Stretch 'r Wings

Executive Summary

Stretch ‘r Wings is a start-up company making medical interior equipment for aircraft operators and hospital flight programs. Stretch ‘r Wings will design thoughtful, complete, and cost-effective medical interior solutions and sub-contract some of the manufacturing.

Stretch ‘r Wings has identified and is working to complete four objectives that will assist them on their path to profitability. The first objective is to obtain Supplemental Type Certification (STC) approval from the FAA. The second objective is an initial prototype of the design. Next is the need to secure parts manufacturer approval. Finally, there is the need to develop a comprehensive marketing plan and promotional campaign.

Stretch ‘r Wings will target aircraft operators and hospital flight programs in both the United States and international markets. Currently, these two segments have the highest market potential. Stretch ‘r Wings will reach these segments in several ways, including direct mailings, brochures, through a website and e-commerce, advertisements in trade publications, and a demo unit. The main segments that will be targeted are the US market as a whole, international markets, and the military. All three segments have a five percent growth rate. The US market has 800 potential customers, 300 for the international market, and 100 for the military market.

Stretch ‘r Wings will leverage their competitive edges, which are based on product innovations/features and price competitiveness. The first edge is their use of an aluminum frame that creates a strong, light unit that is easily assembled. The next edge is a built in storage device, maximizing the precious available space. Lastly, Stretch ‘r Wings will employ a glide ease stretcher system making entry and exit as easy as possible. All Stretch ‘r Wings units are designed to be compact, efficient and safe.

Stretch ‘r Wings has assembled a strong management team to execute their solid plan. ** is the product design master for Stretch ‘r Wings. He has a 20-year career in industrial design and recently has been concentrating his designs on medical applications due in part to the fact that his wife is a physician. **, the business mind of the company, complements our design master. ** will assume operations and strategic planning functions. He has spent the last 17 years as the Vice President of operations of a $45 million bicycle manufacturer.

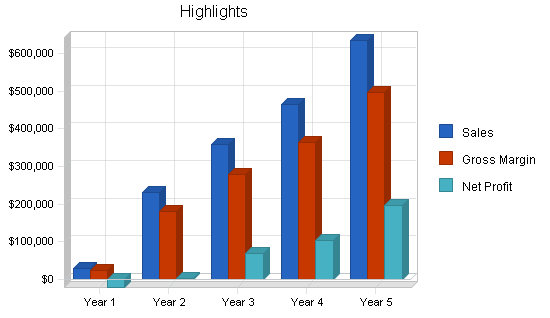

Stretch ‘r Wings will achieve profitability by the end of year one, with profits rising steadily through year five. Sales for year two are conservatively pegged at $230,000, growing to $634,000 in year five. Stretch ‘r Wings is an exciting business that combines innovative designs for an unmet market need. It will be led by a seasoned management team.

**Names have been removed for confidentiality.

1.1 Objectives

The following are the business goals and objectives for Stretch ‘r Wings:

- Obtain STC approval from the FAA on eight of the most popular general aviation aircraft.

- Build a protype of a medical interior for FAA conformity inspection.

- Upon completion of the first STC, Stretch ‘r Wings will secure a Parts Manufacture Approval (PMA) from the FAA.

- Develop a marketing plan, sales literature, website, e-commerce, and sales department. This step will be implemented after the approval of several STCs.

1.2 Mission

Stretch ‘r Wings intends to develop and market a quick-change medical unit for aircraft and helicopters. This unique product will allow the aircraft owner/operator to carry regular passengers or quickly change to carry a medical passenger. The medical unit is a self-contained life support system with an internal component of oxygen, air, vacuum, and both DC and AC electrical power. Stretch ‘r Wings will develop, manufacture, and market this product.

1.3 Keys to Success

Since the aircraft industry is highly regulated for product conformity, Stretch ‘r Wings will need to obtain the necessary STCs and PMAs from the FAA. Although the company’s staff has had several years of successful experience in doing STCs, this process may take longer than is planned, which could negatively affect the company’s prospects.

Once the company’s products are approved by the FAA, the next key to success will be strong marketing efforts to increase brand awareness and customer acceptance. For this purpose, Stretch ‘r Wings will attend all major trade shows, publish high quality sales literature, and provide after-sales service to its clients.

Company Summary

Stretch ‘r Wings is a start-up company which provides quality-designed and manufactured medical units for aircraft and helicopters. The business will be located in the Metro, IL area. This area has many advantages for shipping and receiving, including: manpower, access to State University’s engineering program, and an abundance of manufacturing space for lease.

2.1 Company Ownership

Stretch ‘r Wings will be incorporated. The company will be privately owned by **, who has worked for thirty-four years in the aircraft field. For fourteen years, the owner has designed and manufactured aircraft medical units under the FAA, STC, and PMA.

**Names have been removed for confidentiality.

2.2 Start-up Summary

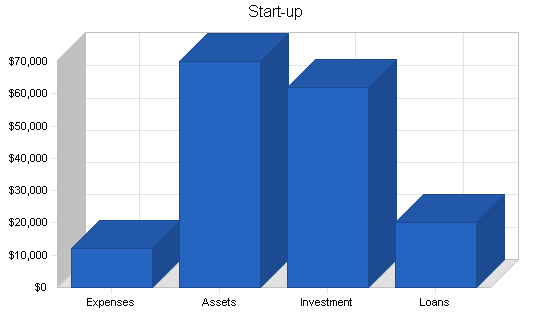

Stretch ‘r Wings’ start-up costs will be $82,000. This includes $12,000 for start-up expenses, $60,000 for cash reserve, and $10,000 in shop equipment assets (furnished by the owner). High cash reserves are required to offset the operating expenses before the company reaches its sales targets. The start-up expenses will be covered by the owner, a second investor, and a $20,000, five-year loan from the bank.

| Start-up Funding | |

| Start-up Expenses to Fund | $12,000 |

| Start-up Assets to Fund | $70,000 |

| Total Funding Required | $82,000 |

| Assets | |

| Non-cash Assets from Start-up | $10,000 |

| Cash Requirements from Start-up | $60,000 |

| Additional Cash Raised | $0 |

| Cash Balance on Starting Date | $60,000 |

| Total Assets | $70,000 |

| Liabilities and Capital | |

| Liabilities | |

| Current Borrowing | $0 |

| Long-term Liabilities | $20,000 |

| Accounts Payable (Outstanding Bills) | $0 |

| Other Current Liabilities (interest-free) | $0 |

| Total Liabilities | $20,000 |

| Capital | |

| Planned Investment | |

| Owner | $35,000 |

| Investor 1 | $27,000 |

| Other | $0 |

| Additional Investment Requirement | $0 |

| Total Planned Investment | $62,000 |

| Loss at Start-up (Start-up Expenses) | ($12,000) |

| Total Capital | $50,000 |

| Total Capital and Liabilities | $70,000 |

| Total Funding | $82,000 |

| Start-up | |

| Requirements | |

| Start-up Expenses | |

| Legal | $1,000 |

| Stationery etc. | $800 |

| Accounting | $600 |

| Jig and Fabricating Equipment | $1,000 |

| Aug. Rent and Security Deposit | $1,050 |

| Research and Development Prototype | $3,000 |

| Aluminum Inventory | $1,000 |

| Software | $500 |

| Engineering Fee – April, May, June, July | $2,500 |

| Other | $550 |

| Total Start-up Expenses | $12,000 |

| Start-up Assets | |

| Cash Required | $60,000 |

| Start-up Inventory | $0 |

| Other Current Assets | $10,000 |

| Long-term Assets | $0 |

| Total Assets | $70,000 |

| Total Requirements | $82,000 |

Products

The medical unit that Stretch ‘r Wings will manufacture is designed to meet all FAA regulations. The unit is fabricated from aircraft-grade aluminum and aircraft hardware. The main frame member is ** aluminum, which is the main key to the design. The interior layout is compact, making use of the new lightweight-composites oxygen cylinder, and the small lightweight-size air pump, vacuum pump, and static inverter. All of the components are protected from damage by the unit’s design. The unit is finished with a durable powder-coat epoxy paint. Additional manufactured items are medical stretchers, isollette stretchers, loading ramps, an equipment shelf, and gas bar. When customers order a unit, we ship it directly to them. We will install the unit in their aircraft at their request.

**Names have been removed for confidentiality.

Market Analysis Summary

Stretch ‘r Wings will target aircraft operators and hospital flight programs in both the United States and international markets. Currently, these two segments have the highest market potential (the chart and table below summarize demand in units). Stretch ‘r Wings will reach these segments in several ways, including direct mailings, brochures, through a website and e-commerce, advertisements in trade publications, and a demo unit.

| Market Analysis | |||||||

| Year 1 | Year 2 | Year 3 | Year 4 | Year 5 | |||

| Potential Customers | Growth | CAGR | |||||

| US Market | 5% | 500 | 525 | 551 | 579 | 608 | 5.01% |

| International Market | 5% | 300 | 315 | 331 | 348 | 365 | 5.03% |

| Military | 3% | 100 | 103 | 106 | 109 | 112 | 2.87% |

| Total | 4.78% | 900 | 943 | 988 | 1,036 | 1,085 | 4.78% |

4.1 Target Market Segment Strategy

Stretch ‘r Wings’ market strategy will be to approach all potential customers outlined in section 4.1. The transportation of medical patients is a global need. With a well-designed medical unit, sales literature, and informed sales staff, we can meet our customers’ needs to have a medical unit installed in their aircraft.

4.1.1 Market Needs

Customer needs in aircraft medical units are uniform across different countries and geographical areas. Customers seek lightweight, dependable, and easy-to-store medical units that are convenient to both clients and the medical personnel that may accompany clients to stationary medical facilities. Air ambulance services run by hospitals require fast patient delivery, especially from areas with limited medical facilities. Similarly, such medical units are required by various civil and military services that are involved in rescuing people during avalanches, earthquakes, flooding, forest fires, or from combat areas.

4.2 Main Competitors

- Company A, located in Metro, CA. Company A, Inc. is a leader in the aircraft and helicopter medical units industry. This company attends many trade shows. They advertise in all trade publications and do an excellent job of marketing their product. A typical unit to compare with other competitors is priced between $34,000 and $36,000. They are known to be a high-priced company; this is due to a large overhead.

- Company B, located in Metro, IN. This company has been in business the longest. Their product does not compare in quality to competitors, but they have sold many units. A typical unit to compare to the competitors is approximately $30,000.

- Company C, located in Metro, LA. Today, they have ten part-time employees and advertise in many trade publications. A typical unit to compare to the competitors is between $27,000 and $30,000.

- Company D, located in Metro, NY. Company D, Inc. has been in business since 1987. This company has a good product, but is limited in growth because of capital. Funds are not available to hire new employees or promote the product. At the present time, this company has one full-time employee and one part-time employee. A typical unit to compare to the competitors is $23,995.

4.2.1 Competition and Buying Patterns

The market for aircraft medical units is fragmented, with several incumbent firms offering products in different niches. As outlined in Section 4.3, all the products offered by current suppliers are high-end specialty items. Each of the suppliers has certain features. The market access barriers are high because of the required FAA approvals. However, Stretch ‘r Wings staff has had many years of experience working in this field and do not anticipate trouble gaining the required approval.

As with many other specialty items, a key approach in targeting future customers is advertising in trade publications and trade shows. This allows the customer to compare the quality and price of the products available, including delivery times, ease of installation, and weight of the unit. The customer collects all his data and often takes one week to six months buy a unit.

4.3 Market Segmentation

The markets for the medical unit are summarized into the following groups:

US Market:

- Fixed Base Operator (FBO): Typically, the aircraft owner is operating a charter business for hire and is looking for ways to increase utilization of his aircraft. He will set up an air ambulance business with a local hospital.

- Local hospital with an Air Medical Program: This existing program is starting their own aircraft program, or adding additional aircraft to their fleet.

- Aircraft Broker: They are selling an aircraft to a customer wishing to have a medical unit installed. This generally happens with international sales.

International Market:

- Aircraft Owners and Operators: They are looking for ways to increase the usage of their aircraft.

- Government Run Programs: Aircraft owners are contacted to run an air ambulance business for the local government.

- Military: Countries such as those in South America and the Middle East are very interested in the aircraft medical unit in order to meet the needs of their militaries.

Strategy and Implementation Summary

Stretch ‘r Wings will set up a sales department after we secure several STCs. This will keep overhead to a minimum. We estimate starting a sales department within nine months of start-up.

5.1 Competitive Edge

The medical unit we will manufacture and market has the following special features.

- Aluminum Frame: Our aluminum frame is lightweight and assembles quickly. Our competitors either bend or weld their frames together, thus making the unit heavy and cumbersome.

- Built-in Storage Drawers: Our built-in drawers are a convenience. The competitors do not have drawers as standard options.

- Glide Ease Stretcher Systems: These systems cause less back strain and give greater patient comfort. The competitors use a variety of systems.

- Cost of the Medical Unit: We feel our pricing is our main competitive edge. We have a high-quality medical unit, provide excellent customer service, and all at an aggressively low price.

5.2 Sales Strategy

Stretch ‘r Wings will employ a professional sales staff with sales expertise in the aircraft and helicopter markets. Along with interface of the medical unit, the sales staff will demonstrate ways in which the the customer can turn more revenue in their business.

5.2.1 Sales Forecast

Our sales forecast is atypical, due to the time required to obtain STCs from the FAA. Stretch ‘r Wings plans to develop our first STC and sales network within nine months. We are projecting the first sale occurring in up to twelve months, possibly 2001.

| Sales Forecast | |||||

| Year 1 | Year 2 | Year 3 | Year 4 | Year 5 | |

| Unit Sales | |||||

| Medical Units | 1 | 8 | 12 | 15 | 20 |

| STC | 1 | 4 | 5 | 6 | 6 |

| Parts | 1 | 1 | 1 | 1 | 1 |

| Loading Ramps and Additions | 1 | 6 | 10 | 12 | 15 |

| Total Unit Sales | 4 | 19 | 28 | 34 | 42 |

| Unit Prices | Year 1 | Year 2 | Year 3 | Year 4 | Year 5 |

| Medical Units | $26,495.00 | $26,995.00 | $27,995.00 | $28,995.00 | $29,995.00 |

| STC | $1,195.00 | $1,195.00 | $1,195.00 | $1,195.00 | $1,195.00 |

| Parts | $1,000.00 | $1,000.00 | $1,000.00 | $1,000.00 | $1,000.00 |

| Loading Ramps and Additions | $1,000.00 | $1,500.00 | $1,500.00 | $1,750.00 | $1,750.00 |

| Sales | |||||

| Medical Units | $26,495 | $215,960 | $335,940 | $434,925 | $599,900 |

| STC | $1,195 | $4,780 | $5,975 | $7,170 | $7,170 |

| Parts | $1,000 | $1,000 | $1,000 | $1,000 | $1,000 |

| Loading Ramps and Additions | $1,000 | $9,000 | $15,000 | $21,000 | $26,250 |

| Total Sales | $29,690 | $230,740 | $357,915 | $464,095 | $634,320 |

| Direct Unit Costs | Year 1 | Year 2 | Year 3 | Year 4 | Year 5 |

| Medical Units | $5,300.00 | $5,700.00 | $6,000.00 | $6,200.00 | $6,400.00 |

| STC | $225.00 | $250.00 | $275.00 | $275.00 | $275.00 |

| Parts | $750.00 | $750.00 | $750.00 | $750.00 | $750.00 |

| Loading Ramps and Additions | $200.00 | $300.00 | $350.00 | $400.00 | $450.00 |

| Direct Cost of Sales | |||||

| Medical Units | $5,300 | $45,600 | $72,000 | $93,000 | $128,000 |

| STC | $225 | $1,000 | $1,375 | $1,650 | $1,650 |

| Parts | $750 | $750 | $750 | $750 | $750 |

| Loading Ramps and Additions | $200 | $1,800 | $3,500 | $4,800 | $6,750 |

| Subtotal Direct Cost of Sales | $6,475 | $49,150 | $77,625 | $100,200 | $137,150 |

5.3 Milestones

The following table lists important program milestones, with dates and responsibilities assigned, and a budget for each. The milestone schedule indicates our emphasis on planning for implementation.

**Names have been removed from the table below for confidentiality.

| Milestones | |||||

| Milestone | Start Date | End Date | Budget | Manager | Department |

| Business Plan | 1/1/2000 | 2/15/2000 | $100 | ** | Management |

| Prototype Unit | 1/20/2000 | 4/15/2000 | $1,000 | ** | Management |

| Financial Backing Presentations | 4/15/2000 | 4/30/2000 | $500 | ** | Management |

| Secure Business Name and Legal | 4/15/2000 | 4/30/2000 | $1,000 | ** | Management |

| Stationery | 4/30/2000 | 5/15/2000 | $300 | ** | Management |

| Office Location | 8/1/2000 | 8/15/2000 | $525 | ** | Management |

| Office Furniture and Equipment | 8/1/2000 | 8/15/2000 | $3,700 | ** | Management |

| Start STC Paperwork and Drawings | 3/15/2000 | 12/30/2000 | $3,500 | ** | Consultant |

| PMA Approval with FAA-MIDO | 9/1/2000 | 11/1/2000 | $200 | ** | Management |

| Brochures and Initial Mailings | 10/1/2000 | 11/15/2000 | $3,000 | ** | Sales dept. |

| Totals | $13,825 | ||||

Management Summary

Stretch ‘r Wings is a small company owned and operated by **. The company will add personnel as it grows, based on projections and timetables, keeping the cost of overhead low. The following is our plan for management, sales staff, and additional employees.

**Names have been removed for confidentiality.

6.1 Personnel Plan

The personnel plan layout is the foundation for Stretch ‘r Wings; having the key people in place will enable the company to start with a solid foundation. Employees will be added as business necessitates them. A projected number to start with is four employees, to be doubled within five years.

** is the developer and designer of the medical products. He will be the manager of the company, and will be responsible for setting up the office and shop area. ** will be hired as the consultant engineer to do drawings for the FAA. ** and ** have worked together doing STC with the FAA, and both know the system.

After several STCs are secured, and the PMA approval is completed, we will add a sales manager. The sales manager will develop the aspects of our marketing plan including the sales literature, website, mass mailing, etc. Next, an office person will be added. The skills necessary will be secretarial, an excellent phone demeanor, and data entry. Following will be production personnel, who will have duties associated with the assembly and installation of medical units.

**Names have been removed for confidentiality.

| Personnel Plan | |||||

| Year 1 | Year 2 | Year 3 | Year 4 | Year 5 | |

| Owner/Manager | $15,000 | $45,000 | $50,000 | $52,000 | $54,000 |

| Office Personnel | $0 | $21,320 | $22,500 | $23,500 | $24,500 |

| Production Personnel | $0 | $21,320 | $22,500 | $44,820 | $47,000 |

| Sales Manager | $5,000 | $30,000 | $31,000 | $32,000 | $33,000 |

| Total People | 2 | 4 | 4 | 5 | 5 |

| Total Payroll | $20,000 | $117,640 | $126,000 | $152,320 | $158,500 |

Financial Plan

The following topics summarize the financial information of Stretch ‘r Wings.

7.1 Important Assumptions

The following table summarizes key financial assumptions.

| General Assumptions | |||||

| Year 1 | Year 2 | Year 3 | Year 4 | Year 5 | |

| Plan Month | 1 | 2 | 3 | 4 | 5 |

| Current Interest Rate | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% |

| Long-term Interest Rate | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% |

| Tax Rate | 25.42% | 25.00% | 25.42% | 25.00% | 25.42% |

| Other | 0 | 0 | 0 | 0 | 0 |

7.2 Break-even Analysis

The following chart and table summarize the break-even analysis, including monthly units and sales break-even points.

| Break-even Analysis | |

| Monthly Units Break-even | 1 |

| Monthly Revenue Break-even | $4,500 |

| Assumptions: | |

| Average Per-Unit Revenue | $7,422.50 |

| Average Per-Unit Variable Cost | $1,618.75 |

| Estimated Monthly Fixed Cost | $3,519 |

7.3 Projected Profit and Loss

The detailed monthly pro forma income statement for the first year is included in the appendix. The annual estimates are included here.

| Pro Forma Profit and Loss | |||||

| Year 1 | Year 2 | Year 3 | Year 4 | Year 5 | |

| Sales | $29,690 | $230,740 | $357,915 | $464,095 | $634,320 |

| Direct Cost of Sales | $6,475 | $49,150 | $77,625 | $100,200 | $137,150 |

| Other | $0 | $0 | $0 | $0 | $0 |

| Total Cost of Sales | $6,475 | $49,150 | $77,625 | $100,200 | $137,150 |

| Gross Margin | $23,215 | $181,590 | $280,290 | $363,895 | $497,170 |

| Gross Margin % | 78.19% | 78.70% | 78.31% | 78.41% | 78.38% |

| Expenses | |||||

| Payroll | $20,000 | $117,640 | $126,000 | $152,320 | $158,500 |

| Sales and Marketing and Other Expenses | $15,300 | $28,400 | $30,000 | $37,500 | $40,000 |

| Depreciation | $0 | $0 | $0 | $0 | $0 |

| Leased Equipment | $0 | $0 | $0 | $0 | $0 |

| Utilities | $350 | $1,200 | $1,400 | $1,500 | $1,500 |

| Phone | $950 | $2,500 | $3,000 | $3,000 | $3,000 |

| Rent | $2,625 | $6,000 | $6,500 | $7,000 | $7,500 |

| Payroll Taxes | $3,000 | $17,646 | $18,900 | $22,848 | $23,775 |

| Other | $0 | $0 | $0 | $0 | $0 |

| Total Operating Expenses | $42,225 | $173,386 | $185,800 | $224,168 | $234,275 |

| Profit Before Interest and Taxes | ($19,010) | $8,204 | $94,490 | $139,727 | $262,895 |

| EBITDA | ($19,010) | $8,204 | $94,490 | $139,727 | $262,895 |

| Interest Expense | $1,784 | $2,400 | $2,000 | $600 | $200 |

| Taxes Incurred | $0 | $1,451 | $23,508 | $34,782 | $66,768 |

| Net Profit | ($20,794) | $4,353 | $68,982 | $104,345 | $195,927 |

| Net Profit/Sales | -70.04% | 1.89% | 19.27% | 22.48% | 30.89% |

7.4 Projected Cash Flow

Cash flow projections are critical to our success. The monthly cash flow is shown in the illustration, with one bar representing the cash flow per month and the other representing the monthly balance. The annual cash flow figures are included here. Detailed monthly numbers are included in the appendix. The initial $20,000 loan will be repaid over five years. Further, to increase the cash balance in FY 2001, a one-year, $20,000 loan will be secured from the bank.

| Pro Forma Cash Flow | |||||

| Year 1 | Year 2 | Year 3 | Year 4 | Year 5 | |

| Cash Received | |||||

| Cash from Operations | |||||

| Cash Sales | $29,690 | $230,740 | $357,915 | $464,095 | $634,320 |

| Subtotal Cash from Operations | $29,690 | $230,740 | $357,915 | $464,095 | $634,320 |

| Additional Cash Received | |||||

| Sales Tax, VAT, HST/GST Received | $0 | $0 | $0 | $0 | $0 |

| New Current Borrowing | $0 | $20,000 | $0 | $0 | $0 |

| New Other Liabilities (interest-free) | $0 | $0 | $0 | $0 | $0 |

| New Long-term Liabilities | $0 | $0 | $0 | $0 | $0 |

| Sales of Other Current Assets | $0 | $0 | $0 | $0 | $0 |

| Sales of Long-term Assets | $0 | $0 | $0 | $0 | $0 |

| New Investment Received | $0 | $0 | $0 | $0 | $0 |

| Subtotal Cash Received | $29,690 | $250,740 | $357,915 | $464,095 | $634,320 |

| Expenditures | Year 1 | Year 2 | Year 3 | Year 4 | Year 5 |

| Expenditures from Operations | |||||

| Cash Spending | $20,000 | $117,640 | $126,000 | $152,320 | $158,500 |

| Bill Payments | $22,436 | $124,938 | $168,928 | $212,357 | $287,020 |

| Subtotal Spent on Operations | $42,436 | $242,578 | $294,928 | $364,677 | $445,520 |

| Additional Cash Spent | |||||

| Sales Tax, VAT, HST/GST Paid Out | $0 | $0 | $0 | $0 | $0 |

| Principal Repayment of Current Borrowing | $0 | $0 | $20,000 | $0 | $0 |

| Other Liabilities Principal Repayment | $0 | $0 | $0 | $0 | $0 |

| Long-term Liabilities Principal Repayment | $3,996 | $4,000 | $4,000 | $4,000 | $4,004 |

| Purchase Other Current Assets | $0 | $0 | $0 | $0 | $0 |

| Purchase Long-term Assets | $0 | $0 | $0 | $0 | $0 |

| Dividends | $0 | $0 | $0 | $0 | $0 |

| Subtotal Cash Spent | $46,432 | $246,578 | $318,928 | $368,677 | $449,524 |

| Net Cash Flow | ($16,742) | $4,162 | $38,987 | $95,418 | $184,796 |

| Cash Balance | $43,258 | $47,421 | $86,408 | $181,826 | $366,622 |

7.5 Projected Balance Sheet

The projected balance sheet is quite solid. We do not project any trouble meeting our debt obligations, as long as we can achieve our specified objectives.

| Pro Forma Balance Sheet | |||||

| Year 1 | Year 2 | Year 3 | Year 4 | Year 5 | |

| Assets | |||||

| Current Assets | |||||

| Cash | $43,258 | $47,421 | $86,408 | $181,826 | $366,622 |

| Inventory | $7,123 | $17,973 | $28,385 | $36,806 | $50,305 |

| Other Current Assets | $10,000 | $10,000 | $10,000 | $10,000 | $10,000 |

| Total Current Assets | $60,381 | $75,393 | $124,793 | $228,631 | $426,927 |

| Long-term Assets | |||||

| Long-term Assets | $0 | $0 | $0 | $0 | $0 |

| Accumulated Depreciation | $0 | $0 | $0 | $0 | $0 |

| Total Long-term Assets | $0 | $0 | $0 | $0 | $0 |

| Total Assets | $60,381 | $75,393 | $124,793 | $228,631 | $426,927 |

| Liabilities and Capital | Year 1 | Year 2 | Year 3 | Year 4 | Year 5 |

| Current Liabilities | |||||

| Accounts Payable | $15,170 | $9,830 | $14,248 | $17,741 | $24,115 |

| Current Borrowing | $0 | $20,000 | $0 | $0 | $0 |

| Other Current Liabilities | $0 | $0 | $0 | $0 | $0 |

| Subtotal Current Liabilities | $15,170 | $29,830 | $14,248 | $17,741 | $24,115 |

| Long-term Liabilities | $16,004 | $12,004 | $8,004 | $4,004 | $0 |

| Total Liabilities | $31,174 | $41,834 | $22,252 | $21,745 | $24,115 |

| Paid-in Capital | $62,000 | $62,000 | $62,000 | $62,000 | $62,000 |

| Retained Earnings | ($12,000) | ($32,794) | ($28,441) | $40,541 | $144,886 |

| Earnings | ($20,794) | $4,353 | $68,982 | $104,345 | $195,927 |

| Total Capital | $29,206 | $33,559 | $102,541 | $206,886 | $402,812 |

| Total Liabilities and Capital | $60,381 | $75,393 | $124,793 | $228,631 | $426,927 |

| Net Worth | $29,206 | $33,559 | $102,541 | $206,886 | $402,812 |

7.6 Business Ratios

The following table outlines important ratios from the laboratory apparatus and furniture industry, as determined by the Standard Industrial Classification (SIC) Index code 3821, Laboratory Equipment and Furniture.

| Ratio Analysis | ||||||

| Year 1 | Year 2 | Year 3 | Year 4 | Year 5 | Industry Profile | |

| Sales Growth | 0.00% | 677.16% | 55.12% | 29.67% | 36.68% | 5.10% |

| Percent of Total Assets | ||||||

| Inventory | 11.80% | 23.84% | 22.75% | 16.10% | 11.78% | 28.60% |

| Other Current Assets | 16.56% | 13.26% | 8.01% | 4.37% | 2.34% | 25.10% |

| Total Current Assets | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 83.70% |

| Long-term Assets | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 16.30% |

| Total Assets | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% |

| Current Liabilities | 25.12% | 39.57% | 11.42% | 7.76% | 5.65% | 37.80% |

| Long-term Liabilities | 26.51% | 15.92% | 6.41% | 1.75% | 0.00% | 14.30% |

| Total Liabilities | 51.63% | 55.49% | 17.83% | 9.51% | 5.65% | 52.10% |

| Net Worth | 48.37% | 44.51% | 82.17% | 90.49% | 94.35% | 47.90% |

| Percent of Sales | ||||||

| Sales | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% |

| Gross Margin | 78.19% | 78.70% | 78.31% | 78.41% | 78.38% | 38.90% |

| Selling, General & Administrative Expenses | 148.77% | 77.19% | 59.30% | 56.34% | 47.63% | 25.40% |

| Advertising Expenses | 8.42% | 6.50% | 4.19% | 4.31% | 3.15% | 1.40% |

| Profit Before Interest and Taxes | -64.03% | 3.56% | 26.40% | 30.11% | 41.45% | 2.00% |

| Main Ratios | ||||||

| Current | 3.98 | 2.53 | 8.76 | 12.89 | 17.70 | 2.36 |

| Quick | 3.51 | 1.92 | 6.77 | 10.81 | 15.62 | 1.33 |

| Total Debt to Total Assets | 51.63% | 55.49% | 17.83% | 9.51% | 5.65% | 52.10% |

| Pre-tax Return on Net Worth | -71.20% | 17.29% | 90.20% | 67.25% | 65.22% | 3.80% |

| Pre-tax Return on Assets | -34.44% | 7.70% | 74.11% | 60.85% | 61.53% | 8.00% |

| Additional Ratios | Year 1 | Year 2 | Year 3 | Year 4 | Year 5 | |

| Net Profit Margin | -70.04% | 1.89% | 19.27% | 22.48% | 30.89% | n.a |

| Return on Equity | -71.20% | 12.97% | 67.27% | 50.44% | 48.64% | n.a |

| Activity Ratios | ||||||

| Inventory Turnover | 10.91 | 3.92 | 3.35 | 3.07 | 3.15 | n.a |

| Accounts Payable Turnover | 2.48 | 12.17 | 12.17 | 12.17 | 12.17 | n.a |

| Payment Days | 27 | 38 | 25 | 27 | 26 | n.a |

| Total Asset Turnover | 0.49 | 3.06 | 2.87 | 2.03 | 1.49 | n.a |

| Debt Ratios | ||||||

| Debt to Net Worth | 1.07 | 1.25 | 0.22 | 0.11 | 0.06 | n.a |

| Current Liab. to Liab. | 0.49 | 0.71 | 0.64 | 0.82 | 1.00 | n.a |

| Liquidity Ratios | ||||||

| Net Working Capital | $45,210 | $45,563 | $110,545 | $210,890 | $402,812 | n.a |

| Interest Coverage | -10.66 | 3.42 | 47.24 | 232.72 | 1,313.16 | n.a |

| Additional Ratios | ||||||

| Assets to Sales | 2.03 | 0.33 | 0.35 | 0.49 | 0.67 | n.a |

| Current Debt/Total Assets | 25% | 40% | 11% | 8% | 6% | n.a |

| Acid Test | 3.51 | 1.92 | 6.77 | 10.81 | 15.62 | n.a |

| Sales/Net Worth | 1.02 | 6.88 | 3.49 | 2.24 | 1.57 | n.a |

| Dividend Payout | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | n.a |

Appendix

| Sales Forecast | |||||||||||||

| Month 1 | Month 2 | Month 3 | Month 4 | Month 5 | Month 6 | Month 7 | Month 8 | Month 9 | Month 10 | Month 11 | Month 12 | ||

| Unit Sales | |||||||||||||

| Medical Units | 0% | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 1 |

| STC | 0% | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 1 |

| Parts | 0% | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 1 |

| Loading Ramps and Additions | 0% | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 1 |

| Total Unit Sales | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 4 | |

| Unit Prices | Month 1 | Month 2 | Month 3 | Month 4 | Month 5 | Month 6 | Month 7 | Month 8 | Month 9 | Month 10 | Month 11 | Month 12 | |

| Medical Units | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 | $26,495.00 | |

| STC | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 | $1,195.00 | |

| Parts | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 | $1,000.00 | |

| Loading Ramps and Additions | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 | $1,000.00 | |

| Sales | |||||||||||||

| Medical Units | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $26,495 | |

| STC | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $1,195 | |

| Parts | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $1,000 | |

| Loading Ramps and Additions | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $1,000 | |

| Total Sales | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $29,690 | |

| Direct Unit Costs | Month 1 | Month 2 | Month 3 | Month 4 | Month 5 | Month 6 | Month 7 | Month 8 | Month 9 | Month 10 | Month 11 | Month 12 | |

| Medical Units | 0.00% | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 | $5,300.00 |

| STC | 0.00% | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 | $225.00 |

| Parts | 0.00% | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 | $750.00 |

| Loading Ramps and Additions | 0.00% | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 | $200.00 |

| Direct Cost of Sales | |||||||||||||

| Medical Units | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $5,300 | |

| STC | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $225 | |

| Parts | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $750 | |

| Loading Ramps and Additions | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $200 | |

| Subtotal Direct Cost of Sales | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $6,475 | |

| Personnel Plan | |||||||||||||

| Month 1 | Month 2 | Month 3 | Month 4 | Month 5 | Month 6 | Month 7 | Month 8 | Month 9 | Month 10 | Month 11 | Month 12 | ||

| Owner/Manager | 0% | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $3,750 | $3,750 | $3,750 | $3,750 |

| Office Personnel | 0% | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| Production Personnel | 0% | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| Sales Manager | 0% | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $2,500 | $2,500 |

| Total People | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 1 | 1 | 2 | 2 | |

| Total Payroll | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $3,750 | $3,750 | $6,250 | $6,250 | |

| General Assumptions | |||||||||||||

| Month 1 | Month 2 | Month 3 | Month 4 | Month 5 | Month 6 | Month 7 | Month 8 | Month 9 | Month 10 | Month 11 | Month 12 | ||

| Plan Month | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 | 11 | 12 | |

| Current Interest Rate | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | |

| Long-term Interest Rate | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | |

| Tax Rate | 30.00% | 25.00% | 25.00% | 25.00% | 25.00% | 25.00% | 25.00% | 25.00% | 25.00% | 25.00% | 25.00% | 25.00% | |

| Other | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | |

| Pro Forma Profit and Loss | |||||||||||||

| Month 1 | Month 2 | Month 3 | Month 4 | Month 5 | Month 6 | Month 7 | Month 8 | Month 9 | Month 10 | Month 11 | Month 12 | ||

| Sales | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $29,690 | |

| Direct Cost of Sales | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $6,475 | |

| Other | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Total Cost of Sales | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $6,475 | |

| Gross Margin | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $23,215 | |

| Gross Margin % | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 78.19% | |

| Expenses | |||||||||||||

| Payroll | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $3,750 | $3,750 | $6,250 | $6,250 | |

| Sales and Marketing and Other Expenses | $0 | $0 | $0 | $0 | $500 | $650 | $650 | $650 | $300 | $7,200 | $5,200 | $150 | |

| Depreciation | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Leased Equipment | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Utilities | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $50 | $50 | $75 | $75 | $100 | |

| Phone | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $100 | $150 | $200 | $250 | $250 | |

| Rent | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $525 | $525 | $525 | $525 | $525 | |

| Payroll Taxes | 15% | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $563 | $563 | $938 | $938 |

| Other | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Total Operating Expenses | $0 | $0 | $0 | $0 | $500 | $650 | $650 | $1,325 | $5,338 | $12,313 | $13,238 | $8,213 | |

| Profit Before Interest and Taxes | $0 | $0 | $0 | $0 | ($500) | ($650) | ($650) | ($1,325) | ($5,338) | ($12,313) | ($13,238) | $15,003 | |

| EBITDA | $0 | $0 | $0 | $0 | ($500) | ($650) | ($650) | ($1,325) | ($5,338) | ($12,313) | ($13,238) | $15,003 | |

| Interest Expense | $164 | $161 | $158 | $156 | $153 | $150 | $147 | $144 | $142 | $139 | $136 | $133 | |

| Taxes Incurred | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Net Profit | ($164) | ($161) | ($158) | ($156) | ($653) | ($800) | ($797) | ($1,469) | ($5,479) | ($12,451) | ($13,374) | $14,869 | |

| Net Profit/Sales | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 50.08% | |

| Pro Forma Cash Flow | |||||||||||||

| Month 1 | Month 2 | Month 3 | Month 4 | Month 5 | Month 6 | Month 7 | Month 8 | Month 9 | Month 10 | Month 11 | Month 12 | ||

| Cash Received | |||||||||||||

| Cash from Operations | |||||||||||||

| Cash Sales | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $29,690 | |

| Subtotal Cash from Operations | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $29,690 | |

| Additional Cash Received | |||||||||||||

| Sales Tax, VAT, HST/GST Received | 0.00% | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| New Current Borrowing | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| New Other Liabilities (interest-free) | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| New Long-term Liabilities | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Sales of Other Current Assets | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Sales of Long-term Assets | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| New Investment Received | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Subtotal Cash Received | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $29,690 | |

| Expenditures | Month 1 | Month 2 | Month 3 | Month 4 | Month 5 | Month 6 | Month 7 | Month 8 | Month 9 | Month 10 | Month 11 | Month 12 | |

| Expenditures from Operations | |||||||||||||

| Cash Spending | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $3,750 | $3,750 | $6,250 | $6,250 | |

| Bill Payments | $5 | $164 | $161 | $158 | $172 | $658 | $800 | $820 | $1,478 | $1,962 | $8,649 | $7,409 | |

| Subtotal Spent on Operations | $5 | $164 | $161 | $158 | $172 | $658 | $800 | $820 | $5,228 | $5,712 | $14,899 | $13,659 | |

| Additional Cash Spent | |||||||||||||

| Sales Tax, VAT, HST/GST Paid Out | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Principal Repayment of Current Borrowing | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Other Liabilities Principal Repayment | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Long-term Liabilities Principal Repayment | $333 | $333 | $333 | $333 | $333 | $333 | $333 | $333 | $333 | $333 | $333 | $333 | |

| Purchase Other Current Assets | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Purchase Long-term Assets | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Dividends | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Subtotal Cash Spent | $338 | $497 | $494 | $491 | $505 | $991 | $1,133 | $1,153 | $5,561 | $6,045 | $15,232 | $13,992 | |

| Net Cash Flow | ($338) | ($497) | ($494) | ($491) | ($505) | ($991) | ($1,133) | ($1,153) | ($5,561) | ($6,045) | ($15,232) | $15,698 | |

| Cash Balance | $59,662 | $59,165 | $58,671 | $58,179 | $57,674 | $56,684 | $55,551 | $54,398 | $48,837 | $42,792 | $27,561 | $43,258 | |

| Pro Forma Balance Sheet | |||||||||||||

| Month 1 | Month 2 | Month 3 | Month 4 | Month 5 | Month 6 | Month 7 | Month 8 | Month 9 | Month 10 | Month 11 | Month 12 | ||

| Assets | Starting Balances | ||||||||||||

| Current Assets | |||||||||||||

| Cash | $60,000 | $59,662 | $59,165 | $58,671 | $58,179 | $57,674 | $56,684 | $55,551 | $54,398 | $48,837 | $42,792 | $27,561 | $43,258 |

| Inventory | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $7,123 |

| Other Current Assets | $10,000 | $10,000 | $10,000 | $10,000 | $10,000 | $10,000 | $10,000 | $10,000 | $10,000 | $10,000 | $10,000 | $10,000 | $10,000 |

| Total Current Assets | $70,000 | $69,662 | $69,165 | $68,671 | $68,179 | $67,674 | $66,684 | $65,551 | $64,398 | $58,837 | $52,792 | $37,561 | $60,381 |

| Long-term Assets | |||||||||||||

| Long-term Assets | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| Accumulated Depreciation | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| Total Long-term Assets | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| Total Assets | $70,000 | $69,662 | $69,165 | $68,671 | $68,179 | $67,674 | $66,684 | $65,551 | $64,398 | $58,837 | $52,792 | $37,561 | $60,381 |

| Liabilities and Capital | Month 1 | Month 2 | Month 3 | Month 4 | Month 5 | Month 6 | Month 7 | Month 8 | Month 9 | Month 10 | Month 11 | Month 12 | |

| Current Liabilities | |||||||||||||

| Accounts Payable | $0 | $158 | $156 | $153 | $150 | $631 | $773 | $771 | $1,420 | $1,672 | $8,411 | $6,886 | $15,170 |

| Current Borrowing | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| Other Current Liabilities | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| Subtotal Current Liabilities | $0 | $158 | $156 | $153 | $150 | $631 | $773 | $771 | $1,420 | $1,672 | $8,411 | $6,886 | $15,170 |

| Long-term Liabilities | $20,000 | $19,667 | $19,334 | $19,001 | $18,668 | $18,335 | $18,002 | $17,669 | $17,336 | $17,003 | $16,670 | $16,337 | $16,004 |

| Total Liabilities | $20,000 | $19,825 | $19,490 | $19,154 | $18,818 | $18,966 | $18,775 | $18,440 | $18,756 | $18,675 | $25,081 | $23,223 | $31,174 |

| Paid-in Capital | $62,000 | $62,000 | $62,000 | $62,000 | $62,000 | $62,000 | $62,000 | $62,000 | $62,000 | $62,000 | $62,000 | $62,000 | $62,000 |

| Retained Earnings | ($12,000) | ($12,000) | ($12,000) | ($12,000) | ($12,000) | ($12,000) | ($12,000) | ($12,000) | ($12,000) | ($12,000) | ($12,000) | ($12,000) | ($12,000) |

| Earnings | $0 | ($164) | ($325) | ($483) | ($639) | ($1,292) | ($2,092) | ($2,889) | ($4,358) | ($9,838) | ($22,289) | ($35,663) | ($20,794) |

| Total Capital | $50,000 | $49,836 | $49,675 | $49,517 | $49,361 | $48,708 | $47,908 | $47,111 | $45,642 | $40,162 | $27,711 | $14,337 | $29,206 |

| Total Liabilities and Capital | $70,000 | $69,662 | $69,165 | $68,671 | $68,179 | $67,674 | $66,684 | $65,551 | $64,398 | $58,837 | $52,792 | $37,561 | $60,381 |

| Net Worth | $50,000 | $49,836 | $49,675 | $49,517 | $49,361 | $48,708 | $47,908 | $47,111 | $45,642 | $40,162 | $27,711 | $14,337 | $29,206 |