverson has degrees in distributive education and sales technology and is a licensed real estate broker. He is highly skilled in business start-up, management, sales, marketing and fulfillment. He is the vice president of All American Playground Equipment and a partner of American Trampoline, and thus is very experienced with sports and playground equipment manufacturing and marketing. He is also highly skilled in subdivision-style construction.

Responsibilities: Participate and actively consult in all phases of the company’s strategic plans. Coordinate the purchase of properties, oversee business management setup, review and consult over inventory control, review and pursue investment capital and profit oversight.

Roger Smout, Marketing and Sales Consultant

Mr. Smout is currently employed as a midwestern district sales manager for I.B.S and was voted salesman of the year for 2001-2002. He is bilingual with Korean as a second language. He has a bachelors degree in technical sales and has completed several focus group courses on employee management, product presentation and placement, with direct customer service experience both in-house and out in the field. Mr. Smout has extensive hands-on experience in advertising production, graphic design layout and multimedia publishing.

Responsibilities: Consult and advise as to the company’s marketing, sales and advertising.

Steven Eames, General Contractor and Construction Consultant

Mr. Eames has been actively licensed by the State of Utah’s Contractor Licensing department for over twenty years.

Responsibilities: Be the acting general contractor for building permits, consult on construction schedule and the like.

Randy Sant, Government Redevelopment Consultant/Advisor

Mr. Sant has overseen and organized almost every redevelopment agency that has been established in the state of Utah. To discover more about Mr. Sant and his abilities in RDA funding please type his name into your Web browser and do a search.

Responsibilities: Consult and actively setup any redevelopment agency and contracts between the company and city government.

Other Executive Support Agencies:

Legal services;

Auditing services;

Insurance company;

Banking services;

Architectural, planning and design services.

6.2 Organizational Structure

The company’s structure is as follows:

| Active Managing Partners/Senior Staff | Limited Partners/Senior Staff Consultants | Non-Partners/Senior Staff Consultants (retained) |

| Mark D. Bergman Managing Partner |

Val R. Iverson Investment, Real Estate and Financial Consultant |

Harold Skripsky Entertainment & Activities Consultant |

| Senator Joseph L. Hull Operations Manager/Public Relations |

Roger Smout Sales and Marketing Consultant |

Randy Sant Redevelopment (RDA) Consultant |

| Laura Strebel Retail Space Leasing Agent & Gift Shop Manager |

Steven Eames Licensed General Contractor Construction Consultant |

– |

| Rod Schaffer Treasurer/Comptroller |

– | – |

| Darren Strebel Manager of Promotions & Customer Service |

– | – |

| Richard Grossenbach Human Resource Manager |

– | – |

This group represents 41% of the company ownership, with the remaining percentage of the company’s ownership under the control of the managing partner, but is considered to be held in the company’s treasury and all taxes that are assessed against this percentage are paid from the general fund.

All partners are considered to have equal voting rights as per ownership and if a vote is called, each partner is allotted one vote per percentage of ownership. The managing partner is elected by votes and is to remain as such unless a vote is requested and the majority votes change.

The managing partner is responsible to oversee all operations and is required to inform and report to all other partners of progress. By no means is the managing partner obligated to perform any requested function unless he is convinced that it is for the betterment of the company or if a majority of the partners request that there be a vote, or that the object in question is voted to be put before arbitration (as explained in the partnership agreement).

| Administrative | Operations | Facilities Maintenance |

| General Manager | Shift Leader |

Lead Supervisor |

| Design and Function Oversight | Assistant. Managers | Hands on Repairman |

| Operations Manager | Customer Service Manager | Two Helpers |

| Human Resource Director | Floor Sales | – |

| Safety Oversight | Ticket Desk Operators | – |

| B-B Contact | Food Handlers | – |

| Contract review | Concession Carts | – |

| Tenant Leasing Agent | Housekeeping | – |

| Accounting & Bookkeeping | – | – |

| Inventory Control | – | – |

| Public Relations | – | – |

| Customer Service Director | – | – |

| Promotions | – | – |

| Activities Coordinator | – | – |

| Gift Shop Manager | – | – |

6.3 Personnel Plan

Customer service is paramount in our business and our business plan. The management team will accomplish this goal by targeting employees who are willing to be trained and by providing encouragement and employee incentive programs. I&B Investments will contract with an employee leasing program to help provide the full-time staff with such things as:

- Health care insurance

- Dental care insurance

- Life insurance

- Vacation time

- Up sell incentive programs

- Discount passes for staff family members

- 401k retirement plans

- Pay checks

Our Personnel Plan reflects how we intend to utilize our peoples’ assets. Most of them will be cross trained and the management team of I&B Investments believes that an employee who is happy at work will enjoy working. It is always easier to please customers with a staff that cares, a facility that is clean and equipment that is kept in proper working order.

| Personnel Plan | |||||

| Year 1 | Year 2 | Year 3 | Year 4 | Year 5 | |

| Operations Personnel | |||||

| John A | $23,184 | $24,343 | $49,904 | $52,399 | $55,019 |

| John B | $23,184 | $24,343 | $49,904 | $52,399 | $55,019 |

| John C | $23,184 | $24,343 | $49,904 | $52,399 | $55,019 |

| John D | $15,000 | $15,750 | $32,288 | $33,902 | $35,597 |

| John E | $15,000 | $15,750 | $32,288 | $33,902 | $35,597 |

| John F | $15,000 | $15,750 | $32,288 | $33,902 | $35,597 |

| John G | $15,000 | $15,750 | $32,288 | $33,902 | $35,597 |

| John H | $15,000 | $15,750 | $32,288 | $33,902 | $35,597 |

| John I | $15,000 | $15,750 | $32,288 | $33,902 | $35,597 |

| John J | $15,000 | $15,750 | $32,288 | $33,902 | $35,597 |

| John K | $15,000 | $15,750 | $32,288 | $33,902 | $35,597 |

| John L | $15,000 | $15,750 | $32,288 | $33,902 | $35,597 |

| John M | $15,000 | $15,750 | $32,288 | $33,902 | $35,597 |

| John N | $15,000 | $15,750 | $32,288 | $33,902 | $35,597 |

| John O | $15,000 | $15,750 | $32,288 | $33,902 | $35,597 |

| John P | $18,768 | $19,706 | $40,398 | $42,418 | $44,539 |

| John Q | $18,768 | $19,706 | $40,398 | $42,418 | $44,539 |

| John R | $18,768 | $19,706 | $40,398 | $42,418 | $44,539 |

| John S | $27,600 | $28,980 | $59,409 | $62,379 | $65,498 |

| John T | $27,600 | $28,980 | $59,409 | $62,379 | $65,498 |

| John U | $27,600 | $28,980 | $59,409 | $62,379 | $65,498 |

| Subtotal | $388,656 | $408,089 | $836,582 | $878,411 | $922,332 |

| Sales and Marketing Personnel | |||||

| Darren Strebel | $27,600 | $28,980 | $30,429 | $31,950 | $33,548 |

| Other | $27,600 | $28,980 | $30,429 | $31,950 | $33,548 |

| Subtotal | $55,200 | $57,960 | $60,858 | $63,901 | $67,096 |

| General and Administrative Personnel | |||||

| Joe Hull | $40,848 | $42,890 | $87,925 | $92,322 | $96,938 |

| Rod Schaffer | $18,768 | $19,706 | $20,692 | $21,726 | $22,813 |

| Restaurant Manager | $40,848 | $42,890 | $87,925 | $92,322 | $96,938 |

| Laura Strebel | $20,976 | $22,025 | $23,126 | $24,282 | $25,496 |

| Mark Bergman | $49,680 | $52,164 | $106,936 | $112,283 | $117,897 |

| Subtotal | $171,120 | $179,676 | $326,605 | $342,935 | $360,082 |

| Other Personnel | |||||

| Jack A | $18,768 | $19,706 | $40,398 | $42,418 | $44,539 |

| Jack B | $18,768 | $19,706 | $40,398 | $42,418 | $44,539 |

| Jack C | $20,976 | $22,025 | $45,151 | $47,408 | $49,779 |

| Sara A | $18,768 | $19,706 | $40,398 | $42,418 | $44,539 |

| Subtotal | $77,280 | $81,144 | $166,345 | $174,662 | $183,396 |

| Total People | 32 | 32 | 32 | 32 | 32 |

| Total Payroll | $692,256 | $726,869 | $1,390,390 | $1,459,909 | $1,532,905 |

Financial Plan

It is anticipated that the multi-million dollar loan that the company will seek to secure will cover the business start-up costs and provide funds for operating expenses for the first year. Management projects that it will need to obtain additional investment capital to fund the loan and long-term assets.

The Highlights chart that accompanies the Executive Summary sets forth the company’s anticipated profitability analysis. Management believes that even minimal revenues should be sufficient to offer investors an acceptable return on investment.

7.1 Important Assumptions

NOTES FOR PROJECTIONS

All sales projections/assumptions are based on operating at 35% +/- of capacity. Refer to the Sales Forecast topic for demographic break down and average cost per person.

- The figure of $890,000 shown in the Start-up Funding table under Current Borrowing, is the start-up investment, amortized with a 19% interest rate and paid off in five years.

- Our long-term commercial loan is amortized at 10% interest over 20 years.

- All pricing has been set by industry standards and the local market.

- Revenues are strictly a projection based on gross possible players per venue and then using 35% +/- of that capacity for our base calculation.

- Contract services include: payroll, pest control, trash removal, cable TV.

- Employees needed and wages have been projected for full time and eight hour shifts. All payroll will be done through a payroll company, therefore giving a flatter rate and making it easier to project.

- Weber County tax rates are:

- Real Estate tax $10.00 per $1,000 of assessed value.

- Personal Property tax base is .009% of cost of equipment.

- Business License is $50.00 for first 10,000 sq ft & $5.00 per every additional 1,000 sq. ft. of building space.

- The income tax rate is estimated before deductions and overhead assumptions are included.

| General Assumptions | |||||

| Year 1 | Year 2 | Year 3 | Year 4 | Year 5 | |

| Plan Month | 1 | 2 | 3 | 4 | 5 |

| Current Interest Rate | 19.00% | 19.00% | 19.00% | 19.00% | 19.00% |

| Long-term Interest Rate | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% |

| Tax Rate | 32.75% | 33.00% | 32.75% | 33.00% | 32.75% |

| Other | 0 | 0 | 0 | 0 | 0 |

7.2 Valuation

In the following Investment Analysis Table, one should note that the entire (gross loan + points) amount of our long-term liabilities ($4,542,500) is the figure we used to determine the Net Present Value (NPV) and the Internal Rate of Return (IRR) of our company’s projected values.

| Investment Analysis | ||||||

| Start | Year 1 | Year 2 | Year 3 | Year 4 | Year 5 | |

| Initial Investment | ||||||

| Investment | $4,542,500 | $0 | $0 | $774,000 | $0 | $0 |

| Dividends | $0 | $0 | $774,000 | $0 | $0 | $0 |

| Ending Valuation | $0 | $7,370,000 | $8,110,000 | $11,400,000 | $11,050,000 | $12,475,000 |

| Combination as Income Stream | ($4,542,500) | $7,370,000 | $8,884,000 | $10,626,000 | $11,050,000 | $12,475,000 |

| Percent Equity Acquired | 0% | |||||

| Net Present Value (NPV) | $15,893,745 | |||||

| Internal Rate of Return (IRR) | 178% | |||||

| Assumptions | ||||||

| Discount Rate | 10.00% | |||||

| Valuation Earnings Multiple | 10 | 10 | 10 | 10 | 10 | |

| Valuation Sales Multiple | 2 | 2 | 2 | 2 | 2 | |

| Investment (calculated) | $965,000 | $0 | $0 | $774,000 | $0 | $0 |

| Dividends | $0 | $774,000 | $0 | $0 | $0 | |

| Calculated Earnings-based Valuation | $7,380,000 | $8,110,000 | $11,440,000 | $11,050,000 | $12,220,000 | |

| Calculated Sales-based Valuation | $7,120,000 | $7,480,000 | $11,590,000 | $12,170,000 | $12,780,000 | |

| Calculated Average Valuation | $7,250,000 | $7,795,000 | $11,515,000 | $11,610,000 | $12,500,000 | |

7.3 Key Financial Indicators

These benchmark indicators give I&B Investments a sense of relative comparison for five years of projections.

7.4 Break-even Analysis

Important notice concerning Break-even Analysis

The figures represented in this analysis are connected to the costs presented in the Start-up, Start-up Funding, and Use of Funds tables.

The following chart shows what we need to produce from sales per month to break-even (according to the assumptions). That is less than 1/2 of our planned 2003 sales level and less than 1/3 +/- for the years beyond. We strongly believe we can succeed and provide handsome returns for our owners/investors.

For the Break-even Analysis, we assume our per month fixed costs include most of management’s payroll, loan payments, investor repayments and an estimation of other basic expenses.

Margins are harder to assume. Our overall average of $8.50 (goods/services sold to each person) is based on the local market average number of sales and with an average cost of 20% ($8.50 – $1.70 = $6.80 gross profit per each good/services sold).

We believe that not only will we entertain a much higher number of customers monthly than required by this break-even chart, we believe that we are going to possibly double the amount projected in our cash flow charts in this business plan, because we are going to be the only facilities of its kind within a 50 mile radius.

| Break-even Analysis | |

| Monthly Revenue Break-even | $51,010 |

| Assumptions: | |

| Average Percent Variable Cost | 32% |

| Estimated Monthly Fixed Cost | $34,725 |

7.5 Projected Profit and Loss

Important notes regarding Depreciation & Payroll Burden

- The depreciation of assets was calculated separately from this Profit and Loss statement. Due to the fact of some accounting issues pertaining to our industry and this program. It appeared to be deducting our depreciation as hard cash expenses and not soft money (tax deduction). Therefore the cash tables did not appear to be reflecting a true statement of cash flow as per our industry (see further explanation below).

- Payroll Burden (overhead/taxes) has been excluded from the Profit and Loss table based on the fact that payroll cost and taxes were pre-calculated and included in the personnel plan table. The basic reason for us doing this is, we plan on using a payroll company. Thus all employee payroll fees, taxes, insurances and other payroll burdens are charged as a flat fee (our industry average fee is: wages + 15% +/- .5%).

As per depreciation figures, our preliminary assessment using a standard 200% declining balance on equipment and assets gives us a first year figure of $190,000 +/-. This figure is considered our income tax deductible base and will adjust each year depending on taxable items, gross income, actual values and depreciation of assets.

Upon reviewing the next table (Profit & Loss), one should note that the company is making a profit in the first month of operation. The yearly analysis is indicated in the table below. The monthly analyses can be found in the appendix.

| Pro Forma Profit and Loss | |||||

| Year 1 | Year 2 | Year 3 | Year 4 | Year 5 | |

| Sales | $3,561,108 | $3,739,163 | $5,795,703 | $6,085,488 | $6,389,763 |

| Direct Cost of Sales | $1,136,888 | $1,193,733 | $1,850,286 | $1,942,800 | $2,039,940 |

| Operations Payroll | $388,656 | $408,089 | $836,582 | $878,411 | $922,332 |

| Known expenses | $0 | $0 | $0 | $0 | $0 |

| Total Cost of Sales | $1,525,544 | $1,601,821 | $2,686,868 | $2,821,211 | $2,962,272 |

| Gross Margin | $2,035,564 | $2,137,342 | $3,108,836 | $3,264,277 | $3,427,491 |

| Gross Margin % | 57.16% | 57.16% | 53.64% | 53.64% | 53.64% |

| Operating Expenses | |||||

| Sales and Marketing Expenses | |||||

| Sales and Marketing Payroll | $55,200 | $57,960 | $60,858 | $63,901 | $67,096 |

| Advertising/Promotion | $18,000 | $18,900 | $29,295 | $30,760 | $32,298 |

| Travel | $1,800 | $1,890 | $2,930 | $3,076 | $3,230 |

| Miscellaneous | $6,000 | $6,300 | $9,765 | $10,253 | $10,766 |

| Total Sales and Marketing Expenses | $81,000 | $85,050 | $102,848 | $107,990 | $113,389 |

| Sales and Marketing % | 2.27% | 2.27% | 1.77% | 1.77% | 1.77% |

| General and Administrative Expenses | |||||

| General and Administrative Payroll | $171,120 | $179,676 | $326,605 | $342,935 | $360,082 |

| Sales and Marketing and Other Expenses | $0 | $0 | $0 | $0 | $0 |

| Depreciation | $0 | $0 | $0 | $0 | $0 |

| Utilities | $14,400 | $15,120 | $23,436 | $24,608 | $25,838 |

| Insurance | $14,760 | $15,498 | $24,022 | $25,223 | $26,484 |

| Telephone | $9,600 | $10,080 | $15,624 | $16,405 | $17,225 |

| Payroll Taxes | $0 | $0 | $0 | $0 | $0 |

| Other General and Administrative Expenses | $0 | $0 | $0 | $0 | $0 |

| Total General and Administrative Expenses | $209,880 | $220,374 | $389,687 | $409,171 | $429,629 |

| General and Administrative % | 5.89% | 5.89% | 6.72% | 6.72% | 6.72% |

| Other Expenses: | |||||

| Other Payroll | $77,280 | $81,144 | $166,345 | $174,662 | $183,396 |

| Consultants | $0 | $0 | $0 | $0 | $0 |

| Office Supplies | $2,400 | $2,520 | $3,906 | $4,101 | $4,306 |

| Postal Fees | $1,800 | $1,890 | $2,930 | $3,076 | $3,230 |

| Professional Fees | $3,600 | $3,780 | $5,859 | $6,152 | $6,460 |

| Housekeeping Supplies | $12,720 | $13,356 | $20,702 | $21,737 | $22,824 |

| Unknown | $3,000 | $3,150 | $4,883 | $5,127 | $5,383 |

| Bad Checks | $600 | $630 | $977 | $1,025 | $1,077 |

| Bank Card Fees | $600 | $630 | $977 | $1,025 | $1,077 |

| Business License | $420 | $441 | $684 | $718 | $754 |

| Facility Maintenance | $18,000 | $18,900 | $29,295 | $30,760 | $32,298 |

| Contract/Consultants | $5,400 | $5,670 | $8,789 | $9,228 | $9,689 |

| Total Other Expenses | $125,820 | $132,111 | $245,344 | $257,611 | $270,492 |

| Other % | 3.53% | 3.53% | 4.23% | 4.23% | 4.23% |

| Total Operating Expenses | $416,700 | $437,535 | $737,878 | $774,772 | $813,511 |

| Profit Before Interest and Taxes | $1,618,864 | $1,699,807 | $2,370,958 | $2,489,505 | $2,613,981 |

| EBITDA | $1,618,864 | $1,699,807 | $2,370,958 | $2,489,505 | $2,613,981 |

| Interest Expense | $519,346 | $489,761 | $670,033 | $839,570 | $797,376 |

| Taxes Incurred | $361,116 | $399,315 | $557,053 | $544,479 | $594,938 |

| Net Profit | $738,401 | $810,731 | $1,143,872 | $1,105,457 | $1,221,667 |

| Net Profit/Sales | 20.74% | 21.68% | 19.74% | 18.17% | 19.12% |

7.6 Projected Cash Flow

The company’s estimated cash flow analysis is outlined in the following table, including the cost and increase in sales and profits made from Phase 2. I&B Investments low overhead will ensure positive cash balance.

| Pro Forma Cash Flow | |||||

| Year 1 | Year 2 | Year 3 | Year 4 | Year 5 | |

| Cash Received | |||||

| Cash from Operations | |||||

| Cash Sales | $3,561,108 | $3,739,163 | $5,795,703 | $6,085,488 | $6,389,763 |

| Subtotal Cash from Operations | $3,561,108 | $3,739,163 | $5,795,703 | $6,085,488 | $6,389,763 |

| Additional Cash Received | |||||

| Sales Tax, VAT, HST/GST Received | $0 | $0 | $0 | $0 | $0 |

| New Current Borrowing | $0 | $0 | $0 | $0 | $0 |

| New Other Liabilities (interest-free) | $0 | $0 | $0 | $0 | $0 |

| New Long-term Liabilities | $0 | $0 | $4,386,000 | $0 | $0 |

| Sales of Other Current Assets | $0 | $0 | $0 | $0 | $0 |

| Sales of Long-term Assets | $0 | $0 | $0 | $0 | $0 |

| New Investment Received | $0 | $0 | $774,000 | $0 | $0 |

| Subtotal Cash Received | $3,561,108 | $3,739,163 | $10,955,703 | $6,085,488 | $6,389,763 |

| Expenditures | Year 1 | Year 2 | Year 3 | Year 4 | Year 5 |

| Expenditures from Operations | |||||

| Cash Spending | $692,256 | $726,869 | $1,390,390 | $1,459,909 | $1,532,905 |

| Bill Payments | $2,054,748 | $2,096,316 | $3,174,328 | $3,498,861 | $3,625,734 |

| Subtotal Spent on Operations | $2,747,004 | $2,823,185 | $4,564,718 | $4,958,770 | $5,158,639 |

| Additional Cash Spent | |||||

| Sales Tax, VAT, HST/GST Paid Out | $0 | $0 | $0 | $0 | $0 |

| Principal Repayment of Current Borrowing | $117,854 | $135,758 | $163,922 | $197,927 | $67,125 |

| Other Liabilities Principal Repayment | $0 | $0 | $0 | $0 | $0 |

| Long-term Liabilities Principal Repayment | $60,434 | $65,126 | $146,052 | $161,678 | $178,607 |

| Purchase Other Current Assets | $0 | $0 | $0 | $0 | $0 |

| Purchase Long-term Assets | $0 | $0 | $0 | $0 | $0 |

| Dividends | $0 | $774,000 | $0 | $0 | $0 |

| Subtotal Cash Spent | $2,925,292 | $3,798,069 | $4,874,692 | $5,318,375 | $5,404,371 |

| Net Cash Flow | $635,816 | ($58,905) | $6,081,011 | $767,113 | $985,392 |

| Cash Balance | $835,816 | $776,910 | $6,857,922 | $7,625,035 | $8,610,427 |

7.7 Projected Balance Sheet

Estimated balance sheets for the years 2003-2008 including Phase 2 in the year 2006 are provided below.

| Pro Forma Balance Sheet | |||||

| Year 1 | Year 2 | Year 3 | Year 4 | Year 5 | |

| Assets | |||||

| Current Assets | |||||

| Cash | $835,816 | $776,910 | $6,857,922 | $7,625,035 | $8,610,427 |

| Other Current Assets | $0 | $0 | $0 | $0 | $0 |

| Total Current Assets | $835,816 | $776,910 | $6,857,922 | $7,625,035 | $8,610,427 |

| Long-term Assets | |||||

| Long-term Assets | $5,077,925 | $5,077,925 | $5,077,925 | $5,077,925 | $5,077,925 |

| Accumulated Depreciation | $0 | $0 | $0 | $0 | $0 |

| Total Long-term Assets | $5,077,925 | $5,077,925 | $5,077,925 | $5,077,925 | $5,077,925 |

| Total Assets | $5,913,741 | $5,854,835 | $11,935,847 | $12,702,960 | $13,688,352 |

| Liabilities and Capital | Year 1 | Year 2 | Year 3 | Year 4 | Year 5 |

| Current Liabilities | |||||

| Accounts Payable | $75,702 | $180,950 | $268,064 | $289,325 | $298,783 |

| Current Borrowing | $772,146 | $636,388 | $472,466 | $274,539 | $207,414 |

| Other Current Liabilities | $0 | $0 | $0 | $0 | $0 |

| Subtotal Current Liabilities | $847,848 | $817,338 | $740,530 | $563,864 | $506,197 |

| Long-term Liabilities | $3,592,066 | $3,526,940 | $7,766,888 | $7,605,210 | $7,426,603 |

| Total Liabilities | $4,439,914 | $4,344,278 | $8,507,418 | $8,169,074 | $7,932,800 |

| Paid-in Capital | $965,000 | $965,000 | $1,739,000 | $1,739,000 | $1,739,000 |

| Retained Earnings | ($229,575) | ($265,174) | $545,557 | $1,689,429 | $2,794,886 |

| Earnings | $738,401 | $810,731 | $1,143,872 | $1,105,457 | $1,221,667 |

| Total Capital | $1,473,826 | $1,510,557 | $3,428,429 | $4,533,886 | $5,755,552 |

| Total Liabilities and Capital | $5,913,741 | $5,854,835 | $11,935,847 | $12,702,960 | $13,688,352 |

| Net Worth | $1,473,826 | $1,510,557 | $3,428,429 | $4,533,886 | $5,755,552 |